TO: NYSE Listed Company Executives FROM: NYSE Regulation, Inc

... Listed companies will be required to call the Exchange’s Market Watch Group (at 212-656-5414 or 877-699-2578) at least 10 minutes in advance of the dissemination of material news any time between 7.00 a.m. Eastern Time (“ET”) and the end of the NYSE trading session (generally 4.00 p.m. ET) and provi ...

... Listed companies will be required to call the Exchange’s Market Watch Group (at 212-656-5414 or 877-699-2578) at least 10 minutes in advance of the dissemination of material news any time between 7.00 a.m. Eastern Time (“ET”) and the end of the NYSE trading session (generally 4.00 p.m. ET) and provi ...

International Stock Market Efficiency: A Non-Bayesian Time

... are mainly two types of papers written in the 1990s and early 2000s. The first approach employs a vector autoregressive (VAR) model to determine whether there is any international linkage of stock prices, especially in short-run relationships among stock price indices (see, for example, Jeon and Vo ...

... are mainly two types of papers written in the 1990s and early 2000s. The first approach employs a vector autoregressive (VAR) model to determine whether there is any international linkage of stock prices, especially in short-run relationships among stock price indices (see, for example, Jeon and Vo ...

Free Sample - Exam Test Bank Store

... 8. Investors buy new issues for the anticipated return, which is some cases has been substantial. Since all publicly held firms had to sell securities initially, the investor may be buying today the shares of tomorrow's success story (e.g., Google). The risk associated with investing in the shares ...

... 8. Investors buy new issues for the anticipated return, which is some cases has been substantial. Since all publicly held firms had to sell securities initially, the investor may be buying today the shares of tomorrow's success story (e.g., Google). The risk associated with investing in the shares ...

evolution of stock markets and role of stock exchange

... It has set up facilities that serve as a model for the securities industry in terms of systems, practices and procedures. NSE has played a catalytic role in reforming the Indian securities market in terms of microstructure, market practices and trading volumes. The market today uses state-of-art inf ...

... It has set up facilities that serve as a model for the securities industry in terms of systems, practices and procedures. NSE has played a catalytic role in reforming the Indian securities market in terms of microstructure, market practices and trading volumes. The market today uses state-of-art inf ...

insider trading policy

... may be liable for damages to the person on the other side of the trade. In addition, any such person who informs or tips a seller or a purchaser of securities of Undisclosed Material Information may be liable for damages. The purchaser, vendor or informer is also liable to compensate the seller or p ...

... may be liable for damages to the person on the other side of the trade. In addition, any such person who informs or tips a seller or a purchaser of securities of Undisclosed Material Information may be liable for damages. The purchaser, vendor or informer is also liable to compensate the seller or p ...

Investors see recession, economists are still divided

... Equity investors have cast a clear vote of “no-confidence” in the theory that the rest of the world will pick up the slack as US growth falters, sending stock markets tumbling around the globe for a second consecutive day on Tuesday. However, an emergency 0.75 percentage point interest-rate cut by t ...

... Equity investors have cast a clear vote of “no-confidence” in the theory that the rest of the world will pick up the slack as US growth falters, sending stock markets tumbling around the globe for a second consecutive day on Tuesday. However, an emergency 0.75 percentage point interest-rate cut by t ...

David Aranzabal

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

Origination Execution

... measured by share of client activity, market rank and profitability Manage a diversified portfolio of business and asset classes, making prudent use of Firm capital Out-perform through market cycles Be the most relevant advisor to its target client base ...

... measured by share of client activity, market rank and profitability Manage a diversified portfolio of business and asset classes, making prudent use of Firm capital Out-perform through market cycles Be the most relevant advisor to its target client base ...

RESEARCH ON SENTIMENT-BASED SMART MONEY

... Research into a “Smart Holdings” model of buying and selling behavior reveals some interesting biases. Research into historical holdings data uncovered several factors that help us predict future holdings: • Funds are attracted to companies that are “like” ones they already own. Likeness can be on ...

... Research into a “Smart Holdings” model of buying and selling behavior reveals some interesting biases. Research into historical holdings data uncovered several factors that help us predict future holdings: • Funds are attracted to companies that are “like” ones they already own. Likeness can be on ...

Irrational Exuberance

... The principal–agent problem occurs when one party is able to make decisions on behalf of another but his own best interests conflict with those of the principal. (often under information asymmetry) For example, in China, mutual fund managers’ best interest is to draw as much capital as possible ...

... The principal–agent problem occurs when one party is able to make decisions on behalf of another but his own best interests conflict with those of the principal. (often under information asymmetry) For example, in China, mutual fund managers’ best interest is to draw as much capital as possible ...

Trading Issues and Enhanced Regulatory Disclosures

... specified price or size parameters or that indicate duplicative orders. ...

... specified price or size parameters or that indicate duplicative orders. ...

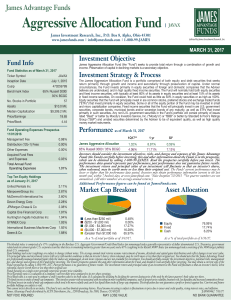

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Chapter 17: Investment

... of goods whenever consumer demand changes Firms maintain inventories of parts and materials, like a production factor, to increase output quickly Firms maintain inventories to avoid running out of stocks Firms maintain inventories of parts and materials when the product requires a number of steps in ...

... of goods whenever consumer demand changes Firms maintain inventories of parts and materials, like a production factor, to increase output quickly Firms maintain inventories to avoid running out of stocks Firms maintain inventories of parts and materials when the product requires a number of steps in ...

PERSONAL FINANCE CASE STUDIES

... longer. Luz, who originally hails from Peru, sends money to her family regularly, but her parents are aging and may need more financial assistance in the future. Lastly, due to the Marcottes’s fairly hectic lifestyle, they have not given much thought to their own retirements, or the possibility of h ...

... longer. Luz, who originally hails from Peru, sends money to her family regularly, but her parents are aging and may need more financial assistance in the future. Lastly, due to the Marcottes’s fairly hectic lifestyle, they have not given much thought to their own retirements, or the possibility of h ...

Financial Markets under the Influence of Government Debt

... ■ Size of government debt as an indicator of stock performance ■ CEE5: Joint government debt smaller than Greece ■ Investment climate in CEE currently very good ■ CEE markets still undervalued Government indebtedness reflected in local stock indices The focus will stay on overcoming the high levels ...

... ■ Size of government debt as an indicator of stock performance ■ CEE5: Joint government debt smaller than Greece ■ Investment climate in CEE currently very good ■ CEE markets still undervalued Government indebtedness reflected in local stock indices The focus will stay on overcoming the high levels ...

Chapter 15 Glossary

... statement of stockholders’ equity One of the basic financial statements, which reports the changes in each stockholders’ equity account and in total stockholders’ equity during the year. It typically shows balances at the beginning of the period, additions and deductions, and balances at the end of ...

... statement of stockholders’ equity One of the basic financial statements, which reports the changes in each stockholders’ equity account and in total stockholders’ equity during the year. It typically shows balances at the beginning of the period, additions and deductions, and balances at the end of ...

UBS Investor Watch

... Global events are creating greater uncertainty for investors… As the world gets smaller and more connected, nearly all investors believe global events have a greater impact on the U.S. markets than they used to. Investors realize they can no longer ignore the impact of these forces on their portfoli ...

... Global events are creating greater uncertainty for investors… As the world gets smaller and more connected, nearly all investors believe global events have a greater impact on the U.S. markets than they used to. Investors realize they can no longer ignore the impact of these forces on their portfoli ...

Global Arbitration Review Inside arbitrators` minds Thursday, 20

... “red flags” suggesting poor performance and for selling securities at the “bottom of the market”. How the trustees in such cases were supposed to have known that the red flags were more predictive than the positive signals or that a stock price had actually reached bottom is unclear. More recently, ...

... “red flags” suggesting poor performance and for selling securities at the “bottom of the market”. How the trustees in such cases were supposed to have known that the red flags were more predictive than the positive signals or that a stock price had actually reached bottom is unclear. More recently, ...

EMH - Csulb.edu

... The premises of an efficient market – A large number of competing profit-maximizing participants analyze and value securities, each independently of the others – New information regarding securities comes to the market in a random fashion – Profit-maximizing investors adjust security prices rapidly ...

... The premises of an efficient market – A large number of competing profit-maximizing participants analyze and value securities, each independently of the others – New information regarding securities comes to the market in a random fashion – Profit-maximizing investors adjust security prices rapidly ...

Market Performance and the Party in Power

... Investing involves market risk. Investment return and value will fluctuate, and it is possible to lose money by investing. In preparing this document, Janus has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. ...

... Investing involves market risk. Investment return and value will fluctuate, and it is possible to lose money by investing. In preparing this document, Janus has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. ...

Press Release Brussels, 8 June 2017 `EU publicly quoted

... and recognizes the importance of strong capital markets in delivering growth and jobs.” EuropeanIssuers believes that capital markets exist to serve the real economy – companies and investors. What EU quoted companies seek from capital markets is flexible access to capital, good risk management, tra ...

... and recognizes the importance of strong capital markets in delivering growth and jobs.” EuropeanIssuers believes that capital markets exist to serve the real economy – companies and investors. What EU quoted companies seek from capital markets is flexible access to capital, good risk management, tra ...

Presentation Headline

... This information is issued by SEI Investments (Europe) Limited, 4th Floor, Time & Life Building 1 Bruton Street, London W1J 6TL which is authorised and regulated by the Financial Services Authority. No offer of any security is made hereby. Recipients of this information who intend to apply for share ...

... This information is issued by SEI Investments (Europe) Limited, 4th Floor, Time & Life Building 1 Bruton Street, London W1J 6TL which is authorised and regulated by the Financial Services Authority. No offer of any security is made hereby. Recipients of this information who intend to apply for share ...

A Framework for Social Investment Practice (Rough

... Derwall, Jeroen, and Kees Koedijk. "Socially Responsible Fixed-Income Funds." Working Paper, Erasmus University, May 2006. Derwall, Jeroen, Nadja Guenster, Rob Bauer, and Kees Koedijk. "The Eco-Efficiency Premium Puzzle." Financial Analysts Journal, March/April 2005. Dowell, Glen, Stuart Hart, and B ...

... Derwall, Jeroen, and Kees Koedijk. "Socially Responsible Fixed-Income Funds." Working Paper, Erasmus University, May 2006. Derwall, Jeroen, Nadja Guenster, Rob Bauer, and Kees Koedijk. "The Eco-Efficiency Premium Puzzle." Financial Analysts Journal, March/April 2005. Dowell, Glen, Stuart Hart, and B ...

BUSINESS ENGLISH 1

... Someone who buys and sells stocks and shares in the hope of making a profit through changes in their value. Shares (portion of the capital of a business company) held by an investor. A licensed professional who buys and sells stocks and shares for clients in exchange for a fee, called a 'commission' ...

... Someone who buys and sells stocks and shares in the hope of making a profit through changes in their value. Shares (portion of the capital of a business company) held by an investor. A licensed professional who buys and sells stocks and shares for clients in exchange for a fee, called a 'commission' ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.