NBER WORKING PAPER SERIES Stephen G. Cecchetti

... The primary exception to the view that asset prices do not belong in a Taylor-type interest-rate reaction function has arisen in an open-economy context. Ball (1999) finds that adding the exchange rate to the Taylor rule improves macroeconomic performance in a model where the exchange rate has a sig ...

... The primary exception to the view that asset prices do not belong in a Taylor-type interest-rate reaction function has arisen in an open-economy context. Ball (1999) finds that adding the exchange rate to the Taylor rule improves macroeconomic performance in a model where the exchange rate has a sig ...

U.S. Treasury Department Unveils New Reporting Requirement for

... Securities and Issuances of U.S. Securities June 8, 2011 The U.S. Treasury Department is rolling out a new reporting requirement that will collect, on a monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term sec ...

... Securities and Issuances of U.S. Securities June 8, 2011 The U.S. Treasury Department is rolling out a new reporting requirement that will collect, on a monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term sec ...

Mutual fund

... Discuss types of funds available to investors and the different kinds of investors services offered by mutual funds and exchange traded funds. Gain an understanding of the variables that should be considered when selecting funds for investment purposes. Identify the sources of return and calculate r ...

... Discuss types of funds available to investors and the different kinds of investors services offered by mutual funds and exchange traded funds. Gain an understanding of the variables that should be considered when selecting funds for investment purposes. Identify the sources of return and calculate r ...

The Effect of Cash Flow on Share Price of the Jordanian

... company. In addition, the division of these statements to cash flow within activities have a joint nature that helps in revealing strength and weak points in term of establishment’s ability to fulfillits obligations, finance expansions and dividends whether for a short or long term (Barkiah, 2009). ...

... company. In addition, the division of these statements to cash flow within activities have a joint nature that helps in revealing strength and weak points in term of establishment’s ability to fulfillits obligations, finance expansions and dividends whether for a short or long term (Barkiah, 2009). ...

A Lost Art Is active management doomed?

... Duration management and yield curve positioning also offer some potential to add value versus an index, but it is notoriously difficult to predict the direction of interest rates and changes in the shape of the yield curve. Moreover, the quantum of likely outperformance is modest for even the most su ...

... Duration management and yield curve positioning also offer some potential to add value versus an index, but it is notoriously difficult to predict the direction of interest rates and changes in the shape of the yield curve. Moreover, the quantum of likely outperformance is modest for even the most su ...

Patent Collateral, Investor Commitment, and the Market for Venture

... Our difference-in-difference (DD) results suggest that VCs serve an important intermediary role in the market for venture lending. The annual debt rate of IT startups backed by VCs with relatively old funds at the time of the crash declined by 14 percentage points post-shock relative to startups bac ...

... Our difference-in-difference (DD) results suggest that VCs serve an important intermediary role in the market for venture lending. The annual debt rate of IT startups backed by VCs with relatively old funds at the time of the crash declined by 14 percentage points post-shock relative to startups bac ...

Investments - Laporte Public School

... building construction projects or specific future projects and any unreserved funds used to provide financial-related managerial flexibility for future fiscal years. ...

... building construction projects or specific future projects and any unreserved funds used to provide financial-related managerial flexibility for future fiscal years. ...

Our Beliefs About Investing

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

Leverage, Balance Sheet Size and Wholesale Funding

... Our paper is related to a few different strands in the existing literature. Regarding wholesale funding of banks, Huang and Ratnovski (2010) analyze a model with a tradeoff between using wholesale funding vs. retail deposits. On one hand, wholesale funding improves efficiency as uninsured wholesale ...

... Our paper is related to a few different strands in the existing literature. Regarding wholesale funding of banks, Huang and Ratnovski (2010) analyze a model with a tradeoff between using wholesale funding vs. retail deposits. On one hand, wholesale funding improves efficiency as uninsured wholesale ...

The Financial Performance of Islamic vs. Conventional Banks: An

... A country’s economic growth, among several other factors, is based on its financial sector’s performance, with the banking sector being the most prominent. Siraj and Pillai (2012) assert that the stability and growth of any economy to a great extent depends on the stability of its banking sector. It ...

... A country’s economic growth, among several other factors, is based on its financial sector’s performance, with the banking sector being the most prominent. Siraj and Pillai (2012) assert that the stability and growth of any economy to a great extent depends on the stability of its banking sector. It ...

Baird Core Intermediate Municipal Bond Fund Summary Prospectus

... combination of a new President of the United States and the first year since 2010 in which both Houses of Congress and the White House are from the same political party. There is uncertainty regarding how the financial markets will react to any changes, and there is the potential that these changes ...

... combination of a new President of the United States and the first year since 2010 in which both Houses of Congress and the White House are from the same political party. There is uncertainty regarding how the financial markets will react to any changes, and there is the potential that these changes ...

Term-Structure Models: a Review - IME-USP

... above more concrete. Typically, a complex trader will enter a transaction with a non-professional counterparty, and will attempt to hedge her exposure by transacting hedging trades with the plain-vanilla derivatives desk. These hedging transactions will attempt to neutralize both the exposure to int ...

... above more concrete. Typically, a complex trader will enter a transaction with a non-professional counterparty, and will attempt to hedge her exposure by transacting hedging trades with the plain-vanilla derivatives desk. These hedging transactions will attempt to neutralize both the exposure to int ...

Financial Institutions Instruments and Markets, 5th Edition

... A. The National Bank of Australia B. Telstra C. The City of Sydney D. The Commonwealth Government 67. Generally, in the long term, a government: A. is a net borrower of funds. B. is a net supplier of funds. C. borrows funds directly from households. D. borrows funds directly from the financial marke ...

... A. The National Bank of Australia B. Telstra C. The City of Sydney D. The Commonwealth Government 67. Generally, in the long term, a government: A. is a net borrower of funds. B. is a net supplier of funds. C. borrows funds directly from households. D. borrows funds directly from the financial marke ...

05low interest rates not appropriate for either euro area or germany

... the euro area have been negative since the start of 2015. The proportion of government bonds offering negative yields has actually increased significantly since then. For the founding states of the European Monetary Union as a whole (excluding Luxembourg), the proportion of one to two-year bonds fal ...

... the euro area have been negative since the start of 2015. The proportion of government bonds offering negative yields has actually increased significantly since then. For the founding states of the European Monetary Union as a whole (excluding Luxembourg), the proportion of one to two-year bonds fal ...

Special Edition Bond Series `Autopilot` (Issue 5)

... How have the markets performed to date? Although this is the fifth issue of Autopilot, we are able to use actual historical market prices from the past 5 years to simulate how our Autopilot management strategy would have performed, had it existed historically, when compared to the price performance ...

... How have the markets performed to date? Although this is the fifth issue of Autopilot, we are able to use actual historical market prices from the past 5 years to simulate how our Autopilot management strategy would have performed, had it existed historically, when compared to the price performance ...

Why expenses matter - Charles Schwab Investment Management

... Shares and 0.08% for Institutional Shares for so long as the investment adviser serves as the adviser to the fund. This agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. ...

... Shares and 0.08% for Institutional Shares for so long as the investment adviser serves as the adviser to the fund. This agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. ...

Supplementary Paper Series for the "Comprehensive Assessment

... interest rate policy ("QQE with a Negative Interest Rate"). The main transmission channel of QQE envisaged by the Bank when it introduced the policy was the reduction in real interest rates.5 Specifically, (1) people's deflationary mindset would be dispelled and inflation expectations would be raise ...

... interest rate policy ("QQE with a Negative Interest Rate"). The main transmission channel of QQE envisaged by the Bank when it introduced the policy was the reduction in real interest rates.5 Specifically, (1) people's deflationary mindset would be dispelled and inflation expectations would be raise ...

Stock Market Response to Monetary and Fiscal Policy Shocks: Multi

... stances, as well as their interaction, play an important role in the economy and thus, we argue, that they also influence stock market performance. Even though a significant number of past studies have concentrated their attention on the relationship between monetary policy and stock market performa ...

... stances, as well as their interaction, play an important role in the economy and thus, we argue, that they also influence stock market performance. Even though a significant number of past studies have concentrated their attention on the relationship between monetary policy and stock market performa ...

Monetary Policy Expectations at the Zero Lower Bound

... path—the most-likely path for future short rate rates. In a shadow-rate model, this modal path corresponds to the expected path of future shadow short rates (or to zero when the expected shadow short rate is negative). A comparison of the mean path to the modal path reveals how tightly the ZLB const ...

... path—the most-likely path for future short rate rates. In a shadow-rate model, this modal path corresponds to the expected path of future shadow short rates (or to zero when the expected shadow short rate is negative). A comparison of the mean path to the modal path reveals how tightly the ZLB const ...

PLANTILLA PPT CORPORATIVA BOLSA KIT IMAGEN

... Securities Settlement House: for long and short-term instruments, Repos. ...

... Securities Settlement House: for long and short-term instruments, Repos. ...

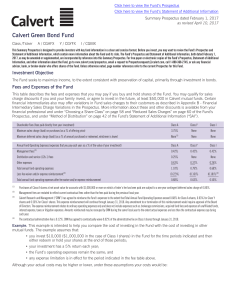

Calvert Green Bond Fund

... higher transaction costs and may increase your tax liability. Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of r ...

... higher transaction costs and may increase your tax liability. Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of r ...

The Relationship between Credit Growth and the Expected Returns

... or with changes in aggregate risk-premium, or both. Credit growth is not significantly correlated with 3year or 5-year rolling betas of bank stock returns on equity and bond market risk factors. If credit growth is correlated with changes in aggregate risk-premium, it should also predict returns for ...

... or with changes in aggregate risk-premium, or both. Credit growth is not significantly correlated with 3year or 5-year rolling betas of bank stock returns on equity and bond market risk factors. If credit growth is correlated with changes in aggregate risk-premium, it should also predict returns for ...

Credit Supply and the Housing Boom

... tranching of mortgages into mortgage-backed securities (MBS) plays a central role, through several channels.1 First, tranching creates highly rated assets out of pools of risky mortgages. These assets can then be purchased by those institutional investors that are restricted by regulation to only ho ...

... tranching of mortgages into mortgage-backed securities (MBS) plays a central role, through several channels.1 First, tranching creates highly rated assets out of pools of risky mortgages. These assets can then be purchased by those institutional investors that are restricted by regulation to only ho ...

Wescott: A History of Our Advice - Wescott Financial Advisory Group

... emphasis on diversified portfolios has dampened the impact of bubbles in real estate, the financial sector and commodities. We were cautious about the instability of the bond market, focused on short-term high quality bonds rather than stretching for yield, and this protected portfolios from losses ...

... emphasis on diversified portfolios has dampened the impact of bubbles in real estate, the financial sector and commodities. We were cautious about the instability of the bond market, focused on short-term high quality bonds rather than stretching for yield, and this protected portfolios from losses ...

how hedge funds are structured

... Determines strategy and makes investing decisions and allocations, as well as manages portfolio risk. The investment manager is also invested in the fund and is compensated via a management fee, as well as a performance fee based on the fund’s annual performance. Managers only get a performance fee ...

... Determines strategy and makes investing decisions and allocations, as well as manages portfolio risk. The investment manager is also invested in the fund and is compensated via a management fee, as well as a performance fee based on the fund’s annual performance. Managers only get a performance fee ...