Study Guide for Exam 1

... b. Suppose the Ohio government prohibits ticket scalping (selling tickets above their face value) and the face value of tickets is $50 (so it’s like a price ceiling set at $50). How many consumers will be dissatisfied as a result of this policy? c. Suppose for a big rival (Michigan) demand jumps to ...

... b. Suppose the Ohio government prohibits ticket scalping (selling tickets above their face value) and the face value of tickets is $50 (so it’s like a price ceiling set at $50). How many consumers will be dissatisfied as a result of this policy? c. Suppose for a big rival (Michigan) demand jumps to ...

monopolistic competition

... Firms in a monopolistically competitive industry have excess capacity: they produce less than the output at which average total cost is minimized. The higher price consumers pay because of excess capacity is offset to some extent by the value they receive from greater diversity. Hence, it is not cle ...

... Firms in a monopolistically competitive industry have excess capacity: they produce less than the output at which average total cost is minimized. The higher price consumers pay because of excess capacity is offset to some extent by the value they receive from greater diversity. Hence, it is not cle ...

here

... PriceSearcher. This chapter deals with markets in which individual firms exercise over the price it charges. Firms in this type of market face a downward-sloping demand for their product and must, therefore, search for the best (profit-maximizing) price. Ultimately, however, entry or exit leads to t ...

... PriceSearcher. This chapter deals with markets in which individual firms exercise over the price it charges. Firms in this type of market face a downward-sloping demand for their product and must, therefore, search for the best (profit-maximizing) price. Ultimately, however, entry or exit leads to t ...

Q - jackson.com.np

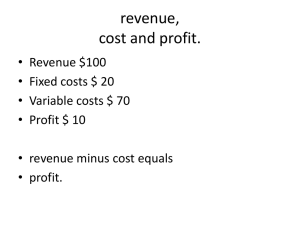

... Accounting profit = total revenue minus total explicit costs Implicit costs (Opportunity Costs) – do not require a cash outlay e.g. the cost of the owner’s time Economic profit = total revenue minus total costs (including explicit and implicit costs) ...

... Accounting profit = total revenue minus total explicit costs Implicit costs (Opportunity Costs) – do not require a cash outlay e.g. the cost of the owner’s time Economic profit = total revenue minus total costs (including explicit and implicit costs) ...

Monopolistic Competition

... • When a perfectly competitive firm raises its price, all of its current customers switch to other firms because the products are identical. They can get exactly the same thing from another firm at the market price. ...

... • When a perfectly competitive firm raises its price, all of its current customers switch to other firms because the products are identical. They can get exactly the same thing from another firm at the market price. ...

File

... Variable Costs –vary directly with the amount produced – raw materials Semi–Fixed Costs - may vary with output but not directly – some types of labour, energy costs ...

... Variable Costs –vary directly with the amount produced – raw materials Semi–Fixed Costs - may vary with output but not directly – some types of labour, energy costs ...

20070722MEnotes

... A. Law of diminishing marginal utility 1. Utility measures the want-satisfying power of a good or service. 2. Marginal utility is the additional or incremental satisfaction (utility) a consumer receives from acquiring one additional unit of a product. 3. Law of diminishing marginal utility: Consumin ...

... A. Law of diminishing marginal utility 1. Utility measures the want-satisfying power of a good or service. 2. Marginal utility is the additional or incremental satisfaction (utility) a consumer receives from acquiring one additional unit of a product. 3. Law of diminishing marginal utility: Consumin ...

Class 13 Benefits of Competition and Monopoly (latest revision

... long-run as well. Indeed, as we will see in a later chapter, much of the wealth of the super rich has come from owning companies that were able to earn economic profits for a long time. Second, in perfect competition, companies would produce the quantity being produced as efficiently as possible in ...

... long-run as well. Indeed, as we will see in a later chapter, much of the wealth of the super rich has come from owning companies that were able to earn economic profits for a long time. Second, in perfect competition, companies would produce the quantity being produced as efficiently as possible in ...

SO251T1S95

... iv, v, and vi. Next, given the budget constraint, 3x + y = 30, explicitly determine the optimal bundles for each utility function in parts i, ii, and iii. Note, you may find it expedient to do i & iv together, and so on. 2. i. Regarding cell phone usage, sketch the budget constraint under (a) a pay ...

... iv, v, and vi. Next, given the budget constraint, 3x + y = 30, explicitly determine the optimal bundles for each utility function in parts i, ii, and iii. Note, you may find it expedient to do i & iv together, and so on. 2. i. Regarding cell phone usage, sketch the budget constraint under (a) a pay ...

Basics of Cost Benefit Analysis

... Knowing the information above (i.e., the old and new prices of X and the amount of X the consumer demands at those prices -- both with and without his utility held constant) from an indifference curve allows us to determine two points on two different demand curves. If it is assumed that the curves ...

... Knowing the information above (i.e., the old and new prices of X and the amount of X the consumer demands at those prices -- both with and without his utility held constant) from an indifference curve allows us to determine two points on two different demand curves. If it is assumed that the curves ...

Heading 1 used for the Chapter heading

... 1. A perfectly competitive market is characterized by many sellers and buyers, firms that produce a standardized product, perfect information among buyers and sellers, and easy entry into and exit from a market. 2. Because a perfectly competitive firm supplies a negligible share of the market output ...

... 1. A perfectly competitive market is characterized by many sellers and buyers, firms that produce a standardized product, perfect information among buyers and sellers, and easy entry into and exit from a market. 2. Because a perfectly competitive firm supplies a negligible share of the market output ...

Chapter 3 - Memorial University

... Knowing the information above (i.e., the old and new prices of X and the amount of X the consumer demands at those prices -- both with and without his utility held constant) from an indifference curve allows us to determine two points on two different demand curves. If it is assumed that the curves ...

... Knowing the information above (i.e., the old and new prices of X and the amount of X the consumer demands at those prices -- both with and without his utility held constant) from an indifference curve allows us to determine two points on two different demand curves. If it is assumed that the curves ...

Defining Monopoly Five Sources of Monopoly

... -Because private firms are not able to charge prices less than average cost and remain in business in the long run, the single-price firm has not alternative but to charge more than marginal cost. - An option that would rid this is state ownership, which would cause a lack of innovation and efficien ...

... -Because private firms are not able to charge prices less than average cost and remain in business in the long run, the single-price firm has not alternative but to charge more than marginal cost. - An option that would rid this is state ownership, which would cause a lack of innovation and efficien ...

The Market for Illegal Goods

... increases in E) will reduce the total resources spent by drug traffickers to bring drugs to market. In contrast, and paradoxically, when demand for drugs is inelastic, total resources spent by drug traffickers will increase as the war increases in severity, and consumption falls. With inelastic dema ...

... increases in E) will reduce the total resources spent by drug traffickers to bring drugs to market. In contrast, and paradoxically, when demand for drugs is inelastic, total resources spent by drug traffickers will increase as the war increases in severity, and consumption falls. With inelastic dema ...

Externality

In economics, an externality is the cost or benefit that affects a party who did not choose to incur that cost or benefit.For example, manufacturing activities that cause air pollution impose health and clean-up costs on the whole society, whereas the neighbors of an individual who chooses to fire-proof his home may benefit from a reduced risk of a fire spreading to their own houses. If external costs exist, such as pollution, the producer may choose to produce more of the product than would be produced if the producer were required to pay all associated environmental costs. Because responsibility or consequence for self-directed action lies partly outside the self, an element of externalization is involved. If there are external benefits, such as in public safety, less of the good may be produced than would be the case if the producer were to receive payment for the external benefits to others. For the purpose of these statements, overall cost and benefit to society is defined as the sum of the imputed monetary value of benefits and costs to all parties involved. Thus, unregulated markets in goods or services with significant externalities generate prices that do not reflect the full social cost or benefit of their transactions; such markets are therefore inefficient.