How the Market Works… and What It Means for Your Portfolio

... Data provided by CRSP Survivor-Bias-Free US Mutual Fund Database. Sample includes mutual funds existing as of 12/2003. Returns analyzed for the five-year period from 2004-2008. For funds with multiple share classes, only the share class with the most assets at the beginning of the sample (12/2003) i ...

... Data provided by CRSP Survivor-Bias-Free US Mutual Fund Database. Sample includes mutual funds existing as of 12/2003. Returns analyzed for the five-year period from 2004-2008. For funds with multiple share classes, only the share class with the most assets at the beginning of the sample (12/2003) i ...

The Full Report from Bond Talk

... lending money. The decision by Nersa to grant Eskom a tariff hike of 31.3% will make it even difficult for home owners and many are likely to lose their homes, said Venter. The Reserve Bank has missed an opportunity to help stimulate the economy by leaving the repo rate unchanged, was his view. Acco ...

... lending money. The decision by Nersa to grant Eskom a tariff hike of 31.3% will make it even difficult for home owners and many are likely to lose their homes, said Venter. The Reserve Bank has missed an opportunity to help stimulate the economy by leaving the repo rate unchanged, was his view. Acco ...

Market making in the UK Power Market Dear all I am writing

... have confined our response solely to the issue of how to inject greater liquidity into the UK power market. We, like OFGEM, recognise that the low level of liquidity in the UK power market has to be addressed as a matter of urgency. We would, however, urge OFGEM to consider the option of a market ma ...

... have confined our response solely to the issue of how to inject greater liquidity into the UK power market. We, like OFGEM, recognise that the low level of liquidity in the UK power market has to be addressed as a matter of urgency. We would, however, urge OFGEM to consider the option of a market ma ...

Ontario District Commercial Banking Presentation to: Ontario North

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

ppt version

... Commercial bank loans not traded in markets Change in value reported slowly by banks over ...

... Commercial bank loans not traded in markets Change in value reported slowly by banks over ...

Understanding Standard and Poor`s Criteria for

... Standard and Poor's(S&P) and Fitch. They account for 90% of the market. The focus will be on Standard & Poor's to explain their criteria on sovereign ratings. ...

... Standard and Poor's(S&P) and Fitch. They account for 90% of the market. The focus will be on Standard & Poor's to explain their criteria on sovereign ratings. ...

CURRICULUM VITAE

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

Microfinancing

... •It’s a service in which the poor people desire & are willing to pay for. •Loans are typically less than $125 made to the rural poor who normally do not qualify for traditionally banking credit. ...

... •It’s a service in which the poor people desire & are willing to pay for. •Loans are typically less than $125 made to the rural poor who normally do not qualify for traditionally banking credit. ...

The Reckoning NY Times

... derivatives, which insure debt holders against default. They are fashioned privately and beyond the ken of regulators — sometimes even beyond the understanding of executives peddling them. Originally intended to diminish risk and spread prosperity, these inventions instead magnified the impact of ba ...

... derivatives, which insure debt holders against default. They are fashioned privately and beyond the ken of regulators — sometimes even beyond the understanding of executives peddling them. Originally intended to diminish risk and spread prosperity, these inventions instead magnified the impact of ba ...

The Treatment of Nonperforming Loans

... Would it be more consistent to treat loan write-offs as price changes rather than other changes in volume? Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should ...

... Would it be more consistent to treat loan write-offs as price changes rather than other changes in volume? Should national accounts cease to record interest accrual on impaired loans? Should the manuals define an income concept including “expected” or actual losses on financial claims? If, so should ...

European banks: Are we back to 2008?

... inability to fund themselves as depositors became nervous (remember the queues outside Northern Rock?) and funding markets closed. Lacking capital and liquidity, banks became forced sellers of assets at the worst time. Bear in mind that the National Asset Management Agency (NAMA), the Irish body tha ...

... inability to fund themselves as depositors became nervous (remember the queues outside Northern Rock?) and funding markets closed. Lacking capital and liquidity, banks became forced sellers of assets at the worst time. Bear in mind that the National Asset Management Agency (NAMA), the Irish body tha ...

Select Consulting, Inc.

... exposure to passively managed bond index funds which tend to have higher exposure to U.S. Treasuries. The proceeds from these adjustments were placed into shorter duration bond funds, with managers focused on capital preservation, yet willing to look into alternative strategies to generate higher yi ...

... exposure to passively managed bond index funds which tend to have higher exposure to U.S. Treasuries. The proceeds from these adjustments were placed into shorter duration bond funds, with managers focused on capital preservation, yet willing to look into alternative strategies to generate higher yi ...

CHAPTER 1 : THE INVESTMENT ENVIRONMENT

... markets in which one could trade financial assets? Financial assets make it easy for commercial firms to raise the capital needed to finance investments in (buy) real assets. If General Electric could not issue stocks or bonds to the public, it would have a far more difficult time raising capital pa ...

... markets in which one could trade financial assets? Financial assets make it easy for commercial firms to raise the capital needed to finance investments in (buy) real assets. If General Electric could not issue stocks or bonds to the public, it would have a far more difficult time raising capital pa ...

HSBC Money Market Fund

... preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the funds is not a deposit of HSBC Bank USA, N.A. and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The funds’ sponsor has no lega ...

... preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the funds is not a deposit of HSBC Bank USA, N.A. and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The funds’ sponsor has no lega ...

PDF - BTR Capital Management

... extraordinarily low, and there is a growing backlog of delayed capital spending projects that will eventually have to be undertaken. Weakness in the dollar is a competitive positive for U.S. companies. And, at this stage of the game, U.S. deficit spending is a source of stability. If that’s not enou ...

... extraordinarily low, and there is a growing backlog of delayed capital spending projects that will eventually have to be undertaken. Weakness in the dollar is a competitive positive for U.S. companies. And, at this stage of the game, U.S. deficit spending is a source of stability. If that’s not enou ...

Understanding the Financial Crisis: Origin and Impact

... growth of East Asian economies. Because the U.S. economy has historically been viewed as a financial “safe haven” – a safe place for foreign citizens to bank their savings – foreign citizens have often moved their savings to the United States The financial crises and dislocations of the 1990s enhanc ...

... growth of East Asian economies. Because the U.S. economy has historically been viewed as a financial “safe haven” – a safe place for foreign citizens to bank their savings – foreign citizens have often moved their savings to the United States The financial crises and dislocations of the 1990s enhanc ...

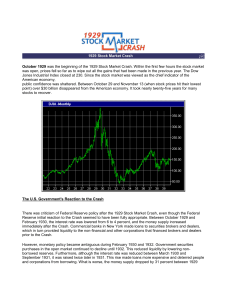

1929 Stock Market Crash ¡@ October 1929 was the beginning of the

... 5. Investors' High Expectation At this time there were no effective legal guidelines on the buying and selling of stock. Free from legal guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on cr ...

... 5. Investors' High Expectation At this time there were no effective legal guidelines on the buying and selling of stock. Free from legal guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on cr ...

Asian Credit Daily

... in negative goodwill recognized from the acquisition of shares in Gemdale Properties and Investment Corp. Ltd in February and December. Net profit was down 85.6% y/y to SGD178.7mn due to one off-gains in 2014 from the disposal of Mandarin Orchard and Mandarin Gallery (SGD1bn) and lower revaluation g ...

... in negative goodwill recognized from the acquisition of shares in Gemdale Properties and Investment Corp. Ltd in February and December. Net profit was down 85.6% y/y to SGD178.7mn due to one off-gains in 2014 from the disposal of Mandarin Orchard and Mandarin Gallery (SGD1bn) and lower revaluation g ...

Questions from Chapter 3 - Purdue Agricultural Economics

... c. document distributed to potential investors that is stamped “incomplete information.” d. SEC’s conditional approval of the prospectus. 15. The initial public offerings, or IPOs: a. do not require the SEC’s final approval of the prospectus. b. always result in immediate wealth for the executives o ...

... c. document distributed to potential investors that is stamped “incomplete information.” d. SEC’s conditional approval of the prospectus. 15. The initial public offerings, or IPOs: a. do not require the SEC’s final approval of the prospectus. b. always result in immediate wealth for the executives o ...