NBER WORKING PAPER SERIES FINANCIAL OPENNESS UNDER ALTERNATIVE REAL EXCHANGE RATE REGIMES

... Prepared for the NBER Conference on "Financial Policies and the World Capital Market: The Problem of Latin American Countries," Mexico City-, March 26—27, 1981. The research reported here is part o the NBER's research program in International Studies. Any opinions expressed are those of the author a ...

... Prepared for the NBER Conference on "Financial Policies and the World Capital Market: The Problem of Latin American Countries," Mexico City-, March 26—27, 1981. The research reported here is part o the NBER's research program in International Studies. Any opinions expressed are those of the author a ...

The Currency Hierarchy and the Center-Periphery - LaI FU

... Employment in the periphery is associated with the growth of the economically active population, the rate of expulsion of the labor from underdeveloped sectors, and capital accumulation in the modern sector. Ultimately, it is noted that unemployment results from the inability of the export sector, t ...

... Employment in the periphery is associated with the growth of the economically active population, the rate of expulsion of the labor from underdeveloped sectors, and capital accumulation in the modern sector. Ultimately, it is noted that unemployment results from the inability of the export sector, t ...

External Constraints on Monetary Policy and The Financial Accelerator

... We intrepret equation (16) as follows: At the margin, the entrepreneur is considering acquiring a unit of capital ¯nanced by debt. The additional debt, however, raises the leverage ratio, increasing the external ¯nance premium and the overall marginal cost of ¯nance. Relative to perfect capital mark ...

... We intrepret equation (16) as follows: At the margin, the entrepreneur is considering acquiring a unit of capital ¯nanced by debt. The additional debt, however, raises the leverage ratio, increasing the external ¯nance premium and the overall marginal cost of ¯nance. Relative to perfect capital mark ...

Lesson 4

... • A change in relative supply of U.S. products An increase in relative supply of US products (caused by an increase in U.S. productivity) causes the price/cost of U.S. goods relative to the price/cost of foreign goods to fall. A real depreciation of the value of US goods: PUS falls relative to E ...

... • A change in relative supply of U.S. products An increase in relative supply of US products (caused by an increase in U.S. productivity) causes the price/cost of U.S. goods relative to the price/cost of foreign goods to fall. A real depreciation of the value of US goods: PUS falls relative to E ...

Full Text - SERIWorld.org

... basis points as investors grew wary ahead of the US Federal Reserve’s monetary policy meeting, and as foreign investors continued to sell government bond futures. On Tuesday, the yield fell 2 basis points as risk averseness grew after major countries’ stock markets dropped amid recent yield rallies ...

... basis points as investors grew wary ahead of the US Federal Reserve’s monetary policy meeting, and as foreign investors continued to sell government bond futures. On Tuesday, the yield fell 2 basis points as risk averseness grew after major countries’ stock markets dropped amid recent yield rallies ...

Economics, by R. Glenn Hubbard and Anthony Patrick O'Brien

... © 2006 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien—1st ed. ...

... © 2006 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien—1st ed. ...

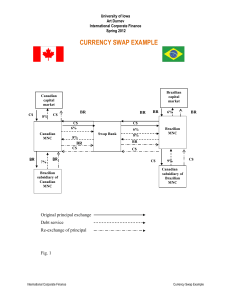

E4 - Art Durnev

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

Central Bank Policy

... Hierarchical vs. Dual Mandates • A hierarchical mandate reinforces the public’s belief in the central bank’s commitment to price stability. • It gets around the time inconsistency problem by limiting the policies that the central bank can do. • However, it can lead to the central bank targeting sho ...

... Hierarchical vs. Dual Mandates • A hierarchical mandate reinforces the public’s belief in the central bank’s commitment to price stability. • It gets around the time inconsistency problem by limiting the policies that the central bank can do. • However, it can lead to the central bank targeting sho ...

Great Expectations and the End of the Depression

... • By (2) leads to deflation • Shocks are persistent, thus people expect output contraction and deflation to occur in the future, thereby increasing expected future real rate, leading to further contraction ...

... • By (2) leads to deflation • Shocks are persistent, thus people expect output contraction and deflation to occur in the future, thereby increasing expected future real rate, leading to further contraction ...

Exchange Rates and External Adjustment: Does Financial Globalization Matter? Philip R. Lane

... Fund (2005) find that the valuation channel is helpful in stabilizing the U.S. external position: a deterioration in the net external position is associated with subsequent depreciation, which improves the external position both through the valuation channel and the trade balance channel.10 Despite ...

... Fund (2005) find that the valuation channel is helpful in stabilizing the U.S. external position: a deterioration in the net external position is associated with subsequent depreciation, which improves the external position both through the valuation channel and the trade balance channel.10 Despite ...

1 Currency Areas, Exchange Rate Systems and

... telling defects in our international monetary system. The inefficiency of our current “syst the hundreds of trillions of dollars of waste capital movements that cross international borders every year solely as a consequence of uncertainty over exchange rates. In this respect we should look with more ...

... telling defects in our international monetary system. The inefficiency of our current “syst the hundreds of trillions of dollars of waste capital movements that cross international borders every year solely as a consequence of uncertainty over exchange rates. In this respect we should look with more ...

Financial Frictions and Unconventional Monetary Policy in Emerging

... intuitive, since otherwise the central bank would be offering credit that is no superior to that which domestic agents can already get from private sources abroad. Second, when borrowing constraints bind, liquidity facilities have a general advantage over direct lending. The intuition has to do with ...

... intuitive, since otherwise the central bank would be offering credit that is no superior to that which domestic agents can already get from private sources abroad. Second, when borrowing constraints bind, liquidity facilities have a general advantage over direct lending. The intuition has to do with ...

2017 Investment and risk outlook

... almost a decade of healing since the global financial crisis (GFC), the comforting fading into rear view of early-2016’s disruptive deflationary scare, and any pernicious prospective inflation still far out of sight. At the same time, official government policies are pivoting increasingly towards th ...

... almost a decade of healing since the global financial crisis (GFC), the comforting fading into rear view of early-2016’s disruptive deflationary scare, and any pernicious prospective inflation still far out of sight. At the same time, official government policies are pivoting increasingly towards th ...

Examining exchange rate return factors before and after

... foreign exchange relationships. Also concluded by Chen, Roll & Ross, 1986 - "Asset prices should depend on their exposures to the state variable that describe the company". Thereto, research papers published regarding the clarification of the common factors within linear relationships between countr ...

... foreign exchange relationships. Also concluded by Chen, Roll & Ross, 1986 - "Asset prices should depend on their exposures to the state variable that describe the company". Thereto, research papers published regarding the clarification of the common factors within linear relationships between countr ...

Document

... the debt and its sustainability depends on the interest rate faced by the debtor and thereby on the risk premium determined in capital markets. Multiple-equilibria scenarios are not uncommon. In their assessments of debt sustainability, each investor has to guess the behavior of the rest of the mark ...

... the debt and its sustainability depends on the interest rate faced by the debtor and thereby on the risk premium determined in capital markets. Multiple-equilibria scenarios are not uncommon. In their assessments of debt sustainability, each investor has to guess the behavior of the rest of the mark ...

Mini Case (p.45) A. Why is corporate finance important to all

... Mortgage securitization is when investment bank packages a group of loans together and sells them as investments. Unfortunately institutional investors did not perform due diligence and even retail investors invested in products they did not understand. The most common form of mortgage securitizatio ...

... Mortgage securitization is when investment bank packages a group of loans together and sells them as investments. Unfortunately institutional investors did not perform due diligence and even retail investors invested in products they did not understand. The most common form of mortgage securitizatio ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: NBER Macroeconomics Annual 1986, Volume 1

... results in a contract that takes into account the interests of the insiders but not the outsiders. Workers cease to influence wage bargains once they have lost their jobs, and therefore cannot take actions that will increase their chances of being employed. Thus the unemployment rate tends to stay a ...

... results in a contract that takes into account the interests of the insiders but not the outsiders. Workers cease to influence wage bargains once they have lost their jobs, and therefore cannot take actions that will increase their chances of being employed. Thus the unemployment rate tends to stay a ...

Synthesis - UCSB Economics

... the US central bank, the Federal Reserve, engages in monetary policy • What: the Fed can buy government securities on the secondary bond market (open market operations) and if it buys from a private bank, for example, credits this bank with reserves. This private bank can use any excess reserves ove ...

... the US central bank, the Federal Reserve, engages in monetary policy • What: the Fed can buy government securities on the secondary bond market (open market operations) and if it buys from a private bank, for example, credits this bank with reserves. This private bank can use any excess reserves ove ...

Exam Name___________________________________

... 50) An increase in the domestic interest rate shifts the expected return schedule for ________ deposits to the ________ and causes the domestic currency to appreciate. A) domestic; right B) domestic; left C) foreign; right D) foreign; left Answer: A 51) A decrease in the domestic interest rate shif ...

... 50) An increase in the domestic interest rate shifts the expected return schedule for ________ deposits to the ________ and causes the domestic currency to appreciate. A) domestic; right B) domestic; left C) foreign; right D) foreign; left Answer: A 51) A decrease in the domestic interest rate shif ...

Inflation Targeting: A Canadian Perspective

... Unlike many other central banks, the Bank of Canada is not responsible for the regulation of financial institutions. The crisis, however, has raised the issue of what role the Bank should play in the macroprudential regulation and how this role will interact with its focus on inflation targeting ...

... Unlike many other central banks, the Bank of Canada is not responsible for the regulation of financial institutions. The crisis, however, has raised the issue of what role the Bank should play in the macroprudential regulation and how this role will interact with its focus on inflation targeting ...

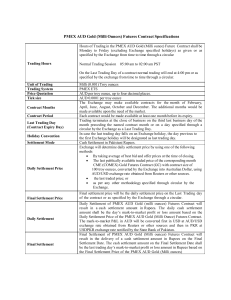

PMEX AUD Gold Futures Contract

... as per any other methodology specified through circular by the Exchange. Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will resu ...

... as per any other methodology specified through circular by the Exchange. Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will resu ...