Money and Banking - Holy Family University

... attempt to – prevent depreciation or – create appreciation ...

... attempt to – prevent depreciation or – create appreciation ...

1 Monetary Policy: The Liquidity Risk Remains By Jane D`Arista The

... combination of capital injections, loans and guaranties extended on the tab of the U.S. Treasury and Federal Reserve to an amount some estimate to be more than half of U.S. GDP. Even at this level, however, many do not think the risk of yet another collapse has been defused. It is widely believed th ...

... combination of capital injections, loans and guaranties extended on the tab of the U.S. Treasury and Federal Reserve to an amount some estimate to be more than half of U.S. GDP. Even at this level, however, many do not think the risk of yet another collapse has been defused. It is widely believed th ...

Document

... Ex. If U.S. investors expect that Swiss interest rates will climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate. Countries will invest their money in the co ...

... Ex. If U.S. investors expect that Swiss interest rates will climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate. Countries will invest their money in the co ...

Document

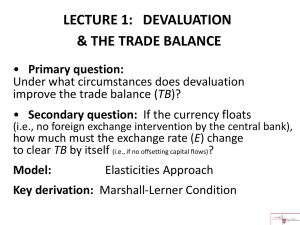

... • Primary question: Under what circumstances does devaluation improve the trade balance (TB)? • Secondary question: If the currency floats ...

... • Primary question: Under what circumstances does devaluation improve the trade balance (TB)? • Secondary question: If the currency floats ...

The Russian Default of 1998

... exchange rate because the country cannot or will not be able to support its currency. In order to maintain the exchange rate peg, the central bank must intervene in the FX market buying up its currency with foreign reserves. ...

... exchange rate because the country cannot or will not be able to support its currency. In order to maintain the exchange rate peg, the central bank must intervene in the FX market buying up its currency with foreign reserves. ...

The Role of Exchange Rate

... consideration of the fundamental forces that determine the supply of and demand for currencies: Country’s income. Changes in a country’s prices. The interest rate in a country. Country’s trade policy. ...

... consideration of the fundamental forces that determine the supply of and demand for currencies: Country’s income. Changes in a country’s prices. The interest rate in a country. Country’s trade policy. ...

2015-05-22 17:00:39.740 GMT (Adds Kelimbetov

... Russia switched to a freefloat in November after burning through almost $90 billion trying to slow the ruble’s drop as oil prices fell and U.S. and European Union sanctions choked off foreign funding. “In Russia, instability was imported ...

... Russia switched to a freefloat in November after burning through almost $90 billion trying to slow the ruble’s drop as oil prices fell and U.S. and European Union sanctions choked off foreign funding. “In Russia, instability was imported ...

Monetary Policy - Diablo Valley College

... securities in secondary financial markets, bank reserves decrease, so interest rates increase due to the lower supply of funds at banks. This decreases consumption and investment which decreases AD, GDP, and CPI. ...

... securities in secondary financial markets, bank reserves decrease, so interest rates increase due to the lower supply of funds at banks. This decreases consumption and investment which decreases AD, GDP, and CPI. ...

RESERVE BANK OF MALAWI MINUTES OF THE 5 MONETARY POLICY COMMITTEE MEETING

... Reflecting effects of the recent reduction in commercial banks’ lending rates, private sector credit from the commercial banks grew by K1.4 billion to K273.6 billion in August 2014 from K272.3 billion in July 2014. However, at 34.3 percent, the average prime lending rates in the money market are sig ...

... Reflecting effects of the recent reduction in commercial banks’ lending rates, private sector credit from the commercial banks grew by K1.4 billion to K273.6 billion in August 2014 from K272.3 billion in July 2014. However, at 34.3 percent, the average prime lending rates in the money market are sig ...

PRESS - RELEASE №38 Transition towards

... The National Bank’s plan for overhauling its monetary policy framework and adopting an inflation targeting regime over the medium term was set out in its “Monetary Policy of the Republic of Kazakhstan till 2020”, issued on April 24, 2015. The goal of adopting inflation targeting over the medium term ...

... The National Bank’s plan for overhauling its monetary policy framework and adopting an inflation targeting regime over the medium term was set out in its “Monetary Policy of the Republic of Kazakhstan till 2020”, issued on April 24, 2015. The goal of adopting inflation targeting over the medium term ...

Dr. Mitchell - people.vcu.edu

... This account keeps track of official holdings of foreign exchange reserves. Negative Balance If there is a negative balance, this means that the stock of foreign exchange reserves has increased (they have “imported” foreign exchange reserves). This means there are fewer units of foreign exchange, mo ...

... This account keeps track of official holdings of foreign exchange reserves. Negative Balance If there is a negative balance, this means that the stock of foreign exchange reserves has increased (they have “imported” foreign exchange reserves). This means there are fewer units of foreign exchange, mo ...

Document

... Now let us suppose that for some reason demand for TL assets decrease (maybe because FED increases policy rates). TL loses value in the free forex market below the fixed parity. In this case CB buys TL and sells dollars. This reduces money(TL) supply and increases the interest rate on TL assets, ...

... Now let us suppose that for some reason demand for TL assets decrease (maybe because FED increases policy rates). TL loses value in the free forex market below the fixed parity. In this case CB buys TL and sells dollars. This reduces money(TL) supply and increases the interest rate on TL assets, ...

Background of European Union

... ◦ Inflation within 1.5% of the best three of the European Union for at least a year ◦ Long-term interest rates must not be more than 2% points higher than the lowest inflation member states ◦ Being in the narrow band of the ERM ‘without tension’ and without initiating a depreciation, for at least tw ...

... ◦ Inflation within 1.5% of the best three of the European Union for at least a year ◦ Long-term interest rates must not be more than 2% points higher than the lowest inflation member states ◦ Being in the narrow band of the ERM ‘without tension’ and without initiating a depreciation, for at least tw ...

Summary of IS-LM

... • Up to now, we have ignored the exchange rate: i.e. the price of foreign currency in terms of domestic currency. • Implicitly we have assumed the exchange rate to be fixed (as well as general price levels, both foreign and domestic). • We now allow for flexible exchange rates and contrast the worki ...

... • Up to now, we have ignored the exchange rate: i.e. the price of foreign currency in terms of domestic currency. • Implicitly we have assumed the exchange rate to be fixed (as well as general price levels, both foreign and domestic). • We now allow for flexible exchange rates and contrast the worki ...

Balance of Payments

... • Change in Relative Interest Rates- impacts short-term capital flows • Example: and increase in the interest rate will increase demand for bonds in that country by foreigners. This will show up as a capital inflow on the capital account, and a strengthening of the exchange rate. • Countries must be ...

... • Change in Relative Interest Rates- impacts short-term capital flows • Example: and increase in the interest rate will increase demand for bonds in that country by foreigners. This will show up as a capital inflow on the capital account, and a strengthening of the exchange rate. • Countries must be ...

Angola update – the case of dollar supply

... reserves stood at 23.4 bln USD, less 3.3 bln USD than levels seen a year ago. We recall that the ability to support the currency going forward will depend on the fx reserves level, which authorities think should continue to cover more than 7 months’ imports, close to present levels. ...

... reserves stood at 23.4 bln USD, less 3.3 bln USD than levels seen a year ago. We recall that the ability to support the currency going forward will depend on the fx reserves level, which authorities think should continue to cover more than 7 months’ imports, close to present levels. ...

developing countries` choice of exchange rate regime should

... Countries that are highly indebted in foreign currencies and which import goods priced in the domestic currency will not be better insulated against economic crises by having flexible exchange rates. That is the central finding of research by Pascal Towbin and Sebastian Weber, which analyses data on ...

... Countries that are highly indebted in foreign currencies and which import goods priced in the domestic currency will not be better insulated against economic crises by having flexible exchange rates. That is the central finding of research by Pascal Towbin and Sebastian Weber, which analyses data on ...

dealing with foreign exchange

... In fact, accumulation of FX reserves, mostly in emerging and petrodollar economies, has created huge imbalances in the global economy, what the Federal Reserve Chairman Ben Bernanke dubbed ‘the global savings glut’ (excess intended saving), leading to a fall in global real longterm interest rates. ...

... In fact, accumulation of FX reserves, mostly in emerging and petrodollar economies, has created huge imbalances in the global economy, what the Federal Reserve Chairman Ben Bernanke dubbed ‘the global savings glut’ (excess intended saving), leading to a fall in global real longterm interest rates. ...

Barbados_en.pdf

... sought to achieve fiscal consolidation, the aim being to reduce the fiscal deficit and the overall public debt within the shortest possible time. Responding to weak economic growth, the Central Bank maintained the loose monetary policy that it had adopted at the start of the crisis. The banking syst ...

... sought to achieve fiscal consolidation, the aim being to reduce the fiscal deficit and the overall public debt within the shortest possible time. Responding to weak economic growth, the Central Bank maintained the loose monetary policy that it had adopted at the start of the crisis. The banking syst ...

Guyana_en.pdf

... Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures from the National Statistics Office. a Preliminary estimates. b Twelve-month variation to June 2011. c Twelve-month variation to October 2011. d Small savings rate. ...

... Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures from the National Statistics Office. a Preliminary estimates. b Twelve-month variation to June 2011. c Twelve-month variation to October 2011. d Small savings rate. ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.