Advisen Industry Report

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

... Widely regarded as one of the financial sector’s most lucrative industries, the investment bank industry has long enjoyed high returns given its involvement in big-ticket transactions with large business establishments and governments. However, high returns often involve great risks, which could con ...

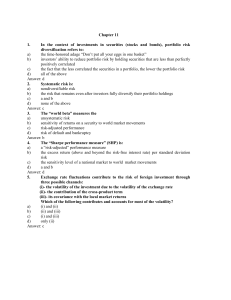

TEST BANK

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

The Fed`s 405% problem

... predictions of an ‘EM crisis’; they were far more resilient than the moves in asset prices would suggest. The fact that investors still overreact to global events shows that Emerging Markets is still misunderstood in many quarters. The actual fall-out from three months of severe outflows, currency v ...

... predictions of an ‘EM crisis’; they were far more resilient than the moves in asset prices would suggest. The fact that investors still overreact to global events shows that Emerging Markets is still misunderstood in many quarters. The actual fall-out from three months of severe outflows, currency v ...

Financial Market Development Financial Education and Financial Regulation in Asia

... share of investment trusts and Mutual Fund ...

... share of investment trusts and Mutual Fund ...

Problem Set - Kanit Kuevibulvanich

... - It can be concluded that, if US Dollar appreciates, US net exports [ rise / fall ]. - (Bonus) Furthermore, it can be said that Japanese Yen has [ appreciated / depreciated ]. 17. If US interest rate is higher than other countries - Then US asset is [ more / less ] attractive to foreign investors/s ...

... - It can be concluded that, if US Dollar appreciates, US net exports [ rise / fall ]. - (Bonus) Furthermore, it can be said that Japanese Yen has [ appreciated / depreciated ]. 17. If US interest rate is higher than other countries - Then US asset is [ more / less ] attractive to foreign investors/s ...

LR Global Bangladesh: Weekly News Update Reporting Week: 12th

... Investment ratio to GDP grows in FY16 Public investment increased to 7.60% while that of private investment to 21.78% in FY16. Investment ratio to the GDP was 28.89% in the 2014-15 fiscal year due to the development in investment situation. The private sector investment ratio to the GDP was then 22. ...

... Investment ratio to GDP grows in FY16 Public investment increased to 7.60% while that of private investment to 21.78% in FY16. Investment ratio to the GDP was 28.89% in the 2014-15 fiscal year due to the development in investment situation. The private sector investment ratio to the GDP was then 22. ...

FT One of the few active operators

... German banks are among the only institutions in Europe still willing to finance real estate deals, and the country’s cash-rich open-ended funds dominate global property investment. The biggest economy in Europe, Germany’s dominant export performance recorded solid growth in gross domestic product in ...

... German banks are among the only institutions in Europe still willing to finance real estate deals, and the country’s cash-rich open-ended funds dominate global property investment. The biggest economy in Europe, Germany’s dominant export performance recorded solid growth in gross domestic product in ...

Real versus Financial Assets All financial assets (owner of the claim)

... o Managing foreign exchange o International diversification reduces risk o Instruments and vehicles continue to develop (ADRs and WEBs) o Information and analysis improves ...

... o Managing foreign exchange o International diversification reduces risk o Instruments and vehicles continue to develop (ADRs and WEBs) o Information and analysis improves ...

Nearly seven years have passed since the last reces-

... form of a “Taylor rule,” whereby a short-term nominal interest rate (the federal funds rate) is adjusted in response to inflation and some measure of real economic activity. Using such a framework,Taylor (1999) shows that estimated versions of the Fed’s policy rule can help account for the “Great In ...

... form of a “Taylor rule,” whereby a short-term nominal interest rate (the federal funds rate) is adjusted in response to inflation and some measure of real economic activity. Using such a framework,Taylor (1999) shows that estimated versions of the Fed’s policy rule can help account for the “Great In ...

The market environment for 2015

... Disclaimer: The views expressed are the opinions of the writer and while believed reliable may differ from the views of Butterfield Bank (Cayman) Ltd. The bank accepts no liability for errors or actions taken on the basis of this information. ...

... Disclaimer: The views expressed are the opinions of the writer and while believed reliable may differ from the views of Butterfield Bank (Cayman) Ltd. The bank accepts no liability for errors or actions taken on the basis of this information. ...

Linear Regression 1

... • “Parents will have to navigate unfamiliar and difficult terrain when it comes time to pay for college this year, with student loan companies in turmoil and banks tightening their standards and raising rates on other types of borrowing.” • “Lawmakers and the administration are trying to head off an ...

... • “Parents will have to navigate unfamiliar and difficult terrain when it comes time to pay for college this year, with student loan companies in turmoil and banks tightening their standards and raising rates on other types of borrowing.” • “Lawmakers and the administration are trying to head off an ...

THE CHANGING ROLE OF THE BANKS The luxury of the

... competitive drive. Savings bank ratios are another example, although their reduction in recent years in the face of deposit-gathering difficulties and housing loan requirements has made this problem an historical one in so far as its effect today lies in the stock of low-interest official and semi-o ...

... competitive drive. Savings bank ratios are another example, although their reduction in recent years in the face of deposit-gathering difficulties and housing loan requirements has made this problem an historical one in so far as its effect today lies in the stock of low-interest official and semi-o ...

How Ultralow Interest Rates Could Backfire

... them a negative rate on their accounts. For example, between early 2015 and mid-2016 Sweden’s Riksbank pushed its policy rate from zero to minus 0.5%. Loan rates by commercial banks also dropped, but not as much, and their deposit rates, which were already at zero, barely fell at all. This also affe ...

... them a negative rate on their accounts. For example, between early 2015 and mid-2016 Sweden’s Riksbank pushed its policy rate from zero to minus 0.5%. Loan rates by commercial banks also dropped, but not as much, and their deposit rates, which were already at zero, barely fell at all. This also affe ...

Chapter 3: The IS

... • Price is rigid only in the short run. • In the long run, price is flexible and output is at the full employment level (QF). • From (5), the interest rate is constant, r=rF as well. • Consider the equilibrium in the money market: M0/P = kQF-hrF. An increase in the money stock leads to price increas ...

... • Price is rigid only in the short run. • In the long run, price is flexible and output is at the full employment level (QF). • From (5), the interest rate is constant, r=rF as well. • Consider the equilibrium in the money market: M0/P = kQF-hrF. An increase in the money stock leads to price increas ...

Should the Riksbank issue e-krona?

... Should the Riksbank issue e-krona? • The printing press made it possible to print banknotes in its time – our current technology enables electronic payments • E-krona – a complement to banknotes and coins – not intended to replace them ...

... Should the Riksbank issue e-krona? • The printing press made it possible to print banknotes in its time – our current technology enables electronic payments • E-krona – a complement to banknotes and coins – not intended to replace them ...

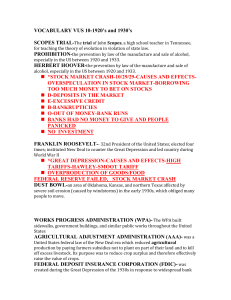

VOCABULARY VUS 10-1920`s and 1930`s SCOPES TRIAL

... sidewalks, government buildings, and similar public works throughout the United States AGRICULTURAL ADJUSTMENT ADMINISTRATION (AAA)- was a United States federal law of the New Deal era which reduced agricultural production by paying farmers subsidies not to plant on part of their land and to kill of ...

... sidewalks, government buildings, and similar public works throughout the United States AGRICULTURAL ADJUSTMENT ADMINISTRATION (AAA)- was a United States federal law of the New Deal era which reduced agricultural production by paying farmers subsidies not to plant on part of their land and to kill of ...

OVERVIEW

... The global financial crisis, which started in the Unites States of America in the second half of 2007 and expanded its area of impact by subsequently spilling over to Europe and Asia, entered a new phase when Lehman Brothers–one of the leading investment banks in the US– filed for bankruptcy protect ...

... The global financial crisis, which started in the Unites States of America in the second half of 2007 and expanded its area of impact by subsequently spilling over to Europe and Asia, entered a new phase when Lehman Brothers–one of the leading investment banks in the US– filed for bankruptcy protect ...

Problem Set 3 Answers - University of Wisconsin–Madison

... dramatically because individuals and firms with the riskiest investment projects are the ones who are most willing to pay higher interest rates. A sharp rise in interest rates which increases adverse selection means that lenders will be more reluctant to lend, leading to a financial crisis in which ...

... dramatically because individuals and firms with the riskiest investment projects are the ones who are most willing to pay higher interest rates. A sharp rise in interest rates which increases adverse selection means that lenders will be more reluctant to lend, leading to a financial crisis in which ...

CLOUDY IN AMERICA, CLEARING IN CHINA

... unemployment rather than monetary stability. The Fed could face political pressure to support U.S. bond prices if global demand declines. Fed action could keep long-term interest rates artificially low but would fail as investors flee the dollar. As of late 2009, the Fed was paying interest on more ...

... unemployment rather than monetary stability. The Fed could face political pressure to support U.S. bond prices if global demand declines. Fed action could keep long-term interest rates artificially low but would fail as investors flee the dollar. As of late 2009, the Fed was paying interest on more ...

As of 30 June 2008 Official Less “weak” capital

... to the test and found seriously lacking. • The framework violated the insurance principle of pooling and ignored the difference between insuring in one’s own currency and that of others. • Unclear regulation has also proved unhelpful in a dispute between Iceland and the UK and Netherlands concerning ...

... to the test and found seriously lacking. • The framework violated the insurance principle of pooling and ignored the difference between insuring in one’s own currency and that of others. • Unclear regulation has also proved unhelpful in a dispute between Iceland and the UK and Netherlands concerning ...

Mr Chairman, there is already a year and a half since

... of provisioning performed by Greek banks during the last 30 years. In doing so, on the one hand we build our defences should things evolve worse than expected, and on the other we give an indication to the market that we will emerge from the crisis as winners. On this point, we have the backing of t ...

... of provisioning performed by Greek banks during the last 30 years. In doing so, on the one hand we build our defences should things evolve worse than expected, and on the other we give an indication to the market that we will emerge from the crisis as winners. On this point, we have the backing of t ...

Financial Markets and Institutions

... When the markets for borrowing and saving operate perfectly, there is no connection between the timing of income from the investment and the timing of the owner’s personal consumption. ...

... When the markets for borrowing and saving operate perfectly, there is no connection between the timing of income from the investment and the timing of the owner’s personal consumption. ...

Why Has Good Economic News Hurt Financial Markets?

... that risks to the current moderate economic expansion have gone down. Assuming recovery continues, the Fed plans to begin reducing the economic support it has provided over the last couple of years. By the end of the year, the Fed could start reversing policies that have injected money into the econ ...

... that risks to the current moderate economic expansion have gone down. Assuming recovery continues, the Fed plans to begin reducing the economic support it has provided over the last couple of years. By the end of the year, the Fed could start reversing policies that have injected money into the econ ...

Questions from Chapter 3 - Purdue Agricultural Economics

... 10. How much cash does Gray Computer Co. have if the firm has a current ratio of 2.5, a quick ratio of 1.2, and current liabilities of $12,000? Gray’s credit sales are $98,000 and its average collection period is 40 days. (Assume 365 days per year.) a. $3,660 b. $14,440 c. $10,740 d. None of the ab ...

... 10. How much cash does Gray Computer Co. have if the firm has a current ratio of 2.5, a quick ratio of 1.2, and current liabilities of $12,000? Gray’s credit sales are $98,000 and its average collection period is 40 days. (Assume 365 days per year.) a. $3,660 b. $14,440 c. $10,740 d. None of the ab ...

The challenge of bad loans is likely to persist

... current crisis highlights the importance of linking the macroeconomic conditions to the health of the banking industry. It also highlights the structural vulnerability in the financial industry to shocks, in particular losses in the loan books. In fact the main goal of macroeconomic stress tests, wh ...

... current crisis highlights the importance of linking the macroeconomic conditions to the health of the banking industry. It also highlights the structural vulnerability in the financial industry to shocks, in particular losses in the loan books. In fact the main goal of macroeconomic stress tests, wh ...