New Zealand`s Exchange Rate Cycles: Evidence and Drivers

... Area, Japan and South Korea) also have similarly large cycles. By comparing the shortterm (i.e. month-to-month) volatility of New Zealand’s exchange rate to other economies, on a trade-weighted basis New Zealand’s exchange rate fluctuates greatly. New Zealand, Australia and Japan face the highest le ...

... Area, Japan and South Korea) also have similarly large cycles. By comparing the shortterm (i.e. month-to-month) volatility of New Zealand’s exchange rate to other economies, on a trade-weighted basis New Zealand’s exchange rate fluctuates greatly. New Zealand, Australia and Japan face the highest le ...

Understanding Financial Crises.

... – market risk (MR): risk that the value of a portfolio will change due to changes in overall market risk factors (stock prices, interest rates, foreign exchange rates, and commodity prices). This is systematic risk that cannot be diversified. • Banks face this on their portfolios of bonds and ...

... – market risk (MR): risk that the value of a portfolio will change due to changes in overall market risk factors (stock prices, interest rates, foreign exchange rates, and commodity prices). This is systematic risk that cannot be diversified. • Banks face this on their portfolios of bonds and ...

Impact of Floating Exchange Rates on Company Risk Management

... In an idealized world, without information and transaction costs, explicit or implicit contract periods, and other obstacles to instantaneous price adjustments, deviations from various equil ibrium conditions such as purchas ing power parity, the law of one price. and both the domestic and internati ...

... In an idealized world, without information and transaction costs, explicit or implicit contract periods, and other obstacles to instantaneous price adjustments, deviations from various equil ibrium conditions such as purchas ing power parity, the law of one price. and both the domestic and internati ...

BANK GROUP`S GUIDELINES FOR FINANCIAL GOVERNANCE

... programs. The Bank supports programs involving subsidies only if they: (i) are transparent, targeted, and capped; (ii) are funded explicitly through the government budget or other sources subject to effective control and regular review; (iii) are fiscally sustainable; (iv) do not give an unfair adva ...

... programs. The Bank supports programs involving subsidies only if they: (i) are transparent, targeted, and capped; (ii) are funded explicitly through the government budget or other sources subject to effective control and regular review; (iii) are fiscally sustainable; (iv) do not give an unfair adva ...

-Basic transformation points in Turkish economy beginning

... • Turkish economy needed additional sources as money flows in foreign exchange to pay foreign loans; • The solution came from the “hot money” flows by national and international players; • Turkey opened up its domestic asset markets to global financial competition in 1989 initiated with the eliminat ...

... • Turkish economy needed additional sources as money flows in foreign exchange to pay foreign loans; • The solution came from the “hot money” flows by national and international players; • Turkey opened up its domestic asset markets to global financial competition in 1989 initiated with the eliminat ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... widening current account deficits, is remarkable, but so is the fact that during 2003 and 2004 U.S. net liabilities have actually declined when scaled by world GDP, despite the large current account deficits. We investigate this issue further in the next section. At the same time, Japan, some small ...

... widening current account deficits, is remarkable, but so is the fact that during 2003 and 2004 U.S. net liabilities have actually declined when scaled by world GDP, despite the large current account deficits. We investigate this issue further in the next section. At the same time, Japan, some small ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... can make discrete jumps at a point in time. This will happen whenever there is a discrete jump in the general price level. In our model this can occur either if the exchange rate jumps or if there is a change in indirect taxes. Since the exchange rate is a forward-looking price which responds to 'ne ...

... can make discrete jumps at a point in time. This will happen whenever there is a discrete jump in the general price level. In our model this can occur either if the exchange rate jumps or if there is a change in indirect taxes. Since the exchange rate is a forward-looking price which responds to 'ne ...

Monetary Policy and Uncertainty in an Empirical Small Open Economy Model PRELIMINARY

... instance, Devereux and Engel (2003) show in a two country model with local currency pricing that optimal monetary policy stipulates stabilization of the nominal exchange rate.1 Similarly, Monacelli (2003) shows that local currency pricing induces a trade-o¤ in stabilizing domestic price in‡ation and ...

... instance, Devereux and Engel (2003) show in a two country model with local currency pricing that optimal monetary policy stipulates stabilization of the nominal exchange rate.1 Similarly, Monacelli (2003) shows that local currency pricing induces a trade-o¤ in stabilizing domestic price in‡ation and ...

M o n e t a r y ... Contents 1 May 2002

... Consensus Forecasts rather more optimistic than earlier in the year. The influences on inflation are not all operating in the same direction. The exchange rate has been rising and international prices for some key exports, such as dairy products, have fallen ...

... Consensus Forecasts rather more optimistic than earlier in the year. The influences on inflation are not all operating in the same direction. The exchange rate has been rising and international prices for some key exports, such as dairy products, have fallen ...

THE EURO AS A THREAT TO EUROPEAN INTEGRATION THE IMF

... The euro has distorted the way in which the economies of Spain, Portugal, Italy and Greece function. Moreover, the countries of southern Europe, as members of a currency union cannot use currency devaluation, the most powerful instrument for coping with a serious economic depression. Economic histor ...

... The euro has distorted the way in which the economies of Spain, Portugal, Italy and Greece function. Moreover, the countries of southern Europe, as members of a currency union cannot use currency devaluation, the most powerful instrument for coping with a serious economic depression. Economic histor ...

π t - Seðlabanki Íslands

... Is inflation control more difficult in very small open economies? The Challenges of Globalisation for Small Open Economies with Independent Currencies 31 May – 1 June 2007 ...

... Is inflation control more difficult in very small open economies? The Challenges of Globalisation for Small Open Economies with Independent Currencies 31 May – 1 June 2007 ...

F t (k)

... The proceeds from the short sale cannot be used by the short seller. Instead, they are deposited in an escrow account in the investor’s name until the investor makes good on the promise to bring the shares back. Moreover, the investor must deposit an additional amount of at least 50% of the short sa ...

... The proceeds from the short sale cannot be used by the short seller. Instead, they are deposited in an escrow account in the investor’s name until the investor makes good on the promise to bring the shares back. Moreover, the investor must deposit an additional amount of at least 50% of the short sa ...

Lecture 1

... • Insurance products introduce actuarial risks such as the risk of death for an individual underwriting a life insurance policy or the risk of catastrophic loss for a product that is indexed non-life insurance risks. • In this course we review the main instruments that could be used to transfer cons ...

... • Insurance products introduce actuarial risks such as the risk of death for an individual underwriting a life insurance policy or the risk of catastrophic loss for a product that is indexed non-life insurance risks. • In this course we review the main instruments that could be used to transfer cons ...

Isabel Vansteenkiste

... Move towards a more resilient international monetary system Coherent conclusions to guide us in the management of capital flows, common principles for cooperation between the IMF and RFAs, and an action plan for local currency bond markets ...

... Move towards a more resilient international monetary system Coherent conclusions to guide us in the management of capital flows, common principles for cooperation between the IMF and RFAs, and an action plan for local currency bond markets ...

The Swiss National Bank in Brief

... The Libor rates are calculated in London on a daily basis for a number of currencies, based on information provided by international banks on their interest rate conditions. In Switzerland, Swiss franc Libors continue to be an important benchmark for many credit relationships in the economy. However ...

... The Libor rates are calculated in London on a daily basis for a number of currencies, based on information provided by international banks on their interest rate conditions. In Switzerland, Swiss franc Libors continue to be an important benchmark for many credit relationships in the economy. However ...

NBER WORKING PAPER SERIES FINANCIAL LIBERALIZATIONS IN LATIN-AMERICA IN THE 1990s:

... characterized by a reversal of declining self-financing ratios around the time of the crisis episode. The financial opening of the 1990s in Argentina is associated with a sizable drop in the self-financing ratio, from about 0.92 to 0.88. This drop ends with the sudden stop, which led to a partial re ...

... characterized by a reversal of declining self-financing ratios around the time of the crisis episode. The financial opening of the 1990s in Argentina is associated with a sizable drop in the self-financing ratio, from about 0.92 to 0.88. This drop ends with the sudden stop, which led to a partial re ...

Dutch Disease in Central and Eastern European Countries

... The term Dutch Disease refers initially to the economic consequences of the large natural gas discovery in the Netherlands during the 1960s, when the increase in wages generated by a boom in natural resources (the export sector), led to the strengthening of their currency, the Dutch guilder. Therefo ...

... The term Dutch Disease refers initially to the economic consequences of the large natural gas discovery in the Netherlands during the 1960s, when the increase in wages generated by a boom in natural resources (the export sector), led to the strengthening of their currency, the Dutch guilder. Therefo ...

sollicitatiebrief Roel [brieven]

... why this trend would only apply to the euro area. In investigating export dynamics, we therefore correct for the trend increases and focus on the share of particular products in total exports. Moreover, we investigate exports as a percentage of GDP, so that we do not lose sight of the size of trade ...

... why this trend would only apply to the euro area. In investigating export dynamics, we therefore correct for the trend increases and focus on the share of particular products in total exports. Moreover, we investigate exports as a percentage of GDP, so that we do not lose sight of the size of trade ...

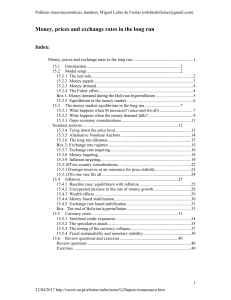

Money, prices and exchange rates in the long run

... When the backing ratio is equal to zero, the central bank has no hard currency at all. In this case, it will not be able to intervene in the foreign exchange market to influence the nominal exchange rate. When the backing ratio is equal to one, the central bank could – at least theoretically – buy b ...

... When the backing ratio is equal to zero, the central bank has no hard currency at all. In this case, it will not be able to intervene in the foreign exchange market to influence the nominal exchange rate. When the backing ratio is equal to one, the central bank could – at least theoretically – buy b ...

Persistent Macroeconomic Imbalances in the Euro Area: Causes

... among countries with different levels of economic development. In particular, in the presence of integrated real and financial markets, we should expect countries with lower per capita income to attract foreign investment because their higher expected productivity growth and corresponding economic g ...

... among countries with different levels of economic development. In particular, in the presence of integrated real and financial markets, we should expect countries with lower per capita income to attract foreign investment because their higher expected productivity growth and corresponding economic g ...

Not So Disconnected: Exchange Rates and the Capital Stock

... inflation rate affect real exchange rates because a subset of households can only hold nominal bonds that make fixed payments in terms of the currency of the country in which they reside. The remaining households have access to complete international asset markets. In equilibrium, the real exchange ...

... inflation rate affect real exchange rates because a subset of households can only hold nominal bonds that make fixed payments in terms of the currency of the country in which they reside. The remaining households have access to complete international asset markets. In equilibrium, the real exchange ...

Exploring the Relationship between Population Age Structure and Real Exchange Rate in OECD Countries

... larger share of elderly people in the population, lacks capital for investment, imports foreign capital and cause the real exchange rate to appreciate. In addition to saving, demography can also work through investment channel. Young dependents place investment demand, mainly through consumption of ...

... larger share of elderly people in the population, lacks capital for investment, imports foreign capital and cause the real exchange rate to appreciate. In addition to saving, demography can also work through investment channel. Young dependents place investment demand, mainly through consumption of ...

Diagnosing Dutch Disease: Does Russia Have the Symptoms?

... resource tradable goods (which we refer to as “manufacturing”), and nontradable goods (which we refer to as “services”). By definition, tradable goods (oil and manufacturing) are subject to international competition; hence, their prices are determined by world demand and supply, and it is assumed th ...

... resource tradable goods (which we refer to as “manufacturing”), and nontradable goods (which we refer to as “services”). By definition, tradable goods (oil and manufacturing) are subject to international competition; hence, their prices are determined by world demand and supply, and it is assumed th ...

is a monetary union in caricom desirable?

... appearance of asymmetric shocks. This analysis is closely akin to Kenen’s for whom only diversified economies enough could accept the fixedness of the exchange rates. There are two major objections to this argument. First of all, the movement of geographical integration can take place in border zone ...

... appearance of asymmetric shocks. This analysis is closely akin to Kenen’s for whom only diversified economies enough could accept the fixedness of the exchange rates. There are two major objections to this argument. First of all, the movement of geographical integration can take place in border zone ...

![sollicitatiebrief Roel [brieven]](http://s1.studyres.com/store/data/009900740_1-05dac9fdae732c72dfaa7f34555fefe9-300x300.png)