Report 52 - Fixed Maturity EUR Industrial Bond Funds

... Portfolios of less than 5 million EUR assets under management, do not contribute to the performance calculation of the composite to which they belong, based on the investment process. There is a six‐month period applied, before portfolios are removed from or entered into the composite. This rule d ...

... Portfolios of less than 5 million EUR assets under management, do not contribute to the performance calculation of the composite to which they belong, based on the investment process. There is a six‐month period applied, before portfolios are removed from or entered into the composite. This rule d ...

Markets Overview

... keep increasing the monetary base at an annual pace of 80 trillion yen with the extended duration of about 7-12 years and its other buying programs of ETFs, J-Reits, CP, corporate bonds and loans programs as announced in the Dec 2015 MPM) and it also kept its Policy-Rate Balances interest rate uncha ...

... keep increasing the monetary base at an annual pace of 80 trillion yen with the extended duration of about 7-12 years and its other buying programs of ETFs, J-Reits, CP, corporate bonds and loans programs as announced in the Dec 2015 MPM) and it also kept its Policy-Rate Balances interest rate uncha ...

Depository System of Ukraine in reforming state

... The result reforming the depository system of Ukraine has undergone significant structural changes. Custodians who were holders of securities accounts and registers of registered securities, which accounted for the lower level of the depository system in accordance with the Law of Ukraine "On the Na ...

... The result reforming the depository system of Ukraine has undergone significant structural changes. Custodians who were holders of securities accounts and registers of registered securities, which accounted for the lower level of the depository system in accordance with the Law of Ukraine "On the Na ...

Russian BCS Holding International Ltd. Assigned

... June 30, 2012. This portfolio comprises 28% of BCS Group's assets and 148% of its equity as of the same date. We understand that the group follows a conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at m ...

... June 30, 2012. This portfolio comprises 28% of BCS Group's assets and 148% of its equity as of the same date. We understand that the group follows a conservative trading strategy, focusing on fairly liquid bonds rated 'B-' or above. Long equity positions accounted for 21% of the total portfolio at m ...

stock comparison - MBA Projects

... conservative; they do not adopt any change easily. Till now just few investors can be recognized who are using technology for online stock trading. Traditional traders still prefer to choose broker as a stock trading mechanism because they are more loyal to their broker. Online trading empowers educ ...

... conservative; they do not adopt any change easily. Till now just few investors can be recognized who are using technology for online stock trading. Traditional traders still prefer to choose broker as a stock trading mechanism because they are more loyal to their broker. Online trading empowers educ ...

Retained Interests in Securitisations and - ECB

... enhancements and guarantees to protect investors from potential losses on the securitised assets. These may take different forms and can be provided internally, externally, or a combination of both. The practice of providing internal credit enhancements to securitisation structures resulted in banks ...

... enhancements and guarantees to protect investors from potential losses on the securitised assets. These may take different forms and can be provided internally, externally, or a combination of both. The practice of providing internal credit enhancements to securitisation structures resulted in banks ...

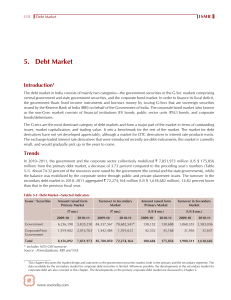

5. Debt Market

... Most government bonds are issued as fixed rate bonds. Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bon ...

... Most government bonds are issued as fixed rate bonds. Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bon ...

Banking in South-Eastern Europe On the move

... ◆ assumption of a leading role in the privatisation process by foreign banks. ◆ exit of smaller, non-niche players. There are still many small banks active in the sector whose respective market share is by and large less than 1 % and which only service a regional market. The entry of foreign banks w ...

... ◆ assumption of a leading role in the privatisation process by foreign banks. ◆ exit of smaller, non-niche players. There are still many small banks active in the sector whose respective market share is by and large less than 1 % and which only service a regional market. The entry of foreign banks w ...

Carry out the ideal future life

... In light of the above factors, dividends and Dividend Accumulation Rate are not guaranteed and may be higher or lower than the values illustrated in the benefit illustration provided at point of sale. You may browse the following website, www.boclife.com.hk/ps, to understand BOC Life’s philosophy in ...

... In light of the above factors, dividends and Dividend Accumulation Rate are not guaranteed and may be higher or lower than the values illustrated in the benefit illustration provided at point of sale. You may browse the following website, www.boclife.com.hk/ps, to understand BOC Life’s philosophy in ...

Systemic Risk in Hedge Funds

... financial institutions. The most important features of this system are margining and practicing collateral to reduce credit risk in leveraged trading. Ultimately, a financial institution will only be willing to provide a certain amount of credit when there is sufficient collateral opposed to it. Tho ...

... financial institutions. The most important features of this system are margining and practicing collateral to reduce credit risk in leveraged trading. Ultimately, a financial institution will only be willing to provide a certain amount of credit when there is sufficient collateral opposed to it. Tho ...

Here - Punter Southall Transaction Services

... measured by the PPF 7800 Index, has not seen an aggregate surplus since March 2011 and fell to its lowest ever level, an overall deficit of £413 billion, in August 2016. The key driver of this collapse in the funding position of schemes is the fall in government bond yields, with real returns fall ...

... measured by the PPF 7800 Index, has not seen an aggregate surplus since March 2011 and fell to its lowest ever level, an overall deficit of £413 billion, in August 2016. The key driver of this collapse in the funding position of schemes is the fall in government bond yields, with real returns fall ...

What Makes a Good ʽBad Bankʼ? The Irish, Spanish and German

... downturn and banking sector bail outs, the design of the AMCs was highly influenced by the Eurostat fiscal accounting principles. Since the creation of the AMCs provided impaired asset relief by the state to the affected banks, their establishment also had to be approved under the European Commissio ...

... downturn and banking sector bail outs, the design of the AMCs was highly influenced by the Eurostat fiscal accounting principles. Since the creation of the AMCs provided impaired asset relief by the state to the affected banks, their establishment also had to be approved under the European Commissio ...

Investment Analysis (FIN 670)

... percent. If the market value of the portfolio at the beginning of 2001 was $100,000, what was the market value of the portfolio at the end of 2007? ...

... percent. If the market value of the portfolio at the beginning of 2001 was $100,000, what was the market value of the portfolio at the end of 2007? ...

Deutsche Bundesbank - Annual Report

... For the first time the Deutsche Bundesbank is publishing, as a supplement to the written word, a CD ROM with long time series taken from the Bank's monetary statistics. The new medium provides users from the worlds of science, politics and journalism not only with comprehensive information in the fo ...

... For the first time the Deutsche Bundesbank is publishing, as a supplement to the written word, a CD ROM with long time series taken from the Bank's monetary statistics. The new medium provides users from the worlds of science, politics and journalism not only with comprehensive information in the fo ...

Risk and Return: The Portfolio Theory The crux of portfolio theory

... implications for the optimal investment strategy . • Implies that all investors will hold combinations of the riskless asset and the market portfolio. • The only difference across investors is in the allocation decision - more risk-averse investors will invest more in the riskless asset, less risk-a ...

... implications for the optimal investment strategy . • Implies that all investors will hold combinations of the riskless asset and the market portfolio. • The only difference across investors is in the allocation decision - more risk-averse investors will invest more in the riskless asset, less risk-a ...

The To-Be-Announced (TBA) Market: a Primer

... the necessary pools on the agreed upon date. In a more traditional interest rate environment, fails do not regularly occur because the buyer of the security begins to earn accrued interest from the initially agreed upon trade date while the seller does not receive the money for the security until it ...

... the necessary pools on the agreed upon date. In a more traditional interest rate environment, fails do not regularly occur because the buyer of the security begins to earn accrued interest from the initially agreed upon trade date while the seller does not receive the money for the security until it ...

chapter 12—special industries: banks, utilities, oil and gas

... exploration and production costs. ANS: F 28. The successful efforts method places only exploration and production costs of successful wells on the balance sheet under property, plant, and equipment. ANS: T 29. A basic issue, still unresolved, relates to whether oil and gas exploration cost should be ...

... exploration and production costs. ANS: F 28. The successful efforts method places only exploration and production costs of successful wells on the balance sheet under property, plant, and equipment. ANS: T 29. A basic issue, still unresolved, relates to whether oil and gas exploration cost should be ...

CAPM in Market Overreaction Conditions: Evidence in Indonesia

... information available, the market condition is called the efficient market. These conditions efficient market related to information on where the market will react to the information available. Fama (1970) presents the three main forms of market efficiency: weak form, semi strong form and strong for ...

... information available, the market condition is called the efficient market. These conditions efficient market related to information on where the market will react to the information available. Fama (1970) presents the three main forms of market efficiency: weak form, semi strong form and strong for ...

Research and Monetary Policy Department Working Paper No:06/04

... where s is the log of EMBI spreads, c is a constant term, rus is the yield on US treasury bonds or Fed funds rate, θ is a proxy for the risk appetite of foreign investors (generally the spread between the yield on US corporate bonds rated BBB+ with a maturity of 10 years and a 10-year US treasury bo ...

... where s is the log of EMBI spreads, c is a constant term, rus is the yield on US treasury bonds or Fed funds rate, θ is a proxy for the risk appetite of foreign investors (generally the spread between the yield on US corporate bonds rated BBB+ with a maturity of 10 years and a 10-year US treasury bo ...

Are the Golden Years of Central Banking Over?

... of International Studies in Geneva in 1983, and has written in the areas of monetary theory and policy, and financial stability. Alberto Giovannini is Chief Executive Officer Unifortune SGR SpA, an asset management company based in Milano, Italy, and has been Principal Policy Advisor of the Commissi ...

... of International Studies in Geneva in 1983, and has written in the areas of monetary theory and policy, and financial stability. Alberto Giovannini is Chief Executive Officer Unifortune SGR SpA, an asset management company based in Milano, Italy, and has been Principal Policy Advisor of the Commissi ...

CHAPTER 5 Risk and Rates of Return

... Firm-specific risk is not important to a well-diversified investor. Suppose investor A and B all want to buy a stock of IBM. Investor A’s portfolio is not no well-diversified and will demand a higher return from the stock than investor B would demand. That is: A is willing to pay a lower price t ...

... Firm-specific risk is not important to a well-diversified investor. Suppose investor A and B all want to buy a stock of IBM. Investor A’s portfolio is not no well-diversified and will demand a higher return from the stock than investor B would demand. That is: A is willing to pay a lower price t ...

Exchange rate risk and internationally diversified

... g i j $ = o~ij -}- flijRmj d- XjS -k- eij $. This equation shows that except in the rare cases where an asset's return is completely independent of the domestic economy (flij -- 0) or negatively related to the performance of the domestic economy (flij < 0), national systematic risk will typically ca ...

... g i j $ = o~ij -}- flijRmj d- XjS -k- eij $. This equation shows that except in the rare cases where an asset's return is completely independent of the domestic economy (flij -- 0) or negatively related to the performance of the domestic economy (flij < 0), national systematic risk will typically ca ...

Slide 0 - Unicaja

... expressly disclaims any obligation or undertaking to disseminate any updates or revisions to the information, including any f inancial data and any forward-looking statements, contained in this document, and will not publicly release any revisions that may affect the information contained in this do ...

... expressly disclaims any obligation or undertaking to disseminate any updates or revisions to the information, including any f inancial data and any forward-looking statements, contained in this document, and will not publicly release any revisions that may affect the information contained in this do ...

Chapter 2 -- The Business, Tax, and Financial Environments

... Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. ...

... Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. ...

Revenue Sharing Fund Families

... per employee per fund family per year). Morgan Stanley’s non-cash compensation policies set conditions for each of these types of payments, and do not permit any gifts or entertainment conditioned on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive ...

... per employee per fund family per year). Morgan Stanley’s non-cash compensation policies set conditions for each of these types of payments, and do not permit any gifts or entertainment conditioned on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive ...