July Economic Outlook

... Source: WSJ Economic Forecasting Survey The WSJ economic forecasting survey is from more than 60 global economists, from different industries and academia. Economic growth is low. The forecast for economic growth continues to be below 3%. I explained last month why our economy has slow growth and wh ...

... Source: WSJ Economic Forecasting Survey The WSJ economic forecasting survey is from more than 60 global economists, from different industries and academia. Economic growth is low. The forecast for economic growth continues to be below 3%. I explained last month why our economy has slow growth and wh ...

US-Japanese Economic Policy Conflicts and Coordination During

... and correspond somewhat with changes in US economic policy toward Japan. This is no coincidence. Throughout these three periods, JapaneseUS relations and foreign exchange and equity markets played a very important role. The recession years 1992-94 in Japan were also the period of transition from the ...

... and correspond somewhat with changes in US economic policy toward Japan. This is no coincidence. Throughout these three periods, JapaneseUS relations and foreign exchange and equity markets played a very important role. The recession years 1992-94 in Japan were also the period of transition from the ...

Foreign Exchange

... exchange rate regime. Since then, the value of the Trinidad and Tobago dollar appreciates or depreciates in response to changes in supply and demand conditions in the foreign exchange market and the intervention policy of the Bank. In practice, the foreign exchange system is a managed float .” http: ...

... exchange rate regime. Since then, the value of the Trinidad and Tobago dollar appreciates or depreciates in response to changes in supply and demand conditions in the foreign exchange market and the intervention policy of the Bank. In practice, the foreign exchange system is a managed float .” http: ...

South Korea -X-Press Benchmark Interest Rate Reduced in South Korea Event

... Analysis and Outlook Today’s decision takes the BoK’s base rate to the level observed during the February 2009 - November 2010 period, following the 2008 global financial crisis. The cut comes after an equivalent reduction following the monetary policy meeting in August and is aimed at placing the e ...

... Analysis and Outlook Today’s decision takes the BoK’s base rate to the level observed during the February 2009 - November 2010 period, following the 2008 global financial crisis. The cut comes after an equivalent reduction following the monetary policy meeting in August and is aimed at placing the e ...

CATO HANDBOOK CONGRESS FOR

... nor can it permanently lower real interest rates. But it can throw the economy off track by policy errors—that is, by creating either too much or too little money to maintain stable expectations about the long-run value of the currency. The most grievous error of discretionary monetary policy, as Mi ...

... nor can it permanently lower real interest rates. But it can throw the economy off track by policy errors—that is, by creating either too much or too little money to maintain stable expectations about the long-run value of the currency. The most grievous error of discretionary monetary policy, as Mi ...

europe`s paradoxes

... When Diego Fusaro asked me to contribute to this issue of Phenomenology and Mind I was honoured and found the opportunity to address an audience completely different from the economic profession to be very stimulating. I suppose his kind invitation was motivated by the unexpected success of my book ...

... When Diego Fusaro asked me to contribute to this issue of Phenomenology and Mind I was honoured and found the opportunity to address an audience completely different from the economic profession to be very stimulating. I suppose his kind invitation was motivated by the unexpected success of my book ...

Chapter Ten

... What Happened After Bretton Woods? Under BW, US required to deliver 1oz of gold to any IMF member that gave US Treasury $35.00. 1958 -1971 US ran accumulated deficit of $56 billion. US gold reserves shrank from $34.8 billion to $12.2 billion. Liabilities to foreign central banks increased from ...

... What Happened After Bretton Woods? Under BW, US required to deliver 1oz of gold to any IMF member that gave US Treasury $35.00. 1958 -1971 US ran accumulated deficit of $56 billion. US gold reserves shrank from $34.8 billion to $12.2 billion. Liabilities to foreign central banks increased from ...

Will the Dollar remain the reserve currency?

... dollar-dominated international monetary system. The problem today is that the great majority of the global supply of liquidity is in dollars, and this supply of liquidity fluctuates along with the monetary and financial conditions of the United States. During the financial meltdown in 2008, there we ...

... dollar-dominated international monetary system. The problem today is that the great majority of the global supply of liquidity is in dollars, and this supply of liquidity fluctuates along with the monetary and financial conditions of the United States. During the financial meltdown in 2008, there we ...

Rethinking Japan`s “Lost Decade”: some Post

... The third aspect is that the conflict between policy objectives is becoming more evident and acute, often polarizing politics and creating gridlock and further delaying needed actions. Ideologies have become more important in the political arena than pragmatism. The policies, which moderate and cent ...

... The third aspect is that the conflict between policy objectives is becoming more evident and acute, often polarizing politics and creating gridlock and further delaying needed actions. Ideologies have become more important in the political arena than pragmatism. The policies, which moderate and cent ...

Read this feature article - Fidelity Investments Canada

... U.S. investor optimism high for pro-growth regulatory and tax policy changes from the new government in Washington. However, the risks of greater protectionism have risen with the ascension of Donald Trump to the U.S. presidency. This article investigates how these risks affect the outlook for the b ...

... U.S. investor optimism high for pro-growth regulatory and tax policy changes from the new government in Washington. However, the risks of greater protectionism have risen with the ascension of Donald Trump to the U.S. presidency. This article investigates how these risks affect the outlook for the b ...

regional economic integration in africa: benefits for lesotho

... conversion of currencies by the individual countries. However, for Lesotho to fully reap the benefits, it would have to diversify its production base. On trade integration, Lesotho will reap the following benefit from the FTA: Lesotho can acquire new markets, especially for manufactured goods in SAD ...

... conversion of currencies by the individual countries. However, for Lesotho to fully reap the benefits, it would have to diversify its production base. On trade integration, Lesotho will reap the following benefit from the FTA: Lesotho can acquire new markets, especially for manufactured goods in SAD ...

Understanding Trade, Exchange Rates and International Capital

... discussed the collapse of global trade in a Federal open-economy models significantly understate the Reserve Bank of Dallas Economic Letter (Wang importance of trade in economic fluctuations. Inter- 2010), which argues that the drop in international national trade growth varies substantially more tr ...

... discussed the collapse of global trade in a Federal open-economy models significantly understate the Reserve Bank of Dallas Economic Letter (Wang importance of trade in economic fluctuations. Inter- 2010), which argues that the drop in international national trade growth varies substantially more tr ...

ECON 6413-001 International Trade

... PROJECT 1: Country Analysis The objective of this project is to monitor the foreign exchange conditions, financial market conditions, and macroeconomic conditions of a particular country. Your essay must be no more than 5 pages long . Additional information (tables and plots) must appear at the end ...

... PROJECT 1: Country Analysis The objective of this project is to monitor the foreign exchange conditions, financial market conditions, and macroeconomic conditions of a particular country. Your essay must be no more than 5 pages long . Additional information (tables and plots) must appear at the end ...

The economics of external debt: a Damocles` Sword hanging

... process of systemic risks. The idea is that several (not inter-linked) economic agents take macroeconomic prices (like exchange rates) as given, which in turn leads them to overinvest and, conversely, overexpose their countries to financial instability. As a result, the full social cost of capital i ...

... process of systemic risks. The idea is that several (not inter-linked) economic agents take macroeconomic prices (like exchange rates) as given, which in turn leads them to overinvest and, conversely, overexpose their countries to financial instability. As a result, the full social cost of capital i ...

Presentation Title

... • With limited domestic savings and rising fixed investment needs, foreign capital flows should have to fill the gap. That is, in order to push the investment ratio towards the 23% range, the country should run larger current account deficits in the years to come. Total Domestic Savings (% GDP) ...

... • With limited domestic savings and rising fixed investment needs, foreign capital flows should have to fill the gap. That is, in order to push the investment ratio towards the 23% range, the country should run larger current account deficits in the years to come. Total Domestic Savings (% GDP) ...

The Realities of Modern Hyperinflation

... economies succumbed to hyperinflation. Austria, Germany, Hungary, Poland, and Russia all racked up enormous price increases, with Germany recording an astronomical 3.25 million percent in a single month in 1923. But, since the 1950s, hyperinflation has been confined to the developing world and the t ...

... economies succumbed to hyperinflation. Austria, Germany, Hungary, Poland, and Russia all racked up enormous price increases, with Germany recording an astronomical 3.25 million percent in a single month in 1923. But, since the 1950s, hyperinflation has been confined to the developing world and the t ...

Europe`s Great Depression: coordination failure

... in wages and prices such policies can be effective. While the trilemma is a choice between policies or political means, it is useful to note that it can also be expressed as a choice between policy objectives, namely the objectives of confidence, liquidity, and adjustment—Paul Krugman’s ‘eternal tri ...

... in wages and prices such policies can be effective. While the trilemma is a choice between policies or political means, it is useful to note that it can also be expressed as a choice between policy objectives, namely the objectives of confidence, liquidity, and adjustment—Paul Krugman’s ‘eternal tri ...

The Euro May Over the Next 15 Years Surpass the Dollar as

... leader among international currencies, a development of historic significance. In 1899 the share of the pound in known foreign exchange holdings of official institutions had been more than twice the total of the next nearest competitors, the franc and the mark, and much greater than the dollar.1 Eve ...

... leader among international currencies, a development of historic significance. In 1899 the share of the pound in known foreign exchange holdings of official institutions had been more than twice the total of the next nearest competitors, the franc and the mark, and much greater than the dollar.1 Eve ...

Chapter 19

... paying much higher rates than Germany (at approximately 2 percent) on new 10-year bond issues ...

... paying much higher rates than Germany (at approximately 2 percent) on new 10-year bond issues ...

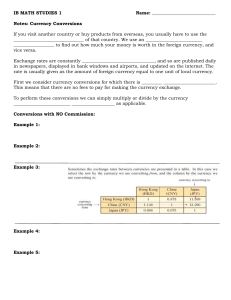

Commission on Currency Exchange

... ____________ ___________. Some traders charge no commission but offer worse exchange rates instead. Suppose you live in the U.S. The table below shows how much one American dollar (USD) is worth in some other currencies: ...

... ____________ ___________. Some traders charge no commission but offer worse exchange rates instead. Suppose you live in the U.S. The table below shows how much one American dollar (USD) is worth in some other currencies: ...

The Requirements for Successful ~~ter~atio~al Macroeco~omic Cooperation Helmut Schlesinger*

... The high degree of interdependence of the goods and financial markets throughout the world causes disturbances on specific markets to spread very quickly to other countries. The oil price shocks, the overshooting of the dollar rate in one direction or the other, the debt problems facing many develop ...

... The high degree of interdependence of the goods and financial markets throughout the world causes disturbances on specific markets to spread very quickly to other countries. The oil price shocks, the overshooting of the dollar rate in one direction or the other, the debt problems facing many develop ...

INTERNATIONAL MONETARY ECONOMICS Syllabus and study

... How did the U.S. trade balance change? Note that there will be 4 mental model factors and 2 Z-D shifts (note that the bandwagon and medium-term exchange rate bias count in this total). You need not mention “ignored” variables (though they are very interesting!) 37. During Dollar Run Up (1980-Februar ...

... How did the U.S. trade balance change? Note that there will be 4 mental model factors and 2 Z-D shifts (note that the bandwagon and medium-term exchange rate bias count in this total). You need not mention “ignored” variables (though they are very interesting!) 37. During Dollar Run Up (1980-Februar ...

Will the Renminbi replace the US Dollar as the world currency?

... affect the competitiveness of its export sector and economic growth. China’s Trilemma- In 1960, Noble prize winner Robert Mundell inferred that a country at one time can’t have an open capital account, along with control over interest rates and currency. For a country like China which is having a fi ...

... affect the competitiveness of its export sector and economic growth. China’s Trilemma- In 1960, Noble prize winner Robert Mundell inferred that a country at one time can’t have an open capital account, along with control over interest rates and currency. For a country like China which is having a fi ...

I. INTERNATIONAL DEVELOPMENTS

... budget deficits recently, the ratio of public debt to GDP continues to rise in many countries (Chart I.11, Chart I.12). The increase in indebtedness rates is more apparent particularly in periphery countries which experience a contraction in economic activity and are obliged to pay high interests at ...

... budget deficits recently, the ratio of public debt to GDP continues to rise in many countries (Chart I.11, Chart I.12). The increase in indebtedness rates is more apparent particularly in periphery countries which experience a contraction in economic activity and are obliged to pay high interests at ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.