CAPM is CRAP, or, The Dead Parrot lives

... impression of being prisoners to their own operations rather than controlling them... They are promising performance on the upside and the downside that is not practical to achieve. So in a world devoid of market index benchmarks what should be we doing? The answer, I think, is to focus upon the tot ...

... impression of being prisoners to their own operations rather than controlling them... They are promising performance on the upside and the downside that is not practical to achieve. So in a world devoid of market index benchmarks what should be we doing? The answer, I think, is to focus upon the tot ...

The Real Effects of US Banking Deregulation

... Given these political economy explanations for banking reform, can we interpret the results from equation (1)? The results in Kroszner and Strahan (1999) suggest that aggregate forces such as technological change affected all financial services firms and created increasingly strong pressures for reg ...

... Given these political economy explanations for banking reform, can we interpret the results from equation (1)? The results in Kroszner and Strahan (1999) suggest that aggregate forces such as technological change affected all financial services firms and created increasingly strong pressures for reg ...

Capital regulation in a macroeconomic model with three layers of

... is generally an optimal level of capital requirements. In effect, capital requirements reduce bank leverage, bank failure risk and the implicit subsidies associated with deposit insurance. Simultaneously, they force the banks to make a greater use of bankers’ limited wealth. This second aspect makes ...

... is generally an optimal level of capital requirements. In effect, capital requirements reduce bank leverage, bank failure risk and the implicit subsidies associated with deposit insurance. Simultaneously, they force the banks to make a greater use of bankers’ limited wealth. This second aspect makes ...

PDF

... spot and those traders will be rewarded at maturity. Therefore, the futures price deviation from the expected spot price is given by the risk premium, which can increase if traders have long or short risk aversion higher than the counterparty. For example, the farmers should sell futures to stabiliz ...

... spot and those traders will be rewarded at maturity. Therefore, the futures price deviation from the expected spot price is given by the risk premium, which can increase if traders have long or short risk aversion higher than the counterparty. For example, the farmers should sell futures to stabiliz ...

Housing and the Monetary Transmission Mechanism Frederic S. Mishkin

... in Japan; their estimate of the OECD average is about 0.035, and their estimate for the United States is 0.03. As I mentioned earlier, expansionary monetary policy in the form of lower interest rates will stimulate the demand for housing, which leads to higher house prices; the resulting increase in ...

... in Japan; their estimate of the OECD average is about 0.035, and their estimate for the United States is 0.03. As I mentioned earlier, expansionary monetary policy in the form of lower interest rates will stimulate the demand for housing, which leads to higher house prices; the resulting increase in ...

Financial Report 2014--15

... of space on 147 acres. The college’s facilities have a replacement value of approximately $1.2 billion, making them the college’s second most valuable asset after the endowment. In order to maintain these vital assets, the college continues its commitment to their ongoing repair and maintenance thro ...

... of space on 147 acres. The college’s facilities have a replacement value of approximately $1.2 billion, making them the college’s second most valuable asset after the endowment. In order to maintain these vital assets, the college continues its commitment to their ongoing repair and maintenance thro ...

Swaps

... markets are 5-year rates The LIBOR−0.1% and LIBOR+0.6% rates available in the floating rate market are sixmonth rates BBBCorp’s fixed rate depends on the spread above LIBOR it borrows at in the future ...

... markets are 5-year rates The LIBOR−0.1% and LIBOR+0.6% rates available in the floating rate market are sixmonth rates BBBCorp’s fixed rate depends on the spread above LIBOR it borrows at in the future ...

186 - Supreme Court of Canada Judgments

... hand, would secure to the company a fair return for the capital invested. By a fair return is meant that the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company) as it would receive if it were investing the same amount in other securi ...

... hand, would secure to the company a fair return for the capital invested. By a fair return is meant that the company will be allowed as large a return on the capital invested in its enterprise (which will be net to the company) as it would receive if it were investing the same amount in other securi ...

Minsky at Basel: how to build an effective banking

... “For the WTO, the international transactions on goods and services increased 11 times from 1977 to 2007. During the same years financial transactions in foreign exchange markets grew at a much higher rate than international trade. They increased 175 times if we only include traditional products and ...

... “For the WTO, the international transactions on goods and services increased 11 times from 1977 to 2007. During the same years financial transactions in foreign exchange markets grew at a much higher rate than international trade. They increased 175 times if we only include traditional products and ...

MUNICIPAL DEBT AND MARGINAL TAX RATES: IS

... the actual cost of capital to government bond dealers for their positions in Treasury bonds. Second, Treasury repo contracts are fully collateralized, or more generally, overcollateralized by the underlying Treasury bonds associated with the transaction. Thus, there is little default risk associated ...

... the actual cost of capital to government bond dealers for their positions in Treasury bonds. Second, Treasury repo contracts are fully collateralized, or more generally, overcollateralized by the underlying Treasury bonds associated with the transaction. Thus, there is little default risk associated ...

Corporate Debt in emerging eConomies

... To begin, we see four risks that the firms themselves face—risks that either may not be fully internalized or may not be fully appreciated. In many ways, these are quite conventional. We call them maturity, currency, roll-over, and speculative risks. Maturity mismatches can arise in the usual way, w ...

... To begin, we see four risks that the firms themselves face—risks that either may not be fully internalized or may not be fully appreciated. In many ways, these are quite conventional. We call them maturity, currency, roll-over, and speculative risks. Maturity mismatches can arise in the usual way, w ...

Estimating the Expected Marginal Rate of Substitution

... assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-specific factor loadings {β } , coefficients that are constant across time. Estimating these factor loadings is a key objective of this research program. In practice, many empirical as ...

... assumptions, equation (10) becomes a panel estimating equation. Time-series variation is used to estimate the asset-specific factor loadings {β } , coefficients that are constant across time. Estimating these factor loadings is a key objective of this research program. In practice, many empirical as ...

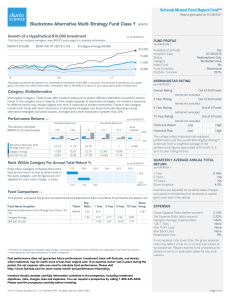

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

Measuring and marking counterparty risk

... transfer risks, allowing for substantially improved risk sharing. They have also created connections among markets and market participants that are only just starting to be understood. Counterparty risk, an example of one such connection, is the risk that a party to an OTC derivatives contract may f ...

... transfer risks, allowing for substantially improved risk sharing. They have also created connections among markets and market participants that are only just starting to be understood. Counterparty risk, an example of one such connection, is the risk that a party to an OTC derivatives contract may f ...

Monetary Policy Statement March 2006 Contents

... the median number of days to sell a house has inched ...

... the median number of days to sell a house has inched ...

Privatization: Pros and Cons

... Why Not Privatize? • What do we do when the stock market drops or goes through a long-term decline? • In four 20 year periods in the past century, inflation adjusted returns were close to zero. • These years were 1901-1921, 1929-1949, ...

... Why Not Privatize? • What do we do when the stock market drops or goes through a long-term decline? • In four 20 year periods in the past century, inflation adjusted returns were close to zero. • These years were 1901-1921, 1929-1949, ...

Center for Economic Policy Analysis A Minskian Analysis of

... What role does financial fragility of firms play in the T-O model? The authors argue firms’ net worth changes over an expansion. A firm’s net worth is defined as assets minus liabilities; assets consist of the capitalized value of its plant and equipment, and liabilities consist of the value of its ...

... What role does financial fragility of firms play in the T-O model? The authors argue firms’ net worth changes over an expansion. A firm’s net worth is defined as assets minus liabilities; assets consist of the capitalized value of its plant and equipment, and liabilities consist of the value of its ...

Deterioration of Bank Balance Sheets and

... loans in foreclosure process in a given quarter increased from 0.5% to 4% between 2006 and 2011. Financial institutions experienced losses from residential mortgages (and related assets) due to the unexpected increases in foreclosures. Depletion of capital forced financial institutions to contract l ...

... loans in foreclosure process in a given quarter increased from 0.5% to 4% between 2006 and 2011. Financial institutions experienced losses from residential mortgages (and related assets) due to the unexpected increases in foreclosures. Depletion of capital forced financial institutions to contract l ...

Spillover Effect of US Quantitative Easing From the

... FOMC is the policy-making branch of the Federal Reserve, and ordinarily holds 8 scheduled meetings each year. At each meeting, there are first discussions about the outlook of the economy and the monetary policy options available. After the discussions, the FOMC votes. The voting members of the FOMC ...

... FOMC is the policy-making branch of the Federal Reserve, and ordinarily holds 8 scheduled meetings each year. At each meeting, there are first discussions about the outlook of the economy and the monetary policy options available. After the discussions, the FOMC votes. The voting members of the FOMC ...

Monetary Policy with Interest on Reserves

... During the last few years, Federal Reserve policy has made many enormous changes. I focus on two: First, the Fed now pays interest on reserves (accounts that banks hold at the Fed), which used not to pay interest. Second, the Fed has amassed an unprecedented balance sheet. Before the crisis, the Fed ...

... During the last few years, Federal Reserve policy has made many enormous changes. I focus on two: First, the Fed now pays interest on reserves (accounts that banks hold at the Fed), which used not to pay interest. Second, the Fed has amassed an unprecedented balance sheet. Before the crisis, the Fed ...

Alternative Legal Institutions, Xinfang and Finance

... • The formal legal system (German civil law origin) was established by the end of the Qing dynasty (1912) • The xinfang system has always been there since 2000 years BC. • So attention should also be paid to the alternative legal systems. ...

... • The formal legal system (German civil law origin) was established by the end of the Qing dynasty (1912) • The xinfang system has always been there since 2000 years BC. • So attention should also be paid to the alternative legal systems. ...

Why are Central Banks Delegated Macroprudential Responsibilities?

... independence (on these issues see, for instance, Ingves, 2011). Indeed, as will be discussed at greater length below, there are serious concerns about whether the central bank could safeguard its hard-won monetary policy independence if it also assumes the role of the macroprudential supervisor beca ...

... independence (on these issues see, for instance, Ingves, 2011). Indeed, as will be discussed at greater length below, there are serious concerns about whether the central bank could safeguard its hard-won monetary policy independence if it also assumes the role of the macroprudential supervisor beca ...

Islamic Syndicated Finance

... In Syndica@ons, one bank will s@ll bear the role of the lead bank and coordinator between the syndicate banks and the borrower Mudaraba can be either: A restricted Mudaraba where the lenders specify a par@cular business in which they want the borrower (investment agent) to inves ...

... In Syndica@ons, one bank will s@ll bear the role of the lead bank and coordinator between the syndicate banks and the borrower Mudaraba can be either: A restricted Mudaraba where the lenders specify a par@cular business in which they want the borrower (investment agent) to inves ...

Too Many To Fail: The Effect of Regulatory Forbearance on Market

... a substantially high level. In other words, depositors prefer enjoying the high-interest income provided by failing banks to withdrawing their funds from those banks, as long as they believe that enough time remains to withdraw their deposits before the bank is closed by the regulator’s order. This ...

... a substantially high level. In other words, depositors prefer enjoying the high-interest income provided by failing banks to withdrawing their funds from those banks, as long as they believe that enough time remains to withdraw their deposits before the bank is closed by the regulator’s order. This ...

Illiquid assets - Select Investment Partners

... immediate gain. But is this fair to all investors? Are exiting investors then being overpaid? We are not talking about distressed sales here. Often, that secondary sale has been pursued for portfolio rebalancing or investment outlook reasons and may have taken months to organise. Arguably, that seco ...

... immediate gain. But is this fair to all investors? Are exiting investors then being overpaid? We are not talking about distressed sales here. Often, that secondary sale has been pursued for portfolio rebalancing or investment outlook reasons and may have taken months to organise. Arguably, that seco ...