The Current Financial Environment 1 The Current Financial

... imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every area and the prices are not affected by how much is borrowed. In conclusion, the government is attempting to make any adjustments necessary to stabilize all the issues with o ...

... imposed by the growth of their shareholders dividends in the stock market. Credit Unions present competitive pricing in every area and the prices are not affected by how much is borrowed. In conclusion, the government is attempting to make any adjustments necessary to stabilize all the issues with o ...

Financial Crisis and Fed Policy Actions

... by firms and individuals who rely on bank loans for funds • The direct and indirect effects cause a fall in aggregate expenditures that reduce real output, causing a recession ...

... by firms and individuals who rely on bank loans for funds • The direct and indirect effects cause a fall in aggregate expenditures that reduce real output, causing a recession ...

third quarter 2015 update 10/15/16

... while the US aggregate bond index is up +1.13%. The markets were hurt this quarter over the concern that the slowdown in China and the emerging markets, which together account for 40% of world Gross Domestic Product (GDP), would cause recessions in the developed economies of the United States, Europ ...

... while the US aggregate bond index is up +1.13%. The markets were hurt this quarter over the concern that the slowdown in China and the emerging markets, which together account for 40% of world Gross Domestic Product (GDP), would cause recessions in the developed economies of the United States, Europ ...

Trump and Markets - Silvercrest Asset Management

... The VIX volatility index rose +12% yesterday, its strongest daily spike since November 3rd, just before the election. It's important to realize, however, that its close on Friday, 10.58, was the lowest since July 2014, and notably lower than the latest peak (22.51) reached on Nov. 4, or many of the ...

... The VIX volatility index rose +12% yesterday, its strongest daily spike since November 3rd, just before the election. It's important to realize, however, that its close on Friday, 10.58, was the lowest since July 2014, and notably lower than the latest peak (22.51) reached on Nov. 4, or many of the ...

Towards Stronger EU Economic Governance

... But: House price increases are fuelling private indebtedness and can have an important impact on consumption, economic performance and financial stability -> more in-depth analysis is required ...

... But: House price increases are fuelling private indebtedness and can have an important impact on consumption, economic performance and financial stability -> more in-depth analysis is required ...

Mid-Winter Comments on Grain Marketing Using current prices and

... relative to their average prices in January each year, beginning with pre-harvest forward contracts through sales from storage the next summer. The figure also shows the median high and low corn price achieved relative to the January average. • The highest prices for each year were more often achiev ...

... relative to their average prices in January each year, beginning with pre-harvest forward contracts through sales from storage the next summer. The figure also shows the median high and low corn price achieved relative to the January average. • The highest prices for each year were more often achiev ...

2012 Economic Summit - St. George Real Estate Trends

... Yes, obtaining credit in many cases is more difficult than a few years ago. Yes, financial issues in Europe have raised anxiety levels throughout the world. Yes, U.S. political uncertainty has done the same. However, one constant is likely to remain in place throughout 2012 and perhaps well into 201 ...

... Yes, obtaining credit in many cases is more difficult than a few years ago. Yes, financial issues in Europe have raised anxiety levels throughout the world. Yes, U.S. political uncertainty has done the same. However, one constant is likely to remain in place throughout 2012 and perhaps well into 201 ...

2009

... Risk increases More difficult to finance investment projects, consumption and trade credits Investments, cars, durables, manufacturing products severly hit ...

... Risk increases More difficult to finance investment projects, consumption and trade credits Investments, cars, durables, manufacturing products severly hit ...

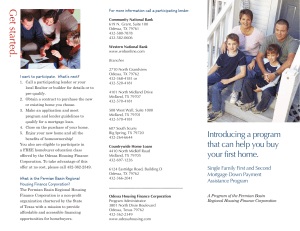

Permian Basin Brochure Lenders.indd

... Housing Finance Corporation? The Permian Basin Regional Housing Finance Corporation is a non-profit organization chartered by the State of Texas with a mission to provide affordable and accessible financing opportunities for homebuyers. ...

... Housing Finance Corporation? The Permian Basin Regional Housing Finance Corporation is a non-profit organization chartered by the State of Texas with a mission to provide affordable and accessible financing opportunities for homebuyers. ...

Are We in a Recession? What Will It Look Like If We Have One?

... Household employment survey a better guide at turning points—but lots of noise ...

... Household employment survey a better guide at turning points—but lots of noise ...

Financial Crises and Aggegate Economic Activity

... Banks will start to fail and fear can spread from one bank to another, causing even healthy banks to go under The multiple bank failures that result are known as a bank panic In a panic, depositors, fearing for the safety of their deposits and not knowing the quality of banks’ loan portfolios, wit ...

... Banks will start to fail and fear can spread from one bank to another, causing even healthy banks to go under The multiple bank failures that result are known as a bank panic In a panic, depositors, fearing for the safety of their deposits and not knowing the quality of banks’ loan portfolios, wit ...

Commercial Mortgage Backed Securities (CMBS)

... • Conduits to sell pools of commercial mortgages – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

... • Conduits to sell pools of commercial mortgages – Subsidiaries of commercial banks – MGIC Investment Corp. – Residential Funding Corporation ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.