Bond Valuation - WordPress.com

... • If you purchased a bond that was callable and the company called it, you would not have the option of holding the bond until it matured. Therefore, the yield to maturity would not be earned. • For example, if MicroDrive’s 10% coupon bonds were callable and if interest rates fell from 10% to 5%, th ...

... • If you purchased a bond that was callable and the company called it, you would not have the option of holding the bond until it matured. Therefore, the yield to maturity would not be earned. • For example, if MicroDrive’s 10% coupon bonds were callable and if interest rates fell from 10% to 5%, th ...

Answers

... The reasons why investment funds are limited in the real world are either external to the company (hard capital rationing) or internal to the company (soft capital rationing). Several reasons have been suggested for hard capital rationing, such as that investors may feel that a company is too risky ...

... The reasons why investment funds are limited in the real world are either external to the company (hard capital rationing) or internal to the company (soft capital rationing). Several reasons have been suggested for hard capital rationing, such as that investors may feel that a company is too risky ...

what is management

... Do you believe that the United States could be facing a hyperinflation problem in the foreseeable future? Why or why not? ...

... Do you believe that the United States could be facing a hyperinflation problem in the foreseeable future? Why or why not? ...

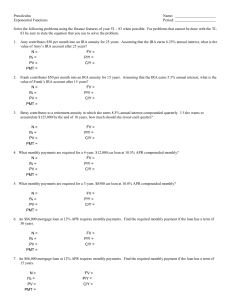

Solve the following problems using the finance

... What is the initial amount of the substance needed if there is to be 1 gram left after 1 minute? ...

... What is the initial amount of the substance needed if there is to be 1 gram left after 1 minute? ...

20 Dec 15 AGNC stock price appreciation in 2016

... The company, as well as investors and the markets have been expecting this increase since early summer and the company’s hedge fund was losing money due to the oversized hedge fund. With this first increase, the scare is over and the markets, and AGNC should take a better position to earn higher inc ...

... The company, as well as investors and the markets have been expecting this increase since early summer and the company’s hedge fund was losing money due to the oversized hedge fund. With this first increase, the scare is over and the markets, and AGNC should take a better position to earn higher inc ...

interest rates and your fixed income investments

... Likewise, the share price of a fixed income mutual fund may move up or down depending on movements in interest rates and their effect on the value of the bonds held in the fund’s portfolio. Since bond prices generally move in the opposite direction of interest rates, as the prices of bonds in the fu ...

... Likewise, the share price of a fixed income mutual fund may move up or down depending on movements in interest rates and their effect on the value of the bonds held in the fund’s portfolio. Since bond prices generally move in the opposite direction of interest rates, as the prices of bonds in the fu ...

Determinants of loan rates

... Suppose a house is bought for 400,000 dollars. The required down payment is 5% of the house price. The rest of the money is borrowed through a 30-year mortgage with monthly payments. What is the amount of down payment and what is the amount of borrowing? The annual percentage rate on the mortgage lo ...

... Suppose a house is bought for 400,000 dollars. The required down payment is 5% of the house price. The rest of the money is borrowed through a 30-year mortgage with monthly payments. What is the amount of down payment and what is the amount of borrowing? The annual percentage rate on the mortgage lo ...

8. Non-current liabilities- bonds

... coupons), is that their book values are always based on their original effective interest rate, i.e. the market yield in effect when they were first sold. Thus, changes in market interest rates subsequent to a bond=s issuance are ignored. Use of the historical interest rate is analogous to historica ...

... coupons), is that their book values are always based on their original effective interest rate, i.e. the market yield in effect when they were first sold. Thus, changes in market interest rates subsequent to a bond=s issuance are ignored. Use of the historical interest rate is analogous to historica ...

international financing and international financial markets

... Growth of Eurodollar Market caused by restrictive US government policies, especially Reserve requirements on deposits Special charges and taxes Required concessionary loan rates Interest rate ceilings Rules which restrict bank competition. ...

... Growth of Eurodollar Market caused by restrictive US government policies, especially Reserve requirements on deposits Special charges and taxes Required concessionary loan rates Interest rate ceilings Rules which restrict bank competition. ...

download

... for valuing such a structure is to adjust the value at each node to refect whether the issue would be put or called. At each node there are 2 decisions about the exercising of an option that must be made. First, given the valuation from the backward induction method at a node, the call rule is invok ...

... for valuing such a structure is to adjust the value at each node to refect whether the issue would be put or called. At each node there are 2 decisions about the exercising of an option that must be made. First, given the valuation from the backward induction method at a node, the call rule is invok ...