Silicon Hills Client Newsletter - Silicon Hills Wealth Management

... One of our partners, Pam Friedman, said “I do” to Mitch Sundet in a beautiful backyard setting amongst a small group of family and friends in April. Pam beamed with excitement and happiness and was the epitome of a blushing, blissful bride. During the groom’s speech, a dashing Mitch couldn’t resist ...

... One of our partners, Pam Friedman, said “I do” to Mitch Sundet in a beautiful backyard setting amongst a small group of family and friends in April. Pam beamed with excitement and happiness and was the epitome of a blushing, blissful bride. During the groom’s speech, a dashing Mitch couldn’t resist ...

Derivatives Market Risk Related to Certain Variable

... The decrease in VaR as of December 31, 2012 was driven by a lower level of foreign exchange rate volatility. For derivatives used to hedge the anticipated level of U.S. dollar-equivalent earnings of our international operations, the estimated hypothetical decline in VaR, measured at a 95% confidence ...

... The decrease in VaR as of December 31, 2012 was driven by a lower level of foreign exchange rate volatility. For derivatives used to hedge the anticipated level of U.S. dollar-equivalent earnings of our international operations, the estimated hypothetical decline in VaR, measured at a 95% confidence ...

Modeling the Active versus Passive Debate

... investing with sub-perfect knowledge, because she does not know the advance price of those stocks to be sold on day 15. Intuitively it would seem unlikely that she could tinker her way to a better return than the perfect portfolio. But she can, and she does so repeatedly. Strategy B beats Strategy ...

... investing with sub-perfect knowledge, because she does not know the advance price of those stocks to be sold on day 15. Intuitively it would seem unlikely that she could tinker her way to a better return than the perfect portfolio. But she can, and she does so repeatedly. Strategy B beats Strategy ...

trading instructions

... (4) The Stock Exchange informs the Republic of Srpska Securities Commission on reported block trades. (5) The Stock Exchange keeps a special record of block trades. Interrupted auctions due to price fluctuations Article 5 (1) According to the Article 109, paragraph 1 of the Rules, trading interval i ...

... (4) The Stock Exchange informs the Republic of Srpska Securities Commission on reported block trades. (5) The Stock Exchange keeps a special record of block trades. Interrupted auctions due to price fluctuations Article 5 (1) According to the Article 109, paragraph 1 of the Rules, trading interval i ...

Click here for the LONG version of the 4th Quarter Newsletter

... place in 2017. Also, there is the potential for bank failures in Italy - Europe's third largest economy which would cause big problems for Europe and possibly the entire globe. Any major global crisis will only add to uncertainty and investors know that the equity markets do not like uncertainty. (S ...

... place in 2017. Also, there is the potential for bank failures in Italy - Europe's third largest economy which would cause big problems for Europe and possibly the entire globe. Any major global crisis will only add to uncertainty and investors know that the equity markets do not like uncertainty. (S ...

CHAPTER 5:

... 3.5% is the expected rate of inflation. Part of the difference is probably a risk premium associated with the uncertainty surrounding the real rate of return on the conventional GICs. This implies that the expected rate of inflation is less than 3.5% per year. E(r) = .35 44% + .30 14% + .35 (– ...

... 3.5% is the expected rate of inflation. Part of the difference is probably a risk premium associated with the uncertainty surrounding the real rate of return on the conventional GICs. This implies that the expected rate of inflation is less than 3.5% per year. E(r) = .35 44% + .30 14% + .35 (– ...

Efficient Risk Reducing Strategies by International Diversification

... lunch”. However, as AdjaozMTuchschmid (1996) and GlenLJorion (1993) pointed out, the unitary hedge ratio is the optimal one only if the exchange rate returns and local returns are uncorrelated and the forward exchange premium is an unbiased predictor of the future exchange rate returns. Black (1989) ...

... lunch”. However, as AdjaozMTuchschmid (1996) and GlenLJorion (1993) pointed out, the unitary hedge ratio is the optimal one only if the exchange rate returns and local returns are uncorrelated and the forward exchange premium is an unbiased predictor of the future exchange rate returns. Black (1989) ...

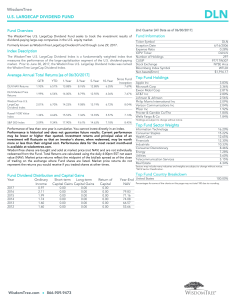

WisdomTree LargeCap Dividend Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

Southeast Asia`s Capital Markets Getting It Right This Time

... Singapore and Myanmar lying at opposite extremes. If Southeast Asia wants sustainable growth, it needs to address a number of issues. One, Southeast Asian markets are dominated by large family-controlled conglomerates that are often opaque in their transactions and wield strong political influence. ...

... Singapore and Myanmar lying at opposite extremes. If Southeast Asia wants sustainable growth, it needs to address a number of issues. One, Southeast Asian markets are dominated by large family-controlled conglomerates that are often opaque in their transactions and wield strong political influence. ...

Interview with Roi Villar Vázquez, Head of

... The purpose of dissemination is to increase web traffic to our campaign, while reputation refers to improve confidence from the websurfer in our campaign. In other words a good reputation aims to improve traffic conversion to investments in our campaign. Much is written on different blogs about onl ...

... The purpose of dissemination is to increase web traffic to our campaign, while reputation refers to improve confidence from the websurfer in our campaign. In other words a good reputation aims to improve traffic conversion to investments in our campaign. Much is written on different blogs about onl ...

for the financial claim.

... sponsored enterprises, mutual fund companies, bond insurance companies, … ...

... sponsored enterprises, mutual fund companies, bond insurance companies, … ...

relationship - University of St Andrews

... recovered from a significant decline during the 1990s, and at the time of writing, trades at around a quarter of the value it saw at its peak in 1989. 2 The aim of this paper is to see whether the same model can explain the US and Japanese stock market while yielding consistent factor loadings. This ...

... recovered from a significant decline during the 1990s, and at the time of writing, trades at around a quarter of the value it saw at its peak in 1989. 2 The aim of this paper is to see whether the same model can explain the US and Japanese stock market while yielding consistent factor loadings. This ...

File

... • Optimism: the market just needs to correct itself. • Told businesses to keep producing products, don’t layoff workers, maintain the status quo. • Told workers don’t demand higher wages or go on strike; just keep on working. • Got Congress to spend money on public works. – But he didn’t want to inc ...

... • Optimism: the market just needs to correct itself. • Told businesses to keep producing products, don’t layoff workers, maintain the status quo. • Told workers don’t demand higher wages or go on strike; just keep on working. • Got Congress to spend money on public works. – But he didn’t want to inc ...

Weekly Market Commentary - Quist Wealth Management

... Source: LPL Financial Research, Bloomberg data 08/07/14 All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. LPL Financial Member FINRA/SIPC ...

... Source: LPL Financial Research, Bloomberg data 08/07/14 All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. LPL Financial Member FINRA/SIPC ...

Financial Institutions and Capital Markets

... securities/industries and start his own reinsurance company while at the same time avoiding any large investment in financial institutions, and how he is now looking for the “new Buffett.” The rest of the course contains the following three modules: 1. The first module, “Financial Institutions” (UVA ...

... securities/industries and start his own reinsurance company while at the same time avoiding any large investment in financial institutions, and how he is now looking for the “new Buffett.” The rest of the course contains the following three modules: 1. The first module, “Financial Institutions” (UVA ...

Ban on short selling

... to net short positions. On October 11 2008, the Act on Financial Supervision was amended. The law now explicitly provides that the AFM may decide that certain types of transactions or trade orders are deemed to fall within the scope of the prohibition on market manipulation. The AFM’s ban on short s ...

... to net short positions. On October 11 2008, the Act on Financial Supervision was amended. The law now explicitly provides that the AFM may decide that certain types of transactions or trade orders are deemed to fall within the scope of the prohibition on market manipulation. The AFM’s ban on short s ...

Long Term Effect of Liquidity on Stock Market Development

... Volatility of stock may be desirable because it reveals changing values among economic fundamentals for a better resource allocation. Excessive stock price changes are however not healthy for a better developed stock market. From the theoretical perspective, higher stock price volatility discourages ...

... Volatility of stock may be desirable because it reveals changing values among economic fundamentals for a better resource allocation. Excessive stock price changes are however not healthy for a better developed stock market. From the theoretical perspective, higher stock price volatility discourages ...

With the floats market set to re-open with a bang Simon

... to float but that number could easily balloon trading in Multimedia TV was suspended in once confidence returns (see table, left, and October 2006 at 0.38p and the stock subsequently delisted in 2008. analysis on page 19). Unfortunately it is far from easy for private Despite such setbacks, the numb ...

... to float but that number could easily balloon trading in Multimedia TV was suspended in once confidence returns (see table, left, and October 2006 at 0.38p and the stock subsequently delisted in 2008. analysis on page 19). Unfortunately it is far from easy for private Despite such setbacks, the numb ...

Question 1 Miss Maple is considering two securities, A and B, and

... Stocks that move perfectly with the market have a beta of 1. Betas get higher as volatility goes up and lower as it goes down. Thus, Southern Co, a utility whose share have traded close to $12 for most of the past three years, has a low beta. At the other extreme, there is True North Networks, which ...

... Stocks that move perfectly with the market have a beta of 1. Betas get higher as volatility goes up and lower as it goes down. Thus, Southern Co, a utility whose share have traded close to $12 for most of the past three years, has a low beta. At the other extreme, there is True North Networks, which ...

North Americans go bargain hunting in UK listed sector

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

NSE Partners with Apeejay Stya University to offer 5

... help students pursue an ASU degree along with NSE certification, transforming them into competent professionals in the field. NSE will provide constant support for effective implementation of these ...

... help students pursue an ASU degree along with NSE certification, transforming them into competent professionals in the field. NSE will provide constant support for effective implementation of these ...

Sphere FTSE Emerging Markets Sustainable Yield Index ETF

... The FTSE Sustainable Yield 150 10% Capped & 100% Hedged to CAD Indices were launched in August of 2015. Performance data prior to the inception of these indices is hypothetical back-tested. The hypothetical back-tested index performance data shown on page 1 has been calculated by FTSE Russell and is ...

... The FTSE Sustainable Yield 150 10% Capped & 100% Hedged to CAD Indices were launched in August of 2015. Performance data prior to the inception of these indices is hypothetical back-tested. The hypothetical back-tested index performance data shown on page 1 has been calculated by FTSE Russell and is ...

an analysis of investor`s confidence and risk taking aptitude from the

... has in himself as compared to informal sources, control over his investments, risk taking ability, confidence of the investor as compared to formal sources such as financial analysts and advisors, expectation to perform better than the stock market, short-term investment attitude. These are some of ...

... has in himself as compared to informal sources, control over his investments, risk taking ability, confidence of the investor as compared to formal sources such as financial analysts and advisors, expectation to perform better than the stock market, short-term investment attitude. These are some of ...

Weekly Update - United Overseas Bank Malaysia

... ill in the background was the continued turmoil in emerging markets. Both the euro and yen made gains against the dollar while US Treasury prices increased across the curve as the markets were spooked by the weaker US manufacturing data and the on-going EM turbulence pushed investors into safe haven ...

... ill in the background was the continued turmoil in emerging markets. Both the euro and yen made gains against the dollar while US Treasury prices increased across the curve as the markets were spooked by the weaker US manufacturing data and the on-going EM turbulence pushed investors into safe haven ...

An Empirical Analysis of the Leverage Effect

... An Empirical Analysis of the Leverage Effect TUESDAY, November 3, 2015, at 8:00 AM Eckhart 117, 5734 S. University Avenue ...

... An Empirical Analysis of the Leverage Effect TUESDAY, November 3, 2015, at 8:00 AM Eckhart 117, 5734 S. University Avenue ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.