Signalling Keynesian - EconIssues – Patrick A McNutt

... • China Yuan/RMB is ‘captive’ to other countries exchange rate policies • EMs and ASLEEP economies will substitute export-led growth for more G: ASEAN nations focus on intraregional trade but no common currency. • Beggar-my-neighbour policies emerge: both US and China cannot rely on export-led growt ...

... • China Yuan/RMB is ‘captive’ to other countries exchange rate policies • EMs and ASLEEP economies will substitute export-led growth for more G: ASEAN nations focus on intraregional trade but no common currency. • Beggar-my-neighbour policies emerge: both US and China cannot rely on export-led growt ...

College of Business Administration

... b. higher rates of interest lead to greater capital flows *c. at lower interest rates the levels of investment and national income are higher d. at lower interest rates the level of national income is lower 2. If the BP curve is above the point of intersection of the IS and LM curves, the nation wil ...

... b. higher rates of interest lead to greater capital flows *c. at lower interest rates the levels of investment and national income are higher d. at lower interest rates the level of national income is lower 2. If the BP curve is above the point of intersection of the IS and LM curves, the nation wil ...

Introduction - ePublications@bond

... Globalization is very much part of the modern vernacular. Arguably, it was first used by McLuhan and Fiore (1968) when they introduced the concept of the ‘global village’. Globalization is characterized by the growth of the international trade of goods and services, the growth in foreign direct in ...

... Globalization is very much part of the modern vernacular. Arguably, it was first used by McLuhan and Fiore (1968) when they introduced the concept of the ‘global village’. Globalization is characterized by the growth of the international trade of goods and services, the growth in foreign direct in ...

Ceci est la version HTML du fichier http://www

... immediately preceding the crisis. The country continued to face mounting current account deficits in 1996, investor perceptions began to shift against local assets, and capital inflows began to attenuate. Authorities tried to extend the growth cycle, but fiscal stimulus, instead of increasing output ...

... immediately preceding the crisis. The country continued to face mounting current account deficits in 1996, investor perceptions began to shift against local assets, and capital inflows began to attenuate. Authorities tried to extend the growth cycle, but fiscal stimulus, instead of increasing output ...

(Please check against delivery) EMBARGOED

... I manage, originated in the crisis. So I will first briefly summarise what the ESM has been doing over the last few years. I will then talk about the European economy, which is doing much better than is often recognized. It has some underlying strengths that help us contain rising scepticism tow ...

... I manage, originated in the crisis. So I will first briefly summarise what the ESM has been doing over the last few years. I will then talk about the European economy, which is doing much better than is often recognized. It has some underlying strengths that help us contain rising scepticism tow ...

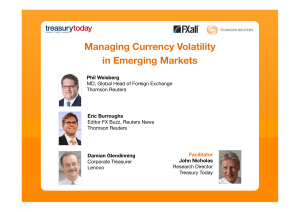

Managing Currency Volatility in Emerging Markets

... Result: lower liquidity, significant basis risk vs spot settlement Can be difficult to predict when payment will be made Cost is frequently higher ...

... Result: lower liquidity, significant basis risk vs spot settlement Can be difficult to predict when payment will be made Cost is frequently higher ...

The Theory of Monetary Degradation as the Development of Post

... below the definition of monetary economy itself). Such case can take place during the transition from planned economy to the market one (or during other big systemic transformations), when rupture in institutional system appears (ñinstitutional hiatusò, see Kozul-Wright and Rayment, 1997) and/or ñr ...

... below the definition of monetary economy itself). Such case can take place during the transition from planned economy to the market one (or during other big systemic transformations), when rupture in institutional system appears (ñinstitutional hiatusò, see Kozul-Wright and Rayment, 1997) and/or ñr ...

10_Floating

... because central banks were unwilling to continue to buy over-valued dollar assets and to sell under-valued foreign currency assets. • Central banks thought they would stop trading in the foreign exchange for a while, and would let exchange rates adjust to supply and demand, and then would re-impose ...

... because central banks were unwilling to continue to buy over-valued dollar assets and to sell under-valued foreign currency assets. • Central banks thought they would stop trading in the foreign exchange for a while, and would let exchange rates adjust to supply and demand, and then would re-impose ...

A Basic Critique of Economic Arguments for Local

... Local currency partially alleviates this problem by sending information to firms about the demand for locally produced goods. In Jayaraman and Oak’s model, local currency has two salient features: the national currency can be used to purchase the local currency, but not the other way around, and loc ...

... Local currency partially alleviates this problem by sending information to firms about the demand for locally produced goods. In Jayaraman and Oak’s model, local currency has two salient features: the national currency can be used to purchase the local currency, but not the other way around, and loc ...

與亞洲金融危機期間的產值跌幅比較 - Hong Kong Monetary Authority

... Our informal enquiry suggests that, at the end of November 2009, about 77% of the funds raised by Mainland companies might still be held as Hong Kong dollar deposits in the Hong Kong or Mainland banking system without being exchanged into other currencies. As mentioned above, Mainland companies rais ...

... Our informal enquiry suggests that, at the end of November 2009, about 77% of the funds raised by Mainland companies might still be held as Hong Kong dollar deposits in the Hong Kong or Mainland banking system without being exchanged into other currencies. As mentioned above, Mainland companies rais ...

Chapter 13 - Personal Home Pages

... An increase in government expenditures → would raise interest rates, → leading to an inflow of foreign capital (loans), → appreciating the currency (higher Y/$), → lowering net exports, → which cancels out the expansionary effect of higher Gov’t spending → leaving the economy at the same level of ou ...

... An increase in government expenditures → would raise interest rates, → leading to an inflow of foreign capital (loans), → appreciating the currency (higher Y/$), → lowering net exports, → which cancels out the expansionary effect of higher Gov’t spending → leaving the economy at the same level of ou ...

INSTITUTO TECNOLOGICO AUTONOMO DE MEXICO

... In this course the students will learn: 1) the basic principles of international trade and investment; 2) the global environment in which international firms operate; 3) the financial exchange systems and institutions that measure and facilitate international transactions; 4) the rules and practice ...

... In this course the students will learn: 1) the basic principles of international trade and investment; 2) the global environment in which international firms operate; 3) the financial exchange systems and institutions that measure and facilitate international transactions; 4) the rules and practice ...

The adoption of sustainable development goals beyond 2015 will be

... enabling international environment needed for the implementation of sustainable development goals. These reforms were already called for by civil society ahead of the 2010 MDG+10 Review Summit 2 and are essential to accelerate progress in the achievement of the existing MDGs and to prevent major se ...

... enabling international environment needed for the implementation of sustainable development goals. These reforms were already called for by civil society ahead of the 2010 MDG+10 Review Summit 2 and are essential to accelerate progress in the achievement of the existing MDGs and to prevent major se ...

4. Financial crises

... Lax fiscal policy the budget deficit is financed by the central bank inflation the internal unequilibrium can not be reconciled with the fixed exchange rate Fiscla expansion increasing internal demand for imports +inflation balance of payment deficit devaulation pressure decrease of reser ...

... Lax fiscal policy the budget deficit is financed by the central bank inflation the internal unequilibrium can not be reconciled with the fixed exchange rate Fiscla expansion increasing internal demand for imports +inflation balance of payment deficit devaulation pressure decrease of reser ...

Eric Helleiner, The Southern Side of Embedded

... The position of Southern countries within the new “embedded liberal” global monetary order has received less attention than that of Northern countries. This neglect is unfortunate because dramatic monetary reforms took in some Southern countries in the early postwar years which were in keeping with ...

... The position of Southern countries within the new “embedded liberal” global monetary order has received less attention than that of Northern countries. This neglect is unfortunate because dramatic monetary reforms took in some Southern countries in the early postwar years which were in keeping with ...

6th Edition - Zimbabwe hyperinflation

... 4. The country’s central bank could not even afford the paper on which to print its worthless trillion-dollar notes. The miserably low savings and incomes of the impoverished population were wiped out. 5. Shopkeepers would frequently double prices between the morning and afternoon, leaving worker’s ...

... 4. The country’s central bank could not even afford the paper on which to print its worthless trillion-dollar notes. The miserably low savings and incomes of the impoverished population were wiped out. 5. Shopkeepers would frequently double prices between the morning and afternoon, leaving worker’s ...

Famous Gold Moves in History

... Gold played a key role in international monetary transactions throughout the 19th and early 20th centuries, as it was used to back currencies. The value of a currency internationally was measured by its fixed relationship to gold, and gold was used to settle international accounts. This system had i ...

... Gold played a key role in international monetary transactions throughout the 19th and early 20th centuries, as it was used to back currencies. The value of a currency internationally was measured by its fixed relationship to gold, and gold was used to settle international accounts. This system had i ...

IIL-113010 - Insurance Information Institute

... * The Maastricht criteria are the criteria for member states to enter the third stage of European Economic and Monetary Union (EMU) and adopt the euro as their currency. The 4 main criteria are based on Article 121(1) of the European Community Treaty. The second criterion involves government finance ...

... * The Maastricht criteria are the criteria for member states to enter the third stage of European Economic and Monetary Union (EMU) and adopt the euro as their currency. The 4 main criteria are based on Article 121(1) of the European Community Treaty. The second criterion involves government finance ...

Monetary and Fiscal Policy Coordination in Fiji What is Monetary

... of the Reserve Bank of Fiji (RBF) with its key objectives of ensuring stable inflation and maintaining an adequate level of foreign reserves that are important for economic growth. On the other hand, fiscal policy is implemented by the Government to achieve sustained economic growth, stimulate inves ...

... of the Reserve Bank of Fiji (RBF) with its key objectives of ensuring stable inflation and maintaining an adequate level of foreign reserves that are important for economic growth. On the other hand, fiscal policy is implemented by the Government to achieve sustained economic growth, stimulate inves ...

Exchange Rate

... – to keep the exchange rate stable: through the buying or selling of foreign currency. Any excess supply of ringgits need to be bought by the Government using its reserves of foreign currency. On the other hand, government needs to sell foreign reserves to support the price of ringgit – under shor ...

... – to keep the exchange rate stable: through the buying or selling of foreign currency. Any excess supply of ringgits need to be bought by the Government using its reserves of foreign currency. On the other hand, government needs to sell foreign reserves to support the price of ringgit – under shor ...

The Causes, Solution and Consequences of the 1997

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

Document

... Monetary Policy Stance • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persisten ...

... Monetary Policy Stance • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persisten ...

Financial Policy Committee

... international levels with stronger capital requirements • A particular focus on large institutions who pose a particularly severe problem of systemic risk • An emphasis on foresight • All accompanied by the creating of a whole host of new institutions at national and international level. ...

... international levels with stronger capital requirements • A particular focus on large institutions who pose a particularly severe problem of systemic risk • An emphasis on foresight • All accompanied by the creating of a whole host of new institutions at national and international level. ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.