Regulatory Constraints on Leverage: The

... leverage requirements. Leverage at those institutions was stable in recent years, whereas leverage at U.S. investment banks (not subject to these constraints) began trending sharply upwards starting in 2004. The combination of stable Tier 1 ratios and sharply rising leverage at some banks illustrate ...

... leverage requirements. Leverage at those institutions was stable in recent years, whereas leverage at U.S. investment banks (not subject to these constraints) began trending sharply upwards starting in 2004. The combination of stable Tier 1 ratios and sharply rising leverage at some banks illustrate ...

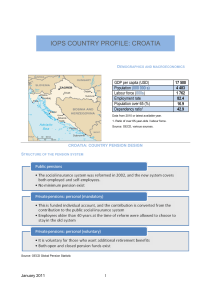

IOPS COUNTRY PROFILE: CROATIA

... the regulatory agency (HANFA). Performance measurement of the pension funds is provided by using accounting units. The index used to calculate returns is called MIREX. The reference rate of return is defined as a weighted arithmetic mean of all mandatory pension funds average rates of return in the ...

... the regulatory agency (HANFA). Performance measurement of the pension funds is provided by using accounting units. The index used to calculate returns is called MIREX. The reference rate of return is defined as a weighted arithmetic mean of all mandatory pension funds average rates of return in the ...

Insights into Evaluating Exchange Traded Funds

... Securities lending plays a major role in the efficient functioning of the securities markets worldwide. It can be an important and significant business practice whereby securities are temporarily transferred by one party (the lender) to another (the borrower). Most “physical” ETFs, such as SPDR ETFs ...

... Securities lending plays a major role in the efficient functioning of the securities markets worldwide. It can be an important and significant business practice whereby securities are temporarily transferred by one party (the lender) to another (the borrower). Most “physical” ETFs, such as SPDR ETFs ...

foreword - Port Phillip Publishing

... The Keynesian model used by central financial planners over the last half century calls for tight policies when the economy is hot…and loose policies when it is cool. This is supposed to smooth out the boom/bust cycle. But what we’ve gotten is not counter-cyclical policies, but just a boatload of ea ...

... The Keynesian model used by central financial planners over the last half century calls for tight policies when the economy is hot…and loose policies when it is cool. This is supposed to smooth out the boom/bust cycle. But what we’ve gotten is not counter-cyclical policies, but just a boatload of ea ...

Heterogeneous Risk Preferences in Financial Markets

... that asset price co-movements with the stochastic discount factor are forecastable. When agents exhibit heterogeneous preferences, the stochastic discount factor does not correspond to a specific agent in every period, but to a time varying level of risk aversion. This level is falling through time ...

... that asset price co-movements with the stochastic discount factor are forecastable. When agents exhibit heterogeneous preferences, the stochastic discount factor does not correspond to a specific agent in every period, but to a time varying level of risk aversion. This level is falling through time ...

FCA Consultation CP16/30: Transaction cost disclosure in

... Placing a duty on fund managers and product providers to collate and supply information on transaction costs is essential to completing the annual governance statements by the Chairs of Trustees of occupational DC pension schemes (including Master Trusts) and provider’s Independent Governance Commit ...

... Placing a duty on fund managers and product providers to collate and supply information on transaction costs is essential to completing the annual governance statements by the Chairs of Trustees of occupational DC pension schemes (including Master Trusts) and provider’s Independent Governance Commit ...

Real Interest Rates, Saving and Investment

... interest rates. The paper also updates previous studies to cover the period 1959{92. The use of data for these 33 years permits the identi¯cation of factors that have been, and probably will be, consistently important in determining the level of real interest rates. The analysis is also extended to ...

... interest rates. The paper also updates previous studies to cover the period 1959{92. The use of data for these 33 years permits the identi¯cation of factors that have been, and probably will be, consistently important in determining the level of real interest rates. The analysis is also extended to ...

Financial Markets

... order to finance investments by corporations, governments and individuals. Financial institutions are the key players in the financial markets as they perform the function of intermediation and thus determine the flow of funds. The financial regulators perform the role of monitoring and regulating t ...

... order to finance investments by corporations, governments and individuals. Financial institutions are the key players in the financial markets as they perform the function of intermediation and thus determine the flow of funds. The financial regulators perform the role of monitoring and regulating t ...

financial stability report

... After a relatively weak first half of the year in 2016, international economic activity increased in the second half, and this trend has continued into the opening months of 2017. However, the pace of growth remains subdued and much uncertainty surrounds the global macroeconomic outlook, owing mainl ...

... After a relatively weak first half of the year in 2016, international economic activity increased in the second half, and this trend has continued into the opening months of 2017. However, the pace of growth remains subdued and much uncertainty surrounds the global macroeconomic outlook, owing mainl ...

Active or Passive

... funds in this study to reduce survivorship bias: the tendency for mutual funds to be excluded from a database because they no longer exist. Mutual funds with poor performance tend to be dropped by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, wh ...

... funds in this study to reduce survivorship bias: the tendency for mutual funds to be excluded from a database because they no longer exist. Mutual funds with poor performance tend to be dropped by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, wh ...

Why Hedge Funds? - CFA Institute Publications

... The first point is that we should be very careful in how we interpret broad-scale hedge fund indexes. The term “hedge fund” does not imply a homogeneous asset class but, rather, describes the way in which the fund is organized. Hedge funds include many disparate investment strategies. The first hedg ...

... The first point is that we should be very careful in how we interpret broad-scale hedge fund indexes. The term “hedge fund” does not imply a homogeneous asset class but, rather, describes the way in which the fund is organized. Hedge funds include many disparate investment strategies. The first hedg ...

Contemporaneous Loan Stress and Termination Risk in Please share

... and Brown, Ciochetti and Riddiough (2005) also present models in which there is negotiation rather than instant foreclosure upon delinquency. In each case the model relies on a different explanation – for example, the cross-collateralization of assets, strategic behavior by lender or borrower, noisy ...

... and Brown, Ciochetti and Riddiough (2005) also present models in which there is negotiation rather than instant foreclosure upon delinquency. In each case the model relies on a different explanation – for example, the cross-collateralization of assets, strategic behavior by lender or borrower, noisy ...

SMEs and Bank Lending Relationships: the Impact of Mergers

... borrowers with differing characteristics. In particular, small firm borrowers of merging banks appear to face additional difficulties in tapping credit in the short run following a merger. Also, borrowers of target banks (especially small target banks when the acquiring bank is large) seem to be har ...

... borrowers with differing characteristics. In particular, small firm borrowers of merging banks appear to face additional difficulties in tapping credit in the short run following a merger. Also, borrowers of target banks (especially small target banks when the acquiring bank is large) seem to be har ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) ...

... (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) ...

Key Issues for Reporters

... U.S.-resident custodians must report all U.S.-held foreign securities entrusted to central securities depositories (e.g., Depository Trust Company (DTC), Euroclear, and Clearstream). ...

... U.S.-resident custodians must report all U.S.-held foreign securities entrusted to central securities depositories (e.g., Depository Trust Company (DTC), Euroclear, and Clearstream). ...

Informational money, Islamic finance, and the dismissal of negative

... n , that is the class of Crescent-Star finances making use of PM only, admits designs of a financial system that may run into a perpetual state of negative interests. (In other words Crescent-Starpm n is strictly included in Crescent-Starpm . 3. WORKING HYPOTHESIS: in the absence of PM, the costs of ...

... n , that is the class of Crescent-Star finances making use of PM only, admits designs of a financial system that may run into a perpetual state of negative interests. (In other words Crescent-Starpm n is strictly included in Crescent-Starpm . 3. WORKING HYPOTHESIS: in the absence of PM, the costs of ...

Macroeconomics Chamberlin and Yueh

... create deposits on its reserves. If households decide to hold some of their deposits in currency, this reduces the reserves of the banking sector and the ability to create money. The currency deposit ratio (cr = C/D) represents the proportion of deposits households hold as cash. If this exceeds zero ...

... create deposits on its reserves. If households decide to hold some of their deposits in currency, this reduces the reserves of the banking sector and the ability to create money. The currency deposit ratio (cr = C/D) represents the proportion of deposits households hold as cash. If this exceeds zero ...

Global Financial Stability Report

... administration in the areas of tax reform and deregulation could have a significant impact on the corporate sector. Healthy corporate balance sheets are a pre requisite for these policy proposals to gain traction and stimulate economic risk taking. Many nonfinancial firms do have the balance sheet ...

... administration in the areas of tax reform and deregulation could have a significant impact on the corporate sector. Healthy corporate balance sheets are a pre requisite for these policy proposals to gain traction and stimulate economic risk taking. Many nonfinancial firms do have the balance sheet ...

Global Financial Stability Report

... administration in the areas of tax reform and deregulation could have a significant impact on the corporate sector. Healthy corporate balance sheets are a pre requisite for these policy proposals to gain traction and stimulate economic risk taking. Many nonfinancial firms do have the balance sheet ...

... administration in the areas of tax reform and deregulation could have a significant impact on the corporate sector. Healthy corporate balance sheets are a pre requisite for these policy proposals to gain traction and stimulate economic risk taking. Many nonfinancial firms do have the balance sheet ...

ETFs: A Call for Greater Transparency and Consistent

... not presented by traditional ETFs: the risk that the other party to a derivatives trade will become bankrupt, default or otherwise not meet its obligations (known as “counterparty exposure”). An ETF with counterparty exposure would not perform as designed if a derivatives counterparty fails to perfo ...

... not presented by traditional ETFs: the risk that the other party to a derivatives trade will become bankrupt, default or otherwise not meet its obligations (known as “counterparty exposure”). An ETF with counterparty exposure would not perform as designed if a derivatives counterparty fails to perfo ...

Remaking the corporate bond market

... ICMA’s 2014 study on the state and evolution of this market. It reviews how liquidity and market efficiency are being defined and impacted by the confluence of extraordinary monetary policy and unprecedented prudential and market regulation, and what the implications for the market are. Unlike the p ...

... ICMA’s 2014 study on the state and evolution of this market. It reviews how liquidity and market efficiency are being defined and impacted by the confluence of extraordinary monetary policy and unprecedented prudential and market regulation, and what the implications for the market are. Unlike the p ...

The State of Middle Market Financing in the US

... produced no more than a “hiccup”, surprising lenders as almost a non-event in the equity and loan markets, and transactions pushed through the U.S. presidential election business as usual. Recent statistics evidenced a slowdown in middle market private equity buyout activity. In 2016, $366.8 billion ...

... produced no more than a “hiccup”, surprising lenders as almost a non-event in the equity and loan markets, and transactions pushed through the U.S. presidential election business as usual. Recent statistics evidenced a slowdown in middle market private equity buyout activity. In 2016, $366.8 billion ...

Forthcoming, Journal of Empirical Finance Measuring The Market

... Hedge funds often employ opportunistic trading strategies on a leveraged basis. It is natural to find their footprints in most major market events. A "small bet" by large hedge funds can be a sizeable transaction that can impact a market. This study estimates hedge fund exposures during a number of ...

... Hedge funds often employ opportunistic trading strategies on a leveraged basis. It is natural to find their footprints in most major market events. A "small bet" by large hedge funds can be a sizeable transaction that can impact a market. This study estimates hedge fund exposures during a number of ...

The volatility of banks in the financial crisis

... are very important in an economy. That is also why it is interesting to look at volatility of banks and more specifically at the drivers of it. The drivers cause volatility to increase in recessions and to decrease in economically better years. But why is that and what are the drivers of that? And h ...

... are very important in an economy. That is also why it is interesting to look at volatility of banks and more specifically at the drivers of it. The drivers cause volatility to increase in recessions and to decrease in economically better years. But why is that and what are the drivers of that? And h ...