Clean Tech - GreenWorld Capital, LLC

... quantity of stock at set intervals of time at future stock prices. An effective registration statement must be maintained in order for take downs to be completed. ...

... quantity of stock at set intervals of time at future stock prices. An effective registration statement must be maintained in order for take downs to be completed. ...

Slide 1

... capitalization ratio (stock market capitalization/GDP) are used instead of turnover ratio (stock value traded/stock market capitalization) as a measure of capital market development. Major findings do not materially change with alternative measures. ...

... capitalization ratio (stock market capitalization/GDP) are used instead of turnover ratio (stock value traded/stock market capitalization) as a measure of capital market development. Major findings do not materially change with alternative measures. ...

WisdomTree Launches Emerging Markets High

... Index returns do not reflect Fund returns. A fund’s portfolio may differ significantly from securities included in an index. Index performance assumes e reinvestment of dividends, but does not include management fees, transaction costs, taxes or expenses that would be incurred by a Fund or brokerage ...

... Index returns do not reflect Fund returns. A fund’s portfolio may differ significantly from securities included in an index. Index performance assumes e reinvestment of dividends, but does not include management fees, transaction costs, taxes or expenses that would be incurred by a Fund or brokerage ...

objective straightforward communications generating potential

... No strategy assures success or protects against loss. Derivatives strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the ...

... No strategy assures success or protects against loss. Derivatives strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the ...

CHARACTERISTICS OF THE EMERGING MARKET ECONOMIES

... · the most advanced markets, · narrow emerging markets, · emerging markets (latent). In the case of advanced emerging markets, Simon brings into question countries such as Malaysia, Mexico, South Korea, Taiwan, or Thailand whose inflation rates are quite low and in which there is some stability in t ...

... · the most advanced markets, · narrow emerging markets, · emerging markets (latent). In the case of advanced emerging markets, Simon brings into question countries such as Malaysia, Mexico, South Korea, Taiwan, or Thailand whose inflation rates are quite low and in which there is some stability in t ...

Instructor`s Manual Chapter 11-7e

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

incentives to investors in the industry

... (iii) Feasibility study on the service (in conformance with ...

... (iii) Feasibility study on the service (in conformance with ...

Everything You Wanted to Know about Asset Management for

... – The first is what rate of return they could get without risk. – The second is that they demand an additional return (an increase in the discount rate) which is proportional to the risk of the investment. It should be noted that while there is only one true risk (uncertainty of future outcomes) for ...

... – The first is what rate of return they could get without risk. – The second is that they demand an additional return (an increase in the discount rate) which is proportional to the risk of the investment. It should be noted that while there is only one true risk (uncertainty of future outcomes) for ...

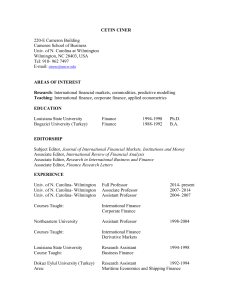

cetin ciner - University of North Carolina Wilmington

... PUBLICATIONS 1) They dynamic relation between crude oil and natural gas prices (with J. Batten and B. Lucey), Energy Economics,forthcoming. 2) Is the price of gold to gold mining stocks asymmetric? (with J. Batten, B. Lucey and A. Kosedag), Economic Modelling, forthcoming. 3) Equities as long-term ...

... PUBLICATIONS 1) They dynamic relation between crude oil and natural gas prices (with J. Batten and B. Lucey), Energy Economics,forthcoming. 2) Is the price of gold to gold mining stocks asymmetric? (with J. Batten, B. Lucey and A. Kosedag), Economic Modelling, forthcoming. 3) Equities as long-term ...

SEBI

... organization from holding such position. Impound and retain the proceeds or securities in respect of any transaction which is under investigation. Attach for a period not exceeding one month, one or more bank account or accounts of any intermediary or any person associated with the securities ma ...

... organization from holding such position. Impound and retain the proceeds or securities in respect of any transaction which is under investigation. Attach for a period not exceeding one month, one or more bank account or accounts of any intermediary or any person associated with the securities ma ...

analysis of problematics related to the stock market in albania

... facilities for local companies not large enough in terms of less stringent requirements and also, sometimes, list firms listed in national stock exchanges as well, in order to give the local brokers access to these securities. Many firms believe that being listed in one of the major exchanges can br ...

... facilities for local companies not large enough in terms of less stringent requirements and also, sometimes, list firms listed in national stock exchanges as well, in order to give the local brokers access to these securities. Many firms believe that being listed in one of the major exchanges can br ...

Presentation - United Nations Statistics Division

... Monetary accounts Full environmental accounting used to calculating monetary accounts for SA. This represents an attempt to accommodate all entries of the more comprehensive physical resource account in the 1993 SNA with monetary values assigned ...

... Monetary accounts Full environmental accounting used to calculating monetary accounts for SA. This represents an attempt to accommodate all entries of the more comprehensive physical resource account in the 1993 SNA with monetary values assigned ...

Seeing the Big Picture: Financial Markets, Conflict and Corruption

... – The first is what rate of return they could get without risk. – The second is that they demand an additional return (an increase in the discount rate) which is proportional to the risk of the investment. It should be noted that while there is only one true risk (uncertainty of future outcomes) for ...

... – The first is what rate of return they could get without risk. – The second is that they demand an additional return (an increase in the discount rate) which is proportional to the risk of the investment. It should be noted that while there is only one true risk (uncertainty of future outcomes) for ...

Bond Strategies for Rising Rate Environments

... doing their homework in today's low yield environment. By sifting through the universe of below investment grade corporate bonds, emerging market bonds, and the like, investors can find securities that perform relatively well in rising interest rate environments. Investments in below investment grad ...

... doing their homework in today's low yield environment. By sifting through the universe of below investment grade corporate bonds, emerging market bonds, and the like, investors can find securities that perform relatively well in rising interest rate environments. Investments in below investment grad ...

How the Stock Market Works 2

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

Hard Choices - Montecito Capital Management

... "Gold is the best speculative bet on the planet now," says Steven Evanson, who heads Evanson Asset Management in Monterey, Calif. But gold has had three straight strong years, going from a 2001 low of $255 per ounce to a 2003 peak of $416. Morningstar analyst Lynn Russell points out this is the firs ...

... "Gold is the best speculative bet on the planet now," says Steven Evanson, who heads Evanson Asset Management in Monterey, Calif. But gold has had three straight strong years, going from a 2001 low of $255 per ounce to a 2003 peak of $416. Morningstar analyst Lynn Russell points out this is the firs ...

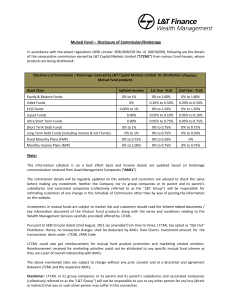

Mutual Fund – Disclosure of Commission/Brokerage Note:

... This information collation is on a best effort basis and Income details are updated based on brokerage communication received from Asset Management Companies (“AMCs”). The commission details will be regularly updated on this website and customers are advised to check the same before making any inves ...

... This information collation is on a best effort basis and Income details are updated based on brokerage communication received from Asset Management Companies (“AMCs”). The commission details will be regularly updated on this website and customers are advised to check the same before making any inves ...

CCTrack April Investment Letter – Learning from the Rain Just as

... estimates, projections, opinions and beliefs of CCTrack. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this report may contain “forward-looking statements.” Actual events, results, or actual performanc ...

... estimates, projections, opinions and beliefs of CCTrack. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this report may contain “forward-looking statements.” Actual events, results, or actual performanc ...

The future of Turkey`s capital markets

... other hand, the Country’s capital markets development has lagged behind overall economic development. Peer group comparisons to similar emerging market economies show that both equity and debt capital markets are underpenetrated in Turkey. The current situation presents an untapped opportunity for m ...

... other hand, the Country’s capital markets development has lagged behind overall economic development. Peer group comparisons to similar emerging market economies show that both equity and debt capital markets are underpenetrated in Turkey. The current situation presents an untapped opportunity for m ...

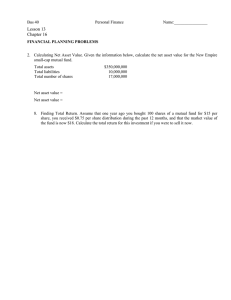

Lesson 13 key - Bakersfield College

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

Stocks Down but Long-Term View Up

... not affiliated with the financial institution or the investment center. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guarant ...

... not affiliated with the financial institution or the investment center. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guarant ...

Month-End Portfolio Data Now Available for Federated Investors

... Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the Products section of FederatedInvestors.com. To order hard copies of this data or to be placed on a mailing list, call 800-245-0242 x5587538, email [email protected] or write to Federated Investors, 100 ...

... Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the Products section of FederatedInvestors.com. To order hard copies of this data or to be placed on a mailing list, call 800-245-0242 x5587538, email [email protected] or write to Federated Investors, 100 ...

May 2015 - Pettinga Financial

... made over time but didn't because you weren't invested). You have to think about the cost of inaction, because not taking any action is potentially risky, too, just in a different way. When you look at it this way, you should realize you can't avoid risk. So, don't let risk just happen to you. Since ...

... made over time but didn't because you weren't invested). You have to think about the cost of inaction, because not taking any action is potentially risky, too, just in a different way. When you look at it this way, you should realize you can't avoid risk. So, don't let risk just happen to you. Since ...

News Release Nomura Asset Management Nomura`s NEXT FUNDS

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.