Click here to read the full report.

... As we look out for the remainder of 2014 and start planning for 2015 we are still very bullish on equities as an asset class. Although U.S. equities are at their long-term average valuation and corporate profit margins are at all-time highs, there are a number of reasons to expect the U.S. economy a ...

... As we look out for the remainder of 2014 and start planning for 2015 we are still very bullish on equities as an asset class. Although U.S. equities are at their long-term average valuation and corporate profit margins are at all-time highs, there are a number of reasons to expect the U.S. economy a ...

The Thinking of Subprime Lending Crisis

... reason why this subprime lending crisis could spread to such an extremely big scale. Perhaps, even if there is no financial crisis existing in the real-estate, there must be occurred in another industry in the prerequisite that today’s financial systems have not been changed. 2. The characteristics ...

... reason why this subprime lending crisis could spread to such an extremely big scale. Perhaps, even if there is no financial crisis existing in the real-estate, there must be occurred in another industry in the prerequisite that today’s financial systems have not been changed. 2. The characteristics ...

Reporting Considerations

... Agency's decision to permit the "sweep" of Fannie Mae's and Freddie Mac's earnings to the Treasury. This opinion had left the agencies unable to pay dividends on their common and preferred stock. In past years, Fannie Mae and Freddie Mac preferred and common stock had been held (in many cases prior ...

... Agency's decision to permit the "sweep" of Fannie Mae's and Freddie Mac's earnings to the Treasury. This opinion had left the agencies unable to pay dividends on their common and preferred stock. In past years, Fannie Mae and Freddie Mac preferred and common stock had been held (in many cases prior ...

Developments in risks on account of housing loans

... In view of the increase in risk occasioned by recent developments in the Israeli housing market as specified above, banking corporations shall carefully examine the need to increase their loan loss provisions on account of housing loans. ...

... In view of the increase in risk occasioned by recent developments in the Israeli housing market as specified above, banking corporations shall carefully examine the need to increase their loan loss provisions on account of housing loans. ...

Housing Market: How has the Housing Market Affected the Economy

... market is affecting the economy. The slowing of the nation’s housing market is a dramatic turn for not only the industry, but the entire economy. In addition to the effects it has had on the lending and mortgage sector, the slowing housing market has also caused median home prices to decline for the ...

... market is affecting the economy. The slowing of the nation’s housing market is a dramatic turn for not only the industry, but the entire economy. In addition to the effects it has had on the lending and mortgage sector, the slowing housing market has also caused median home prices to decline for the ...

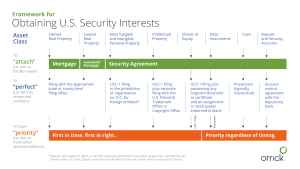

Obtaining US Security Interests

... Filing with the appropriate state or county level filing office ...

... Filing with the appropriate state or county level filing office ...

Document

... Source: SNL Financial. Data as of 1/8/09. The KBW Regional Banking Index (KRX) is an equal weighted index of 50 geographically diverse companies representing regional banking institutions listed on U.S. stock markets. Note: This graph is a continuation of the graph on the previous page. ...

... Source: SNL Financial. Data as of 1/8/09. The KBW Regional Banking Index (KRX) is an equal weighted index of 50 geographically diverse companies representing regional banking institutions listed on U.S. stock markets. Note: This graph is a continuation of the graph on the previous page. ...

Transmission mechanism of monetary policy

... Changes in interest rates affect saving and investment decisions of households and firms. For example, everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumption and investment are also affected by mo ...

... Changes in interest rates affect saving and investment decisions of households and firms. For example, everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumption and investment are also affected by mo ...

How Efforts to Avoid Past Mistakes Created New

... 8. See, e.g., Gross, “On the Wings of an Eagle”: (This year’s April taper talk by the Federal Reserve is perhaps a good example of this forward path of asset returns. Admittedly the reaction in the bond market was rather sudden and it precipitated not only the disillusioning of bond holders, but als ...

... 8. See, e.g., Gross, “On the Wings of an Eagle”: (This year’s April taper talk by the Federal Reserve is perhaps a good example of this forward path of asset returns. Admittedly the reaction in the bond market was rather sudden and it precipitated not only the disillusioning of bond holders, but als ...

Public Risk, Private Gain Public Risk, Private Gain By Steven

... Dimon may have made the deal of a lifetime, picking up a prime brokerage and half-dozen other profitable operations while getting the Federal Reserve to take on all the risks from its heavily discounted financial holdings until they can be sold at a more reasonable price. In that sense, it's more do ...

... Dimon may have made the deal of a lifetime, picking up a prime brokerage and half-dozen other profitable operations while getting the Federal Reserve to take on all the risks from its heavily discounted financial holdings until they can be sold at a more reasonable price. In that sense, it's more do ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.