Securities Firms and Investment Banks

... Position trading, pure arbitrage, risk arbitrage, program trading ...

... Position trading, pure arbitrage, risk arbitrage, program trading ...

Set 1 - NYU Stern

... Securitization of residential mortgage loans: •GNMA: Ginnie Mae, Government national Mortgage Assoc., split in 1968 from Fannie Mae, directly owned by government. •Sponsors mortgage-backed securities programs of Fis •Acts as guarantor to investors regarding the timely passthrough of principal and in ...

... Securitization of residential mortgage loans: •GNMA: Ginnie Mae, Government national Mortgage Assoc., split in 1968 from Fannie Mae, directly owned by government. •Sponsors mortgage-backed securities programs of Fis •Acts as guarantor to investors regarding the timely passthrough of principal and in ...

Dear Valued Investor, After the market close on Friday, Standard

... differs from AAA obligors “only to a small degree.” Therefore, U.S. debt is still rated very strong. In addition, the two other major U.S. rating agencies, Moody’s and Fitch, have maintained their highest ratings for U.S. federal debt. S&P kept the short-term rating of the United States at the top r ...

... differs from AAA obligors “only to a small degree.” Therefore, U.S. debt is still rated very strong. In addition, the two other major U.S. rating agencies, Moody’s and Fitch, have maintained their highest ratings for U.S. federal debt. S&P kept the short-term rating of the United States at the top r ...

Fedwire Securities Joint Custody Service

... The Fedwire® Securities Joint Custody Service is offered by the Federal Reserve Banks for financial institutions and is designed to assist state and local government entities in mitigating risk to deposits of public funds. The service facilitates the collateralization of deposits made by a governmen ...

... The Fedwire® Securities Joint Custody Service is offered by the Federal Reserve Banks for financial institutions and is designed to assist state and local government entities in mitigating risk to deposits of public funds. The service facilitates the collateralization of deposits made by a governmen ...

CREDIT PROFILE OF SPAREBANK 1 SR-BANK

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

... Stavanger, the regional capital of Rogaland and SR-Bank's headquarters, is the centre of the Norwegian oil industry. The petroleum sector is simplifying processes and reducing costs to increase profitability with lower oil prices. This released capacity, helped by low interest rates and a weak excha ...

Word - corporate

... Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to certain non-U.S. persons in accordance with Regulation S under the Securities Act. Alliance Data expects to use the net proceeds of the offering to repay a portion of the outstanding indebtedness under its revolvin ...

... Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to certain non-U.S. persons in accordance with Regulation S under the Securities Act. Alliance Data expects to use the net proceeds of the offering to repay a portion of the outstanding indebtedness under its revolvin ...

Chapter 15 PowerPoint Presentation

... Consider a U.S.-based company that owns a controlling interest in a French company. The reporting currency of the U.S. company is the dollar. The French company maintains its books in Euros. Before preparing consolidated statements, the U.S. company must translate the French company’s statements int ...

... Consider a U.S.-based company that owns a controlling interest in a French company. The reporting currency of the U.S. company is the dollar. The French company maintains its books in Euros. Before preparing consolidated statements, the U.S. company must translate the French company’s statements int ...

Structured Finance - NYU Stern School of Business

... Three conditions enable the separation of the assets and the originator The transfer must be a true sale, or its legal equivalent. If originator is only pledging the assets to secure a debt, this would be regarded as collaterized financing in which the originator would stay directly indebted to the ...

... Three conditions enable the separation of the assets and the originator The transfer must be a true sale, or its legal equivalent. If originator is only pledging the assets to secure a debt, this would be regarded as collaterized financing in which the originator would stay directly indebted to the ...

Asian Credit Daily

... This publication is solely for information purposes only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or s ...

... This publication is solely for information purposes only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our prior written consent. This publication should not be construed as an offer or solicitation for the subscription, purchase or s ...

designing the portfolio that meets your goals

... Helping you achieve long-term portfolio returns while minimizing risk to your assets is key to designing a recommended investment portfolio. This requires a strategy rooted in diversification by geography, sectors, and asset classes, and one that aligns with your profile. Asset allocation through an ...

... Helping you achieve long-term portfolio returns while minimizing risk to your assets is key to designing a recommended investment portfolio. This requires a strategy rooted in diversification by geography, sectors, and asset classes, and one that aligns with your profile. Asset allocation through an ...

Private Placements and Infrastructure Finance.qxp

... in-house specialist debt investors. The very private nature of the assets has ensured their reputation remains obscure. However, there are excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majo ...

... in-house specialist debt investors. The very private nature of the assets has ensured their reputation remains obscure. However, there are excellent opportunities for pension funds in these asset classes which are uncovered by delving further into the fixed income markets. It is likely that the majo ...

Financial Institutions

... place the order and charge a fee (commission) › Full-service brokerage firms advise customers on which securities to buy and help manage their investments › Discount brokers place orders for customers too but other services may be limited…fees are less ...

... place the order and charge a fee (commission) › Full-service brokerage firms advise customers on which securities to buy and help manage their investments › Discount brokers place orders for customers too but other services may be limited…fees are less ...

Ch10

... Absolute yield spread may stay the same even if interest rates are rising or falling. This could be misleading, since as a percentage of the benchmark rate, the spread is declining. This effect can only be captured by the relative yield spread or the yield ratio. As verification of this, suppose th ...

... Absolute yield spread may stay the same even if interest rates are rising or falling. This could be misleading, since as a percentage of the benchmark rate, the spread is declining. This effect can only be captured by the relative yield spread or the yield ratio. As verification of this, suppose th ...

Houston Paper - First International

... as it ignores the fact that banks need to work together through the interbank markets to fund business and also need a vibrant credit market to sell loans into. The credit markets have always provided the link between lenders and investors, through the issue of bonds or the creation of a range of fi ...

... as it ignores the fact that banks need to work together through the interbank markets to fund business and also need a vibrant credit market to sell loans into. The credit markets have always provided the link between lenders and investors, through the issue of bonds or the creation of a range of fi ...

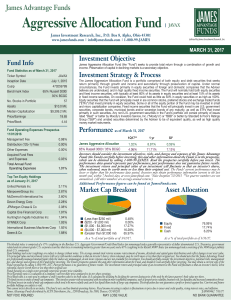

Aggressive Allocation Fund | JAVAX

... Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with market conditions so th ...

... Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with market conditions so th ...