2013 - Central Bank of Sri Lanka

... economic activity. In spite of slower loan growth, the banking and finance company sectors maintained their soundness at healthy levels. The insurance sector also maintained its solvency and liquidity at healthy levels during the year. Financial markets have remained liquid. The money market had exc ...

... economic activity. In spite of slower loan growth, the banking and finance company sectors maintained their soundness at healthy levels. The insurance sector also maintained its solvency and liquidity at healthy levels during the year. Financial markets have remained liquid. The money market had exc ...

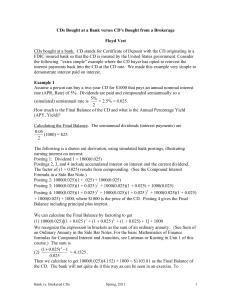

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... APY. Write down the 1-, 2-, and 5-year rates. Write down the National Average rates and compare with the top rates. Do some math to compare the differences on a $100,000 CD from age 30 to 70. • For CDs bought from a brokerage, go to www.vanguard.com. Click on Go to Personal Investors Site. Under Res ...

... APY. Write down the 1-, 2-, and 5-year rates. Write down the National Average rates and compare with the top rates. Do some math to compare the differences on a $100,000 CD from age 30 to 70. • For CDs bought from a brokerage, go to www.vanguard.com. Click on Go to Personal Investors Site. Under Res ...

University Maintenance and Repair fund codes generally begin with

... California State University, San Bernardino (University) funds come from a variety of sources and are accounted for separately. Among the major sources are: state funds, student fees, trust and selfsupporting funds (Continuing Education, Parking Services, Student Housing, Student Health Center etc.) ...

... California State University, San Bernardino (University) funds come from a variety of sources and are accounted for separately. Among the major sources are: state funds, student fees, trust and selfsupporting funds (Continuing Education, Parking Services, Student Housing, Student Health Center etc.) ...

The Central Bank and Interest Rate Risk

... They do not reflect current values as determined by market values. Effective financial decisionmaking requires up-to-date information that incorporates current expectations about future events. Market values provide the best estimate of the present condition of an FI and serve as an effective signal ...

... They do not reflect current values as determined by market values. Effective financial decisionmaking requires up-to-date information that incorporates current expectations about future events. Market values provide the best estimate of the present condition of an FI and serve as an effective signal ...

NBER WORKING PAPER SERIES MACROECONOMICS WITH FINANCIAL FRICTIONS: A SURVEY Markus K. Brunnermeier

... environments the issuance of additional government bonds can even lead to a “crowdingin effect” and be welfare enhancing. As (idiosyncratic) uncertainty increases, the welfare improving effect of higher government debt also increases. Note that unlike the standard (New-) Keynesian argument this reas ...

... environments the issuance of additional government bonds can even lead to a “crowdingin effect” and be welfare enhancing. As (idiosyncratic) uncertainty increases, the welfare improving effect of higher government debt also increases. Note that unlike the standard (New-) Keynesian argument this reas ...

The Effect of Government Policy on China`s Stock Market

... books. Smith believes people’s rational egoism drives them to maximize their self-interests and in the meantime also benefits society. His ethical theory however is not equal to selfishness. He argued that the bank notes would come to have the same value as gold and silver money when people have suc ...

... books. Smith believes people’s rational egoism drives them to maximize their self-interests and in the meantime also benefits society. His ethical theory however is not equal to selfishness. He argued that the bank notes would come to have the same value as gold and silver money when people have suc ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... banking activities and relatively few legal impediments to the mixing of banking and commerce may therefore produce less efficient and more fragile financial systems. Those who favor substantial freedom with respect to the activities of commercial banks argue that universal banking creates more divers ...

... banking activities and relatively few legal impediments to the mixing of banking and commerce may therefore produce less efficient and more fragile financial systems. Those who favor substantial freedom with respect to the activities of commercial banks argue that universal banking creates more divers ...

title - ARK Financial Services

... Passive asset class funds retain the benefits of indexing. They are relatively low cost, low turnover and tax efficient. However, they improve on the index model through additional strategies. Let’s look at some of the ways a passive asset class fund can improve returns. Creating Buy-and-Hold Ranges ...

... Passive asset class funds retain the benefits of indexing. They are relatively low cost, low turnover and tax efficient. However, they improve on the index model through additional strategies. Let’s look at some of the ways a passive asset class fund can improve returns. Creating Buy-and-Hold Ranges ...

stability report

... trends and domestic developments, and reviews financial soundness indicators of banks and nonbanks financial institution with a view to promote stability of the Saudi financial market. SAMA defines financial stability as a state in which there are no, and there is confidence that there will be no, s ...

... trends and domestic developments, and reviews financial soundness indicators of banks and nonbanks financial institution with a view to promote stability of the Saudi financial market. SAMA defines financial stability as a state in which there are no, and there is confidence that there will be no, s ...

The Effect of Market Power on Stability and Performance of Islamic

... new studies find risk-incentive mechanisms that show the opposite direction, meaning banks take on more risk when become more concentrated. Uhde and Heimeshoff (2009) have classified the existing arguments regarding these two views. According to this classification, proponents of the “concentrations ...

... new studies find risk-incentive mechanisms that show the opposite direction, meaning banks take on more risk when become more concentrated. Uhde and Heimeshoff (2009) have classified the existing arguments regarding these two views. According to this classification, proponents of the “concentrations ...

Stable Value Fund

... Income Risk: The possibility that a fund’s income will decline as a result of falling interest rates. Investments are generally made for terms of at least two to five years, on average, producing a rate of fund income that will be higher than that earned on shorter-maturity money market funds. But b ...

... Income Risk: The possibility that a fund’s income will decline as a result of falling interest rates. Investments are generally made for terms of at least two to five years, on average, producing a rate of fund income that will be higher than that earned on shorter-maturity money market funds. But b ...

Efficiency of Financial Intermediation: An

... However, it is proxied by different indicators such as interest rate margins and banking spreads, indicating a gap between the representative lending and deposit rates of the banking sector. The most widely used indicators of COFI are: (1) the net interest margin (NIM) – the gap between interest ear ...

... However, it is proxied by different indicators such as interest rate margins and banking spreads, indicating a gap between the representative lending and deposit rates of the banking sector. The most widely used indicators of COFI are: (1) the net interest margin (NIM) – the gap between interest ear ...

top 2016 developments in real estate

... relates to the largest financial institutions and their providers, and cybersecurity risks that could cause systemic failure in the financial markets. The New York State Department of Financial Services has issued proposed cybersecurity regulations - with respect to banks and other financial institu ...

... relates to the largest financial institutions and their providers, and cybersecurity risks that could cause systemic failure in the financial markets. The New York State Department of Financial Services has issued proposed cybersecurity regulations - with respect to banks and other financial institu ...

Document

... a. Financial markets attract funds from investors and channel the funds to corporations. b. Money markets enable corporations to borrow funds on a short-term basis so that they can © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except fo ...

... a. Financial markets attract funds from investors and channel the funds to corporations. b. Money markets enable corporations to borrow funds on a short-term basis so that they can © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except fo ...

Chapter Ten

... (short position) incurs the obligation to deliver the underlying commodity at contract maturity in exchange for receiving the futures price that was outstanding at the time the contract was enacted. Most futures contracts do not result in delivery; indeed some contracts do not even allow delivery. T ...

... (short position) incurs the obligation to deliver the underlying commodity at contract maturity in exchange for receiving the futures price that was outstanding at the time the contract was enacted. Most futures contracts do not result in delivery; indeed some contracts do not even allow delivery. T ...

... For some time we have been predicting that from next June, the Fed will begin raising the funds rate by 25 basis points at every meeting. We expect the rate to reach 1.50% by the end of next year. The process can be expected to end in early-2017 once a neutral interest rate of 4% is achieved. While ...

Structure and nature of sa#7305 (Page 1)

... Having analysed the structure of saving in Namibia, one is inclined to conclude that the country is in a better position to use its current savings to finance long-term investments. This is based on the premise that the economy has well developed contractual saving institutions such as life insuranc ...

... Having analysed the structure of saving in Namibia, one is inclined to conclude that the country is in a better position to use its current savings to finance long-term investments. This is based on the premise that the economy has well developed contractual saving institutions such as life insuranc ...

A Primer on Bonds Bond Prices and Yields

... (a) duration of 5-year bonds with coupon rates of 12% (paid annually) is 4 years duration of 20-year bonds with coupon rates of 6% (paid annually) is 11 years è how much of each of these coupon bonds (in market value) should you hold to both fully fund and immunize your obligation? (b) What will be ...

... (a) duration of 5-year bonds with coupon rates of 12% (paid annually) is 4 years duration of 20-year bonds with coupon rates of 6% (paid annually) is 11 years è how much of each of these coupon bonds (in market value) should you hold to both fully fund and immunize your obligation? (b) What will be ...

Information for investors

... for purchase and for sale (the bid-ask spread), as well as the fact that there is no bid-ask quotation for the appropriate volume of transactions at any moment (or period). Therefore, the investor may find it impossible to buy or sell some liquid assets under normal market conditions. This can happe ...

... for purchase and for sale (the bid-ask spread), as well as the fact that there is no bid-ask quotation for the appropriate volume of transactions at any moment (or period). Therefore, the investor may find it impossible to buy or sell some liquid assets under normal market conditions. This can happe ...

Chap021-Investors and the Investment Process

... Investments for the Long Run • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk ...

... Investments for the Long Run • Advice from the mutual fund industry: • Don’t try to outguess the market by moving your money in and out. Buy and hold instead. • Diversify to reduce risk. • Put money in stocks, bonds, and money market mutual funds. • Avoid keeping 401(k) money in a company’s lowrisk ...

Discussion paper Transparency and liquidity

... between conflicting aspects. On the one hand, a high degree of transparency has a positive effect on markets through higher liquidity and more competition. Information about current buy and sell prices as well as market depth for both orders and transactions provides all investors with a more inform ...

... between conflicting aspects. On the one hand, a high degree of transparency has a positive effect on markets through higher liquidity and more competition. Information about current buy and sell prices as well as market depth for both orders and transactions provides all investors with a more inform ...

Treasury Yields May Fall Short of Consensus Views

... The University of Michigan’s consumer sentiment index is expected to have come in at 97.5 in April, modestly below its preliminary estimate but still above March’s 96.9. Stocks and gasoline will likely weigh on sentiment. Unlike other measures of sentiment, there isn’t strong evidence of a political ...

... The University of Michigan’s consumer sentiment index is expected to have come in at 97.5 in April, modestly below its preliminary estimate but still above March’s 96.9. Stocks and gasoline will likely weigh on sentiment. Unlike other measures of sentiment, there isn’t strong evidence of a political ...

Type Title Here (20-pt Arial bold)

... Past performance is not a guide to current or future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investme ...

... Past performance is not a guide to current or future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investme ...

Chaebol, Financial Liberalization, and Economic Crisis

... objective: NBFIs’ share in total deposits increased from less than 30 percent up to 1980 to more than 60 percent by the early 1990s. In fact, in 1990 their share of deposits surpassed that of banks, accounting for almost 60 percent of total deposits. The same can be said about their share of loans, ...

... objective: NBFIs’ share in total deposits increased from less than 30 percent up to 1980 to more than 60 percent by the early 1990s. In fact, in 1990 their share of deposits surpassed that of banks, accounting for almost 60 percent of total deposits. The same can be said about their share of loans, ...

Real Regulatory Capital Management and Dividend Payout

... impairment rules) and show that investors acted as if the potential negative effects of FVA out-weighed any benefits associated with having more timely and transparent mark-to-market data for decision making. Plantin et al. (2008) explain how FVA generates excessive volatility in prices, by degradin ...

... impairment rules) and show that investors acted as if the potential negative effects of FVA out-weighed any benefits associated with having more timely and transparent mark-to-market data for decision making. Plantin et al. (2008) explain how FVA generates excessive volatility in prices, by degradin ...