The Rise and Fall of Mortgage Securitization

... MacKenzie’s account, which focuses on the instruments, is informative but incomplete. The question MacKenzie does not answer is why the community of financial engineers, mostly located within investment banks suddenly became interested in using mortgage backed securities as raw material for CDO. It ...

... MacKenzie’s account, which focuses on the instruments, is informative but incomplete. The question MacKenzie does not answer is why the community of financial engineers, mostly located within investment banks suddenly became interested in using mortgage backed securities as raw material for CDO. It ...

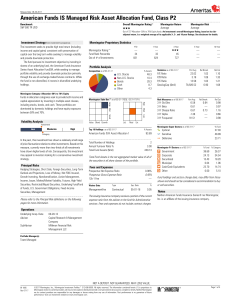

American Funds IS Managed Risk Asset Allocation Fund

... mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performa ...

... mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performa ...

Weekly Market Commentary September 12, 2016

... III) Gold suffered a third-straight decline Friday, but salvaged a slim weekly gain as traders looked to a cadre of Federal Reserve speakers for clues on the near-term direction of interest rates. For the week gold higher by +0.22% rising from $1328.8 to $1331.8 (MTD +1.56% YTD 25.46%). This report ...

... III) Gold suffered a third-straight decline Friday, but salvaged a slim weekly gain as traders looked to a cadre of Federal Reserve speakers for clues on the near-term direction of interest rates. For the week gold higher by +0.22% rising from $1328.8 to $1331.8 (MTD +1.56% YTD 25.46%). This report ...

The impact of market liquidity in times of stress on corporate bond

... problem. Underwriters must take the bonds into inventory and then sell them to investors, and during illiquid times they are less likely to do that. They must also be willing to act as dealers and make a market in the bond to help ensure liquidity. Underwriters (dealers) do not like to hold unhedged ...

... problem. Underwriters must take the bonds into inventory and then sell them to investors, and during illiquid times they are less likely to do that. They must also be willing to act as dealers and make a market in the bond to help ensure liquidity. Underwriters (dealers) do not like to hold unhedged ...

Abu Dhabi Commercial Bank PJSC

... beyond ADCB‟s control and have been made based upon management‟s expectations and beliefs concerning future developments and their potential effect upon ADCB. By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which a ...

... beyond ADCB‟s control and have been made based upon management‟s expectations and beliefs concerning future developments and their potential effect upon ADCB. By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which a ...

the impact of the systematic risk and the financial leverage on the

... securities one by one, they could compare the returns of individual securities to the general price indicator of the market and the capital asset pricing model (CAMP) or Sharp's theory of capital markets was derived from the heart of this proposal. Wang (2003) measured the conditional relationship b ...

... securities one by one, they could compare the returns of individual securities to the general price indicator of the market and the capital asset pricing model (CAMP) or Sharp's theory of capital markets was derived from the heart of this proposal. Wang (2003) measured the conditional relationship b ...

Managing Interest Rate Risk: Duration GAP and Economic

... the corporation’s equity under various changes in interest rates. Rate changes are instantaneous changes from current rates. The change in economic value of equity is derived from the difference between changes in the market value of assets and changes in the market value of liabilities. ...

... the corporation’s equity under various changes in interest rates. Rate changes are instantaneous changes from current rates. The change in economic value of equity is derived from the difference between changes in the market value of assets and changes in the market value of liabilities. ...

Green Paper on Long-Term Financing of the European Economy

... investments. However, the ability of institutional investors and markets to fill this gap depends on a number of conditions. Alongside the right calibration of the prudential regulatory framework, many claim that accounting principles, valuation measurements and the behaviour of asset managers creat ...

... investments. However, the ability of institutional investors and markets to fill this gap depends on a number of conditions. Alongside the right calibration of the prudential regulatory framework, many claim that accounting principles, valuation measurements and the behaviour of asset managers creat ...

Green Paper on Long-Term Financing of the European - EUR-Lex

... investments. However, the ability of institutional investors and markets to fill this gap depends on a number of conditions. Alongside the right calibration of the prudential regulatory framework, many claim that accounting principles, valuation measurements and the behaviour of asset managers creat ...

... investments. However, the ability of institutional investors and markets to fill this gap depends on a number of conditions. Alongside the right calibration of the prudential regulatory framework, many claim that accounting principles, valuation measurements and the behaviour of asset managers creat ...

Community Capital Management

... performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performanc ...

... performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performanc ...

Determinants of Microfinance Loan Performance and Fluctuation Over the Business Cycle

... Microfinance institutions (MFI) provide important banking services to the poorest sections of the world’s population. MFIs provide financial tools for the poorest of the poor to finance new investments and smooth consumption, but crucial for their ability to sustainably alleviate poverty is consiste ...

... Microfinance institutions (MFI) provide important banking services to the poorest sections of the world’s population. MFIs provide financial tools for the poorest of the poor to finance new investments and smooth consumption, but crucial for their ability to sustainably alleviate poverty is consiste ...

Timothy Plan High Yield Bond Fund Class I

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

Capital Market: History Record

... • The return of large-company portfolio is essentially the return of S&P 500 index (proxy for market portfolio), so 8% − 3% = 5% market premium can be view as the reward to bear one unit systematic risk • If a stock has a beta of 2, how much risk premium should be awarded to investors who hold it? ...

... • The return of large-company portfolio is essentially the return of S&P 500 index (proxy for market portfolio), so 8% − 3% = 5% market premium can be view as the reward to bear one unit systematic risk • If a stock has a beta of 2, how much risk premium should be awarded to investors who hold it? ...

Internet Banking in Europe: a comparative analysis

... between UK and Continental banks could be various. For example, UK banks may pay higher interest rates to clients in order to expand the deposit base. We will now examine some structural differences across EU countries. ...

... between UK and Continental banks could be various. For example, UK banks may pay higher interest rates to clients in order to expand the deposit base. We will now examine some structural differences across EU countries. ...

Modelling in Corporate Finance

... Observations of the potential explanatory variable k for bank i and period t Random error term with distribution N(0,), Variance-covariance matrix of it error terms Number of banks in sample Years in observation period Number of explanatory variables Maximum lag of the explanatory variable k of th ...

... Observations of the potential explanatory variable k for bank i and period t Random error term with distribution N(0,), Variance-covariance matrix of it error terms Number of banks in sample Years in observation period Number of explanatory variables Maximum lag of the explanatory variable k of th ...

foundation market-based investment funds

... 5.1% and the MSCI Emerging Markets Index decreased 1.6%. Value stocks held up better than growth names with the Russell 1000 Value Index returned 12.3%, while the Russell 1000 Growth Index returned 9.5%. Fixed Income markets posted small gains or slight losses during the first quarter as interest ra ...

... 5.1% and the MSCI Emerging Markets Index decreased 1.6%. Value stocks held up better than growth names with the Russell 1000 Value Index returned 12.3%, while the Russell 1000 Growth Index returned 9.5%. Fixed Income markets posted small gains or slight losses during the first quarter as interest ra ...

When and how US dollar shortages evolved into the full crisis

... banks to provide eligible counterparties with unlimited USD funding in response to market conditions. In this paper, we empirically investigate when and how the USD shortage problem entered the full-fledged crisis regime, using the 1-year and 10-year crosscurrency swap prices for the GBP/USD, EUR/US ...

... banks to provide eligible counterparties with unlimited USD funding in response to market conditions. In this paper, we empirically investigate when and how the USD shortage problem entered the full-fledged crisis regime, using the 1-year and 10-year crosscurrency swap prices for the GBP/USD, EUR/US ...

Turkish Banking Sector`s Profitability Factors

... International Journal of Economics and Financial Issues, Vol. 3, No. 1, 2013, pp.27-41 affect aggregate profitability. Business cycle effects, in particular lagged GDP growth, display a substantial procyclical impact on bank profits. Athanasoglou et al. (2008) examine the effect of bank-specific, i ...

... International Journal of Economics and Financial Issues, Vol. 3, No. 1, 2013, pp.27-41 affect aggregate profitability. Business cycle effects, in particular lagged GDP growth, display a substantial procyclical impact on bank profits. Athanasoglou et al. (2008) examine the effect of bank-specific, i ...

Emerging Markets Fund

... derivatives take the fund’s total exposure to equity / sector / country over 100%, this will be incorporated in the tables above. The sector/industry classification used (ie Global Industry Classification Standard or Industry Classification Benchmark) varies by fund. Top Positions: those companies i ...

... derivatives take the fund’s total exposure to equity / sector / country over 100%, this will be incorporated in the tables above. The sector/industry classification used (ie Global Industry Classification Standard or Industry Classification Benchmark) varies by fund. Top Positions: those companies i ...

Market Discipline and Subordinated Debt: A Review of

... Academics and regulatory economists have long been concerned that mispriced deposit insurance undermines monitoring of banks by investors and increases incentives for bank risk-taking. Government supervision provides a partial substitute for the private corporate governance services provided by a fi ...

... Academics and regulatory economists have long been concerned that mispriced deposit insurance undermines monitoring of banks by investors and increases incentives for bank risk-taking. Government supervision provides a partial substitute for the private corporate governance services provided by a fi ...

Multiple Choice Questions

... An invention that raises the future marginal product of capital would cause an increase in desired investment, which would cause the investment curve to shift to the ________ and would cause the real interest rate to ________. (a) right; increase (b) right; decrease (c) left; increase (d) left; decr ...

... An invention that raises the future marginal product of capital would cause an increase in desired investment, which would cause the investment curve to shift to the ________ and would cause the real interest rate to ________. (a) right; increase (b) right; decrease (c) left; increase (d) left; decr ...

Economic Review 1, 2013 , Algorithmic trading in the foreign

... dissemination of price information. The global turnover in this market every day involves amounts corresponding to tens of thousands of billions of Swedish krona.4 The foreign exchange trading can be divided into two segments, trading between banks (interbank) and trading between banks and their cus ...

... dissemination of price information. The global turnover in this market every day involves amounts corresponding to tens of thousands of billions of Swedish krona.4 The foreign exchange trading can be divided into two segments, trading between banks (interbank) and trading between banks and their cus ...

On Reserve: A Resource for Economic Educators

... development of new and more efficient ways to transfer the funds held in these transaction accounts to pay for goods and services. The most common instrument used to transfer funds held on deposit is the check. Checks came into widespread use in this nation when deposit banking was established after ...

... development of new and more efficient ways to transfer the funds held in these transaction accounts to pay for goods and services. The most common instrument used to transfer funds held on deposit is the check. Checks came into widespread use in this nation when deposit banking was established after ...

Market Liquidity after the Financial Crisis

... Fleming, Shachar: Federal Reserve Bank of New York (e-mails: [email protected], [email protected]). Adrian: International Monetary Fund (e-mail: [email protected]). Vogt contributed to this paper while working at the Federal Reserve Bank of New York. An earlier version of this paper circu ...

... Fleming, Shachar: Federal Reserve Bank of New York (e-mails: [email protected], [email protected]). Adrian: International Monetary Fund (e-mail: [email protected]). Vogt contributed to this paper while working at the Federal Reserve Bank of New York. An earlier version of this paper circu ...

Should the Government be in the Banking Business? The Role of

... stressed by the social and development views, and internal efficiency, namely the ability of stateowned enterprises to carry out their mandate. This view emphasizes that while market imperfections may exist, agency costs within government bureaucracies may more than offset the social gains of public ...

... stressed by the social and development views, and internal efficiency, namely the ability of stateowned enterprises to carry out their mandate. This view emphasizes that while market imperfections may exist, agency costs within government bureaucracies may more than offset the social gains of public ...