Timothy Boobier Grazia Manisera Steffy Ndjotong

... equity investment, whereas ‘total’ includes debt as well) were much higher to rich countries relative to poor countries, and this is while equity inflows made up a larger proportion of total inflows for poor countries as well. Contradicting the neoclassical model, this is a stark demonstration of th ...

... equity investment, whereas ‘total’ includes debt as well) were much higher to rich countries relative to poor countries, and this is while equity inflows made up a larger proportion of total inflows for poor countries as well. Contradicting the neoclassical model, this is a stark demonstration of th ...

Exchange Rate Topics

... Fixed Exchange Rate • If the central bank undertakes to keep the exchange rate fixed and that is a credible undertaking, then 0. t 1 • If the relative values of currency are fixed, then funds will flow out of the domestic currency if domestic interest rates are too low and flow into domestic c ...

... Fixed Exchange Rate • If the central bank undertakes to keep the exchange rate fixed and that is a credible undertaking, then 0. t 1 • If the relative values of currency are fixed, then funds will flow out of the domestic currency if domestic interest rates are too low and flow into domestic c ...

International Monetary Systems

... • “External balance” achieved when a current account is – neither so deeply in deficit that the country may be unable to repay its foreign debts, – nor so strongly in surplus that foreigners are put in that position. • For example, pressure on Japan in the 1980s and China in the 2000s. ...

... • “External balance” achieved when a current account is – neither so deeply in deficit that the country may be unable to repay its foreign debts, – nor so strongly in surplus that foreigners are put in that position. • For example, pressure on Japan in the 1980s and China in the 2000s. ...

Rutgers Model United Nations 2007

... the cancellation of debt as long as it rightfully justified. For example, International law has dictated several legal arguments as legal justification for unilateral cancellation of external debt. One is the state of necessity, where it is imperative that a nation weighed down with debt and is fail ...

... the cancellation of debt as long as it rightfully justified. For example, International law has dictated several legal arguments as legal justification for unilateral cancellation of external debt. One is the state of necessity, where it is imperative that a nation weighed down with debt and is fail ...

monetary policy force effect by means of banks money creation

... promote monetary policy and its effects. This is due to the fact that the monetary authority insists on objectives without their association in one complex of measures for real economic growth. Thus the banking supervisory decisions are in contradiction with the objectives of monetary policy on mone ...

... promote monetary policy and its effects. This is due to the fact that the monetary authority insists on objectives without their association in one complex of measures for real economic growth. Thus the banking supervisory decisions are in contradiction with the objectives of monetary policy on mone ...

Comparative Study on Monetary and Fiscal Policy in the Eurozone

... For better understanding of current sovereign debt trends in the EMU it should be also considered that when entering a monetary union, member countries change the nature of their sovereign debt in a fundamental way, i.e. they cease to have control over the currency in which their debt is issued. As ...

... For better understanding of current sovereign debt trends in the EMU it should be also considered that when entering a monetary union, member countries change the nature of their sovereign debt in a fundamental way, i.e. they cease to have control over the currency in which their debt is issued. As ...

the surge in the loonie

... Cuts in policy interest rates: The fed funds rate cut by 75 basis points to 4.5%, while every other central bank in the world is raising policy rates Deteriorating inflation-adjusted interest differentials with the rest of the world The growing cost and burden on the U.S. A. of the war on terror and ...

... Cuts in policy interest rates: The fed funds rate cut by 75 basis points to 4.5%, while every other central bank in the world is raising policy rates Deteriorating inflation-adjusted interest differentials with the rest of the world The growing cost and burden on the U.S. A. of the war on terror and ...

Cape Verde Pre-Brief Presentation

... the check Bulgaria and Romania and other EU accession countries will get from the EU. ...

... the check Bulgaria and Romania and other EU accession countries will get from the EU. ...

THE SURGE IN THE LOONIE:

... Cuts in policy interest rates: The fed funds rate cut by 75 basis points to 4.5%, while every other central bank in the world is raising policy rates Deteriorating inflation-adjusted interest differentials with the rest of the world The growing cost and burden on the U.S. A. of the war on terror and ...

... Cuts in policy interest rates: The fed funds rate cut by 75 basis points to 4.5%, while every other central bank in the world is raising policy rates Deteriorating inflation-adjusted interest differentials with the rest of the world The growing cost and burden on the U.S. A. of the war on terror and ...

RETHINKING MACROECONOMIC POLICIES FOR

... Theory and policy were both concerned with how monetary and fiscal policies should be used to attain stipulated objectives. The narrow focus led to an apparent convergence of objectives. Hence, this corpus of knowledge was sought to be used in developing economies without any significant modificatio ...

... Theory and policy were both concerned with how monetary and fiscal policies should be used to attain stipulated objectives. The narrow focus led to an apparent convergence of objectives. Hence, this corpus of knowledge was sought to be used in developing economies without any significant modificatio ...

Economics Web Newsletter - McGraw Hill Higher Education

... deficit of $417.4 billion, or 4.1% of U.S. gross domestic product, the total output of goods and services. By 2006, Goldman Sachs economists predict it will bloat to 6.5% of GDP. For years, the deficit has been financed by foreign purchases of U.S. companies, plant and equipment, as well as of U.S. ...

... deficit of $417.4 billion, or 4.1% of U.S. gross domestic product, the total output of goods and services. By 2006, Goldman Sachs economists predict it will bloat to 6.5% of GDP. For years, the deficit has been financed by foreign purchases of U.S. companies, plant and equipment, as well as of U.S. ...

Peru_en.pdf

... expenditure (15.1%), particularly capital spending (66.2%). The increase in current spending was due to growing procurement of goods and services (23.1%) and a 9.2% increase in government payroll costs. The rise in capital expenditure was, in turn, caused by higher spending on fixed capital formatio ...

... expenditure (15.1%), particularly capital spending (66.2%). The increase in current spending was due to growing procurement of goods and services (23.1%) and a 9.2% increase in government payroll costs. The rise in capital expenditure was, in turn, caused by higher spending on fixed capital formatio ...

Capital Account Liberalization

... • Financial and corporate sector restructuring, reforms and reconstruction, together with the introduction of better regulatory and supervisory frameworks • Economic recovery facilitated by intra-regional trade linkages • Substantial reduction of financial vulnerabilities through reduction of short- ...

... • Financial and corporate sector restructuring, reforms and reconstruction, together with the introduction of better regulatory and supervisory frameworks • Economic recovery facilitated by intra-regional trade linkages • Substantial reduction of financial vulnerabilities through reduction of short- ...

Exchange Rate Regimes

... habits? All that is required is that everyone decide to come to his office an hour earlier, have lunch an hour earlier, etc. But obviously it is much simpler to change the clock that guides all than to have each individual separately change his pattern of reaction to the clock, even though all want ...

... habits? All that is required is that everyone decide to come to his office an hour earlier, have lunch an hour earlier, etc. But obviously it is much simpler to change the clock that guides all than to have each individual separately change his pattern of reaction to the clock, even though all want ...

Summary of IS-LM

... – Work under fixed e – but government may not be able to borrow – Crises usually happen in debt-ridden countries ...

... – Work under fixed e – but government may not be able to borrow – Crises usually happen in debt-ridden countries ...

Problem of Exchange Rates - International Growth Centre

... …and Rwanda may wish to track these developments to anticipate external exchange rate surprises Source: J.P. Morgan, October 21, 2010 ...

... …and Rwanda may wish to track these developments to anticipate external exchange rate surprises Source: J.P. Morgan, October 21, 2010 ...

The Gold Standard, Bretton Woods and Other Monetary Regimes: A

... mechanisms, such as an independent conservative central hank.’~Such mechanisms may Prevent the perceived disad~-antageof sacrificing national sovereignty to the supernational (lictates of a fixed exchange rate. A fourth issue is that of international coopet-anon and policy coordination. Recent game ...

... mechanisms, such as an independent conservative central hank.’~Such mechanisms may Prevent the perceived disad~-antageof sacrificing national sovereignty to the supernational (lictates of a fixed exchange rate. A fourth issue is that of international coopet-anon and policy coordination. Recent game ...

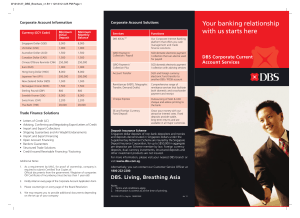

Your banking relationship with us starts here

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

Trends and Leadership Challenges in the Evolution of the Global

... Unsurprisingly, China and emerging economies are mainly responsible for the increase in global trade. As a whole, South America recorded the highest increase in exports performance, with an annual 10 percent in the period 2005-2011. Led by a labour-intensive manufacturing sector for export markets ( ...

... Unsurprisingly, China and emerging economies are mainly responsible for the increase in global trade. As a whole, South America recorded the highest increase in exports performance, with an annual 10 percent in the period 2005-2011. Led by a labour-intensive manufacturing sector for export markets ( ...

George A Provopoulos: The Greek economic crisis and the euro

... the crisis for Europe’s single currency, the euro. Greece is at the epicentre of the crisis; my presentation will, therefore, highlight the Greek roots of the crisis. The origins To provide some perspective to the present situation, let us look back just a year. At that time, conferences were being ...

... the crisis for Europe’s single currency, the euro. Greece is at the epicentre of the crisis; my presentation will, therefore, highlight the Greek roots of the crisis. The origins To provide some perspective to the present situation, let us look back just a year. At that time, conferences were being ...

ECB`s Monetary Measures during the Financial Crisis

... the European Financial Stability Fund, invoking difficulties in supporting the banking sector due to the exposure related to Greece’s debt. On 30 November, Troika (consisting of the European Commission, IMF and ECB) and the Cypriot government agreed on the austerity measures associated to the bailou ...

... the European Financial Stability Fund, invoking difficulties in supporting the banking sector due to the exposure related to Greece’s debt. On 30 November, Troika (consisting of the European Commission, IMF and ECB) and the Cypriot government agreed on the austerity measures associated to the bailou ...

The Flexible Model, Gold Dinar and Exchange Rate Determination

... maintained by cooperation between monetary authorities of different nations. d) A fourth admired feature was that it represented a credible commitment regime. This was due that the fact many nations that adhered to the gold standard forgo their opportunities using monetary expansion and fiscal polic ...

... maintained by cooperation between monetary authorities of different nations. d) A fourth admired feature was that it represented a credible commitment regime. This was due that the fact many nations that adhered to the gold standard forgo their opportunities using monetary expansion and fiscal polic ...

Economics of Monetary Union 10e

... • Elimination of foreign exchange markets within union eliminates cost of exchanging one currency into another • Cost reductions amount to 0.25 to 0.5% of GDP (according to European Commission) • Full cost reduction only achieved when payments systems are fully integrated ...

... • Elimination of foreign exchange markets within union eliminates cost of exchanging one currency into another • Cost reductions amount to 0.25 to 0.5% of GDP (according to European Commission) • Full cost reduction only achieved when payments systems are fully integrated ...

End of an Epoch: Britain`s Withdrawal from the Gold Standard

... constraints (see Kitson and Michie, 1993). The resilient countries were those that could maintain both a strong trade performance with high economic growth. Such countries did not have the problem of dealing with a balance of payments deficit by deflationary means. Two of the most resilient countrie ...

... constraints (see Kitson and Michie, 1993). The resilient countries were those that could maintain both a strong trade performance with high economic growth. Such countries did not have the problem of dealing with a balance of payments deficit by deflationary means. Two of the most resilient countrie ...

Presentation for conference on Non-China Developing Asia?

... after the financial crisis, the desire to rebuild foreign exchange reserves was another reason why authorities in the region intervened in foreign exchange markets to purchase dollars, but this motive has likely diminished in importance as reserves have become very substantial). Once domestic deman ...

... after the financial crisis, the desire to rebuild foreign exchange reserves was another reason why authorities in the region intervened in foreign exchange markets to purchase dollars, but this motive has likely diminished in importance as reserves have become very substantial). Once domestic deman ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.