Introduction

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

Anatomy of a Currency Crisis

... Contagion refers to the transmission of a currency crisis throughout a region The Thai Baht in 1997 was followed shortly by crises in Malaysia, Indonesia, Korea The Mexican Peso crisis in 1994 spread to Central and South America (“The Tequila ...

... Contagion refers to the transmission of a currency crisis throughout a region The Thai Baht in 1997 was followed shortly by crises in Malaysia, Indonesia, Korea The Mexican Peso crisis in 1994 spread to Central and South America (“The Tequila ...

Course # and Course Name

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

... The history of XRs in the U.S. The different types of XR regimes What the Federal Reserve is What the Euro is How the FX market operates ...

PSFU NEWS PRIVATE SECTOR MEETS BANK OF UGANDA TO

... contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchange rate may shoot up to the projected fixed rate. d) Trade with countries using their local cu ...

... contracts (e.g. SWAPS, Forwards). These would help in planning since through these the exchange rate is fixed with the specific financial institutions. This however maybe taken with caution since the exchange rate may shoot up to the projected fixed rate. d) Trade with countries using their local cu ...

Presentation

... Once the fiscal envelope is determined: Expenditure policy: composition of spending, efficiency and equity issues, scope for ...

... Once the fiscal envelope is determined: Expenditure policy: composition of spending, efficiency and equity issues, scope for ...

Modeling Financial Crises: A Schematic Approach

... 3. Model the economy in a way that allows us ...

... 3. Model the economy in a way that allows us ...

International Finance

... the demand and supply of another. But it explains in a superficial sense. This simple explanation doesn’t tell us what factors underlie the demand for and supply of a currency. Some fundamental factors, such as inflation, productivity, interest rates, and government policies are quite important in e ...

... the demand and supply of another. But it explains in a superficial sense. This simple explanation doesn’t tell us what factors underlie the demand for and supply of a currency. Some fundamental factors, such as inflation, productivity, interest rates, and government policies are quite important in e ...

The Impact of the Great Recession and Policy Responses in

... a) Fiscal policy: increase in public spending (subsidies to private sector – energy, transport and food industries), lower tax rates on wages, adjustment of retirement contributions and programs to ...

... a) Fiscal policy: increase in public spending (subsidies to private sector – energy, transport and food industries), lower tax rates on wages, adjustment of retirement contributions and programs to ...

International Economics Imports Exports Net Exports Balance of

... Considering opportunity cost, when will countries choose to trade? ...

... Considering opportunity cost, when will countries choose to trade? ...

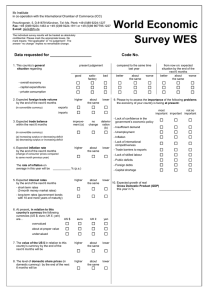

WES Questionnaire (PDF, 25 KB)

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

Geographical distribution of investments from three leading

... Geographical distribution of investments from three leading European economies in 1910 (USD billion) British capital ...

... Geographical distribution of investments from three leading European economies in 1910 (USD billion) British capital ...

ECONOMIC DEVELOPMENT & INTERNATIONAL POLITICS

... • Brazil is complaining now • Used to have a fixed XR • Then East Asian Financial Crisis hit ...

... • Brazil is complaining now • Used to have a fixed XR • Then East Asian Financial Crisis hit ...

International Finance

... freely, and then “sterilizes” to prevent domestic inflation. Sterilization means that the central bank sells govt bonds to mop up the excess local currency. ...

... freely, and then “sterilizes” to prevent domestic inflation. Sterilization means that the central bank sells govt bonds to mop up the excess local currency. ...

The main qualities of an orthodox currency board are

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...

Argentina_en.pdf

... In 2009, the monetary aggregates expanded more slowly, and liquidity ratios therefore showed a moderate reduction. Monetary policy was directed towards limiting fluctuations in the financial and exchange-rate variables through operations involving both external and internal assets. The demand for ba ...

... In 2009, the monetary aggregates expanded more slowly, and liquidity ratios therefore showed a moderate reduction. Monetary policy was directed towards limiting fluctuations in the financial and exchange-rate variables through operations involving both external and internal assets. The demand for ba ...

FRBSF E L CONOMIC ETTER

... dollar-denominated securities; one reason for this is that foreign governments like the highly liquid market for U.S.Treasury securities.As of December 2003, dollar-denominated securities accounted for roughly 70% of total reserves, while eurodenominated reserves accounted for about 20% (BIS 2004). ...

... dollar-denominated securities; one reason for this is that foreign governments like the highly liquid market for U.S.Treasury securities.As of December 2003, dollar-denominated securities accounted for roughly 70% of total reserves, while eurodenominated reserves accounted for about 20% (BIS 2004). ...

File

... When imports > exports a country has a trade deficit. The country would need higher interest rates so that financial capital flows into the country. The greater the supply of the currency the lower the exchange rate. ...

... When imports > exports a country has a trade deficit. The country would need higher interest rates so that financial capital flows into the country. The greater the supply of the currency the lower the exchange rate. ...

Chapter 3

... currencies are linked together in a system of “pegged” exchange rates. All currencies are convertible into gold. The Bretton Woods system, although essentially a pegged exchange rate system, allowed for changes in exchange rates when economic circumstances required such changes. Therefore, the syste ...

... currencies are linked together in a system of “pegged” exchange rates. All currencies are convertible into gold. The Bretton Woods system, although essentially a pegged exchange rate system, allowed for changes in exchange rates when economic circumstances required such changes. Therefore, the syste ...

幻灯片 1

... creation of the housing bubble by leaving interest rates too low for too long, even as Chinese investment further stoked an easy-money economy. The Fed should have cut interest rates less in the middle of this decade, they say, and started raising them sooner, to help reduce speculation in real esta ...

... creation of the housing bubble by leaving interest rates too low for too long, even as Chinese investment further stoked an easy-money economy. The Fed should have cut interest rates less in the middle of this decade, they say, and started raising them sooner, to help reduce speculation in real esta ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.