Securities Lending in the Emerging Markets

... A majority of securities lending transactions take place in developed markets; however, as investor portfolios become more heavily weighted toward emerging markets, they are increasingly looking at lending these securities to earn additional income for their funds. However, investors seeking to enga ...

... A majority of securities lending transactions take place in developed markets; however, as investor portfolios become more heavily weighted toward emerging markets, they are increasingly looking at lending these securities to earn additional income for their funds. However, investors seeking to enga ...

Quarterly Newsletter - October 2011 : Pinney and Scofield : http

... very important to understand both the power and the limits of unconventional monetary policy. In the U.S. and Europe there are budget problems, i.e. political problems. The markets know that long-term government expenditures are unfunded. This causes investors to worry that these expenditures might ...

... very important to understand both the power and the limits of unconventional monetary policy. In the U.S. and Europe there are budget problems, i.e. political problems. The markets know that long-term government expenditures are unfunded. This causes investors to worry that these expenditures might ...

Marketing research, market orientation and customer

... interrelationships between these streams of research. ...

... interrelationships between these streams of research. ...

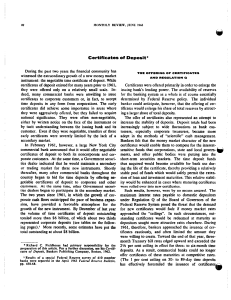

Certificates of Deposit - Federal Reserve Bank of New York

... The lesser marketability of nonprime certificates is The deposit of tune funds at commercial banks is reflected both in the interest rates at which they are guided both by interest rate considerations and by bank- originally issued and in the rates at which they trade customer relationships. Many co ...

... The lesser marketability of nonprime certificates is The deposit of tune funds at commercial banks is reflected both in the interest rates at which they are guided both by interest rate considerations and by bank- originally issued and in the rates at which they trade customer relationships. Many co ...

February 6, 2015

... Pfizer offers to buy Hospira on Thursday, for $90 per share in cash, or $17 billion including debt, a 39% premium to Hospira’s closing stock price on Wednesday. It expects the deal to close later this year. Hospira stock increased by 35% to nearly $88 on Thursday, while Pfizer stock rose 2.7% to $32 ...

... Pfizer offers to buy Hospira on Thursday, for $90 per share in cash, or $17 billion including debt, a 39% premium to Hospira’s closing stock price on Wednesday. It expects the deal to close later this year. Hospira stock increased by 35% to nearly $88 on Thursday, while Pfizer stock rose 2.7% to $32 ...

Reading Ch 2 A Tycoon Of The MUTUAL FUNDS

... Liquidity. Several sorts of mutual funds put their funds into so-called money markets, which deal in short-term Treasury bills, commercial paper and the like. These act much like savings accounts (but pay a higher interest rate) with the goal of keeping funds liquid, or easily transferred into other ...

... Liquidity. Several sorts of mutual funds put their funds into so-called money markets, which deal in short-term Treasury bills, commercial paper and the like. These act much like savings accounts (but pay a higher interest rate) with the goal of keeping funds liquid, or easily transferred into other ...

Gaining Trust

... the likelihood of another hike this year plummeted as traders anticipated that decelerating growth would force the Fed to delay tightening. After the release of the June jobs report, the odds of a 2016 hike rebounded to at least 25%.4 We believe Fed officials will delay a hike to allow more time to ...

... the likelihood of another hike this year plummeted as traders anticipated that decelerating growth would force the Fed to delay tightening. After the release of the June jobs report, the odds of a 2016 hike rebounded to at least 25%.4 We believe Fed officials will delay a hike to allow more time to ...

MGMT-005 Final Key - Kids in Prison Program

... money, they can utilize the information in their own personal finances as well as guide and answer questions from bank customers. The bank recently hired Laila. She was hired at a high-level position because she brought with her extensive bank management experience. Laila’s responsibilities included ...

... money, they can utilize the information in their own personal finances as well as guide and answer questions from bank customers. The bank recently hired Laila. She was hired at a high-level position because she brought with her extensive bank management experience. Laila’s responsibilities included ...

Michael Shulman - AAII

... • Real world recession • Real world debt crisis and credit contraction • A casino market ...

... • Real world recession • Real world debt crisis and credit contraction • A casino market ...

Practice set and Solutions 1

... 1) A mutual fund represents a pool of financial resources obtained from individuals and companies, which is invested in the money and capital markets. This process represents another method for economic savers to channel funds to companies and government units that need extra funds. 2) Money market ...

... 1) A mutual fund represents a pool of financial resources obtained from individuals and companies, which is invested in the money and capital markets. This process represents another method for economic savers to channel funds to companies and government units that need extra funds. 2) Money market ...

A key challenge and a solution to our sustainable development

... portfolio investors. Analysis of our financial system indicates that part of the mentioned sources of long term financing are intermediated through our financial system that include banks, microfinance institutions, pension funds, insurance firms and capital markets -- but a large part of long-term ...

... portfolio investors. Analysis of our financial system indicates that part of the mentioned sources of long term financing are intermediated through our financial system that include banks, microfinance institutions, pension funds, insurance firms and capital markets -- but a large part of long-term ...

Copyright ©2006-16 SirChartsAlot, Inc All rights reserved 1 Global

... Given the odds for the incumbent party, to retain the White House for

four more years, the odds also favor the S&P-500 index climbing higher over the

next three months. Yet surprisingly, Goldman Sachs , is bucking the “bullish”

presidential polls. On July 30th, GS predicted the recen ...

... Given the odds for the incumbent party

What is Forex?

... • The exchange rate is determined through the interaction of market forces dealing with supply and demand. • The value of a currency, in the simplest explanation, is a reflection of the condition of that country's economy with respect to other major economies. ...

... • The exchange rate is determined through the interaction of market forces dealing with supply and demand. • The value of a currency, in the simplest explanation, is a reflection of the condition of that country's economy with respect to other major economies. ...

Flash Notes

... the direction of domestic short term rates will primarily be driven by changes in US interest rates. For 2017, we expect three rate hikes from the Fed, bringing the FFTR to 1.5% by end-2017 from 0.5-0.75% presently. While the increase will not be one-for-one, we still expect Singapore domestic rates ...

... the direction of domestic short term rates will primarily be driven by changes in US interest rates. For 2017, we expect three rate hikes from the Fed, bringing the FFTR to 1.5% by end-2017 from 0.5-0.75% presently. While the increase will not be one-for-one, we still expect Singapore domestic rates ...

NAV | KWD 1.05938 (As of 29-Nov-16)

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

RBI IFRS Session - Impairment

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

FRBSF E L CONOMIC ETTER

... rates compared with expected future rates on short-term debt—in other words, an unusually low term premium (see Swanson, forthcoming). Other indications can be found in the very low options-based implied volatilities on most types of financial instruments, including equities, debt, and exchange rate ...

... rates compared with expected future rates on short-term debt—in other words, an unusually low term premium (see Swanson, forthcoming). Other indications can be found in the very low options-based implied volatilities on most types of financial instruments, including equities, debt, and exchange rate ...

The Relationship Between Rising Rates And Rising Ringgit

... factors affecting supply and demand are interest rates and the overall strength of the economy. Country Of Case Study: Malaysia While the Malaysian economy is seen to be fairly stable, the main question on investors’ minds is this – the direction of interest rates. If a country raises its interest r ...

... factors affecting supply and demand are interest rates and the overall strength of the economy. Country Of Case Study: Malaysia While the Malaysian economy is seen to be fairly stable, the main question on investors’ minds is this – the direction of interest rates. If a country raises its interest r ...

Factors explaining the robust growth of M1

... circulation have accounted for, on average, around one-quarter of annual M1 growth over the past three years (see Chart A). Even after four years, the unwinding of effects related to the cash changeover is still ongoing. The annual growth rate of currency in circulation has gradually declined, but, ...

... circulation have accounted for, on average, around one-quarter of annual M1 growth over the past three years (see Chart A). Even after four years, the unwinding of effects related to the cash changeover is still ongoing. The annual growth rate of currency in circulation has gradually declined, but, ...

BACK TO THE FUTURE FOR THE FED

... monetary policy after nine years of Treasury dominance. Beginning in April 1942, shortly after U.S. entry into World War II, the Fed agreed to cap interest rates on Treasury bonds in order to help finance the war effort. The cap meant that the Fed had given up control of interest rate policy. It als ...

... monetary policy after nine years of Treasury dominance. Beginning in April 1942, shortly after U.S. entry into World War II, the Fed agreed to cap interest rates on Treasury bonds in order to help finance the war effort. The cap meant that the Fed had given up control of interest rate policy. It als ...

Stefan Gerlach Alberto Giovannini Cédric Tille 17 July 2009, VOX

... risk leading to a credit crunch in certain circumstances. Similarly, regulatory authorities must recognise that interest rate changes can have systemic implications for the financial sector. In particular, a period of sustained low interest rates can lead to a search for yield that builds up excessi ...

... risk leading to a credit crunch in certain circumstances. Similarly, regulatory authorities must recognise that interest rate changes can have systemic implications for the financial sector. In particular, a period of sustained low interest rates can lead to a search for yield that builds up excessi ...

February 2015 - Daiwa Capital Markets

... GDP growth rates of 2½-3%Q/Q ann. to be sustained through 2015. Indeed, significant positive momentum persists in the labour market, with the unemployment rate down to 5.7% in January and non-farm payrolls up on average over the past three months by more than 330k, the firmest since the late ‘90s. A ...

... GDP growth rates of 2½-3%Q/Q ann. to be sustained through 2015. Indeed, significant positive momentum persists in the labour market, with the unemployment rate down to 5.7% in January and non-farm payrolls up on average over the past three months by more than 330k, the firmest since the late ‘90s. A ...