Q1 Thoughts on the Market

... rates to rise and there is a concern that this will hinder home prices. However, investors tempered this fear with the knowledge that real estate benefits from an improving economy. Rates will generally only increase if economic figures are sound. · We favor exposure to Real Estate through income-pr ...

... rates to rise and there is a concern that this will hinder home prices. However, investors tempered this fear with the knowledge that real estate benefits from an improving economy. Rates will generally only increase if economic figures are sound. · We favor exposure to Real Estate through income-pr ...

ppt

... Beyond Binary Trees One of the most important applications for search trees is databases If the DB is small enough to fit into RAM, almost any scheme for balanced trees is okay ...

... Beyond Binary Trees One of the most important applications for search trees is databases If the DB is small enough to fit into RAM, almost any scheme for balanced trees is okay ...

chapter4

... – Credit ratings (by Standard and Poors, etc.) evaluate the default risk of public companies. ...

... – Credit ratings (by Standard and Poors, etc.) evaluate the default risk of public companies. ...

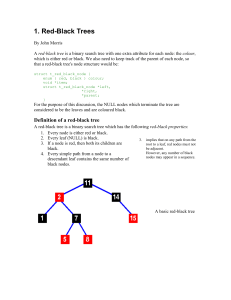

Red-Black tree

... memory. However, remember word size and memory. Note this works both ways: a single bit could mean the incursion of an extra cost. However, a node may well have excess space because it doesn't take up a full word size and so no cost to store the extra bit. ...

... memory. However, remember word size and memory. Note this works both ways: a single bit could mean the incursion of an extra cost. However, a node may well have excess space because it doesn't take up a full word size and so no cost to store the extra bit. ...

The Financialization of Commodity Futures Markets Christopher L. Gilbert

... Comovement summary • For food commodities, the biofuels appear to dominate financialization as the explanation for comovement. • This can also explain the earlier finding that, over the same period, volatility has risen for grains and vegetable oil prices, irrespective of whether or not traded on f ...

... Comovement summary • For food commodities, the biofuels appear to dominate financialization as the explanation for comovement. • This can also explain the earlier finding that, over the same period, volatility has risen for grains and vegetable oil prices, irrespective of whether or not traded on f ...

1st Half 2016 Newsletter - Harpswell Capital Advisors

... actually paid down debt levels but governments have more than made up the difference. Our concern with growing government debt is twofold: 1. Artificially low interest rates give a false signal to government officials regarding the level of debt they can support. Once interest rates return to equil ...

... actually paid down debt levels but governments have more than made up the difference. Our concern with growing government debt is twofold: 1. Artificially low interest rates give a false signal to government officials regarding the level of debt they can support. Once interest rates return to equil ...

Data structures & ANALYSIS OF ALGORITHMS

... insertions and deletions are made at both the front and rear ends of the queue. There are two variations of a deque, namely, input restricted deque and output restricted deque. • The input restricted deque allows insertion at one end (it can be either ...

... insertions and deletions are made at both the front and rear ends of the queue. There are two variations of a deque, namely, input restricted deque and output restricted deque. • The input restricted deque allows insertion at one end (it can be either ...

STOCK-TRAK

... toll-free number for web page support and customer service, and 24/7 access to their accounts. No other simulation can offer all of these features! Instructors customize STOCK-TRAK to fit their class by choosing the starting and ending date of their trading period, initial cash balance, and diversif ...

... toll-free number for web page support and customer service, and 24/7 access to their accounts. No other simulation can offer all of these features! Instructors customize STOCK-TRAK to fit their class by choosing the starting and ending date of their trading period, initial cash balance, and diversif ...

Lecture 1

... 3. Draw all possible connected graphs G on 4 vertices and 3 edges. 4. Draw all possible connected graphs G on 4 vertices and 4 edges. 5. Suppose G is not connected. What the maximum number of edges in G? 5. Prove or give a counterexample to the following claim: Any tree is bipartite. ...

... 3. Draw all possible connected graphs G on 4 vertices and 3 edges. 4. Draw all possible connected graphs G on 4 vertices and 4 edges. 5. Suppose G is not connected. What the maximum number of edges in G? 5. Prove or give a counterexample to the following claim: Any tree is bipartite. ...

questions in real estate finance

... PO Strip: Interest rate goes up, discount rate goes up, prepayment goes down and net effect is value goes down IO Strip: Interest rate goes up, discount rate goes up, prepayment goes down and net effect is value goes up ...

... PO Strip: Interest rate goes up, discount rate goes up, prepayment goes down and net effect is value goes down IO Strip: Interest rate goes up, discount rate goes up, prepayment goes down and net effect is value goes up ...

6.02 Understand economic indicators to recognize economic trends

... present value of future cash flows. The relationship is an inverse relationship. If interest rates (and discount rates) rise, prices fall. The reverse is also true. Since interest rates directly affect discount rates and present values of future cash flows represent underlying economic value, we hav ...

... present value of future cash flows. The relationship is an inverse relationship. If interest rates (and discount rates) rise, prices fall. The reverse is also true. Since interest rates directly affect discount rates and present values of future cash flows represent underlying economic value, we hav ...

Slide 1

... Alternative measures of financial and capital market development are used. Liquidity ratio (M3/GDP) is used instead of private credit ratio (private credit/GDP) to measure a degree of financial development. Value traded ratio (stock value traded/GDP) and market capitalization ratio (stock market cap ...

... Alternative measures of financial and capital market development are used. Liquidity ratio (M3/GDP) is used instead of private credit ratio (private credit/GDP) to measure a degree of financial development. Value traded ratio (stock value traded/GDP) and market capitalization ratio (stock market cap ...

Summary on Financial Markets The three main functions of the

... A long position in an asset represents current or future ownership. A long position benefits when the asset increases in value. A short position represents an agreement to sell or deliver an asset or results from borrowing an asset and selling it (i.e., a short sale) . A short position benefits when ...

... A long position in an asset represents current or future ownership. A long position benefits when the asset increases in value. A short position represents an agreement to sell or deliver an asset or results from borrowing an asset and selling it (i.e., a short sale) . A short position benefits when ...

Data Structures Lecture 1

... Nodes are stored in an array A Node v is stored at A[rank(v)] rank(root) = 1 Left in even: if node is the left child of parent(node), rank(node) = 2 rank(parent(node)) Right in odd: if node is the right child of parent(node), rank(node) = 2 rank(parent(node)) + 1 ...

... Nodes are stored in an array A Node v is stored at A[rank(v)] rank(root) = 1 Left in even: if node is the left child of parent(node), rank(node) = 2 rank(parent(node)) Right in odd: if node is the right child of parent(node), rank(node) = 2 rank(parent(node)) + 1 ...

tree

... There is exactly one path between the root and each of the other nodes in the tree Each node except the root has exactly one node above it in the tree, called its parent, and we extend the family analogy talking of children, siblings, or grandparents Nodes with no children are leaves or terminal nod ...

... There is exactly one path between the root and each of the other nodes in the tree Each node except the root has exactly one node above it in the tree, called its parent, and we extend the family analogy talking of children, siblings, or grandparents Nodes with no children are leaves or terminal nod ...

Dictionary

... i) replace the deleted element with its predecessor — note that the predecessor will always have an empty right child • One left; then far right ...

... i) replace the deleted element with its predecessor — note that the predecessor will always have an empty right child • One left; then far right ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.