TRUE/FALSE

... 9. A mutual savings bank is an example of a deposittype financial institution. 10. The main purpose of the Federal Reserve System is to supervise and regulate member banks in order to help service the public. 11. When preparing a bank reconciliation, an outstanding check must be added to the bank st ...

... 9. A mutual savings bank is an example of a deposittype financial institution. 10. The main purpose of the Federal Reserve System is to supervise and regulate member banks in order to help service the public. 11. When preparing a bank reconciliation, an outstanding check must be added to the bank st ...

Price/Book and Price/Sales Ratios

... book value is. Book value is what would be left over for shareholders if a company shut down its operations, paid off all of its creditors, collected from all of its debtors, and liquidated itself. It's a more tangible measure of value than earnings, because book value tells you what you might actua ...

... book value is. Book value is what would be left over for shareholders if a company shut down its operations, paid off all of its creditors, collected from all of its debtors, and liquidated itself. It's a more tangible measure of value than earnings, because book value tells you what you might actua ...

Name Last 4 (PSU ID) ______ First 2 letters of

... support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at ...

... support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at ...

File ch17 Chapter 17 Bond Yields Type: Multiple Choice 1. How is

... 3. The vast majority of corporate bonds pay floating rate interest on a quarterly basis. Ans: False ...

... 3. The vast majority of corporate bonds pay floating rate interest on a quarterly basis. Ans: False ...

D.A.V. PUBLIC SCHOOL, NEW PANVEL

... Q.14.Show shows rotational symmetry in alphabet H and Z, also write an Order and angle of rotation of each. SECTION C Q.15 . Evaluate: ...

... Q.14.Show shows rotational symmetry in alphabet H and Z, also write an Order and angle of rotation of each. SECTION C Q.15 . Evaluate: ...

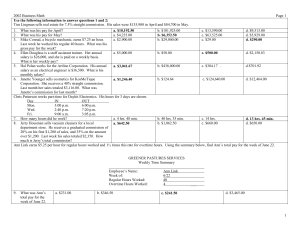

Chapter 6 "DO YOU UNDERSTAND" QUESTIONS Assume that the

... (b) Calculate the price volatility using the percentage change formula. Answer: 4 year, 7% annual coupon bond selling at par. Duration = 3624.32/1000 = 3.62. Per equation 5.8, (-3.62)(0.005/1.07)(100) = -1.69%. Using the bond price formula, the increase in interest rate (now it is 7.5%) would actual ...

... (b) Calculate the price volatility using the percentage change formula. Answer: 4 year, 7% annual coupon bond selling at par. Duration = 3624.32/1000 = 3.62. Per equation 5.8, (-3.62)(0.005/1.07)(100) = -1.69%. Using the bond price formula, the increase in interest rate (now it is 7.5%) would actual ...

Corporate Earnings Hit by Rising Pension Liabilities

... based on long-term interest rates. When that rate falls, the liability rises. At the same time, a drop in equity markets has reduced the value of corporate investments, increasing the gap between pension assets and liabilities, thus double-teaming the hit to corporate balance sheets. “Everything is ...

... based on long-term interest rates. When that rate falls, the liability rises. At the same time, a drop in equity markets has reduced the value of corporate investments, increasing the gap between pension assets and liabilities, thus double-teaming the hit to corporate balance sheets. “Everything is ...

Day IN OUT

... Savings and Loan Co. On December 9, interest is computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the ...

... Savings and Loan Co. On December 9, interest is computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the ...

C + M = S Marketing Calculation Template

... * Break Even unit volume = Total Fixed Cost / per-unit $mark-up … $500,000 / $8 = 62,500 units (“treat packages”) {NOTE: Total Fixed Cost equals Operating Expense + Invested Capital (if included)} -- If you look closely at the BE formula, it is literally a calculation for getting a “fixed cost monke ...

... * Break Even unit volume = Total Fixed Cost / per-unit $mark-up … $500,000 / $8 = 62,500 units (“treat packages”) {NOTE: Total Fixed Cost equals Operating Expense + Invested Capital (if included)} -- If you look closely at the BE formula, it is literally a calculation for getting a “fixed cost monke ...

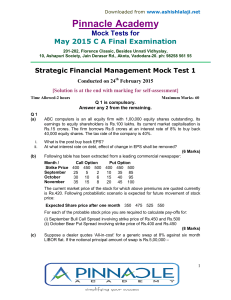

Pinnacle Academ y

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...