Slides

... increasing supply will result in gains for the investor. The reason is that real investment cannot occur instantaneously and there is a larger window within which such investment can be profitably made. Furthermore, not everybody has the resources/knowhow to undertake real investment in a given se ...

... increasing supply will result in gains for the investor. The reason is that real investment cannot occur instantaneously and there is a larger window within which such investment can be profitably made. Furthermore, not everybody has the resources/knowhow to undertake real investment in a given se ...

Price Dispersion in OTC Markets: A New

... bond (Treasury and corporate), most new derivative markets etc. • Microstructure of OTC markets is different from exchangetraded (ET) markets. • Lack of a centralized trading platform: Trades are result of bilateral negotiations → Trades can take place at different prices at the same time. • Search ...

... bond (Treasury and corporate), most new derivative markets etc. • Microstructure of OTC markets is different from exchangetraded (ET) markets. • Lack of a centralized trading platform: Trades are result of bilateral negotiations → Trades can take place at different prices at the same time. • Search ...

download

... Diversified financial transactions also lend themselves to e-commerce applications, especially Web-based ones. In Chapter 5, we described e-banking, online securities trading, and more. Many of these can be done in a wireless environment (Chapter 6, and the Handlesbanken case in Chapter 2). Here we ...

... Diversified financial transactions also lend themselves to e-commerce applications, especially Web-based ones. In Chapter 5, we described e-banking, online securities trading, and more. Many of these can be done in a wireless environment (Chapter 6, and the Handlesbanken case in Chapter 2). Here we ...

Syllabus B Com Sem-6 FC302B Personal Financial Planning

... Personal financial planning – meaning, objectives, process The concept of Time Value of Money and its application in financial planning Unit – II Personal tax planning – basics of tax assessment for an individual, deductions and reliefs available to an individual, avenues for tax savings for an indi ...

... Personal financial planning – meaning, objectives, process The concept of Time Value of Money and its application in financial planning Unit – II Personal tax planning – basics of tax assessment for an individual, deductions and reliefs available to an individual, avenues for tax savings for an indi ...

Research on the Stock Market Response to Earnings - PUC-SP

... Fifth, data computing. pi is computed by using of the closing prices on the transaction days for a whole year; compute Rit in the event window and group Rit in unequal intervals according to the RC / NI value; compute Rit of each group; inspect the response of the stock price to various earnings man ...

... Fifth, data computing. pi is computed by using of the closing prices on the transaction days for a whole year; compute Rit in the event window and group Rit in unequal intervals according to the RC / NI value; compute Rit of each group; inspect the response of the stock price to various earnings man ...

November 2011 - Capital Markets Board of Turkey

... between the institutions through the exchange of information on matters related to the supervision of financial institutions and the establishment of a communication channel. During their stay in Turkey, the Korean Delegation also visited the Istanbul Stock Exchange and Banking Regulation and Superv ...

... between the institutions through the exchange of information on matters related to the supervision of financial institutions and the establishment of a communication channel. During their stay in Turkey, the Korean Delegation also visited the Istanbul Stock Exchange and Banking Regulation and Superv ...

Emerging markets in 2017

... This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity International refers ...

... This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity International refers ...

Course: Corporate Finance

... A new issue of securities increases both the amount of cash held by the company and the amount of stocks or bonds held by the public. Such an issue is known as a primary issue and it is sold in the primary market. But in addition to helping companies raise new cash, financial markets also allow inve ...

... A new issue of securities increases both the amount of cash held by the company and the amount of stocks or bonds held by the public. Such an issue is known as a primary issue and it is sold in the primary market. But in addition to helping companies raise new cash, financial markets also allow inve ...

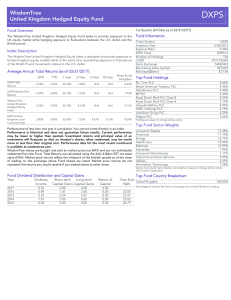

WisdomTree United Kingdom Hedged Equity Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

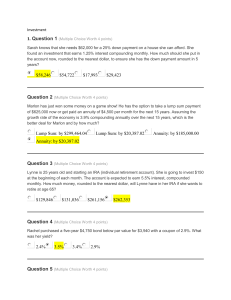

Investment - OpenStudy

... Lucas purchased 90 shares of stock in a computer company at $87.92 per share and Peyton purchased 55 shares of stock in a different computer company for $72.03 per share. After holding the stock for two years, Lucas sold his for a total of $8,476.20, and Peyton sold hers for a total of $4,192.10. Wh ...

... Lucas purchased 90 shares of stock in a computer company at $87.92 per share and Peyton purchased 55 shares of stock in a different computer company for $72.03 per share. After holding the stock for two years, Lucas sold his for a total of $8,476.20, and Peyton sold hers for a total of $4,192.10. Wh ...

Finance 332

... a. All historical information only. b. All public information only. c. All historical, public, and private information. d. All historical and public information only. 9. Which of the following is not an assumption of an efficient market? a. The presence of a large number of profit maximizing partici ...

... a. All historical information only. b. All public information only. c. All historical, public, and private information. d. All historical and public information only. 9. Which of the following is not an assumption of an efficient market? a. The presence of a large number of profit maximizing partici ...

Introduction to Money and the Financial System

... Liquidity is the cost, in terms of time and money of converting an asset into cash at any time. Since no one is ever certain about their future cash needs for transactions, people prefer liquid assets. Liquid assets are thought to be assets for which there are thick markets – I.e assets with many bu ...

... Liquidity is the cost, in terms of time and money of converting an asset into cash at any time. Since no one is ever certain about their future cash needs for transactions, people prefer liquid assets. Liquid assets are thought to be assets for which there are thick markets – I.e assets with many bu ...

US Equities

... • The corporate sector has been a relatively bright spot in the U.S. economy over the past several years as the environment of low interest rates and robust profitability has allowed corporations to reduce interest expense, shore up balance sheets, and accumulate the highest levels of liquid assets ...

... • The corporate sector has been a relatively bright spot in the U.S. economy over the past several years as the environment of low interest rates and robust profitability has allowed corporations to reduce interest expense, shore up balance sheets, and accumulate the highest levels of liquid assets ...

Bangladeshi Money Supply And Equity Returns: A Co-Integration Analysis:

... The standard neoclassical paradigm of financial economics assumes that investors react to noteworthy news events by adjusting their investment portfolios because these events change the risk-return profile of securities. Therefore, changes in the money supply, particularly M1 money, are important in ...

... The standard neoclassical paradigm of financial economics assumes that investors react to noteworthy news events by adjusting their investment portfolios because these events change the risk-return profile of securities. Therefore, changes in the money supply, particularly M1 money, are important in ...

Iowa State University, Department of Economics

... 5. For full credit on the essay questions: 1) LABEL all graphs completely, including "demand for _____ by _____" and "supply of ____ by _____." 2) Explain, using complete sentences, what causes which changes in behavior. DO write "demand(or supply) for(of) _____ increases(or decreases);" DO write “t ...

... 5. For full credit on the essay questions: 1) LABEL all graphs completely, including "demand for _____ by _____" and "supply of ____ by _____." 2) Explain, using complete sentences, what causes which changes in behavior. DO write "demand(or supply) for(of) _____ increases(or decreases);" DO write “t ...

fall303

... The managers of PonchoParts, Inc. plan to manufacture engine blocks for classic cars from the 1960s era. They expect to sell 250 blocks annually for the next 5 years. The necessary foundry and machining equipment will cost a total of $800,000 and will be depreciated on a straight-line basis to zero ...

... The managers of PonchoParts, Inc. plan to manufacture engine blocks for classic cars from the 1960s era. They expect to sell 250 blocks annually for the next 5 years. The necessary foundry and machining equipment will cost a total of $800,000 and will be depreciated on a straight-line basis to zero ...

SM_C04_Reilly1ce

... of this information. Adequate liquidity is desirable so that participants may buy and sell their goods and/or services rapidly, at a price reflecting the supply and demand. The costs of transferring ownership and middleman commissions should be low. Finally, the prevailing price should reflect all a ...

... of this information. Adequate liquidity is desirable so that participants may buy and sell their goods and/or services rapidly, at a price reflecting the supply and demand. The costs of transferring ownership and middleman commissions should be low. Finally, the prevailing price should reflect all a ...

Market Volatility: a Friend of Active Management?

... short*). Since passive index funds, or passively managed ETFs, are static in nature and hold the same portfolio as the benchmark, there are no efforts made to analyse securities (determine which are worth owning and which are not) and then build a portfolio accordingly. That is not to denigrate pass ...

... short*). Since passive index funds, or passively managed ETFs, are static in nature and hold the same portfolio as the benchmark, there are no efforts made to analyse securities (determine which are worth owning and which are not) and then build a portfolio accordingly. That is not to denigrate pass ...

1. Without the participation of financial intermediaries in financial

... 43. To cover managerial expenses, mutual funds typically charge (Points: 6) management fees of 1 to 2 percent of total assets per year commissions of typically 8 to 10 percent of transaction market value per year. management fees of typically more than 10 percent of total assets per year. commissio ...

... 43. To cover managerial expenses, mutual funds typically charge (Points: 6) management fees of 1 to 2 percent of total assets per year commissions of typically 8 to 10 percent of transaction market value per year. management fees of typically more than 10 percent of total assets per year. commissio ...

List of terms and expressions for the exam(2015)

... Scope of Financial Management CFO Treasurer Controller Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer an ...

... Scope of Financial Management CFO Treasurer Controller Goal of Financial Management NYSE NASDAQ securities cash flow Primary and Secondary Markets over-the-counter deals (OTC deals) Dow Jones capital stock stocks and shares common vs. preferred stocks dividend shareholder IPO bond the bond issuer an ...

File

... contributed to the Great Depression: –Examine the documents provided and complete the chart in your notes –After examining all documents, try to group the documents into categories –When finished, create a one sentence thesis that explains why the depression began…be prepared to discuss ...

... contributed to the Great Depression: –Examine the documents provided and complete the chart in your notes –After examining all documents, try to group the documents into categories –When finished, create a one sentence thesis that explains why the depression began…be prepared to discuss ...

Notes: All index returns exclude reinvested dividends, and the 5

... leave and proceed to the selected site. Neither Woodbury Financial Services, Inc., nor its registered representatives. ...

... leave and proceed to the selected site. Neither Woodbury Financial Services, Inc., nor its registered representatives. ...

Answer Sheet for Stock Market Lessons

... What was the closing price for Intel 3 months ago (click on historical data)? ___________$16.67_______________________________________ How many percent of shares do insiders (management and directors) own? _7%______________________ ...

... What was the closing price for Intel 3 months ago (click on historical data)? ___________$16.67_______________________________________ How many percent of shares do insiders (management and directors) own? _7%______________________ ...

Markets, Investments and Marketing-simulation Games

... For the first time the business game is used in the training of regular students and post-graduates in 1986 in the sector “Market situation of international markets” of the then existing department “Organization and management of foreign trade”. It was practiced as special course for three academic ...

... For the first time the business game is used in the training of regular students and post-graduates in 1986 in the sector “Market situation of international markets” of the then existing department “Organization and management of foreign trade”. It was practiced as special course for three academic ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.