Towards a post-Keynesian consensus in macroeconomics

... argue that the trend rate of interest and the normal profit rate are linked one on one. ► There is a link with target return pricing and normal-cost pricing, where the interest rate determines the target rate of return that will help to set the markup. ► Raising interest rates to slow down the econo ...

... argue that the trend rate of interest and the normal profit rate are linked one on one. ► There is a link with target return pricing and normal-cost pricing, where the interest rate determines the target rate of return that will help to set the markup. ► Raising interest rates to slow down the econo ...

money_lecs_2_2013_v3_post

... 1. Fed buys assess backed mortgage (from bank for simplicity) 2. Bank is glad to unload it, and just holds excess reserves. 3. No impact on the money supply or on federal funds rate. A (very small) impact on mortgage interest rates. ...

... 1. Fed buys assess backed mortgage (from bank for simplicity) 2. Bank is glad to unload it, and just holds excess reserves. 3. No impact on the money supply or on federal funds rate. A (very small) impact on mortgage interest rates. ...

Second Half Outlook 2014

... continue selling bonds in favor of stocks. Similar movements may happen in the European markets, and this could prove to be a significant story for the rest of 2014. Although our portfolios reflect broad representation of market capitalization, we continue to maintain a slight overweight toward mid- ...

... continue selling bonds in favor of stocks. Similar movements may happen in the European markets, and this could prove to be a significant story for the rest of 2014. Although our portfolios reflect broad representation of market capitalization, we continue to maintain a slight overweight toward mid- ...

Topic: reference currency basket of the renminbi

... buoyant global economy is providing considerable support to the stability of the global financial system, as central banks increasingly do not wish to be “behind the curve” in containing inflation or anchoring inflation expectation, and as interest rates continue to rise, albeit at a slower pace, th ...

... buoyant global economy is providing considerable support to the stability of the global financial system, as central banks increasingly do not wish to be “behind the curve” in containing inflation or anchoring inflation expectation, and as interest rates continue to rise, albeit at a slower pace, th ...

Fed Focus: A Community Conference The Hotel Captain Cook, Anchorage, Alaska

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

Fed Focus: A Community Conference

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally—and very importantly—the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

Download pdf | 78 KB |

... incomplete, as widening credit spreads, more restrictive lending standards, and credit market dysfunction have worked against the monetary easing and led to tighter financial conditions overall. In particular, many traditional funding sources for financial institutions and markets have dried up, and ...

... incomplete, as widening credit spreads, more restrictive lending standards, and credit market dysfunction have worked against the monetary easing and led to tighter financial conditions overall. In particular, many traditional funding sources for financial institutions and markets have dried up, and ...

The Causes of the Great Depression

... • Market hits its peak on September 3, 1929 – Prices drop after this – Sometimes in small amounts, sometimes in tumbles ...

... • Market hits its peak on September 3, 1929 – Prices drop after this – Sometimes in small amounts, sometimes in tumbles ...

Lynch, Troy - FSI terms of reference

... The Reserve Bank of Australia - easing of monetary policy Though the terms of reference of this enquiry will ‘not make recommendations on the objectives and procedures of the Reserve Bank of Australia (RBA) in its conduct of monetary policy,’ it behoves the inquiry to examine the conduct and implica ...

... The Reserve Bank of Australia - easing of monetary policy Though the terms of reference of this enquiry will ‘not make recommendations on the objectives and procedures of the Reserve Bank of Australia (RBA) in its conduct of monetary policy,’ it behoves the inquiry to examine the conduct and implica ...

Credit Market Liquidity

... credit market wheel since they are used by a wide variety of investor types (ranging from institutional money managers to money market funds) to facilitate transactions over a short window of time. Repo activity has also fallen as a result of increased regulations placed on large financial institut ...

... credit market wheel since they are used by a wide variety of investor types (ranging from institutional money managers to money market funds) to facilitate transactions over a short window of time. Repo activity has also fallen as a result of increased regulations placed on large financial institut ...

Ch 22-23 The Great Depression

... allowing investors to purchase a stock for only a fraction of its price (CREDIT) and borrow the rest at high interest rates. • When Stock Market begins to crash banks call in loans • To pay back banks investors sold stocks for less than they purchased • Loose money and go into debt • No US Governmen ...

... allowing investors to purchase a stock for only a fraction of its price (CREDIT) and borrow the rest at high interest rates. • When Stock Market begins to crash banks call in loans • To pay back banks investors sold stocks for less than they purchased • Loose money and go into debt • No US Governmen ...

Class 4: States and Markets 2

... • How much does each dollar of stimulus increase the GDP? • Answer: It depends on where the money goes • Stimulus has no effect if the recipient doesn’t spend it • Stimulus can have a large effect if the recipient spends it in a way that starts a “chain reaction” – Ex: An infrastructure project: Gov ...

... • How much does each dollar of stimulus increase the GDP? • Answer: It depends on where the money goes • Stimulus has no effect if the recipient doesn’t spend it • Stimulus can have a large effect if the recipient spends it in a way that starts a “chain reaction” – Ex: An infrastructure project: Gov ...

Part 3. Financial Institutions

... Mutual funds companies earn income in two ways. The first is that the managers are paid fees by the investors based on the value of the assets in the firm. Numbers around 0.5% are typical. Some mutual funds also charge a fee when the funds are first purchased, called a “load”. For example, if you in ...

... Mutual funds companies earn income in two ways. The first is that the managers are paid fees by the investors based on the value of the assets in the firm. Numbers around 0.5% are typical. Some mutual funds also charge a fee when the funds are first purchased, called a “load”. For example, if you in ...

PDF - Nedgroup Investments

... both public officials and private investors engaged in some serious flights of fancy. Perhaps believing in myths is the only means to cope with the actions of the few being taken for the many. ...

... both public officials and private investors engaged in some serious flights of fancy. Perhaps believing in myths is the only means to cope with the actions of the few being taken for the many. ...

Speech to Town Hall – Los Angeles Los Angeles, California

... market for mortgage-backed securities seems likely to limit credit flows and therefore to have at least some negative effect on real residential construction, depending on how long the disruptions persist. A key point is that, even as liquidity in mortgage-backed securities markets improves, the ris ...

... market for mortgage-backed securities seems likely to limit credit flows and therefore to have at least some negative effect on real residential construction, depending on how long the disruptions persist. A key point is that, even as liquidity in mortgage-backed securities markets improves, the ris ...

Presentation to the CFA Hawaii Seventh Annual Economic Forecast Dinner

... Indeed, exports are one reason U.S. manufacturers have been creating jobs at a pace not seen since the 1990s. Gross domestic product, or GDP, measures the nation’s total output of goods and services. After adjusting for inflation, GDP grew at less than a 1 percent annual rate in the first half of 20 ...

... Indeed, exports are one reason U.S. manufacturers have been creating jobs at a pace not seen since the 1990s. Gross domestic product, or GDP, measures the nation’s total output of goods and services. After adjusting for inflation, GDP grew at less than a 1 percent annual rate in the first half of 20 ...

– 16 No: 2013 Release Date: 16 April 2013

... weak global economic activity. The current account deficit has increased somewhat following the revival in domestic demand. However, the current policy framework and the decline in commodity prices are expected contain the widening in the current account deficit. Recently, there is a re-acceleration ...

... weak global economic activity. The current account deficit has increased somewhat following the revival in domestic demand. However, the current policy framework and the decline in commodity prices are expected contain the widening in the current account deficit. Recently, there is a re-acceleration ...

1 - BrainMass

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

... b. Since all firms borrow from the same financial markets, all firms have the same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. ...

Economic Turbulence Ahead: How Much, How Long, and What

... Ginnie Mae, and Freddie Mac to underwrite mortgage securities in promotion of the housing sector. Because these institutions have the implicit full faith backing of the U.S. treasury, their activities have promoted morally hazardous lending by underwriting institutions, and which accelerated when mo ...

... Ginnie Mae, and Freddie Mac to underwrite mortgage securities in promotion of the housing sector. Because these institutions have the implicit full faith backing of the U.S. treasury, their activities have promoted morally hazardous lending by underwriting institutions, and which accelerated when mo ...

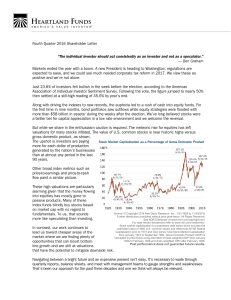

Past performance does not guarantee future results.

... An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Plea ...

... An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Plea ...

Presented at the European Commission DG-ECFIN Conference Ireland’s EU-IMF Programme:

... sustainable given the modest debt ratios that generally prevail, applying them to the levels of indebtedness involved in the European loans was always going to be problematic. All calculations (including those published by the IMF at the programme’s outset), indicated serious sustainability concern ...

... sustainable given the modest debt ratios that generally prevail, applying them to the levels of indebtedness involved in the European loans was always going to be problematic. All calculations (including those published by the IMF at the programme’s outset), indicated serious sustainability concern ...

View as DOC (2) 248 KB

... United States and there is speculation that this will lead to the US tapering the Federal reserves support in the financial markets.. The market, seeing these signs, has already begun to speculate when the need for "Keynesian" support will end, pushing some bond yields higher in advance of the expec ...

... United States and there is speculation that this will lead to the US tapering the Federal reserves support in the financial markets.. The market, seeing these signs, has already begun to speculate when the need for "Keynesian" support will end, pushing some bond yields higher in advance of the expec ...

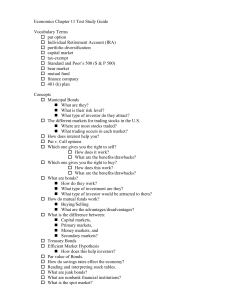

Economics Chapter 11 Test Study Guide

... Which one gives you the right to sell? How does it work? What are the benefits/drawbacks? Which one gives you the right to buy? How does this work? What are the benefits/drawbacks? What are bonds? How do they work? What type of investment are they? What type of investor would be ...

... Which one gives you the right to sell? How does it work? What are the benefits/drawbacks? Which one gives you the right to buy? How does this work? What are the benefits/drawbacks? What are bonds? How do they work? What type of investment are they? What type of investor would be ...