Exchange Rates, Balance of Payments, and International Debt

... 4. Continuing the yap example, what might the yap government be forced to do if it did not have a sufficient quantity of yaps on reserve to eliminate the excess demand? • The yap government might be forced to borrow yaps from another country, or even agree to increase the exchange rate ($ per yap). ...

... 4. Continuing the yap example, what might the yap government be forced to do if it did not have a sufficient quantity of yaps on reserve to eliminate the excess demand? • The yap government might be forced to borrow yaps from another country, or even agree to increase the exchange rate ($ per yap). ...

Currency Boards - Cato Institute

... relatively new institutional arrangements. In 1900, there were only 18 central banks in the world. By 1940, 40 countries had them, and today there are 174. Of those, 6 are bound by currency board rules that do not permit discretionary monetary policies. In addition, there are seven monetary authorit ...

... relatively new institutional arrangements. In 1900, there were only 18 central banks in the world. By 1940, 40 countries had them, and today there are 174. Of those, 6 are bound by currency board rules that do not permit discretionary monetary policies. In addition, there are seven monetary authorit ...

Brazil responses to the international financial crisis: a well succeed

... proposals point towards arranging a managed exchange rate regime in order to assure external balance and, particularly, price stability (Ferrari Filho, 2006a: Chapter 3). In his International Clearing Union (Keynes, 1980b), Keynes makes this idea clear by signaling that one of the aims of having a f ...

... proposals point towards arranging a managed exchange rate regime in order to assure external balance and, particularly, price stability (Ferrari Filho, 2006a: Chapter 3). In his International Clearing Union (Keynes, 1980b), Keynes makes this idea clear by signaling that one of the aims of having a f ...

empirical studies of nigeria`s foreign exchange parallel market ii

... all available information so that economic profits can not be earned through exploiting this information set. Different levels of efficiency can be distinguished depending on how much information is used to form expectations about future prices — weak form, semi-strong form and strong form (Fama, 19 ...

... all available information so that economic profits can not be earned through exploiting this information set. Different levels of efficiency can be distinguished depending on how much information is used to form expectations about future prices — weak form, semi-strong form and strong form (Fama, 19 ...

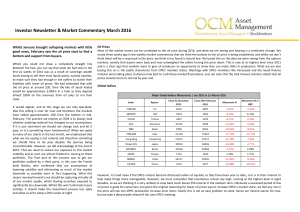

Market Commentary March 2016

... would be out for him and also the Euro-Sceptics. We have seen several accusations of scaremongering from both sides, which will surely get worse on the run up to June 23rd. Looking at the on-line betting, then it still seems that we shall remain in Europe come the end of June, and certainly the rebo ...

... would be out for him and also the Euro-Sceptics. We have seen several accusations of scaremongering from both sides, which will surely get worse on the run up to June 23rd. Looking at the on-line betting, then it still seems that we shall remain in Europe come the end of June, and certainly the rebo ...

Chapter 18 - Pearson Canada

... It has been argued that -targeting may lead to tight policy when > * and thus may lead to larger Y fluctuations. But -targeting does not require a sole focus on . The decision of central banks to choose targets above zero reflects the concern that zero may have negative effects on the econ ...

... It has been argued that -targeting may lead to tight policy when > * and thus may lead to larger Y fluctuations. But -targeting does not require a sole focus on . The decision of central banks to choose targets above zero reflects the concern that zero may have negative effects on the econ ...

ch20_5e

... An increase in the U.S. interest rate, say, after a monetary contraction, will cause the U.S. interest rate to increase, and the demand for U.S. bonds to rise. As investors switch from foreign currency to dollars, the dollar appreciates. The more the dollar appreciates, the more investors expect it ...

... An increase in the U.S. interest rate, say, after a monetary contraction, will cause the U.S. interest rate to increase, and the demand for U.S. bonds to rise. As investors switch from foreign currency to dollars, the dollar appreciates. The more the dollar appreciates, the more investors expect it ...

Open Economy Macroeconomics

... A fixed exchange rate regime (including managed float or dirty float) is one such that the balance of payments for official financing is not identically zero, the surplus or deficit being covered by the domestic monetary authority’s use of the foreign currency reserves to intervene in currency marke ...

... A fixed exchange rate regime (including managed float or dirty float) is one such that the balance of payments for official financing is not identically zero, the surplus or deficit being covered by the domestic monetary authority’s use of the foreign currency reserves to intervene in currency marke ...

- wiwi.uni

... includes all sovereign states on the continent. For my analysis, I exclude the two non-Latin members of UNASUR, Guyana and Suriname, due to their negligible size, and focus on Brazil and the nine Spanish-speaking countries of South America. Mercosur, the South American integration scheme most openly ...

... includes all sovereign states on the continent. For my analysis, I exclude the two non-Latin members of UNASUR, Guyana and Suriname, due to their negligible size, and focus on Brazil and the nine Spanish-speaking countries of South America. Mercosur, the South American integration scheme most openly ...

An Institutional Framework for Comparing Emerging Market

... Historically, CBAs were set up in small open economies with limited expertise in monetary management, little experience in central banking, or weak financial systems.8 The smaller the economy and the higher its degree of openness, the lower is the cost of foregoing the exchange rate as an instrument ...

... Historically, CBAs were set up in small open economies with limited expertise in monetary management, little experience in central banking, or weak financial systems.8 The smaller the economy and the higher its degree of openness, the lower is the cost of foregoing the exchange rate as an instrument ...

How Stimulatory Are Large

... By Vasco Cúrdia and Andrea Ferrero The Federal Reserve’s large-scale purchases of long-term Treasury securities most likely provided a moderate boost to economic growth and inflation. Importantly, the effects appear to depend greatly on the Fed’s guidance that short-term interest rates would remain ...

... By Vasco Cúrdia and Andrea Ferrero The Federal Reserve’s large-scale purchases of long-term Treasury securities most likely provided a moderate boost to economic growth and inflation. Importantly, the effects appear to depend greatly on the Fed’s guidance that short-term interest rates would remain ...

entrada - Bolsa de Madrid

... a regulated market and its price discovery mechanism, not on any of the many multilateral trading facilities that have sprung up under MiFID. What is key here is that MTFs themselves or their participants trust stock exchanges for price discovery and in fact use the prices set at regulated markets a ...

... a regulated market and its price discovery mechanism, not on any of the many multilateral trading facilities that have sprung up under MiFID. What is key here is that MTFs themselves or their participants trust stock exchanges for price discovery and in fact use the prices set at regulated markets a ...

Working Paper 12-15: Choice and Coercion in East Asian Exchange

... Tables 1 through 4 report the regression results. Table 1 confirms the results of other studies, that the weight of the US dollar was very high prior to mid-2005. McKinnon and Schnabl (2004) thus revived the term “dollar standard” to describe the regional regime during this period. The Japanese yen ...

... Tables 1 through 4 report the regression results. Table 1 confirms the results of other studies, that the weight of the US dollar was very high prior to mid-2005. McKinnon and Schnabl (2004) thus revived the term “dollar standard” to describe the regional regime during this period. The Japanese yen ...

The Impacts of the Asian Economic Crisis on

... According to the estimation by Ito and other economists in the IMF, the short run real exchange rate elasticities of import in these countries are from 0.24 (Malaysia) to 2.14 (Thailand). It indicates that a 1% depreciation of the currency, the country might reduce import from 0.24% to 2.14%. Second ...

... According to the estimation by Ito and other economists in the IMF, the short run real exchange rate elasticities of import in these countries are from 0.24 (Malaysia) to 2.14 (Thailand). It indicates that a 1% depreciation of the currency, the country might reduce import from 0.24% to 2.14%. Second ...

Chapter 12 - Academic Csuohio

... Example: Part 2 September 2002, $1.00 per € February 2006, $1.25 per € How does this change affect the relative price of assets? • You cannot directly deposit U.S. dollars into a foreign bank, so you convert the $1000 into euros. In September 2002, you receive €1000 to deposit into your Germ ...

... Example: Part 2 September 2002, $1.00 per € February 2006, $1.25 per € How does this change affect the relative price of assets? • You cannot directly deposit U.S. dollars into a foreign bank, so you convert the $1000 into euros. In September 2002, you receive €1000 to deposit into your Germ ...

capital flows, exchange rates and growth: evidence from

... Estimating a growth equation for a panel covering 24 emerging-market economies in the 1975-1997 period, they find large and sometimes lasting negative effects on output of these negative capital account shocks. Capital Flows and Alternative Policy Regimes The stylized facts that help to explain why ...

... Estimating a growth equation for a panel covering 24 emerging-market economies in the 1975-1997 period, they find large and sometimes lasting negative effects on output of these negative capital account shocks. Capital Flows and Alternative Policy Regimes The stylized facts that help to explain why ...

Low Interest Rate Policy and the Use of Reserve Requirements in

... major advanced economies to stabilize financial markets and step-up growth. Not surprisingly, in our integrated global financial system monetary policy reactions in economies with major funding and reserve currencies (the United States and the Euro Area) do not leave the rest of the world unaffected ...

... major advanced economies to stabilize financial markets and step-up growth. Not surprisingly, in our integrated global financial system monetary policy reactions in economies with major funding and reserve currencies (the United States and the Euro Area) do not leave the rest of the world unaffected ...

NBER WORKING PAPER SERIES HOW MANY MONIES? A GENETIC APPROACH TO FINDING

... where O is a random shock, L is labor employed in period t, and 0 < /3 < 1 is the share of labor. Nominal wages are downward sticky . A simple formulation is to assume that the (log) of the nominal wage is set in order to obtain labor market equilibrium based on information available in period t — 1 ...

... where O is a random shock, L is labor employed in period t, and 0 < /3 < 1 is the share of labor. Nominal wages are downward sticky . A simple formulation is to assume that the (log) of the nominal wage is set in order to obtain labor market equilibrium based on information available in period t — 1 ...

The research reported here is part of the NBER's research

... policies that initiate a change in trend, nor from any other disturbances. The traditional argument against flexible exchange rates, coming from the experience of the interwar period, is that flexible rates are unstable, ...

... policies that initiate a change in trend, nor from any other disturbances. The traditional argument against flexible exchange rates, coming from the experience of the interwar period, is that flexible rates are unstable, ...

Document

... Long-run effect of an increase in the subsidy rate on inflation is ambiguous. Two opposite effects: Increase in subsidy payments increases government spending and reduces the wedge between the actual price ratio and its required level which tends to raise real money balances. Higher activity in ...

... Long-run effect of an increase in the subsidy rate on inflation is ambiguous. Two opposite effects: Increase in subsidy payments increases government spending and reduces the wedge between the actual price ratio and its required level which tends to raise real money balances. Higher activity in ...

FAQ Power Exchange - Tata Power Trading Company Ltd.

... ACP is reduced in the surplus area (sale > purchase) and increased in the deficit area (purchase > sale). This will reduce the sale and increase the purchase in the surplus area. In the same way, it will reduce the purchase and increase the sale in the deficit area. Thus, the needed flow is reduced ...

... ACP is reduced in the surplus area (sale > purchase) and increased in the deficit area (purchase > sale). This will reduce the sale and increase the purchase in the surplus area. In the same way, it will reduce the purchase and increase the sale in the deficit area. Thus, the needed flow is reduced ...

Asian Currency and Financial Crises: Lessons from Vulnerability

... consequences of deep flaws in the Asian economies such as Asian ‘crony capitalism’ seem to us to be strongly overstated. Without question, there were macroeconomic imbalances, weak financial institutions, widespread corruption, and inadequate legal foundations in each of the affected countries. Thes ...

... consequences of deep flaws in the Asian economies such as Asian ‘crony capitalism’ seem to us to be strongly overstated. Without question, there were macroeconomic imbalances, weak financial institutions, widespread corruption, and inadequate legal foundations in each of the affected countries. Thes ...

File

... The real exchange rate is determined by the supply and demand for foreign-currency exchange. The supply of dollars to be exchanged into foreign currency comes from net capital outflow. Because net capital outflow does not depend on the real exchange rate, the supply curve is vertical. The demand for ...

... The real exchange rate is determined by the supply and demand for foreign-currency exchange. The supply of dollars to be exchanged into foreign currency comes from net capital outflow. Because net capital outflow does not depend on the real exchange rate, the supply curve is vertical. The demand for ...

What Types of Financial Market Structures Exist

... and pay a fixed dividend expressed as a percentage of par value. Preferred stock is a claim against a corporation's cash flow that is prior to the claims of its common stock holders but is generally subordinate to the claims of its debt holders. In addition, like debt holders but unlike common stock ...

... and pay a fixed dividend expressed as a percentage of par value. Preferred stock is a claim against a corporation's cash flow that is prior to the claims of its common stock holders but is generally subordinate to the claims of its debt holders. In addition, like debt holders but unlike common stock ...