CS790 – Introduction to Bioinformatics

... Binary search tree performance suffers when the tree is unbalanced The AVL tree is a BST with the following additional property: For every node, the heights of its left and right subtrees differ by at most 1. • The depth of an n node tree will be, at most, O(log n), so search and insert are O(lo ...

... Binary search tree performance suffers when the tree is unbalanced The AVL tree is a BST with the following additional property: For every node, the heights of its left and right subtrees differ by at most 1. • The depth of an n node tree will be, at most, O(log n), so search and insert are O(lo ...

I Semester I, 2007-08 Submitted By :Y6279 and Y6154

... 4. It should be noted that the maximum height of the tree in case of red black tree is 2(log(n+1)) , whereas in binary search tree the height is larger than the height of the rb tree(it can even be n in the worst case) . SWo bst should take more time to search than rb tree. Although it can be proved ...

... 4. It should be noted that the maximum height of the tree in case of red black tree is 2(log(n+1)) , whereas in binary search tree the height is larger than the height of the rb tree(it can even be n in the worst case) . SWo bst should take more time to search than rb tree. Although it can be proved ...

AIRLINE VALUATION USING DISCOUNTED CASH FLOW METHOD

... new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which is widely used for business valuation in Europe. The paper finds that DCF is a powerful tool t ...

... new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which is widely used for business valuation in Europe. The paper finds that DCF is a powerful tool t ...

Discussing Trees

... • We would find that we would want to insert 55 in the node containing 50,56,57, 58. – But, that would cause this node to contain 5 records. Since a node can contain only 4 records, you must split this node into two...the new left node gets the two smaller values and the new right node gets the two ...

... • We would find that we would want to insert 55 in the node containing 50,56,57, 58. – But, that would cause this node to contain 5 records. Since a node can contain only 4 records, you must split this node into two...the new left node gets the two smaller values and the new right node gets the two ...

CS163_Topic10

... • We would find that we would want to insert 55 in the node containing 50,56,57, 58. – But, that would cause this node to contain 5 records. Since a node can contain only 4 records, you must split this node into two...the new left node gets the two smaller values and the new right node gets the two ...

... • We would find that we would want to insert 55 in the node containing 50,56,57, 58. – But, that would cause this node to contain 5 records. Since a node can contain only 4 records, you must split this node into two...the new left node gets the two smaller values and the new right node gets the two ...

Trees

... • Nodes at a given level are children of nodes of previous level • Node with children is the parent node of those children • Nodes with same parent are siblings • Node with no children is a leaf node • The only node with no parent is the root node – All others have one parent each ...

... • Nodes at a given level are children of nodes of previous level • Node with children is the parent node of those children • Nodes with same parent are siblings • Node with no children is a leaf node • The only node with no parent is the root node – All others have one parent each ...

Exercise No

... a. In an AVL tree just the leaves may be only-children, and therefore for every only-child in T, there exists a unique parent node that is not an only-child. The total number of onlychildren in T is at most n/2, which means that LR(T)≤ (n/2)/n = 1/2. ...

... a. In an AVL tree just the leaves may be only-children, and therefore for every only-child in T, there exists a unique parent node that is not an only-child. The total number of onlychildren in T is at most n/2, which means that LR(T)≤ (n/2)/n = 1/2. ...

b3NtYW4=.MjAxMC0wMy0yNF8wODowMzoxOA==3

... Continuous Variable Model • A stock price is currently at $40 • At the end of 1 year it is considered that it will have a probability distribution of f(40,10) where f(m,s) is a normal distribution with mean m and standard deviation s. Options, Futures, and Other Derivatives, 5th edition © 2002 by Jo ...

... Continuous Variable Model • A stock price is currently at $40 • At the end of 1 year it is considered that it will have a probability distribution of f(40,10) where f(m,s) is a normal distribution with mean m and standard deviation s. Options, Futures, and Other Derivatives, 5th edition © 2002 by Jo ...

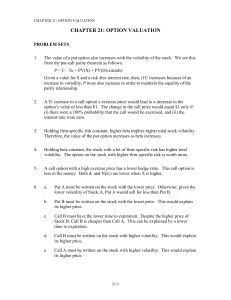

Chapter 10

... • Delta (D) is the rate of change of the option price with respect to the underlying security • Gamma (G) is the rate of change of delta (D) with respect to the price of the underlying asset • Theta (Q) of a derivative (or portfolio of derivatives) is the rate of change of the value with respect to ...

... • Delta (D) is the rate of change of the option price with respect to the underlying security • Gamma (G) is the rate of change of delta (D) with respect to the price of the underlying asset • Theta (Q) of a derivative (or portfolio of derivatives) is the rate of change of the value with respect to ...

Binary Search Trees

... Randomly builts BSTs tend to be balanced ⇒ given set S randomly permute elements, then insert in that order. (CLRS 12.4) • In general, all elements in S are not available at start Solution: assign a random number called the “priority” for each key (assume keys are distinct). In addition to satisfyin ...

... Randomly builts BSTs tend to be balanced ⇒ given set S randomly permute elements, then insert in that order. (CLRS 12.4) • In general, all elements in S are not available at start Solution: assign a random number called the “priority” for each key (assume keys are distinct). In addition to satisfyin ...

Will an inverted yield curve predict the next recession … again

... balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and global economic conditions) determine how longterm rates respond. In fact, market participants often ...

... balance, as these rate adjustments tend to have the desired effect on the economy in the near term, but ultimately, a number of market factors (including inflation expectation, employment growth and global economic conditions) determine how longterm rates respond. In fact, market participants often ...

Final Solutions

... (c) W (at most one trie node for each bit in the input). Alternate solution 1: use a TST instead of a binary trie. Since the radix size is 2, the running time will still be linear: you at most double the length of a search path for a codeword. Alternate solution 2: sort all of the codewords (MSD rad ...

... (c) W (at most one trie node for each bit in the input). Alternate solution 1: use a TST instead of a binary trie. Since the radix size is 2, the running time will still be linear: you at most double the length of a search path for a codeword. Alternate solution 2: sort all of the codewords (MSD rad ...

Bond Pricing on a BAII Plus

... N = number of payment dates = 15 I/Y = required return PMT = C = 112.50 FV = M = 5,000 CPT PV = B0 Required return (r) ...

... N = number of payment dates = 15 I/Y = required return PMT = C = 112.50 FV = M = 5,000 CPT PV = B0 Required return (r) ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.