1. O verview

... also included some measures in the road map to enhance the flexibility of the FX liquidity management. In this regard, transaction limits for banks at the CBRT Foreign Exchange and Banknotes Markets were raised by around 130 percent to 50 billion USD on 1 September 2015. Consequently, the sum of dep ...

... also included some measures in the road map to enhance the flexibility of the FX liquidity management. In this regard, transaction limits for banks at the CBRT Foreign Exchange and Banknotes Markets were raised by around 130 percent to 50 billion USD on 1 September 2015. Consequently, the sum of dep ...

Jim2 Multicurrency - Happen Business Accounting Software

... Currency rates in action in a live environment Your commencement date for Multicurrency is January 1 st. The Exchange Rate for USD is set at $0.80. The default SETUP for USD remains at 5% Spread Limit with 14 day Out of Date warning. On January 1st, purchasing and payments in USD transactions are g ...

... Currency rates in action in a live environment Your commencement date for Multicurrency is January 1 st. The Exchange Rate for USD is set at $0.80. The default SETUP for USD remains at 5% Spread Limit with 14 day Out of Date warning. On January 1st, purchasing and payments in USD transactions are g ...

Exchange Rates

... • In touch with data and research: McParity – As a test of the PPP hypothesis, the Economist magazine periodically reports on the prices of Big Mac hamburgers in different countries – The prices, when translated into dollar terms using the nominal exchange rate, range from $1.62 in India to $6.81 in ...

... • In touch with data and research: McParity – As a test of the PPP hypothesis, the Economist magazine periodically reports on the prices of Big Mac hamburgers in different countries – The prices, when translated into dollar terms using the nominal exchange rate, range from $1.62 in India to $6.81 in ...

Risk Management: An Introduction to Financial Engineering

... The Risk Management Process Identify the types of price fluctuations that will impact the firm Some risks are obvious; others are not Some risks may offset each other, so it is important to look at the firm as a portfolio of risks and not just look at each risk separately You must also look ...

... The Risk Management Process Identify the types of price fluctuations that will impact the firm Some risks are obvious; others are not Some risks may offset each other, so it is important to look at the firm as a portfolio of risks and not just look at each risk separately You must also look ...

Welcome to the course on Currencies.

... to three different currencies – the primary currency and two additional currencies. In the presented example, in the sales pricelist the primary currency is the default currency (that is the British Pound) to go into documents for local customers. In the additional currency in this pricelist, prices ...

... to three different currencies – the primary currency and two additional currencies. In the presented example, in the sales pricelist the primary currency is the default currency (that is the British Pound) to go into documents for local customers. In the additional currency in this pricelist, prices ...

This PDF is a selection from a published volume from... Bureau of Economic Research Volume Title: NBER Macroeconomics Annual 201

... Francesco Giavazzi opened the discussion by following up on Charles Engel’s comment that the response of the nominal and real exchange rates imply that a contractionary monetary shock raises domestic inflation relative to foreign inflation. Giavazzi asked whether this empirical result is simply a ma ...

... Francesco Giavazzi opened the discussion by following up on Charles Engel’s comment that the response of the nominal and real exchange rates imply that a contractionary monetary shock raises domestic inflation relative to foreign inflation. Giavazzi asked whether this empirical result is simply a ma ...

BULLETIN CENTRAL BANK OF THE REPUBLIC OF TURKEY INSIDE:

... continued to persist throughout the world. While the central banks of developed economies have given priority to financial stability and growth during this period, those of emerging economies have focused on the rise of inflation. ...

... continued to persist throughout the world. While the central banks of developed economies have given priority to financial stability and growth during this period, those of emerging economies have focused on the rise of inflation. ...

S0311811_es.pdf

... liberalization and the resumption of economic growth after the “lost decade” that marked the 1980s. The first year of the 1990s decade coincided also with the large scale introduction of new financial instruments that allowed operators to trade riskier papers, opening the door to an active market of ...

... liberalization and the resumption of economic growth after the “lost decade” that marked the 1980s. The first year of the 1990s decade coincided also with the large scale introduction of new financial instruments that allowed operators to trade riskier papers, opening the door to an active market of ...

Hanging by a Thread: A Look Into the Venezuelan Crisis

... lot of money owned and no revenues getting in. On the other hand, China has a large exposure to Venezuela’s debt and risks having to deal with a potential national default. Beijing has already sent unofficial envoys to hold talks with Maduro’s opposition in order to secure the payment of the debt an ...

... lot of money owned and no revenues getting in. On the other hand, China has a large exposure to Venezuela’s debt and risks having to deal with a potential national default. Beijing has already sent unofficial envoys to hold talks with Maduro’s opposition in order to secure the payment of the debt an ...

This PDF is a selection from an out-of-print volume from the... of Economic Research

... inflation, introduction of the VAT-the overall retrenchment in the public sector deficit has not been large, a fact which finds its counterpart in the continuing need for moderate amounts of foreign borrowing. In many ways, the public sector balance remains the Achilles’ heel of the Turkish economy. ...

... inflation, introduction of the VAT-the overall retrenchment in the public sector deficit has not been large, a fact which finds its counterpart in the continuing need for moderate amounts of foreign borrowing. In many ways, the public sector balance remains the Achilles’ heel of the Turkish economy. ...

An Empirical Study of a ‘Mystery of Currency Exposure’ with the Case of A-Share Listed Companies

... economies. Given the premise that management and allocation functions in the market are rational, currency risk exposure should rather be measured based on the classification of exchange rate changes, and the real exchange risk exposure coefficient should be measured from the perspective of unexpect ...

... economies. Given the premise that management and allocation functions in the market are rational, currency risk exposure should rather be measured based on the classification of exchange rate changes, and the real exchange risk exposure coefficient should be measured from the perspective of unexpect ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... which deals with the medium- and long-term equilibrium implications, and the other of which deals with the problem of short-run adjustment when factor markets do not clear. ...

... which deals with the medium- and long-term equilibrium implications, and the other of which deals with the problem of short-run adjustment when factor markets do not clear. ...

Exchange Rate Regimes in East Asia – Recent Trends

... analytical results on and convergence support these results although unit root tests are significantly rejected in several specifications during Period 1. The fourth section points out coordination failure in exchange rate systems in East Asia and suggests that East Asian monetary authorities sh ...

... analytical results on and convergence support these results although unit root tests are significantly rejected in several specifications during Period 1. The fourth section points out coordination failure in exchange rate systems in East Asia and suggests that East Asian monetary authorities sh ...

A Macroeconometric Model for the Euro Economy

... techniques. As a rule cointegrating relations are estimated jointly with the short-run dynamics in one step; see Stock and Watson (1993). This avoids the well known bias of the two-step procedure arising in finite samples. After the estimation the cointegrating relations are often restricted accordi ...

... techniques. As a rule cointegrating relations are estimated jointly with the short-run dynamics in one step; see Stock and Watson (1993). This avoids the well known bias of the two-step procedure arising in finite samples. After the estimation the cointegrating relations are often restricted accordi ...

Exam Review PowerPoint

... In Lucas misperceptions model the distinction between the long-run and short run is that in the long run actual price must be equal to expected price. A short run aggregate supply curve is drawn for a given expected price level; the actual price level varies. On the short run aggregate supply curve ...

... In Lucas misperceptions model the distinction between the long-run and short run is that in the long run actual price must be equal to expected price. A short run aggregate supply curve is drawn for a given expected price level; the actual price level varies. On the short run aggregate supply curve ...

January 2012 - Appropriate Balance Financial Services

... rural dwellers ‐ rising to 51.3% of the nation’s 1.3 billon people. This is a very positive development for the global market in the long‐term and may be the tipping point for China as a consumer. International companies have been waiting for years for the Chinese to become consumers. That time m ...

... rural dwellers ‐ rising to 51.3% of the nation’s 1.3 billon people. This is a very positive development for the global market in the long‐term and may be the tipping point for China as a consumer. International companies have been waiting for years for the Chinese to become consumers. That time m ...

BULLETIN

... MANAGEMENT AND SIMPLIFICATION STEPS Due to economic conditions brought about by the global financial crisis in 2008, interest rates in advanced economies dropped to zero or close-to-zero levels. However, since the policy implementations fell short of reviving the domestic demand, non-conventional mo ...

... MANAGEMENT AND SIMPLIFICATION STEPS Due to economic conditions brought about by the global financial crisis in 2008, interest rates in advanced economies dropped to zero or close-to-zero levels. However, since the policy implementations fell short of reviving the domestic demand, non-conventional mo ...

Will the Dollar remain the reserve currency?

... as the world’s premier reserve currency. In today’s world of currency wars and zero interest rates, governments want to lend abroad rather than borrow. They send capital abroad to push down the values of their currencies in order to boost exports and economic growth. Official purchases of foreign ex ...

... as the world’s premier reserve currency. In today’s world of currency wars and zero interest rates, governments want to lend abroad rather than borrow. They send capital abroad to push down the values of their currencies in order to boost exports and economic growth. Official purchases of foreign ex ...

Ceci est la version HTML du fichier http://www

... Malaysia did not have large short-term external debt or a grossly weak banking sector (if perhaps somewhat overextended in real estate), and, without IMF financing, adopted macroeconomic policies that were akin to those under IMF programs—tight monetary and fiscal policies—at least until the spring ...

... Malaysia did not have large short-term external debt or a grossly weak banking sector (if perhaps somewhat overextended in real estate), and, without IMF financing, adopted macroeconomic policies that were akin to those under IMF programs—tight monetary and fiscal policies—at least until the spring ...

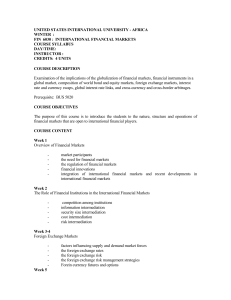

united states international university - africa

... eurobonds market, features, new issue procedures, valuation ...

... eurobonds market, features, new issue procedures, valuation ...

New rules on collateral for securities in repurchase agreements

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

Net capital flows and real exchange rate depreciation effects on the business cycle in emerging market:

... Following related literature, the restricted-model specification includes a set of control variables such as the annual GDP world growth rate and the terms of trade. In turn, when analysing whether the relationships in question are influenced by country fundamentals, the choice of structural variabl ...

... Following related literature, the restricted-model specification includes a set of control variables such as the annual GDP world growth rate and the terms of trade. In turn, when analysing whether the relationships in question are influenced by country fundamentals, the choice of structural variabl ...

International Economics: A European Focus

... Money supply, output, inflation and the exchange rate under managed flexibility The volatility of exchange rates Choice of exchange rate regime Case study 10.2 The currency board system Summary Key concepts Questions for discussion Suggested reading 11 Capital flows and financial crises Introduction ...

... Money supply, output, inflation and the exchange rate under managed flexibility The volatility of exchange rates Choice of exchange rate regime Case study 10.2 The currency board system Summary Key concepts Questions for discussion Suggested reading 11 Capital flows and financial crises Introduction ...

Contagion, Herding and Exchange-rate Instability

... Calvo and Mendoza20 argue that as the world becomes more globalised, optimal portfolio diversification results in a higher degree of contagion and financial volatility. The authors develop a model of an integrated financial market with incomplete information and identical mean-variance optimising inves ...

... Calvo and Mendoza20 argue that as the world becomes more globalised, optimal portfolio diversification results in a higher degree of contagion and financial volatility. The authors develop a model of an integrated financial market with incomplete information and identical mean-variance optimising inves ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... deposits, which amounted to about 140 percent of GDP on average in the 2000s, and have been increasing over time. Most of those deposits are time and saving deposits that bear an interest rate. The access of foreign investors to Chinese financial assets is severely limited. For equity, two types of ...

... deposits, which amounted to about 140 percent of GDP on average in the 2000s, and have been increasing over time. Most of those deposits are time and saving deposits that bear an interest rate. The access of foreign investors to Chinese financial assets is severely limited. For equity, two types of ...