InnovFin Equity Investment Guidelines

... This document is for information purposes only. This document is an outline of the principal operational guidelines for the product described herein, which are subject to change and non-exhaustive. This document is intended to provide a basis for discussions and does not constitute a recommendation, ...

... This document is for information purposes only. This document is an outline of the principal operational guidelines for the product described herein, which are subject to change and non-exhaustive. This document is intended to provide a basis for discussions and does not constitute a recommendation, ...

Q1 2017 Market ChartBook

... international investors to benefit from a strong technical bid this past quarter. Investors in developed international markets received 6.1% in Q2 led by Denmark, France, and Italy while emerging markets largely followed suit with Q2 returns of 6.4%. Euroskeptics Le Pen and Wilders lost in their res ...

... international investors to benefit from a strong technical bid this past quarter. Investors in developed international markets received 6.1% in Q2 led by Denmark, France, and Italy while emerging markets largely followed suit with Q2 returns of 6.4%. Euroskeptics Le Pen and Wilders lost in their res ...

Shorts and Derivatives in Portfolio Statistics

... back at some point in the future. If the price falls after the short sale, the investor will have sold high and can now buy low to close the short position and lock in a profit. However, if the price of the security increases after the short sale, the investor will experience losses by buying it at ...

... back at some point in the future. If the price falls after the short sale, the investor will have sold high and can now buy low to close the short position and lock in a profit. However, if the price of the security increases after the short sale, the investor will experience losses by buying it at ...

EMIR and MiFID2/MiFIR: Update on recognition procedures for non

... introduce a new procedure for recognising non-EU markets as equivalent for these purposes (new Article 2a EMIR). The current definition of OTC derivatives in EMIR causes difficulty to market participants trading in non-EU ETD. Article 2(7) of EMIR currently provides that derivatives are treated as ...

... introduce a new procedure for recognising non-EU markets as equivalent for these purposes (new Article 2a EMIR). The current definition of OTC derivatives in EMIR causes difficulty to market participants trading in non-EU ETD. Article 2(7) of EMIR currently provides that derivatives are treated as ...

Frontier Markets

... larger opportunity set. Furthermore, according to the Efficient Market Hypothesis (Eugene Fama), you cannot beat the market since current prices reflect all available information. The Efficient Market Hypothesis argues that only the “market” portfolio is efficient, and as Frontier Markets represent ...

... larger opportunity set. Furthermore, according to the Efficient Market Hypothesis (Eugene Fama), you cannot beat the market since current prices reflect all available information. The Efficient Market Hypothesis argues that only the “market” portfolio is efficient, and as Frontier Markets represent ...

Estimating the country risk premium in emerging markets: the case

... calculate the required rate of return for the security and hence the fair price. The CAPM developed by Sharpe (1964) on a Markowitz (1952) portfolio theory, as a logical step forward, is a very simple to use. But, it is an economic model based on a simplified world using a wide range of assumptions. ...

... calculate the required rate of return for the security and hence the fair price. The CAPM developed by Sharpe (1964) on a Markowitz (1952) portfolio theory, as a logical step forward, is a very simple to use. But, it is an economic model based on a simplified world using a wide range of assumptions. ...

University of Louisville Endowment Fund Statement of Investment

... converted must be listed on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX), or the National Association of Securities Dealers Automated Quote System (NASDAQ), or, for foreign securities, equivalent exchanges in their country of domicile. Any other securities or investment veh ...

... converted must be listed on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX), or the National Association of Securities Dealers Automated Quote System (NASDAQ), or, for foreign securities, equivalent exchanges in their country of domicile. Any other securities or investment veh ...

16: Asset Valuation: Derivative Investments

... Arbitrage is defined as the existence of riskless profit without investment and involves selling an asset and simultaneously buying the same asset for a lower price. Since the trades cancel each other, no investment is required. Because it is done simultaneously, a profit is guaranteed, making the ...

... Arbitrage is defined as the existence of riskless profit without investment and involves selling an asset and simultaneously buying the same asset for a lower price. Since the trades cancel each other, no investment is required. Because it is done simultaneously, a profit is guaranteed, making the ...

Does Financial Distress Risk Drive the Momentum Anomaly?

... until 1990 is small (between 1 and 14 per year); although, during the 1990s, the number of such firms increased ranging from 28 to 53 a year. Almost all negative book value firms have bankrupt z-scores.4 ...

... until 1990 is small (between 1 and 14 per year); although, during the 1990s, the number of such firms increased ranging from 28 to 53 a year. Almost all negative book value firms have bankrupt z-scores.4 ...

Market Signals Associated with Taiwan REIT IPOs

... approved, and the maximum number of news reports is released on the date of the public offering, but news declines afterwards. News is only reported on the listing day, without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information ma ...

... approved, and the maximum number of news reports is released on the date of the public offering, but news declines afterwards. News is only reported on the listing day, without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information ma ...

share issuance and equity returns in the istanbul stock exchange

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

NBER WORKING PAPER SERIES RISK AVERSION AND OPTIMAL PORTFOLIO POLICIES IN

... Marcet and Singleton (1999) use simulation methods to analyze an economy where agents face borrowing constraints and differ with respect to their labor income and risk aversion. In contrast to these papers, we provide an explicit characterization in terms of exogenous variables for the consumption an ...

... Marcet and Singleton (1999) use simulation methods to analyze an economy where agents face borrowing constraints and differ with respect to their labor income and risk aversion. In contrast to these papers, we provide an explicit characterization in terms of exogenous variables for the consumption an ...

Exit Strategies of Venture Capitalists in Hot Issue Markets: Evidence

... closely linked because the going public of a firm offers an important exit opportunity for early investors. This applies especially for hot issue markets, i.e., periods in which equity prices are extraordinary high and the number of IPOs increases dramatically (Lemer, 1994). Thus, the opening of a n ...

... closely linked because the going public of a firm offers an important exit opportunity for early investors. This applies especially for hot issue markets, i.e., periods in which equity prices are extraordinary high and the number of IPOs increases dramatically (Lemer, 1994). Thus, the opening of a n ...

Institutional Ownership and Credit Spreads: An Information

... Recent literature has examined whether firms attracting more institutional investors on the equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), t ...

... Recent literature has examined whether firms attracting more institutional investors on the equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), t ...

13: Asset Valuation: Equity Investments

... determinant of how well individual firms in the industry perform. most valuation models recommend the use of industry-wide average required returns, rather than individual returns. the goal of the top-down approach is to identify those companies in cyclical industries with the highest P/E ratios. ...

... determinant of how well individual firms in the industry perform. most valuation models recommend the use of industry-wide average required returns, rather than individual returns. the goal of the top-down approach is to identify those companies in cyclical industries with the highest P/E ratios. ...

Download attachment

... Options, derivative products and futures are not suitable for all investors, and trading in these instruments is considered risky. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security or r ...

... Options, derivative products and futures are not suitable for all investors, and trading in these instruments is considered risky. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security or r ...

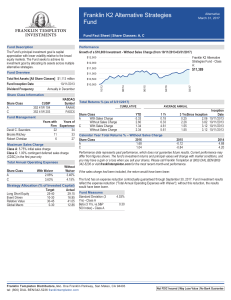

Franklin K2 Alternative Strategies Fund Fact Sheet

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

Forecasting the equity premium in the Australian market

... Table 2a and 2b provides the descriptive statistics for the series. The mean, standard deviation and median are calculated as annual percentage returns, while the other statistics are based on findings from the monthly data. In table 2a the average log equity premium for the entire sample is 2.95% a ...

... Table 2a and 2b provides the descriptive statistics for the series. The mean, standard deviation and median are calculated as annual percentage returns, while the other statistics are based on findings from the monthly data. In table 2a the average log equity premium for the entire sample is 2.95% a ...

Capital Commitment and Illiquidity in Corporate Bonds

... We document a number of striking findings, including that dealer concentration, while relatively high, has trended down over time. In recent years, individual dealers trade more bonds on average, and an average bond is traded by more dealers, results that suggest increased competition in market maki ...

... We document a number of striking findings, including that dealer concentration, while relatively high, has trended down over time. In recent years, individual dealers trade more bonds on average, and an average bond is traded by more dealers, results that suggest increased competition in market maki ...

INVESTMENT POLICY The Kitsap Community Foundation (“the

... expense payments, and preservation of the Fund’s principal value. Commercial paper assets must be rated at least A1 or P-1 (by Moody’s or S&P). No more than 5% of the Fund’s total market value may be invested in the obligations of a single issuer, with the exception of the U.S. Government and its ag ...

... expense payments, and preservation of the Fund’s principal value. Commercial paper assets must be rated at least A1 or P-1 (by Moody’s or S&P). No more than 5% of the Fund’s total market value may be invested in the obligations of a single issuer, with the exception of the U.S. Government and its ag ...

Asset Pricing When Traders Sell Extreme Winners and Losers

... schedule (selling – buying), which corresponds to investors’ demand. Second, I estimate the relative magnitude of demand perturbation on the gain side versus that on the loss side, so that later we can see if the price effects from the two sides are consistent with this relation. I conduct analysis ...

... schedule (selling – buying), which corresponds to investors’ demand. Second, I estimate the relative magnitude of demand perturbation on the gain side versus that on the loss side, so that later we can see if the price effects from the two sides are consistent with this relation. I conduct analysis ...

Securities Processing: The Effects of a T+3 System on Security Prices

... demanding this premium because of potential processing errors that are costly to fix and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day of the week effect, but when the payment delay is controlled for, the effect still exists ...

... demanding this premium because of potential processing errors that are costly to fix and that delay payment by more than six business days. In addition, his study explores whether payment delays explain the day of the week effect, but when the payment delay is controlled for, the effect still exists ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.