saving and investing slide show

... and types of securities purchased to make up the fund. • Represents partial ownership in fund’s collective holdings. Dividends paid can be re-directed into the company or cashed for personal projects. – Everyone in the fund shares the wealth or lose together ...

... and types of securities purchased to make up the fund. • Represents partial ownership in fund’s collective holdings. Dividends paid can be re-directed into the company or cashed for personal projects. – Everyone in the fund shares the wealth or lose together ...

ECB Fumbles the Stimulus-Baton Hand

... Meanwhile, Ms. Yellen may have more a fight on her hands with the Fed’s doves than expected. During the Q&A of her speech on Wednesday, she noted that they may have to “tolerate some dissent.” In recent days, two Fed governors have made dovish public statements. “The way she talked about expecting d ...

... Meanwhile, Ms. Yellen may have more a fight on her hands with the Fed’s doves than expected. During the Q&A of her speech on Wednesday, she noted that they may have to “tolerate some dissent.” In recent days, two Fed governors have made dovish public statements. “The way she talked about expecting d ...

Fixed Term Deposit redemption prior to maturity

... Fixed Term Deposit redemption prior to maturity Specific information is being collected from you when you complete this form. You are not obliged to provide this personal information, but without it, your request may not be completed. The personal information provided on this form may be disclosed t ...

... Fixed Term Deposit redemption prior to maturity Specific information is being collected from you when you complete this form. You are not obliged to provide this personal information, but without it, your request may not be completed. The personal information provided on this form may be disclosed t ...

Overview of the Financial System

... (immoral) from the lender’s point of view, because they make it less likely that the loan will be paid back. Because moral hazard lowers the probability that the loan will be repaid, lenders may decide that they would rather not make a loan. ...

... (immoral) from the lender’s point of view, because they make it less likely that the loan will be paid back. Because moral hazard lowers the probability that the loan will be repaid, lenders may decide that they would rather not make a loan. ...

U.S. Monetary Policy: An Introduction

... problems in the financial system. It can lead to significant declines in the value of collateral owned by households and firms, making it more difficult to borrow.And falling collateral values may force lenders to call in outstanding loans, which would force firms to cut back their scale of operatio ...

... problems in the financial system. It can lead to significant declines in the value of collateral owned by households and firms, making it more difficult to borrow.And falling collateral values may force lenders to call in outstanding loans, which would force firms to cut back their scale of operatio ...

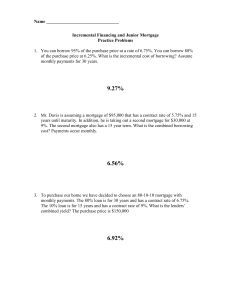

Adjustable Rate Mortgage

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

Regulatory Analyst, Derivatives

... or Financial Risk Manager (FRM) program is considered an asset. An understanding of Alberta and North American power, gas and/or crude markets terminology and current energy trading practices, market trends and marketplace terminology is considered an asset. ...

... or Financial Risk Manager (FRM) program is considered an asset. An understanding of Alberta and North American power, gas and/or crude markets terminology and current energy trading practices, market trends and marketplace terminology is considered an asset. ...

Winter 2015 - RBC Wealth Management

... About the same time oil prices began to weaken. Since then, oil has dropped by almost 60%. Outsized moves have also occurred in the US dollar, the Canadian Dollar and other world currencies and the whole commodity complex. Interest rates have not gone up – they have dropped massively and in some cou ...

... About the same time oil prices began to weaken. Since then, oil has dropped by almost 60%. Outsized moves have also occurred in the US dollar, the Canadian Dollar and other world currencies and the whole commodity complex. Interest rates have not gone up – they have dropped massively and in some cou ...

Session 33- Market Timing Indicators II

... prior year (Interest Ratet-1), we arrive at the following results: Interest Ratet = 0.0139 - 0.1456 Interest Ratet-1 R2=.0728 ...

... prior year (Interest Ratet-1), we arrive at the following results: Interest Ratet = 0.0139 - 0.1456 Interest Ratet-1 R2=.0728 ...

Cash or liquid asset management

... Financial Executive face-to-face Open an account & discuss investment options Place orders for stocks, bonds, & mutual funds And much more! ...

... Financial Executive face-to-face Open an account & discuss investment options Place orders for stocks, bonds, & mutual funds And much more! ...

Presentation to the Center for Economics and Public Policy UC Irvine

... discussing economic risks and where the FOMC thinks monetary policy may be headed.6 It’s interesting to note that the statement language typically has bigger effects on financial conditions than the federal funds rate decision itself.7 That’s not that surprising. After all, the current level of the ...

... discussing economic risks and where the FOMC thinks monetary policy may be headed.6 It’s interesting to note that the statement language typically has bigger effects on financial conditions than the federal funds rate decision itself.7 That’s not that surprising. After all, the current level of the ...

SPECIAL TOPIC: Building a Circular Flow Diagram McCaffery © F

... As long as X = M the Capital Inflows arrow is unnecessary. But they seldom do equal each other. The difference is found in the Capital Inflows arrow. If we purchase $7 of Imports from foreign economies and they only use $3 of those dollars to buy our Goods and Services, our exports, then they are le ...

... As long as X = M the Capital Inflows arrow is unnecessary. But they seldom do equal each other. The difference is found in the Capital Inflows arrow. If we purchase $7 of Imports from foreign economies and they only use $3 of those dollars to buy our Goods and Services, our exports, then they are le ...

The role of hedge funds (II)

... Is the relatively limited systemic impact of the recent failure of Amaranth a sufficient source of comfort? Probably not. The fact that Amaranth could manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk manage ...

... Is the relatively limited systemic impact of the recent failure of Amaranth a sufficient source of comfort? Probably not. The fact that Amaranth could manage to accumulate highly concentrated positions in the energy futures markets without the market knowing it suggests that counterparty-risk manage ...

Report

... easing: it targeted current account balances held by financial institutions by providing liquidity, allowing reserve balances to rise. At the same time, the BOJ issued what is now called “forward guidance” by openly committing to keep the policy until consumer prices’ annual rate of change was a sta ...

... easing: it targeted current account balances held by financial institutions by providing liquidity, allowing reserve balances to rise. At the same time, the BOJ issued what is now called “forward guidance” by openly committing to keep the policy until consumer prices’ annual rate of change was a sta ...

Short-Term Savings Vehicles: Money Markets, MARS and VRDOs

... risk associated with money market funds while potentially receiving higher returns. The article also describes how the bonds are structured and discusses when it might be appropriate for investors to include either MARS or VRDOs in their portfolios. ...

... risk associated with money market funds while potentially receiving higher returns. The article also describes how the bonds are structured and discusses when it might be appropriate for investors to include either MARS or VRDOs in their portfolios. ...

DOCX - World bank documents

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

- the Other Canon

... activity; and the proprietary purchase and sale of financial assets to benefit from pricing differentials that occur at a point in time or over time.8 These two activity types are significant from a Schumpeterian perspective, since the form aims to increase total income and wealth, while the latter ...

... activity; and the proprietary purchase and sale of financial assets to benefit from pricing differentials that occur at a point in time or over time.8 These two activity types are significant from a Schumpeterian perspective, since the form aims to increase total income and wealth, while the latter ...

BM18_14TrusteeReport_Presentation_en

... Source: Office of Federal Housing Enterprise Oversight Mortgage Bankers Association, as reported by the Federal Reserve Bank of San Francisco ...

... Source: Office of Federal Housing Enterprise Oversight Mortgage Bankers Association, as reported by the Federal Reserve Bank of San Francisco ...

Introduction - Princeton University Press

... while also lending the United States the money to pay for these im ports. The world was in a sweet but unsustainable spot. ...

... while also lending the United States the money to pay for these im ports. The world was in a sweet but unsustainable spot. ...

University of Toronto

... 1.Fundamental Characteristics of the Financial Industry, and the Natural Evolution Key issues: Apparent Features and Trends (what are the unique features of the financial market?); Fundamental Causes (why are they being so?); Policy Implication (why should the financial system be regulated by govern ...

... 1.Fundamental Characteristics of the Financial Industry, and the Natural Evolution Key issues: Apparent Features and Trends (what are the unique features of the financial market?); Fundamental Causes (why are they being so?); Policy Implication (why should the financial system be regulated by govern ...

FINAL Financial Stability Fact Sheet

... contributing to and potentially accelerating what already threatens to be a serious recession. Restarting our economy and job creation requires both jumpstarting economic demand for goods and services through our American Recovery and Reinvestment Act and simultaneously ensuring through our new Fina ...

... contributing to and potentially accelerating what already threatens to be a serious recession. Restarting our economy and job creation requires both jumpstarting economic demand for goods and services through our American Recovery and Reinvestment Act and simultaneously ensuring through our new Fina ...

Chapter 14 (13) Exchange Rate Determination

... • Spot rates: for currency exchanges “on the spot” • Forward rates: for currency exchanges that will occur at a future ...

... • Spot rates: for currency exchanges “on the spot” • Forward rates: for currency exchanges that will occur at a future ...

2nd Homework - Samuel Moon Jung

... D) models that ignore expectations have little predictive power, even in the short run. 14) If additional information is not used when forming an optimal forecast because it is not available at that time, then expectations are A) obviously formed irrationally. B) still considered to be formed ration ...

... D) models that ignore expectations have little predictive power, even in the short run. 14) If additional information is not used when forming an optimal forecast because it is not available at that time, then expectations are A) obviously formed irrationally. B) still considered to be formed ration ...