THIS RELEASE (AND THE INFORMATION CONTAINED

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

Economics 330 Money and Banking Lecture 18

... Traded on Exchanges: Global competition Regulated by CFTC Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. D ...

... Traded on Exchanges: Global competition Regulated by CFTC Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. D ...

Banking - mshsLyndaHampton

... Transferring money from a personal account to businesses or individuals for payments is a basic function of day-to-day financial activity at a bank. Checking Accounts are the most commonly used payment service. Money that you place in a checking account is called a demand deposit because you can ...

... Transferring money from a personal account to businesses or individuals for payments is a basic function of day-to-day financial activity at a bank. Checking Accounts are the most commonly used payment service. Money that you place in a checking account is called a demand deposit because you can ...

Contact - Xcel Energy - Web site maintenance

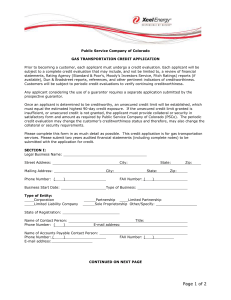

... Any applicant considering the use of a guarantor requires a separate application submitted by the prospective guarantor. Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured ...

... Any applicant considering the use of a guarantor requires a separate application submitted by the prospective guarantor. Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured ...

Green Securitisation - Climate Bonds Initiative

... access to capital and lowers cost of capital Access to capital: • Loans to small-scale projects can be aggregated and then securitised to reach an adequate deal size for bond markets • Capital raised through the sale of assetbacked securities by the loan originators can be used to create a fresh p ...

... access to capital and lowers cost of capital Access to capital: • Loans to small-scale projects can be aggregated and then securitised to reach an adequate deal size for bond markets • Capital raised through the sale of assetbacked securities by the loan originators can be used to create a fresh p ...

Reducing US Stocks to Bring Balanced Portfolios Closer to Long

... are rising. In our balanced Advantage portfolios, we hold a position in senior secured floating-rate bank loans. Like high yield bonds, these loans are rated below investment grade, but they have two differences. Firstly, they have a senior claim on assets in the event of a default. Secondly, the in ...

... are rising. In our balanced Advantage portfolios, we hold a position in senior secured floating-rate bank loans. Like high yield bonds, these loans are rated below investment grade, but they have two differences. Firstly, they have a senior claim on assets in the event of a default. Secondly, the in ...

Cash Conversion Cycle: Example

... This chapter examines a number of short-term planning strategies and provides a greater understanding of how firms develop short-term ...

... This chapter examines a number of short-term planning strategies and provides a greater understanding of how firms develop short-term ...

ADVANCED MEDICAL ISOTOPE Corp (Form: 8-K

... Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. On December 30, 2011, in exchange for $113,600, the Company issued to an investor who is a director and principal shareholder of the Company a convertible note in the princip ...

... Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. On December 30, 2011, in exchange for $113,600, the Company issued to an investor who is a director and principal shareholder of the Company a convertible note in the princip ...

View PDF

... This material is distributed for informational purposes only. The investment ideas and expressions of opinion may contain certain forward looking statements and should not be viewed as recommendations, personal investment advice or considered an offer to buy or sell specific securities. Data and sta ...

... This material is distributed for informational purposes only. The investment ideas and expressions of opinion may contain certain forward looking statements and should not be viewed as recommendations, personal investment advice or considered an offer to buy or sell specific securities. Data and sta ...

The Origins of the U.S. Financial and Economic Crises

... even threatened some U.S. financial institutions that had lent to these countries. By their very nature, financial markets are prone to periods of euphoria where lending and speculation expand rapidly (the “boom”), alternating with periods of deep decline (“bust”), when lending collapses. This is be ...

... even threatened some U.S. financial institutions that had lent to these countries. By their very nature, financial markets are prone to periods of euphoria where lending and speculation expand rapidly (the “boom”), alternating with periods of deep decline (“bust”), when lending collapses. This is be ...