Answers - UCSB Economics

... to a greater expected future inflation rate and then to a greater nominal interest rate. This reduces the real balances people are willing to hold, and it leads to a fall in real seigniorage. With long run equilibrium, in which the nominal interest equals a constant real interest rate plus the monet ...

... to a greater expected future inflation rate and then to a greater nominal interest rate. This reduces the real balances people are willing to hold, and it leads to a fall in real seigniorage. With long run equilibrium, in which the nominal interest equals a constant real interest rate plus the monet ...

Fact Sheet:SPDR DoubleLine Short Duration Total

... Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end p ...

... Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end p ...

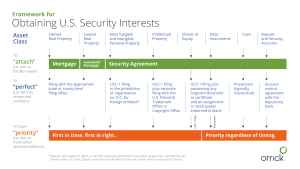

Obtaining US Security Interests

... *Special rules apply for rights in: aircraft, railroads, government securities, judgments, commercial tort claims, letters of credit, goods covered by certificates of title and certain other unique asset classes. ...

... *Special rules apply for rights in: aircraft, railroads, government securities, judgments, commercial tort claims, letters of credit, goods covered by certificates of title and certain other unique asset classes. ...

national securities

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

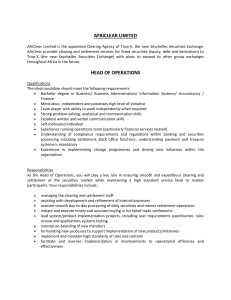

head of operations - Trop-X

... AfriClear Limited is the appointed Clearing Agency of Trop-X, the new Seychelles Securities Exchange. AfriClear provides clearing and settlement services for listed securities (equity, debt and derivatives) to Trop-X (the new Seychelles Securities Exchange) with plans to expand to other group exchan ...

... AfriClear Limited is the appointed Clearing Agency of Trop-X, the new Seychelles Securities Exchange. AfriClear provides clearing and settlement services for listed securities (equity, debt and derivatives) to Trop-X (the new Seychelles Securities Exchange) with plans to expand to other group exchan ...

Notes on chapter 9

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

ESTR.ASpA successfully places EUR 100 million senior notes BNP

... Mr. Alessandro Piazzi, Chief Executive Officer of E.s.tr.a. declared “The placement and listing of the notes on the Irish Stock Exchange is a first important step to finance, not only the investment plan of the Group over the next three years – estimated at €100 million, but also the funding needs a ...

... Mr. Alessandro Piazzi, Chief Executive Officer of E.s.tr.a. declared “The placement and listing of the notes on the Irish Stock Exchange is a first important step to finance, not only the investment plan of the Group over the next three years – estimated at €100 million, but also the funding needs a ...

Privatization and Politics - FGV

... Published ranking of a debtor’s or issuer’s credit quality, based on detailed financial analysis by an external credit assessment institution (rating agency), specifically related to an entity’s ability to meet its debt obligations. Ratings are used by lenders to decide on approval of credit applica ...

... Published ranking of a debtor’s or issuer’s credit quality, based on detailed financial analysis by an external credit assessment institution (rating agency), specifically related to an entity’s ability to meet its debt obligations. Ratings are used by lenders to decide on approval of credit applica ...

Personal Finance Unit Study Guide

... c. Give examples of the direct relationship between risk and return. d. Evaluate a variety of savings and investment options; include stocks, bonds, and mutual funds. SSEPF4 The student will evaluate the costs and benefits of using credit. a. List factors that affect credit worthiness. b. Compare in ...

... c. Give examples of the direct relationship between risk and return. d. Evaluate a variety of savings and investment options; include stocks, bonds, and mutual funds. SSEPF4 The student will evaluate the costs and benefits of using credit. a. List factors that affect credit worthiness. b. Compare in ...

Prepare your portfolio for rising interest rates

... Important Risks: Mutual funds are actively managed and their characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, ...

... Important Risks: Mutual funds are actively managed and their characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, ...

PreConf-Session B – Heaney

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

The Great Liquidity Squeeze of 2017: Cash dries up as loan

... over twice the rate of banking in general. Loans as a percentage of assets are at their highest level since 2009. What has been the result of these developments is that, in addition to improved earnings, the means for funding this demand is becoming a challenge. To be sure, these are issues that a c ...

... over twice the rate of banking in general. Loans as a percentage of assets are at their highest level since 2009. What has been the result of these developments is that, in addition to improved earnings, the means for funding this demand is becoming a challenge. To be sure, these are issues that a c ...

At US Bank, we`re passionate about helping customers and the

... - Underwriting nonprofit sector credit exposure - Managing assigned credit portfolio - Monitoring credit risk within that portfolio, to include • Timely preparation of annual reviews • Periodic monitoring of covenant compliance • Timely spreading and review of financial statements upon receipt • Ide ...

... - Underwriting nonprofit sector credit exposure - Managing assigned credit portfolio - Monitoring credit risk within that portfolio, to include • Timely preparation of annual reviews • Periodic monitoring of covenant compliance • Timely spreading and review of financial statements upon receipt • Ide ...

Thoughts on the Market - July 2007

... The real estate slump here and elsewhere is likely to worsen, given that most of the adjustable rate mortgages written in the last three years will be reset with higher interest rates, …. As a result, borrowers of an estimated $800 billion in loans will be forced in the next 12 months to 18 months t ...

... The real estate slump here and elsewhere is likely to worsen, given that most of the adjustable rate mortgages written in the last three years will be reset with higher interest rates, …. As a result, borrowers of an estimated $800 billion in loans will be forced in the next 12 months to 18 months t ...

FISSION URANIUM CORP. (the “Company”) CERTIFICATE TO

... the Company is relying upon Section 2.20 of NI 54-101 in making the Abridgment with respect to subsections 2.2(1) and 2.5(1) of NI 54-101. ...

... the Company is relying upon Section 2.20 of NI 54-101 in making the Abridgment with respect to subsections 2.2(1) and 2.5(1) of NI 54-101. ...

Financial Crisis In US

... Italy, Medici of Florence: first modern loan and deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civil War: entire US banking system under federal regulation ...

... Italy, Medici of Florence: first modern loan and deposit system to handle multiple currency, later improved by Dutch and British, imported to American colonies Growing pains through a period of minimal regulation, legislation during Civil War: entire US banking system under federal regulation ...

The Debt Ceiling and the Road Ahead

... other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you should keep an eye on your bond portfolio. One indicator of investors' assessment of th ...

... other, nongovernmental loans such as mortgages and consumer credit. Since many interest rates are based on Treasury rates, rates generally would likely be affected. And since bond prices fall when rates rise, you should keep an eye on your bond portfolio. One indicator of investors' assessment of th ...

Bonds Payable * A corporate debt

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...

... If market rate > stated rate, issue at a discount If market rate < stated rate, issue at a premium ...