integrated supervisor

... Handbook) in relation to individual supervisors and SSM • Concerns implementation practice and colleges • Up to now weights of individual authorities were balanced • Newly one supervisor (ECB) will be much stronger and bigger than any other ...

... Handbook) in relation to individual supervisors and SSM • Concerns implementation practice and colleges • Up to now weights of individual authorities were balanced • Newly one supervisor (ECB) will be much stronger and bigger than any other ...

Financial Sector Evolution In the New Regulatory Environment

... an increasing share of flows. These firms, which can often be identified by their pass‐through tax treatment, include mutual funds, exchange traded funds (ETFs), real estate investment trusts (REITs), business development companies (BDCs), private equity firms, ...

... an increasing share of flows. These firms, which can often be identified by their pass‐through tax treatment, include mutual funds, exchange traded funds (ETFs), real estate investment trusts (REITs), business development companies (BDCs), private equity firms, ...

The Federal Reserve System (cont`d)

... – Describe how you will use the money and how you will repay it – Prepare for an interview – If rejected, ask the loan officer why ...

... – Describe how you will use the money and how you will repay it – Prepare for an interview – If rejected, ask the loan officer why ...

small and medium-sized enterprises` access to finance

... Equity financing is essential for innovative firms that have the potential for rapid growth and are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovat ...

... Equity financing is essential for innovative firms that have the potential for rapid growth and are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovat ...

The value of illiquidity

... Many pension funds (and endowments) have increased their allocation to alternatives given the low returns from fixed income investments and an ultra-loose global monetary policy. In 2014, the Government Pension Investment Fund (GPIF) of Japan announced the adoption of a new policy asset mix that all ...

... Many pension funds (and endowments) have increased their allocation to alternatives given the low returns from fixed income investments and an ultra-loose global monetary policy. In 2014, the Government Pension Investment Fund (GPIF) of Japan announced the adoption of a new policy asset mix that all ...

Bond insurers and the markets

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

FridayMarch28thMeeting - Sites at Lafayette

... • In Feb online bill payment grows to more than 50,000 ...

... • In Feb online bill payment grows to more than 50,000 ...

Housing and Financial Market Conditions Eric S. Rosengren

... have the potential to be impacted should there be unexpected international financial problems emanating from Europe Many, but not all, MMMFs have exposures to European banks by virtue of holding the banks’ short-term debt Conversely, European banks are reliant on MMMFs, which are a major source ...

... have the potential to be impacted should there be unexpected international financial problems emanating from Europe Many, but not all, MMMFs have exposures to European banks by virtue of holding the banks’ short-term debt Conversely, European banks are reliant on MMMFs, which are a major source ...

private credit for insurers

... cash-flow matching versus liabilities given their stable payment characteristics. ...

... cash-flow matching versus liabilities given their stable payment characteristics. ...

finance company

... • Residential and commercial mortgages have become a major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt ex ...

... • Residential and commercial mortgages have become a major component of finance companies’ assets • Often issued to riskier borrowers and charge a higher interest rate for that risk • Securitized mortgage assets: mortgages packaged and used as assets backing secondary market securities • Bad debt ex ...

Weekly Commentary 07-05-11 PAA

... What to Watch: Any significant change in the level of interest rates – either up or down – could move the stock market. With macro issues such as the end of quantitative easing, an uneven U.S. recovery, European debt woes, and the Washington budget battle still swirling around, interest rates could ...

... What to Watch: Any significant change in the level of interest rates – either up or down – could move the stock market. With macro issues such as the end of quantitative easing, an uneven U.S. recovery, European debt woes, and the Washington budget battle still swirling around, interest rates could ...

**** 1

... ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to KODIT such amount by the rate as prescribed ...

... ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to KODIT such amount by the rate as prescribed ...

Short-term financing

... Short-term loans – those with maturity periods of one year or less -generally offered by commercial banks for purposes which included financing of business activities. Two types of Short-term loans 1. Unsecured loan (clean loan) - does not require a collateral 2. Secured Loans – requires a collatera ...

... Short-term loans – those with maturity periods of one year or less -generally offered by commercial banks for purposes which included financing of business activities. Two types of Short-term loans 1. Unsecured loan (clean loan) - does not require a collateral 2. Secured Loans – requires a collatera ...

Microcredit in Burkina Faso

... Average loan amount between 7 and 500 USD 6-12 months • Medium or Long term individual credit Average loan amount between 400-4000 USD >12 months ...

... Average loan amount between 7 and 500 USD 6-12 months • Medium or Long term individual credit Average loan amount between 400-4000 USD >12 months ...

View PDF

... Directional managers use the long/short mandate to improve riskadjusted returns in a variety of capital markets. Long/short equity managers execute the strategy with stocks at net exposures north of 25% and sometimes higher than 100%. Dedicated short-biased equity managers will carry exposures less ...

... Directional managers use the long/short mandate to improve riskadjusted returns in a variety of capital markets. Long/short equity managers execute the strategy with stocks at net exposures north of 25% and sometimes higher than 100%. Dedicated short-biased equity managers will carry exposures less ...

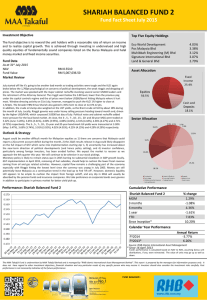

Mini Lecture 8

... and they are good examples of the passive approach to saving for retirement. This approach can be described as “buy and hold.” Conversely, managed funds are heavily managed by someone who gets paid a fee to continually analyze individual assets and adjust the composition of the fund with lots of buy ...

... and they are good examples of the passive approach to saving for retirement. This approach can be described as “buy and hold.” Conversely, managed funds are heavily managed by someone who gets paid a fee to continually analyze individual assets and adjust the composition of the fund with lots of buy ...

Document

... • Don’t lose sight this is the biggest credit event in history – no quick rebound • Remember that the investor base for most credit products decimated – rebuilding will take years – “Shadow banking” gone • Govt. intervention knows no boundaries • Generational change in consumer psychology – Boomers ...

... • Don’t lose sight this is the biggest credit event in history – no quick rebound • Remember that the investor base for most credit products decimated – rebuilding will take years – “Shadow banking” gone • Govt. intervention knows no boundaries • Generational change in consumer psychology – Boomers ...