Back To School Early September is a time for transition, often from

... June. Second, throughout the globe, we have seen significant changes in policy. The longawaited tapering of asset purchases by the Federal Reserve is expected to begin this month, just as Japan tries to implement real structural reform. Finally, the tragic events in Syria remind us that tensions in ...

... June. Second, throughout the globe, we have seen significant changes in policy. The longawaited tapering of asset purchases by the Federal Reserve is expected to begin this month, just as Japan tries to implement real structural reform. Finally, the tragic events in Syria remind us that tensions in ...

Less is More Size: 29kb Last modified: Sat

... risk their survival. Yet, Banks continue to cling to obsolete business models including universal banking and originate to distribute. The universal banking model has been revived during the credit crisis by regulators and institutions like Citi among others. They believe the stability of earnings a ...

... risk their survival. Yet, Banks continue to cling to obsolete business models including universal banking and originate to distribute. The universal banking model has been revived during the credit crisis by regulators and institutions like Citi among others. They believe the stability of earnings a ...

FRBSF L CONOMIC

... warrant exceptionally low levels of the federal funds rate for an extended period.” This guidance indicates that the length of the “extended period” depends on the expected path of unemployment and inflation. Similarly, the benchmark policy rule would prescribe an earlier or later increase in the fu ...

... warrant exceptionally low levels of the federal funds rate for an extended period.” This guidance indicates that the length of the “extended period” depends on the expected path of unemployment and inflation. Similarly, the benchmark policy rule would prescribe an earlier or later increase in the fu ...

money - MLedford

... - checking accounts - money market accounts – money lent to the bank for a short period - certificates of deposit (CDs) – money lent to the bank for a longer period of time. (money held in a checking account is a demand deposit, because checks are paid “on demand”; CDs are time deposits, because the ...

... - checking accounts - money market accounts – money lent to the bank for a short period - certificates of deposit (CDs) – money lent to the bank for a longer period of time. (money held in a checking account is a demand deposit, because checks are paid “on demand”; CDs are time deposits, because the ...

US History Standard 6.3

... Early in the 1920s, the Federal Reserve pursued easy credit policies. By charging low interest rates on its loans to member banks, the Fed helped to fuel the stock market speculation mania. In the late 1920s, the Federal Reserve initiated a tight money strategy in an effort to curb stock market spec ...

... Early in the 1920s, the Federal Reserve pursued easy credit policies. By charging low interest rates on its loans to member banks, the Fed helped to fuel the stock market speculation mania. In the late 1920s, the Federal Reserve initiated a tight money strategy in an effort to curb stock market spec ...

rciukrainepowerpoints1_files/Day 1

... -No non-bank financial regulation in place -Substantial deposit outflows in 4th quarter 2008 and 1st quarter ...

... -No non-bank financial regulation in place -Substantial deposit outflows in 4th quarter 2008 and 1st quarter ...

Opt for short-term debt funds as an alternative to FDs

... With interest rates in fixed Radhakrishnan, head of fixed deposits (FDs) in banks income, SBI Mutual Fund. declining, an option before FD One advantage of investing investors is to look at debt in these funds is that if interest funds, which carry low risk. rates begin to rise, the returns The inter ...

... With interest rates in fixed Radhakrishnan, head of fixed deposits (FDs) in banks income, SBI Mutual Fund. declining, an option before FD One advantage of investing investors is to look at debt in these funds is that if interest funds, which carry low risk. rates begin to rise, the returns The inter ...

bworld12050603 - Bureau of the Treasury

... investors access to higher-yielding securities as well as to raise funds to finance its budgetary needs for 2004. The government wants to seize the opportunity to borrow while it is still relatively cheap to sell bonds ahead of next year’s polls when the money market is expected to be more volatile. ...

... investors access to higher-yielding securities as well as to raise funds to finance its budgetary needs for 2004. The government wants to seize the opportunity to borrow while it is still relatively cheap to sell bonds ahead of next year’s polls when the money market is expected to be more volatile. ...

continued from cover - Association Reserves

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

Caryl Communications Draft for __CWNJ_136047___(client)

... A: “We’re finding deals and would like to find more of them—and there should be more of them. There are people that are buying debt and looking for financing, and we would like to help finance them to give them the chance.” Q: In terms of traditional assets, how can risk be minimized going forward? ...

... A: “We’re finding deals and would like to find more of them—and there should be more of them. There are people that are buying debt and looking for financing, and we would like to help finance them to give them the chance.” Q: In terms of traditional assets, how can risk be minimized going forward? ...

Fed Focus: Fresno—Partners With Business Holiday Inn Centre Plaza, Fresno, California

... Finally--and very importantly--the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

... Finally--and very importantly--the Fed’s conduct of monetary policy contributes to the long-run health of the economy by promoting maximum sustainable employment and stable prices. ...

Multiple Choice Tutorial Chapter 33 International Trade

... protect yourself from the uncertainties of the market. To add an element of certainty to your business you enter into a ______ _______ with a bank. a. futures contract b. balloon payment c. vertical contract A. A futures contract is a way to hedge your bets on some future event. In this case the far ...

... protect yourself from the uncertainties of the market. To add an element of certainty to your business you enter into a ______ _______ with a bank. a. futures contract b. balloon payment c. vertical contract A. A futures contract is a way to hedge your bets on some future event. In this case the far ...

House prices could rise up to 7% in 2014

... 3% to 5% rise in house prices over 2013. “I still think that’s the case, 5% to 7% is the next increment but I don’t think we will see that this year,” he told The Australian Financial Review. RP Data-Rismark has dwelling values across the eight capital cities up 2.3% for the first four months of the ...

... 3% to 5% rise in house prices over 2013. “I still think that’s the case, 5% to 7% is the next increment but I don’t think we will see that this year,” he told The Australian Financial Review. RP Data-Rismark has dwelling values across the eight capital cities up 2.3% for the first four months of the ...

Chapter 12: Monetary Policy

... II. Powers of the Fed A. General Powers i. Open-Market Operations While the Fed trades a variety of short- and long-term debt instruments in an effort to influence the economy, the main one is the Treasury Bill (t-bills), the most stable and risk-free asset. a. Expansionary example: Fed buys $200 Bi ...

... II. Powers of the Fed A. General Powers i. Open-Market Operations While the Fed trades a variety of short- and long-term debt instruments in an effort to influence the economy, the main one is the Treasury Bill (t-bills), the most stable and risk-free asset. a. Expansionary example: Fed buys $200 Bi ...

Beggar-Thy-Neighbor Interest Rate Policies

... belief can still influence U.S. government policies. American China bashing today to appreciate the renminbi, or Japan bashing back in the 1970s through the mid 1990s to appreciate the yen, were aimed at reducing their trade surpluses—but neither succeeded in doing so. Although nobody loves the doll ...

... belief can still influence U.S. government policies. American China bashing today to appreciate the renminbi, or Japan bashing back in the 1970s through the mid 1990s to appreciate the yen, were aimed at reducing their trade surpluses—but neither succeeded in doing so. Although nobody loves the doll ...

Lecture 10 Chapter 11 PPT

... Another Example of Avoiding Regulation • Eurodollars • Dollar denominated deposits in foreign banks or foreign branches of US banks. • Sweep Accounts: Funds are “swept” out of checking accounts nightly and invested at overnight rates. Since they are no longer checkable deposits, reserve requirement ...

... Another Example of Avoiding Regulation • Eurodollars • Dollar denominated deposits in foreign banks or foreign branches of US banks. • Sweep Accounts: Funds are “swept” out of checking accounts nightly and invested at overnight rates. Since they are no longer checkable deposits, reserve requirement ...

Real versus Financial Assets

... o Money market instruments Bank certificates of deposit, T-bills, commercial paper, etc. o Capital market instrument Treasury Bonds • Common stock o Ownership stake in thecorporation, residual cash flow • Derivative securities o Securities providing payoffs that depend on the values of other assets ...

... o Money market instruments Bank certificates of deposit, T-bills, commercial paper, etc. o Capital market instrument Treasury Bonds • Common stock o Ownership stake in thecorporation, residual cash flow • Derivative securities o Securities providing payoffs that depend on the values of other assets ...

The End of The World Is Off The Table

... A Couple of Other Notes We wanted to get in front of a headline that will likely become a bigger issue during the current quarter, “Brexit.” On June 23rd, citizens of Britain will hold a referendum on whether or not to exit the European Union (EU). The EU is a political/economic union of 28 primaril ...

... A Couple of Other Notes We wanted to get in front of a headline that will likely become a bigger issue during the current quarter, “Brexit.” On June 23rd, citizens of Britain will hold a referendum on whether or not to exit the European Union (EU). The EU is a political/economic union of 28 primaril ...

- Wasatch Advisors

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

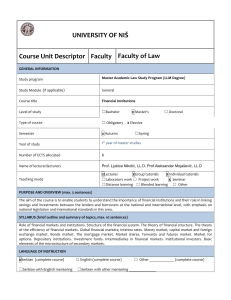

Financial Institutions

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

... The aim of the course is to enable students to understand the importance of financial institutions and their role in linking savings and investments between the lenders and borrowers at the national and international level, with emphasis on national legislation and international standards in this ar ...

MONETARY POLICY MEASURES

... Repo Rate The repo rate under the Liquidity Adjustment Facility (LAF) has been retained at 4.75 per cent. Reverse Repo Rate The reverse repo rate under the LAF has been retained at 3.25 per cent. ...

... Repo Rate The repo rate under the Liquidity Adjustment Facility (LAF) has been retained at 4.75 per cent. Reverse Repo Rate The reverse repo rate under the LAF has been retained at 3.25 per cent. ...

How does a monetary policy affect the economy

... are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attractive, thus people will switch to them instead of equity. This is very marked in firms investment decisions – they will not invest when they can obtain more money by puttin ...

... are reluctant to invest, they rather buy up existing firms. Keynesians also argue that interest rate rise makes bonds more attractive, thus people will switch to them instead of equity. This is very marked in firms investment decisions – they will not invest when they can obtain more money by puttin ...

Our investment approach in the current market environment

... Zuger Kantonalbank focuses its portfolios rigorously on the long-term anticipated market environment. In this conjunction, attention is paid in particular to long-term interest rate trends and anticipated growth. This is in order to base its decisions on the soundest possible foundations. ...

... Zuger Kantonalbank focuses its portfolios rigorously on the long-term anticipated market environment. In this conjunction, attention is paid in particular to long-term interest rate trends and anticipated growth. This is in order to base its decisions on the soundest possible foundations. ...