File - computergixz

... Another solution, called deletion by copying, was proposed by Thomas Hibbard and Donald Knuth. If the node has two children, the problem can be reduced to one of two simple cases: The node is a leaf or the node has only one nonempty child. This can be done by replacing the key being deleted with its ...

... Another solution, called deletion by copying, was proposed by Thomas Hibbard and Donald Knuth. If the node has two children, the problem can be reduced to one of two simple cases: The node is a leaf or the node has only one nonempty child. This can be done by replacing the key being deleted with its ...

Bond Trading Strategies and Bond Swaps

... In some cases, you may be able to increase the return on short-term investments by systematically taking advantage of the yield spread between short- and long-term maturities. The yield curve compares the yields of similar securities with various maturities. Typically, that line slopes upward as mat ...

... In some cases, you may be able to increase the return on short-term investments by systematically taking advantage of the yield spread between short- and long-term maturities. The yield curve compares the yields of similar securities with various maturities. Typically, that line slopes upward as mat ...

BsBDH1edchap006Alt

... is the rate of return implied by the current bond price YTM can also be thought of as the market interest rate If you have a financial calculator, enter N, PV, PMT and FV, remembering the sign convention (PMT and FV need to have the same sign, PV the opposite sign) ...

... is the rate of return implied by the current bond price YTM can also be thought of as the market interest rate If you have a financial calculator, enter N, PV, PMT and FV, remembering the sign convention (PMT and FV need to have the same sign, PV the opposite sign) ...

the great risk/return inversion - who loses out?

... overweight positions because they have gained a contribution to their target return and have encountered no tracking error concerns. The initial price rise to the new valuation level is thus amplified, making these stocks both more expensive and more volatile. There is an opposing force upon stocks ...

... overweight positions because they have gained a contribution to their target return and have encountered no tracking error concerns. The initial price rise to the new valuation level is thus amplified, making these stocks both more expensive and more volatile. There is an opposing force upon stocks ...

Valuing the Cooperative Firm Phil Kenkel Bill Fitzwater Cooperative

... The stock in a cooperative firm is not publically traded but is instead redeemed by the cooperative at book value at some future point in time. This structure eliminates an observable stock price than can be used to infer the value of the firm. Firm value is not generally an important issue for coop ...

... The stock in a cooperative firm is not publically traded but is instead redeemed by the cooperative at book value at some future point in time. This structure eliminates an observable stock price than can be used to infer the value of the firm. Firm value is not generally an important issue for coop ...

Lecture 7 a

... If the company did not plowback some earnings, the stock price would remain at $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

... If the company did not plowback some earnings, the stock price would remain at $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

DataStructuresExamSupp12 - School of Computer Science

... Understand how to build binary trees, heaps, graphs together with their internal representations and relevant algorithms. Appreciate differences between basic complexity classes of algorithms (constant, linear, quadratic and logarithmic). ...

... Understand how to build binary trees, heaps, graphs together with their internal representations and relevant algorithms. Appreciate differences between basic complexity classes of algorithms (constant, linear, quadratic and logarithmic). ...

CS2007Ch14

... An internal node with 3 keys has 4 pointers. The 3 keys are the smallest values in the last 3 nodes pointed to by the 4 pointers. The first pointer points to nodes with values less than the first ...

... An internal node with 3 keys has 4 pointers. The 3 keys are the smallest values in the last 3 nodes pointed to by the 4 pointers. The first pointer points to nodes with values less than the first ...

CSE 326: Data Structures Lecture #7 Branching Out

... – very different orderings on elements – pqueues require comparisons on the elements – stacks and queues are highly efficient (pqueues slightly less so) – theoretical computational power (pqueues and queues beat stacks ...

... – very different orderings on elements – pqueues require comparisons on the elements – stacks and queues are highly efficient (pqueues slightly less so) – theoretical computational power (pqueues and queues beat stacks ...

II.A.bonds.rates

... Do banks issue bonds ? Why ? We won’t use bond pricing in this class but we need to have intuition for how financial instruments’ values change when interest rates change ...

... Do banks issue bonds ? Why ? We won’t use bond pricing in this class but we need to have intuition for how financial instruments’ values change when interest rates change ...

Threadneedle UK Select Fund

... acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed ...

... acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed ...

Chapter 5-2 - Computer Science

... A full binary tree (as seen in the middle figure below) occurs when all internal nodes have two children and all leaves are at the same depth. A complete binary tree (as seen in the right figure below) is an almost-full binary tree; the bottom level of the tree is filling from left to right but may ...

... A full binary tree (as seen in the middle figure below) occurs when all internal nodes have two children and all leaves are at the same depth. A complete binary tree (as seen in the right figure below) is an almost-full binary tree; the bottom level of the tree is filling from left to right but may ...

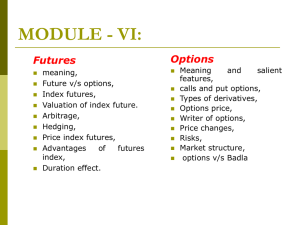

Derivatives - WordPress.com

... a contract which derives its value from the prices, or index of prices, of underlying securities; ...

... a contract which derives its value from the prices, or index of prices, of underlying securities; ...

Asset Allocation Views

... demand to appear in the data before we consider changing our stance. We have been awaiting an opportunity to upgrade emerging market equities since 2011, and for the time being that wait will continue as the strength of the US dollar will continue to weigh on the region. There are also country speci ...

... demand to appear in the data before we consider changing our stance. We have been awaiting an opportunity to upgrade emerging market equities since 2011, and for the time being that wait will continue as the strength of the US dollar will continue to weigh on the region. There are also country speci ...

Media - Profile Financial Services

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

1 Persistent Data Structures

... • requires O(1) space per data change (unavoidable if keep old date) • to lookup data field, need to search based on time. • store values in binary tree • checking/changing a data item takes O(log m) time after m updates • multiplicative slowdown of O(log m) in structure access. Path copying: • much ...

... • requires O(1) space per data change (unavoidable if keep old date) • to lookup data field, need to search based on time. • store values in binary tree • checking/changing a data item takes O(log m) time after m updates • multiplicative slowdown of O(log m) in structure access. Path copying: • much ...

Document

... The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in the debt market, the level of bo ...

... The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in the debt market, the level of bo ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.