SELL HIGH AND BUY LOW REMAINS THE BEST PLAN!! July 22

... subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other i ...

... subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other i ...

The Traditional Securitization Process Bank

... – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The borrower is not guaranteed the full face value of the loan. – Club deals: For small deals (usually $200 million or less), the loan is shared among banks, each of whi ...

... – Best Efforts deals: The size of the loan is determined by the commitments of banks that agree to participate in the syndication. The borrower is not guaranteed the full face value of the loan. – Club deals: For small deals (usually $200 million or less), the loan is shared among banks, each of whi ...

Financial crisis - World Bank Group

... • MENA benefits from own sources of finance, including SWFs and homegrown investors • Prospects for South-South investment • Strong growth potential in mobile & Internet • Investment in ICTs could offer a way out of the crisis, but needs to be prioritized. • Delays in licenses: Bahrain, Jordan & Leb ...

... • MENA benefits from own sources of finance, including SWFs and homegrown investors • Prospects for South-South investment • Strong growth potential in mobile & Internet • Investment in ICTs could offer a way out of the crisis, but needs to be prioritized. • Delays in licenses: Bahrain, Jordan & Leb ...

The 2007/2008 financial crisis came with a strong fall in stock prices

... early as the mid-1990s, but unsure about its persistence. In fact, research at the time pointed to both temporary factors as well as permanent structural change (through for example, new just-in-time inventory management) as reasons for the fall in output volatility. To analyse how this uncertainty, ...

... early as the mid-1990s, but unsure about its persistence. In fact, research at the time pointed to both temporary factors as well as permanent structural change (through for example, new just-in-time inventory management) as reasons for the fall in output volatility. To analyse how this uncertainty, ...

Licence to speculate

... There were just a handful of corporate defaults in the whole of EM (despite it representing 50.4% of global GDP) and several of them were due to a regulatory change in Mexico. None were due to anything the Fed did. Instead, as we went into 2014 it was the US economy that really failed to deliver. Th ...

... There were just a handful of corporate defaults in the whole of EM (despite it representing 50.4% of global GDP) and several of them were due to a regulatory change in Mexico. None were due to anything the Fed did. Instead, as we went into 2014 it was the US economy that really failed to deliver. Th ...

Weekly Review Quiz as of 2008-08-14

... b) dropped 85% and 80% respectively * c) dropped 25% and 20% respectively d) rose 40% and 45% respectively e) rose 10% and 15% respectively 2. To what were the stock prices of Fannie Mae and Freddie Mac reacting? a) the number of homeowners defaulting in August was the highest in 32 years * b) the T ...

... b) dropped 85% and 80% respectively * c) dropped 25% and 20% respectively d) rose 40% and 45% respectively e) rose 10% and 15% respectively 2. To what were the stock prices of Fannie Mae and Freddie Mac reacting? a) the number of homeowners defaulting in August was the highest in 32 years * b) the T ...

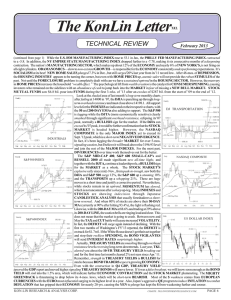

The KonLin Letter page 6.pmd

... Look at the shaded area of last month’s long-term monthly charts after failing at 14000 in ’07, the DJIA is punching up through longterm overhead resistance and must close above 14198.1. All support levels for the INDEXES are indicated on their respective charts, with DJ TRANSPORTATION the 50 and 20 ...

... Look at the shaded area of last month’s long-term monthly charts after failing at 14000 in ’07, the DJIA is punching up through longterm overhead resistance and must close above 14198.1. All support levels for the INDEXES are indicated on their respective charts, with DJ TRANSPORTATION the 50 and 20 ...

ThAT wAS Then. ThIS IS now. - McEnearney Associates, Inc.

... eligible buyers, keeping both demand and prices artificially high. And those rapidly rising prices fueled a market based largely on speculation. With back-to-back years of 20%+ home price appreciation, everyone wanted in on the act, with little concern about mortgage payments that would jump to proh ...

... eligible buyers, keeping both demand and prices artificially high. And those rapidly rising prices fueled a market based largely on speculation. With back-to-back years of 20%+ home price appreciation, everyone wanted in on the act, with little concern about mortgage payments that would jump to proh ...

BloombugCapitalWeeklyForecast8

... In order to avoid the fate of bankruptcy, GM must reach debt-for-stock agreement with creditors before June 1, but creditors are not happy with the GM bids. Some analysts said, GM bankruptcy will lead to increase in U.S. unemployment, and cause severe impact on economic. This week the U.S. Treasury ...

... In order to avoid the fate of bankruptcy, GM must reach debt-for-stock agreement with creditors before June 1, but creditors are not happy with the GM bids. Some analysts said, GM bankruptcy will lead to increase in U.S. unemployment, and cause severe impact on economic. This week the U.S. Treasury ...

The Crash of 2008: Cause and Aftermath

... set of regulations and mandates that forced various lending institutions to extend more loans to low- and moderate-income households. In order to meet these mandates, lending standards had to be reduced. By the early years of the 21st century, it was possible to borrow more (relative to your income) ...

... set of regulations and mandates that forced various lending institutions to extend more loans to low- and moderate-income households. In order to meet these mandates, lending standards had to be reduced. By the early years of the 21st century, it was possible to borrow more (relative to your income) ...

Residential mortgage lending for underserved communities: recent

... Despite persistently low interest rates, relatively modest growth in home prices, and a strengthening labor market, purchase mortgage volume remains low compared to the pre-crisis and pre-bubble years, and the homeownership rate continues to fall. Factors contributing to the homeownership decline in ...

... Despite persistently low interest rates, relatively modest growth in home prices, and a strengthening labor market, purchase mortgage volume remains low compared to the pre-crisis and pre-bubble years, and the homeownership rate continues to fall. Factors contributing to the homeownership decline in ...

President’s Message

... major banks will have a strong incentive to take the same type of risk, which significantly increases the overall risk in the financial system. The significant expansion of the monetary base (printing money) is surely creating misinvestments in the economy. The combination of easy money, low long-te ...

... major banks will have a strong incentive to take the same type of risk, which significantly increases the overall risk in the financial system. The significant expansion of the monetary base (printing money) is surely creating misinvestments in the economy. The combination of easy money, low long-te ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.