INVESTMENT POLICY The Kitsap Community Foundation (“the

... diversification, and a predictable and dependable source of cash flow. It is expected that fixed income investments will not be totally dedicated to the long-term bond market, but will be flexibly allocated among maturities of different lengths. Fixed income instruments should reduce the overall vol ...

... diversification, and a predictable and dependable source of cash flow. It is expected that fixed income investments will not be totally dedicated to the long-term bond market, but will be flexibly allocated among maturities of different lengths. Fixed income instruments should reduce the overall vol ...

Statement of Financial Condition

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

The Crisis Aftermath: New Regulatory Paradigms

... One of the ways in which CEPR responded to the global financial crisis in early 2009 was to quickly establish a project on ‘Financial Stability and Regulation’. At that time, in the aftermath of the Lehman Brothers debacle when the world was pretty much still in a state of shock, there was no clear- ...

... One of the ways in which CEPR responded to the global financial crisis in early 2009 was to quickly establish a project on ‘Financial Stability and Regulation’. At that time, in the aftermath of the Lehman Brothers debacle when the world was pretty much still in a state of shock, there was no clear- ...

View - FASB

... like that of the S&L industry, ended up costing taxpayers about $151 billion by late 2011 and the meter is still running. It is interesting to note that some of their financial problems were ALM-related, that is, a result of hedging with interest rate swaps that went the wrong way and contributed to ...

... like that of the S&L industry, ended up costing taxpayers about $151 billion by late 2011 and the meter is still running. It is interesting to note that some of their financial problems were ALM-related, that is, a result of hedging with interest rate swaps that went the wrong way and contributed to ...

Euro Area Policies: 2016 Article IV Consultation--Press Release

... The euro area recovery continues, supported by still low oil prices, a neutral fiscal stance, and accommodative monetary policy. Directors cautioned, however, that inflation and inflation expectations remain stubbornly low, raising adjustment challenges for debtors, and that crisis legacies of high ...

... The euro area recovery continues, supported by still low oil prices, a neutral fiscal stance, and accommodative monetary policy. Directors cautioned, however, that inflation and inflation expectations remain stubbornly low, raising adjustment challenges for debtors, and that crisis legacies of high ...

FREE Sample Here

... C) All derivative markets can absorb a greater dollar transaction without an adverse effect on the price of the derivative instrument; that is, the derivative market may be more liquid than the cash market. D) Some derivative markets can absorb a greater dollar transaction but with an adverse effect ...

... C) All derivative markets can absorb a greater dollar transaction without an adverse effect on the price of the derivative instrument; that is, the derivative market may be more liquid than the cash market. D) Some derivative markets can absorb a greater dollar transaction but with an adverse effect ...

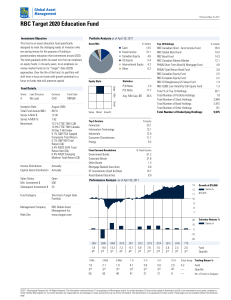

RBC Target 2020 Education Fund

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

... based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 to September 30, 2016, expressed on an annualized basis. Adjusted MER is prov ...

chapter 5 - BYU Marriott School

... the value of the portfolio is X, then, in order to earn a 15% expected return: X(1.15) = $100,000 X = $86,957 If the portfolio is purchased at $86,957, and the expected payoff is $100,000, then the expected rate of return, E(r), is: ...

... the value of the portfolio is X, then, in order to earn a 15% expected return: X(1.15) = $100,000 X = $86,957 If the portfolio is purchased at $86,957, and the expected payoff is $100,000, then the expected rate of return, E(r), is: ...

Inflation and the Housing Market

... the inflation rate rises to 2, 4, and 8 percent, raising the mortgage rate by corresponding amounts, the annual payment is seen to increase by 30, 60, and 130 percent respectively. The reason for the higher annual payment is that the payments are spread over a long period of time and, in the presenc ...

... the inflation rate rises to 2, 4, and 8 percent, raising the mortgage rate by corresponding amounts, the annual payment is seen to increase by 30, 60, and 130 percent respectively. The reason for the higher annual payment is that the payments are spread over a long period of time and, in the presenc ...

2016 DFAST Mid-Cycle Stress Test Disclosure

... – Citi identified events which would have a significant impact to its risk profile, with input from business and control function leaders. – Citi used these events with historical data and observed relationships between variables to create a global macroeconomic forecast which was then applied to ea ...

... – Citi identified events which would have a significant impact to its risk profile, with input from business and control function leaders. – Citi used these events with historical data and observed relationships between variables to create a global macroeconomic forecast which was then applied to ea ...

Private Equity`s Place in Defined Contribution Schemes

... environment differs considerably from traditional DB. However, there are some structural changes which are taking place in DC which support a more traditional approach to investment in ‘illiquids’. As more money has flowed into DC, sponsors have adopted default investment options for their participa ...

... environment differs considerably from traditional DB. However, there are some structural changes which are taking place in DC which support a more traditional approach to investment in ‘illiquids’. As more money has flowed into DC, sponsors have adopted default investment options for their participa ...

Are Universal Banks Better Intermediaries? ∗ Daniel Neuhann Farzad Saidi

... one loan and underwriting service concurrently from the same universal bank in or after 1996. The control group consists of firms that in or after 1996 received at least one loan from a universal bank but trusted another bank with an underwriting mandate. To pick a control group of firms with unive ...

... one loan and underwriting service concurrently from the same universal bank in or after 1996. The control group consists of firms that in or after 1996 received at least one loan from a universal bank but trusted another bank with an underwriting mandate. To pick a control group of firms with unive ...

Systemic risk of UCITS investment funds and financial market

... On the other hand, the measures used to capture systemic risk of institutional investors' sector, investment funds especially, are underrepresented. Within the Financial Soundness Indicators – FSI, considered being indicators of financial stability and resilience, not a single one out of 40 indicato ...

... On the other hand, the measures used to capture systemic risk of institutional investors' sector, investment funds especially, are underrepresented. Within the Financial Soundness Indicators – FSI, considered being indicators of financial stability and resilience, not a single one out of 40 indicato ...

Macroeconomic Implications of Bank Capital Requirements ∗ Luisa Lambertini

... loan loss provisions (LLPs) and net charge-offs (NCOs) and how they affect the balance sheet of the banks and the rest of the economy. For this purpose we only focus on the set of 15 largest BHCs which constitute about 76% of the total bank assets in our data sample, and almost about 2% of the tota ...

... loan loss provisions (LLPs) and net charge-offs (NCOs) and how they affect the balance sheet of the banks and the rest of the economy. For this purpose we only focus on the set of 15 largest BHCs which constitute about 76% of the total bank assets in our data sample, and almost about 2% of the tota ...

The Euro and the Geography of International Debt Flow

... recent fourth Capital Requirements Directive continues to allow zero risk weights for euro area sovereign debts, even though the borrowing countries cannot print currency to pay their debts.) Fourth, financial regulations in the EU were harmonized (Kalemli-Ozcan et al., 2010) and the euro infrastru ...

... recent fourth Capital Requirements Directive continues to allow zero risk weights for euro area sovereign debts, even though the borrowing countries cannot print currency to pay their debts.) Fourth, financial regulations in the EU were harmonized (Kalemli-Ozcan et al., 2010) and the euro infrastru ...

Aegon CEE: Executing our strategy

... Lowering of one or more of insurer financial strength ratings of Aegon’s insurance subsidiaries and the adverse impact such action may have on the premium writings, policy retention, profitability and liquidity of its insurance subsidiaries; ...

... Lowering of one or more of insurer financial strength ratings of Aegon’s insurance subsidiaries and the adverse impact such action may have on the premium writings, policy retention, profitability and liquidity of its insurance subsidiaries; ...

Balance of Competencies 17.01.14

... front-run and gold-plate EU proposals. One recent example of front-running has been the implementation of the Retail Distribution Review (RDR) ahead of MiFID/R. This has led to increased costs for UK financial services firms to accommodate changes to implement the RDR; and although a national overri ...

... front-run and gold-plate EU proposals. One recent example of front-running has been the implementation of the Retail Distribution Review (RDR) ahead of MiFID/R. This has led to increased costs for UK financial services firms to accommodate changes to implement the RDR; and although a national overri ...

CREDIT SUPPLY AND THE HOUSING BOOM

... factors behind the boom, which is central to our analysis. Even if the two constraints are independent in our framework, their interaction is key in equilibrium, because house prices depend on their collateral value, which is positive only when the borrowing constraint binds. Moreover, this interact ...

... factors behind the boom, which is central to our analysis. Even if the two constraints are independent in our framework, their interaction is key in equilibrium, because house prices depend on their collateral value, which is positive only when the borrowing constraint binds. Moreover, this interact ...

INTRODUCTION HIGHLIGHTS Regulatory Issues Market

... with the FRB buying US $85 Billion worth of bonds monthly. The announcement by Mr. Bernanke of the end to the FRB’s bond purchases by mid-2014 precipitated a sell-off of shares globally by panicky investors. The panicky sell-offs began in New York before spreading to other major global financial cen ...

... with the FRB buying US $85 Billion worth of bonds monthly. The announcement by Mr. Bernanke of the end to the FRB’s bond purchases by mid-2014 precipitated a sell-off of shares globally by panicky investors. The panicky sell-offs began in New York before spreading to other major global financial cen ...

Net Noninterest Income

... © 2008 The McGraw-Hill Companies, Inc., All Rights Management and Financial Services, 7/e Reserved. of Bank a bank? ...

... © 2008 The McGraw-Hill Companies, Inc., All Rights Management and Financial Services, 7/e Reserved. of Bank a bank? ...

The Effect of Capital Controls on Interest Rate Differentials

... The main reasons for imposing capital inflow controls are to curb capital inflows, avoid real exchange rate (RER) appreciation, bias the structure of external liabilities towards long-run securities, and generate room for maneuver for monetary policy (in the presence of RER targets). All these goals ...

... The main reasons for imposing capital inflow controls are to curb capital inflows, avoid real exchange rate (RER) appreciation, bias the structure of external liabilities towards long-run securities, and generate room for maneuver for monetary policy (in the presence of RER targets). All these goals ...

Capital and Risk Management Pillar 3 Disclosures for the

... exposure measure consists of total assets (excluding items deducted from Tier 1 capital, if any) and certain off-balance sheet items converted into credit exposure equivalents as well as adjustments for derivatives to reflect credit risk and other risks. The Bank was required to report under both Ba ...

... exposure measure consists of total assets (excluding items deducted from Tier 1 capital, if any) and certain off-balance sheet items converted into credit exposure equivalents as well as adjustments for derivatives to reflect credit risk and other risks. The Bank was required to report under both Ba ...

Joint Stock Company “The Ural Bank for Reconstruction and

... Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with relevant ethical requirements and plan and perform the audit to obtain ...

... Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with relevant ethical requirements and plan and perform the audit to obtain ...

The Risk-free Rate and the Market Risk Premium

... premium of 6.0% to date. For the purpose of this paper, the Authority has updated its estimate of the market risk premium using these methods. The updated estimate is 6.0%, as at October 2012. Additionally, unusual and volatile conditions in bond markets have led to historically low yields on Common ...

... premium of 6.0% to date. For the purpose of this paper, the Authority has updated its estimate of the market risk premium using these methods. The updated estimate is 6.0%, as at October 2012. Additionally, unusual and volatile conditions in bond markets have led to historically low yields on Common ...

NBER WORKING PAPER SERIES Stephen G. Cecchetti

... The primary exception to the view that asset prices do not belong in a Taylor-type interest-rate reaction function has arisen in an open-economy context. Ball (1999) finds that adding the exchange rate to the Taylor rule improves macroeconomic performance in a model where the exchange rate has a sig ...

... The primary exception to the view that asset prices do not belong in a Taylor-type interest-rate reaction function has arisen in an open-economy context. Ball (1999) finds that adding the exchange rate to the Taylor rule improves macroeconomic performance in a model where the exchange rate has a sig ...