The Argentine Banking and Exchange rate crisis of 2001: Can

... apparent strength of the Argentine Financial System. After the adoption of “Convertibilidad” in 1991, Argentina implemented a deep financial reform including a financial liberalization. At the same time, strong prudential regulations were introduced putting the Financial System close to those of dev ...

... apparent strength of the Argentine Financial System. After the adoption of “Convertibilidad” in 1991, Argentina implemented a deep financial reform including a financial liberalization. At the same time, strong prudential regulations were introduced putting the Financial System close to those of dev ...

ExRiskValue

... 4. (Long term investors and short term investors) For long term investors, their return mainly comes from dividend payouts. For short term investors, their return mainly comes from capital gains. Research works by Robert Shiller showed that stock prices are much more volatile than changes in dividen ...

... 4. (Long term investors and short term investors) For long term investors, their return mainly comes from dividend payouts. For short term investors, their return mainly comes from capital gains. Research works by Robert Shiller showed that stock prices are much more volatile than changes in dividen ...

MS-Word, RTF - Maine Legislature

... United States Code, Section 2901. The Treasurer of State may transfer funds into and out of the respective funds in the cash pool as circumstances may require to meet current obligations and shall request the State Controller to effect such transfers by journal entry as set forth in section 131-B. W ...

... United States Code, Section 2901. The Treasurer of State may transfer funds into and out of the respective funds in the cash pool as circumstances may require to meet current obligations and shall request the State Controller to effect such transfers by journal entry as set forth in section 131-B. W ...

Financial Institutions and Financial Markets

... • Managing the portfolios of other market participants. • LIST – Depository Institutions (commercial banks, savings and loan associations, savings banks, and credit unions), insurance companies, pension funds; and finance companies. ...

... • Managing the portfolios of other market participants. • LIST – Depository Institutions (commercial banks, savings and loan associations, savings banks, and credit unions), insurance companies, pension funds; and finance companies. ...

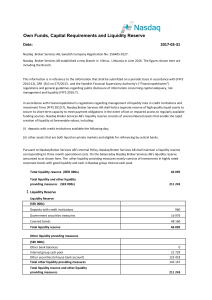

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

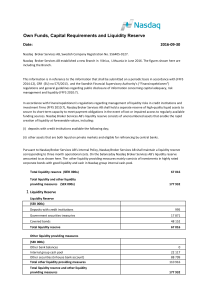

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

Developments and prospects in the real estate market

... In the housing market, the drop in prices continued at a strong pace throughout 2013, although this pace had eased gradually since early 2013. More specifically, data collected from credit institutions show an average annual rate of decline of 10.3% in apartment prices in 2013, against -11.7% in 201 ...

... In the housing market, the drop in prices continued at a strong pace throughout 2013, although this pace had eased gradually since early 2013. More specifically, data collected from credit institutions show an average annual rate of decline of 10.3% in apartment prices in 2013, against -11.7% in 201 ...

security analysis and portfolio management

... 1. Risk– depends on following factors— a) Longer maturity period higher risk b) Creditworthiness of borrower more– risks are lower (Govt. securities) c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its ret ...

... 1. Risk– depends on following factors— a) Longer maturity period higher risk b) Creditworthiness of borrower more– risks are lower (Govt. securities) c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its ret ...

progressive green Pty Ltd - Australian Energy Market Commission

... the improvements in market efficiency are captured, but as mentioned above, it may rise in the near term. This will impact the whole market as well as our customers. This rule change may prevent some behaviours in the market (like late trading interval re-bidding by large generators), but will undou ...

... the improvements in market efficiency are captured, but as mentioned above, it may rise in the near term. This will impact the whole market as well as our customers. This rule change may prevent some behaviours in the market (like late trading interval re-bidding by large generators), but will undou ...

Interest Rates

... bank cannot set the real interest rates because it cannot set inflation expectations. One may therefore wonder how an adjustment in short-run nominal interest rate can affect consumption and investment decisions, which are carried out over a longer horizon. The answer lies in the fact that central b ...

... bank cannot set the real interest rates because it cannot set inflation expectations. One may therefore wonder how an adjustment in short-run nominal interest rate can affect consumption and investment decisions, which are carried out over a longer horizon. The answer lies in the fact that central b ...

Inquiry into the post-GFC banking sector

... It is important to note that, while the GFC in Australia is considered “over”, the effects of sustained increased funding costs in particular, are still being felt. The ongoing sovereign debt crisis in Europe can be seen as a second phase to the GFC. As a result, the global economic environment rema ...

... It is important to note that, while the GFC in Australia is considered “over”, the effects of sustained increased funding costs in particular, are still being felt. The ongoing sovereign debt crisis in Europe can be seen as a second phase to the GFC. As a result, the global economic environment rema ...

Comparison of China and US` Bank Reserves and Their Implications

... PBOC has been adjusting RRR more frequently. Record shows that since mid-2006, there have been more than forty time of RRR adjustments from the PBOC, while the Fed has left the RRR unchanged, only slightly adjusting the deposit amounts applicable each year. This illustrates the vastly different impo ...

... PBOC has been adjusting RRR more frequently. Record shows that since mid-2006, there have been more than forty time of RRR adjustments from the PBOC, while the Fed has left the RRR unchanged, only slightly adjusting the deposit amounts applicable each year. This illustrates the vastly different impo ...

Bolsa Comercio Santiago (Santiago Stock Exchange)

... Growing due to the relatively new focus on international trade and business investment ...

... Growing due to the relatively new focus on international trade and business investment ...

The Stock Market Crash of 1929

... The Stock Market Crash of 1929 In the 1920s, a large number of people invested in the stock market. At the time many bought on the margin, meaning these people borrowed money from loan companies in order to buy stocks. The reason for this was because the stocks in the early 1920s increased at a very ...

... The Stock Market Crash of 1929 In the 1920s, a large number of people invested in the stock market. At the time many bought on the margin, meaning these people borrowed money from loan companies in order to buy stocks. The reason for this was because the stocks in the early 1920s increased at a very ...

Duration Friend or Foe? - Altius Asset Management

... bond market. We don’t expect the magnitude and velocity of interest rate hikes to be as aggressive as that, given economic growth is more fragile and needs continued support. However, investors should expect bond yields to normalise in the medium term, which will result in capital losses on long rat ...

... bond market. We don’t expect the magnitude and velocity of interest rate hikes to be as aggressive as that, given economic growth is more fragile and needs continued support. However, investors should expect bond yields to normalise in the medium term, which will result in capital losses on long rat ...

Will an inverted yield curve predict the next recession … again

... preceded a recession. On average, this ominous indicator appears one year prior to the recession, but lead times have varied from five to 16 months (see graph below). What causes an inverted yield curve? The Fed’s monetary policy tends to be a catalyst for yield curve inversions. It is worth noting ...

... preceded a recession. On average, this ominous indicator appears one year prior to the recession, but lead times have varied from five to 16 months (see graph below). What causes an inverted yield curve? The Fed’s monetary policy tends to be a catalyst for yield curve inversions. It is worth noting ...

Summer Doldrums - RBC Wealth Management

... It seems like the summer of 2010 has expressed a different story each week when it comes to the economy and the financial markets. Some weeks it’s optimism, other’s its pessimism. Some weeks it’s hope, the next fear…some weeks inflationary then the next deflationary. But at the end of it all, the gy ...

... It seems like the summer of 2010 has expressed a different story each week when it comes to the economy and the financial markets. Some weeks it’s optimism, other’s its pessimism. Some weeks it’s hope, the next fear…some weeks inflationary then the next deflationary. But at the end of it all, the gy ...

OnPoint—Strategies to benefit from rising rates

... Source: Bloomberg. Past performance is no guarantee of future results. These charts are for illustrative purposes only and not representative of performance for any particular investment. These charts are for select time periods. Results over different periods would have varied. Indexes are unmanage ...

... Source: Bloomberg. Past performance is no guarantee of future results. These charts are for illustrative purposes only and not representative of performance for any particular investment. These charts are for select time periods. Results over different periods would have varied. Indexes are unmanage ...

Determinants of Interest Rates

... matures in 1 year and sells for $800? What if it matured in 2 years? 4.9 Which $1000 face value bond currently selling for $800 has higher y-t-m: •20 year bond with current yield of 15% or •1 year bond with current yield of 5%? 4.12 If there is a decline in interest rates, which would you rather be ...

... matures in 1 year and sells for $800? What if it matured in 2 years? 4.9 Which $1000 face value bond currently selling for $800 has higher y-t-m: •20 year bond with current yield of 15% or •1 year bond with current yield of 5%? 4.12 If there is a decline in interest rates, which would you rather be ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... component due to the cost of adverse selection, but it shows very high prices if referred to the administrative costs and profits components. • OBSERVATION: probably .this second component also discounts the distribution costs (very high in Italy, see mutual funds and other insurance products) • The ...

... component due to the cost of adverse selection, but it shows very high prices if referred to the administrative costs and profits components. • OBSERVATION: probably .this second component also discounts the distribution costs (very high in Italy, see mutual funds and other insurance products) • The ...

Your Money - CSUB Home Page

... If money supply is increased, typically economy grows quickly, companies hire more workers, people spend more If money supply is decreased, economy slows down, unemployment increases etc. More money there is in the economy, the higher is the price level, less purchasing power (inflation) As fed chan ...

... If money supply is increased, typically economy grows quickly, companies hire more workers, people spend more If money supply is decreased, economy slows down, unemployment increases etc. More money there is in the economy, the higher is the price level, less purchasing power (inflation) As fed chan ...

The Asian Bond Fund initiative

... They tend to supplement and complement each other. ABF was unique as the only initiative involving actual ...

... They tend to supplement and complement each other. ABF was unique as the only initiative involving actual ...

From low to negative rates

... affiliates of foreign banks in Austria, thus arriving at a sample of N=946 banks. As control variables we use a wide set of bank-specific and macroeconomic variables (see table 1). Macroeconomic data are taken from the OeNB’s macroeconomic dataset. To prevent outliers from distorting the empirical a ...

... affiliates of foreign banks in Austria, thus arriving at a sample of N=946 banks. As control variables we use a wide set of bank-specific and macroeconomic variables (see table 1). Macroeconomic data are taken from the OeNB’s macroeconomic dataset. To prevent outliers from distorting the empirical a ...

Multi-Year Financial Plan

... • After FY15-16, increase by inflation + 1% (equivalent to 3.5%); assumes no extraordinary General Assembly actions which require institutional funding to implement. The one exception is in FY18-19, assumes 4.65% increase to fund planned state-mandated VRS rate increase. In addition, the BOV approve ...

... • After FY15-16, increase by inflation + 1% (equivalent to 3.5%); assumes no extraordinary General Assembly actions which require institutional funding to implement. The one exception is in FY18-19, assumes 4.65% increase to fund planned state-mandated VRS rate increase. In addition, the BOV approve ...