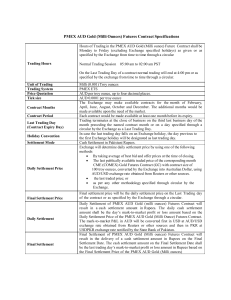

PMEX AUD Gold Futures Contract

... as per any other methodology specified through circular by the Exchange. Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will resu ...

... as per any other methodology specified through circular by the Exchange. Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will resu ...

STOCK PRICE AND EXCHANGE RATE: THE CASE OF BIST 100

... relationship between stock prices and exchange rate markets. According to authors, exchange rate activities are important macro-economic variables affecting business life. Chow et. al. (1997) used monthly data periods in the first part of their study. Authors failed to determine a relationship betwe ...

... relationship between stock prices and exchange rate markets. According to authors, exchange rate activities are important macro-economic variables affecting business life. Chow et. al. (1997) used monthly data periods in the first part of their study. Authors failed to determine a relationship betwe ...

Dynamic General Equilibrium Analysis: The Open Economy

... The Þndings in the upper panel of Table 1 show that the Þrst regime is easily dominant in the case of full pass through. By allowing the nominal and real exchange rate to vary in response to shocks, targeting nontradables inßation achieves much lower volatility in output and investment, even if CPI ...

... The Þndings in the upper panel of Table 1 show that the Þrst regime is easily dominant in the case of full pass through. By allowing the nominal and real exchange rate to vary in response to shocks, targeting nontradables inßation achieves much lower volatility in output and investment, even if CPI ...

A fresh look at the merits of a currency union

... losing domestic monetary policy is less of a concern, since the central bank’s response in terms of changing interest rates will be appropriate for all member states. It is when a member state faces ‘asymmetric shocks’ – shocks that affect it differently from other member states – that the relative ...

... losing domestic monetary policy is less of a concern, since the central bank’s response in terms of changing interest rates will be appropriate for all member states. It is when a member state faces ‘asymmetric shocks’ – shocks that affect it differently from other member states – that the relative ...

Macroeconomic Theory of Open Economy

... Effect of an Import Quota There is no change in the interest rate because nothing happens in the loanable funds market. There will be no change in net exports. There is no change in net foreign investment even though an import quota reduces imports. ...

... Effect of an Import Quota There is no change in the interest rate because nothing happens in the loanable funds market. There will be no change in net exports. There is no change in net foreign investment even though an import quota reduces imports. ...

SUBA- MBITA JOINT 565/2 BUSINESS STUDIES PAPER 2

... - Through a decision by the shareholders to voluntarily wind up - When there is amalgamation - When membership fall below the minimum that is required by law - Deregistration by the registrar of companies due to failure to comply with the law - Accomplishment of purchase or expiry of period of opera ...

... - Through a decision by the shareholders to voluntarily wind up - When there is amalgamation - When membership fall below the minimum that is required by law - Deregistration by the registrar of companies due to failure to comply with the law - Accomplishment of purchase or expiry of period of opera ...

UK current account - November 2016

... Sources: ONS, S&P Global Market Intelligence and Bank calculations. (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 15 November 2016. (b) The estimate for the change in the holding of shares in 2016 Q4 is based on data up to 15 November 201 ...

... Sources: ONS, S&P Global Market Intelligence and Bank calculations. (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 15 November 2016. (b) The estimate for the change in the holding of shares in 2016 Q4 is based on data up to 15 November 201 ...

CHAPTER 5:

... Your holding period return for the next year on the money market fund depends on what 30 day interest rates will be each month when it is time to roll over maturing securities. The one-year savings deposit will offer a 7.5% holding period return for the year. If you forecast the rate on money market ...

... Your holding period return for the next year on the money market fund depends on what 30 day interest rates will be each month when it is time to roll over maturing securities. The one-year savings deposit will offer a 7.5% holding period return for the year. If you forecast the rate on money market ...

econ stor How to spend it: Commodity and non-commodity sovereign wealth funds

... – and their owners – governments – have been perceived by some as providing fertile ground for conspiracy theories, such as fear of industrial espionage or geopolitical threats. These concerns were strongly summarized by maverick TV anchor Jim Cramer at the time SWFs heavily invested in US banks: “D ...

... – and their owners – governments – have been perceived by some as providing fertile ground for conspiracy theories, such as fear of industrial espionage or geopolitical threats. These concerns were strongly summarized by maverick TV anchor Jim Cramer at the time SWFs heavily invested in US banks: “D ...

proposed capital market development policy statement

... development of domestic capital markets to better position the economy to compete in an increasingly open and competitive global environment; The Government of The Bahamas recognizes that if The Bahamas' economy is to be vibrant and sustainable, there would need to be available to all users of finan ...

... development of domestic capital markets to better position the economy to compete in an increasingly open and competitive global environment; The Government of The Bahamas recognizes that if The Bahamas' economy is to be vibrant and sustainable, there would need to be available to all users of finan ...

Measuring world growth: do weights matter?

... world, with the weights reflecting the relative importance of each region in the world economy (i.e. its share in the total value of world GDP). In order to compute this share, national data, initially expressed in the national currency, are converted into a common currency using an exchange rate me ...

... world, with the weights reflecting the relative importance of each region in the world economy (i.e. its share in the total value of world GDP). In order to compute this share, national data, initially expressed in the national currency, are converted into a common currency using an exchange rate me ...

Real Exchange Rate Fluctuations

... the banks: might generate problems if they are regarded as (1) a change in the rules, in the upside or (2) a regulatory subsidy, in the downside. ...

... the banks: might generate problems if they are regarded as (1) a change in the rules, in the upside or (2) a regulatory subsidy, in the downside. ...

The World and Regional Economic Outlook a. Global Economic

... The global expansion has been losing speed in the face of a major financial crisis. The slowdown has been greatest in the advanced economies, particularly in the United States, where the housing market correction continues to exacerbate financial stress. The emerging and developing economies have so ...

... The global expansion has been losing speed in the face of a major financial crisis. The slowdown has been greatest in the advanced economies, particularly in the United States, where the housing market correction continues to exacerbate financial stress. The emerging and developing economies have so ...

View/Open

... Currency exchange rates can play an important role in agricultural markets. In the United States, the relative strength of the U.S. dollar against currencies of other countries can have important impacts on prices for U.S. agricultural commodities. For example, when the U.S. dollar appreciates (that ...

... Currency exchange rates can play an important role in agricultural markets. In the United States, the relative strength of the U.S. dollar against currencies of other countries can have important impacts on prices for U.S. agricultural commodities. For example, when the U.S. dollar appreciates (that ...

Preview Sample 1

... revaluation as a result of actions taken by a country’s central banker. Currency trading by international speculators can also lead to devaluation. When a country’s economy is strong or when demand for its goods is high, its currency tends to appreciate in value. When currency values fluctuate, glob ...

... revaluation as a result of actions taken by a country’s central banker. Currency trading by international speculators can also lead to devaluation. When a country’s economy is strong or when demand for its goods is high, its currency tends to appreciate in value. When currency values fluctuate, glob ...

BALANCE OF PAYMENTS

... activity in the Israeli stock exchange or in a foreign stock exchange, and includes bonds issued abroad by the Government of Israel, in addition, as stated, to investments at less than one-tenth of equity. Financial derivatives instruments are also included here. Other investment - This subgroup inc ...

... activity in the Israeli stock exchange or in a foreign stock exchange, and includes bonds issued abroad by the Government of Israel, in addition, as stated, to investments at less than one-tenth of equity. Financial derivatives instruments are also included here. Other investment - This subgroup inc ...

A Small Economic Model for Argentina (Summary)

... Additonaly, the SEM incorporates a broad spectrum of exchange rate and monetary policies. In particular, it is deemed to be relevant that the SEM may re‡ect the simultaneous monetary authority intervention in the money and foreign exchange markets. For such purpose, it is necessary to introduce the ...

... Additonaly, the SEM incorporates a broad spectrum of exchange rate and monetary policies. In particular, it is deemed to be relevant that the SEM may re‡ect the simultaneous monetary authority intervention in the money and foreign exchange markets. For such purpose, it is necessary to introduce the ...

OVERVIEW

... economy are welcomed by the markets and this positive perception underpins the relative upward shift in the outlook of global financial markets. In this framework, the upside pressure on bond yields in the Euro area have been taken under control to some extent and the risk of deepening of financial ...

... economy are welcomed by the markets and this positive perception underpins the relative upward shift in the outlook of global financial markets. In this framework, the upside pressure on bond yields in the Euro area have been taken under control to some extent and the risk of deepening of financial ...

The Curious Case of the Yen as a Safe Haven Currency

... C. The effect of risk-off episodes on yield differentials ..............................................14 D. The effect of risk-off episodes on non-commercial derivative positions................14 V. Conclusions .................................................................................... ...

... C. The effect of risk-off episodes on yield differentials ..............................................14 D. The effect of risk-off episodes on non-commercial derivative positions................14 V. Conclusions .................................................................................... ...

The European Monetary System (1)

... While the United Kingdom and the United States were on the gold standard from 1821 and 1834 respectively, most of the countries had joined the system by 1870. The essential feature of this system was that governments gave an unconditional guarantee to convert their paper money or fiat money into gol ...

... While the United Kingdom and the United States were on the gold standard from 1821 and 1834 respectively, most of the countries had joined the system by 1870. The essential feature of this system was that governments gave an unconditional guarantee to convert their paper money or fiat money into gol ...

download

... To hedge or not to hedge? In addition, for a given level of debt, lower earnings volatility will entail a lower probability of a negative net worth. … Because currency matching reduces the probability of financial distress, it allows the firm to have greater leverage and therefore a greater tax shi ...

... To hedge or not to hedge? In addition, for a given level of debt, lower earnings volatility will entail a lower probability of a negative net worth. … Because currency matching reduces the probability of financial distress, it allows the firm to have greater leverage and therefore a greater tax shi ...