hussman strategic dividend value fund

... issuers engaged in industries within a particular business sector is affected by valuation considerations and other investment characteristics of that sector. As a result, the Fund’s investments in various business sectors generally will change over time, and a significant allocation to any particul ...

... issuers engaged in industries within a particular business sector is affected by valuation considerations and other investment characteristics of that sector. As a result, the Fund’s investments in various business sectors generally will change over time, and a significant allocation to any particul ...

550.448 Financial Engineering and Structured Products

... The MBS assumes the same characteristics as the collateral that secure the principal and interest payments. Bonds that are based on collateral with fixed rates are called fixed rate MBS. Bonds that are based on collateral with floating rates are called adjustable rate mortgage backed securitie ...

... The MBS assumes the same characteristics as the collateral that secure the principal and interest payments. Bonds that are based on collateral with fixed rates are called fixed rate MBS. Bonds that are based on collateral with floating rates are called adjustable rate mortgage backed securitie ...

Institutional Investment Constraints and Stock Prices

... benchmark. We hypothesize that if money managers already overweight a stock, they may not buy more of the stock, even if they receive positive information about the stock. If money managers already underweight a stock, they may be reluctant to sell the stock, even if they receive negative informatio ...

... benchmark. We hypothesize that if money managers already overweight a stock, they may not buy more of the stock, even if they receive positive information about the stock. If money managers already underweight a stock, they may be reluctant to sell the stock, even if they receive negative informatio ...

Demystifying Responsible Investment Performance

... responsible investment appears to have borne the stigma of its largely exclusionary past. Therefore, it is important to recognise that the new philosophy of responsible investment is proactive. It systematically integrates ESG factors into the investment process to enhance financial performance; and ...

... responsible investment appears to have borne the stigma of its largely exclusionary past. Therefore, it is important to recognise that the new philosophy of responsible investment is proactive. It systematically integrates ESG factors into the investment process to enhance financial performance; and ...

prospectus - Cullen Funds

... Like all investments, investing in the High Dividend Fund involves risks, including the risk that you may lose part or all of the money you invest. General Stock Risks. The High Dividend Fund’s major risks are those of investing in the stock market, which can mean that the Fund may experience sudden ...

... Like all investments, investing in the High Dividend Fund involves risks, including the risk that you may lose part or all of the money you invest. General Stock Risks. The High Dividend Fund’s major risks are those of investing in the stock market, which can mean that the Fund may experience sudden ...

Speculative Retail Trading and Asset Prices

... This result is robust to variations in portfolio sorting and weighting methods. It is not limited to particular sample periods. It is stronger among small stocks. Our results do not change materially when we follow the Asparouhova, Bessembinder, and Kalcheva (2010) method to account for the impact o ...

... This result is robust to variations in portfolio sorting and weighting methods. It is not limited to particular sample periods. It is stronger among small stocks. Our results do not change materially when we follow the Asparouhova, Bessembinder, and Kalcheva (2010) method to account for the impact o ...

Measuring Swedish Investor Sentiment Stock Market Response to

... believed that these irrational investors could safely be ignored from financial theories such as asset pricing models. However, DeLong et. al. found that because these noise traders’ sentiment was difficult to predict and in part due to high enough transaction costs, the rational investors were ...

... believed that these irrational investors could safely be ignored from financial theories such as asset pricing models. However, DeLong et. al. found that because these noise traders’ sentiment was difficult to predict and in part due to high enough transaction costs, the rational investors were ...

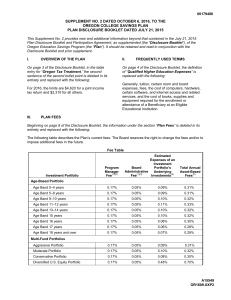

Disclosure Booklet - Oregon College Savings Plan

... (1) Although the Plan Manager Fee and the Board Administrative Fee are deducted from an Investment Portfolio, not from your Account, each Account in the Investment Portfolio indirectly bears its pro rata share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investme ...

... (1) Although the Plan Manager Fee and the Board Administrative Fee are deducted from an Investment Portfolio, not from your Account, each Account in the Investment Portfolio indirectly bears its pro rata share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investme ...

On the Design of Collateralized Debt Obligation

... SLP of investors is fully exhausted by default losses. In contrast to a true sale transaction, the originator does not receive the issuance proceeds in a synthetic transaction. These need to be invested in AAA-securities or other almost default-free assets. In all transactions, the originator decide ...

... SLP of investors is fully exhausted by default losses. In contrast to a true sale transaction, the originator does not receive the issuance proceeds in a synthetic transaction. These need to be invested in AAA-securities or other almost default-free assets. In all transactions, the originator decide ...

Mission-Related Investing at the F.B. Heron Foundation

... Heron’s total fund performance was in the second quartile of the Mellon All-Foundation Universe on both a trailing one-year and three-year basis, with 18 percent of assets in market-rate mission-related investments, 6 percent in belowmarket program-related investments (PRIs) and 3 percent in grants. ...

... Heron’s total fund performance was in the second quartile of the Mellon All-Foundation Universe on both a trailing one-year and three-year basis, with 18 percent of assets in market-rate mission-related investments, 6 percent in belowmarket program-related investments (PRIs) and 3 percent in grants. ...

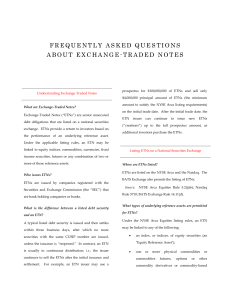

Frequently Asked Questions about Exchange

... ETNs are listed on the NYSE Arca and the Nasdaq. The BATS Exchange also permits the listing of ETNs. ...

... ETNs are listed on the NYSE Arca and the Nasdaq. The BATS Exchange also permits the listing of ETNs. ...

XPP-PDF Support Utility

... permits a fund to, as a starting point, classify the liquidity of its portfolio investments according to their asset class (rather than on an investment-by-investment basis). This approach recognizes that many investments within an asset class may be considered interchangeable from a liquidity persp ...

... permits a fund to, as a starting point, classify the liquidity of its portfolio investments according to their asset class (rather than on an investment-by-investment basis). This approach recognizes that many investments within an asset class may be considered interchangeable from a liquidity persp ...

Government Money Fund (formerly T. Rowe Price Prime Reserve

... institutional client accounts for which T. Rowe Price or its affiliate has discretionary investment authority. For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement acco ...

... institutional client accounts for which T. Rowe Price or its affiliate has discretionary investment authority. For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement acco ...

PROSPECTUS DATED 17 JANUARY 2014 BUREAU

... within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The Bonds will be in dematerialised bearer form in the denomination of Euro 100,000 each. The ...

... within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The Bonds will be in dematerialised bearer form in the denomination of Euro 100,000 each. The ...

The Size and Specialization of Direct Investment Portfolios

... empirical proxies and tests. Section 4 describes the data and empirical results. Section 5 concludes. Appendix A contains all proofs and some examples using specific distributional assumptions. are bid up. There is an increase in competition within the industry for a limited number of attractive inv ...

... empirical proxies and tests. Section 4 describes the data and empirical results. Section 5 concludes. Appendix A contains all proofs and some examples using specific distributional assumptions. are bid up. There is an increase in competition within the industry for a limited number of attractive inv ...

Word - corporate

... variations of such words or by similar expressions. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about KCG’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are in ...

... variations of such words or by similar expressions. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about KCG’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are in ...

form 10-k toyota motor credit corporation

... maximum amount that may be financed. Upon receipt of the credit application, our origination system automatically requests a credit bureau report from one of the major credit bureaus. We use a proprietary credit scoring system to evaluate an applicant’s risk profile. Factors used by the credit scori ...

... maximum amount that may be financed. Upon receipt of the credit application, our origination system automatically requests a credit bureau report from one of the major credit bureaus. We use a proprietary credit scoring system to evaluate an applicant’s risk profile. Factors used by the credit scori ...

DOC - Investor Relations

... The Company provides for income taxes at the end of each interim period based on the estimated effective tax rate for the full year in addition to discrete events which impact the interim period. The Company’s effective tax rate differs from the U.S. statutory rate principally due to the rate impact ...

... The Company provides for income taxes at the end of each interim period based on the estimated effective tax rate for the full year in addition to discrete events which impact the interim period. The Company’s effective tax rate differs from the U.S. statutory rate principally due to the rate impact ...

eurazeo sells approximately one third of its stake in elis

... Eurazeo, which has accompanied Elis since its initial investment in October 2007, today announced the sale via its subsidiary Legendre Holding 27 (LH27) of 17.1 million Elis shares, representing 15.0% of the company’s capital at a share price of €16.45, for a total consideration of €281 million, by ...

... Eurazeo, which has accompanied Elis since its initial investment in October 2007, today announced the sale via its subsidiary Legendre Holding 27 (LH27) of 17.1 million Elis shares, representing 15.0% of the company’s capital at a share price of €16.45, for a total consideration of €281 million, by ...

DebT anD (noT mucH) DeLeveraGInG

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

DebT anD (noT mucH) DeLeveraGInG

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

... After the global financial crisis hit in 2008, the McKinsey Global Institute began an intensive research effort to understand the magnitude and implications of the global credit bubble that sparked it. In our first report, released in January 2010, we examined growth in debt in the ten largest econo ...

Dynamic Factor Timing and the Predictability of Actively Managed

... Research interest in active mutual fund management has centered on whether active mutual fund managers are able to generate returns in excess of the systematic risks to which their portfolios are exposed and, if so, whether this ability is persistent. To answer these questions, the literature has fr ...

... Research interest in active mutual fund management has centered on whether active mutual fund managers are able to generate returns in excess of the systematic risks to which their portfolios are exposed and, if so, whether this ability is persistent. To answer these questions, the literature has fr ...

Medium Term Debt Strategy

... Following the upgrade of Tonga to a moderate risk level, the MoFNP continues to be cautious and to closely monitor GoT’s debt sustainability level in line with the recommended targets. During this initial MTDS period, practical options must be identified for GoT to implement in order to keep its fut ...

... Following the upgrade of Tonga to a moderate risk level, the MoFNP continues to be cautious and to closely monitor GoT’s debt sustainability level in line with the recommended targets. During this initial MTDS period, practical options must be identified for GoT to implement in order to keep its fut ...

essays on market frictions in the real estate market

... liquidity to the market at the most necessary time. Thus, segmentation and liquidity are closely related. However, a number of subtle differences should be accounted for: Segmentation prevents investors from sharing investment risks across different asset ...

... liquidity to the market at the most necessary time. Thus, segmentation and liquidity are closely related. However, a number of subtle differences should be accounted for: Segmentation prevents investors from sharing investment risks across different asset ...