ch30

... Within the EMU, individual countries were limited in fiscal policy responses due to restrictions on debt outstanding – Further, the ECB supposedly follows an inflation target rule and thus is not able to directly intervene to stabilize outcome – In the end, countries did take fiscal actions and the ...

... Within the EMU, individual countries were limited in fiscal policy responses due to restrictions on debt outstanding – Further, the ECB supposedly follows an inflation target rule and thus is not able to directly intervene to stabilize outcome – In the end, countries did take fiscal actions and the ...

Answers to Textbook Problems

... governments some scope to run independent exchange rate and monetary policies in the short run. The chapter reviews the results of attempts to demonstrate empirically the effectiveness of sterilized foreignexchange operations which, however, are generally negative. Also discussed is the role of cent ...

... governments some scope to run independent exchange rate and monetary policies in the short run. The chapter reviews the results of attempts to demonstrate empirically the effectiveness of sterilized foreignexchange operations which, however, are generally negative. Also discussed is the role of cent ...

Tension and new alliances - the currency wars

... current juncture. Indeed, in the past months, a number of countries have engaged in direct interventions in the foreign exchange markets or adopted some forms of capital controls. Let me offer a few thoughts on these issues. If we look back at the developments in the international monetary system ov ...

... current juncture. Indeed, in the past months, a number of countries have engaged in direct interventions in the foreign exchange markets or adopted some forms of capital controls. Let me offer a few thoughts on these issues. If we look back at the developments in the international monetary system ov ...

Guatemala_en.pdf

... peace agreements (IETAP), which is due to expire at the end of 2007. If this is agreed, it will generate revenue equivalent to 1% of GDP for the 2008 budget. In the course of the year, in order to counter inflationary pressures, the monetary authorities made five increases of 0.25 points each to the ...

... peace agreements (IETAP), which is due to expire at the end of 2007. If this is agreed, it will generate revenue equivalent to 1% of GDP for the 2008 budget. In the course of the year, in order to counter inflationary pressures, the monetary authorities made five increases of 0.25 points each to the ...

Quiz 6

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

... (7) Under the fixed-exchange rate system, the central bank of a small open economy must: a. Have a reserve of its own currency, which it must have accumulated in past transactions b. Have a reserve of foreign currency, which it can print c. Allow the money supply to adjust to whatever level will ens ...

International Trade & Finance

... company into dollars. U.S. exports create a demand for dollars and a supply of foreign money, pounds in this case. On the other hand, imports create a supply for dollars and a demand of foreign money. Variable Exchange Rate The freely floating exchange rates are determined by the forces of demand an ...

... company into dollars. U.S. exports create a demand for dollars and a supply of foreign money, pounds in this case. On the other hand, imports create a supply for dollars and a demand of foreign money. Variable Exchange Rate The freely floating exchange rates are determined by the forces of demand an ...

Chap31

... cooperate capital market denominated in euros. Since its inception at $1.17, the euro has weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

... cooperate capital market denominated in euros. Since its inception at $1.17, the euro has weakened considerably, reaching a low of $0.8229 on October 27, 2000. Potential participants include the U.K. and Sweden; Denmark voted against joining the EMU on September 28, 2000. ...

UNCTAD N° 5, December 2008

... assumed a bigger role in their growth performance and they had reduced their dependence on foreign capital by building up current account surpluses. In fact, those developing countries that have shown some resilience are those with a high share of manufactures in their total trade. These countries w ...

... assumed a bigger role in their growth performance and they had reduced their dependence on foreign capital by building up current account surpluses. In fact, those developing countries that have shown some resilience are those with a high share of manufactures in their total trade. These countries w ...

1. Efficiency of the international monetary system means that the

... In a reference zone or a target zone, the exchange rate is allowed to fluctuate within a band. The exchange rate should only deviate from the (real) equilibrium exchange rate within a limited range. Coordination of monetary and stabilization policies has to ensure that the limits of the range of flu ...

... In a reference zone or a target zone, the exchange rate is allowed to fluctuate within a band. The exchange rate should only deviate from the (real) equilibrium exchange rate within a limited range. Coordination of monetary and stabilization policies has to ensure that the limits of the range of flu ...

Evolution by Region - Pennsylvania State University

... • US GDP is $14.4 trillion per year – US exports = $1.97 trillion, imports = $2.67 trillion • Net exports = -$706 billion – By comparison total US investment in residential construction = $704 billion in 2006 before the housing bust ...

... • US GDP is $14.4 trillion per year – US exports = $1.97 trillion, imports = $2.67 trillion • Net exports = -$706 billion – By comparison total US investment in residential construction = $704 billion in 2006 before the housing bust ...

IPEII File - CSUN Moodle

... international monetary system. The pressure to maintain par values in a fixed exchange rate regime was a major burden. Flexibility was limited. Disequilibria that was short-term could remedied reasonably smoothly. Structural or long-term disequlibria could force devalue and revaluations of currency, ...

... international monetary system. The pressure to maintain par values in a fixed exchange rate regime was a major burden. Flexibility was limited. Disequilibria that was short-term could remedied reasonably smoothly. Structural or long-term disequlibria could force devalue and revaluations of currency, ...

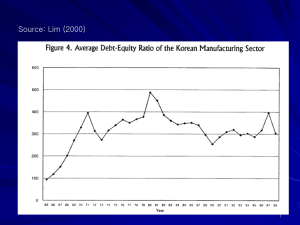

슬라이드 1 - Sogang

... foreign loans to firms designated by the government. Banks do not develop the ability to assess and manage risks in loan-making business Interest rates are set by government. Banks absorb losses from bail-out operations dictated by the government. ...

... foreign loans to firms designated by the government. Banks do not develop the ability to assess and manage risks in loan-making business Interest rates are set by government. Banks absorb losses from bail-out operations dictated by the government. ...

Guyana_en.pdf

... credit has been tighter overall, with the public sector bearing the brunt of the reduction, while credit to the private sector has continued to grow, albeit at a slower ...

... credit has been tighter overall, with the public sector bearing the brunt of the reduction, while credit to the private sector has continued to grow, albeit at a slower ...

F570 International Corporate Finance

... I = investment purchases of capital goods G = Government purchases of goods & services X = Exports of goods & services M = Imports of goods & services ...

... I = investment purchases of capital goods G = Government purchases of goods & services X = Exports of goods & services M = Imports of goods & services ...

ch 20 end of chapter answers

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, rapid productivity growth in the tradeable goods sector produces an ...

... 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, rapid productivity growth in the tradeable goods sector produces an ...

Russia - bofit

... The education and culture ministry last autumn performed a survey of institutions of higher education in Russia, and this year plans to reform or shut down the poorest performing schools. The survey is seen to be related to the government’s current efforts to reduce the number of higher education in ...

... The education and culture ministry last autumn performed a survey of institutions of higher education in Russia, and this year plans to reform or shut down the poorest performing schools. The survey is seen to be related to the government’s current efforts to reduce the number of higher education in ...

Document

... “monetary approach to the balance of payments”; “real exchange rate”. • Impossible trinity: open capital account, stable exchange rate, independent monetary policy. • “Monetary approach”; with open capital account, agents will respond to domestic tightening through capital inflow. • “Real exchange r ...

... “monetary approach to the balance of payments”; “real exchange rate”. • Impossible trinity: open capital account, stable exchange rate, independent monetary policy. • “Monetary approach”; with open capital account, agents will respond to domestic tightening through capital inflow. • “Real exchange r ...

a Global Challenge by David Vines [PPT 235.00KB]

... An under-developed financial system and over-protected financial sector in some Asian economies meant that the private sector had to rely on borrowing, rather than equity issuance, to raise investment funds. As a result, firms became highly leveraged, but banks continued to lend because they were un ...

... An under-developed financial system and over-protected financial sector in some Asian economies meant that the private sector had to rely on borrowing, rather than equity issuance, to raise investment funds. As a result, firms became highly leveraged, but banks continued to lend because they were un ...

Eco120Int_Lecture13

... of goods and services to foreigners (exports), the payments for goods and services bought from foreigners (imports), and also property income (such as interest and profits) and current transfers (such as gifts) received from and paid to foreigner. •Capital account is a summary of country’s asset tra ...

... of goods and services to foreigners (exports), the payments for goods and services bought from foreigners (imports), and also property income (such as interest and profits) and current transfers (such as gifts) received from and paid to foreigner. •Capital account is a summary of country’s asset tra ...

10. Economic and Monetary Union

... of euros and sets short-term interest rates for the euro)/to make regulations (on minimum reserves for credit institutions and where the Council provides on the prudential supervision of credit institutions)/it has executive powers (it can instruct the NCBs)/it can impose fines on undertakings/It is ...

... of euros and sets short-term interest rates for the euro)/to make regulations (on minimum reserves for credit institutions and where the Council provides on the prudential supervision of credit institutions)/it has executive powers (it can instruct the NCBs)/it can impose fines on undertakings/It is ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.

![a Global Challenge by David Vines [PPT 235.00KB]](http://s1.studyres.com/store/data/008212734_1-d43f41a44ab999eda72c55b2aa583755-300x300.png)