provide early warning signals of the recent crises, as well... interested in risk management. Because it is a readable account...

... productivity growth, unit labor costs will remain fairly stable and China’s competitive advantage will persist. Hence, relying solely on wage increases to rebalance the current account is unlikely to be successful, according to Lardy. With regard to consumer credit, Lardy notes that consumer borrowi ...

... productivity growth, unit labor costs will remain fairly stable and China’s competitive advantage will persist. Hence, relying solely on wage increases to rebalance the current account is unlikely to be successful, according to Lardy. With regard to consumer credit, Lardy notes that consumer borrowi ...

Savings, Investment Spending, and the Financial System

... A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future. Loans, stocks, bonds, and bank deposits are types of financial assets. ...

... A physical asset is a tangible object that can be used to generate future income. An investment is the purchase of a financial or physical asset. A liability is a requirement to pay income in the future. Loans, stocks, bonds, and bank deposits are types of financial assets. ...

December 2016 - SecureWealth

... Unbelievably, in the first month or so of being elected, Donald Trump has had the most positive effect on American financial markets out of all previous US Presidents. The lesson learned: To try and base investment decisions/a portfolio on the mainstream media or popular opinion is absolutely fraugh ...

... Unbelievably, in the first month or so of being elected, Donald Trump has had the most positive effect on American financial markets out of all previous US Presidents. The lesson learned: To try and base investment decisions/a portfolio on the mainstream media or popular opinion is absolutely fraugh ...

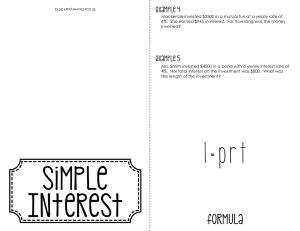

I = prt - SWMStbradford

... 6%. She earned $945 in interest. For how long was the money invested? ...

... 6%. She earned $945 in interest. For how long was the money invested? ...

Doing Business in Mexico_ICC BC Meeting Slides

... since 2002. • Brokerage houses have a significant • New niche banks and financial entities participation in the financial markets. have been participating in the local credit market. • Banco de México, the Central Bank, operates as an autonomus entity within the Federal Government, including monetar ...

... since 2002. • Brokerage houses have a significant • New niche banks and financial entities participation in the financial markets. have been participating in the local credit market. • Banco de México, the Central Bank, operates as an autonomus entity within the Federal Government, including monetar ...

ch03 - U of L Class Index

... Riskier than money market (more interest rate risk), but less risky than bond funds (shorter ...

... Riskier than money market (more interest rate risk), but less risky than bond funds (shorter ...

COLOMBIA—CB Hikes 25bps As Tightening Cycle Continues

... FED, USD, FX: “The likelihood higher now that the Fed will raise its benchmark interest rate in December; rates on long-term bonds rose. The dollar appreciated and prices of major commodities declined. The price of oil fell below that projected by the technical team. The fall in the terms of trade r ...

... FED, USD, FX: “The likelihood higher now that the Fed will raise its benchmark interest rate in December; rates on long-term bonds rose. The dollar appreciated and prices of major commodities declined. The price of oil fell below that projected by the technical team. The fall in the terms of trade r ...

An Introduction to Hackney`s Markets

... to regulate and enforce market regulations within Hackney Council, this involves daily monitoring of all traders and commodities sold and the allocation of vacant pitches to temporary traders. Market regulation is governed by the London Local Authorities Act 1990 as amended to 2007. The service has ...

... to regulate and enforce market regulations within Hackney Council, this involves daily monitoring of all traders and commodities sold and the allocation of vacant pitches to temporary traders. Market regulation is governed by the London Local Authorities Act 1990 as amended to 2007. The service has ...

Investment Terminology and Concepts

... • Stocks can provide investors with dividends and capital gains. • Over time, common stocks outperform all other investments. • Stocks are somewhat liquid. • Growth of your investment is determined by more than just interest rates. back ...

... • Stocks can provide investors with dividends and capital gains. • Over time, common stocks outperform all other investments. • Stocks are somewhat liquid. • Growth of your investment is determined by more than just interest rates. back ...

Asian High Yield Outlook

... Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited. Fidelity Funds is an open-ended investment company established in Luxembourg with different classes of shares. Reference to FF before a fund name refers to Fidelity Funds. Fide ...

... Fidelity, Fidelity Worldwide Investment, the Fidelity Worldwide Investment logo and F symbol are trademarks of FIL Limited. Fidelity Funds is an open-ended investment company established in Luxembourg with different classes of shares. Reference to FF before a fund name refers to Fidelity Funds. Fide ...

ABA Response to FDIC NPR on Risk

... Thus, factors other than strong capital should dominate the measurement of a bank’s failure risk, and thus its assessments. We note the statistics in the proposal that support a high weighting for the tier 1 leverage ratio. These may primarily reflect the near-term effect of weak capital in unsound ...

... Thus, factors other than strong capital should dominate the measurement of a bank’s failure risk, and thus its assessments. We note the statistics in the proposal that support a high weighting for the tier 1 leverage ratio. These may primarily reflect the near-term effect of weak capital in unsound ...

Balance of Payments

... • Capital and financial account • Capital account • Financial account • Balance of payments accounts sum ...

... • Capital and financial account • Capital account • Financial account • Balance of payments accounts sum ...

Chapter 36

... • Capital and financial account • Capital account • Financial account • Balance of payments accounts sum ...

... • Capital and financial account • Capital account • Financial account • Balance of payments accounts sum ...

Impact of Regulations on Bank Lending

... on lending while simultaneously cutting down the rates that they offer on deposits. This will enable banks to improve upon their lending margins, which have been under pressure in the current regulatory environment. Banks are also adopting a risk-based pricing approach that allows them to charge a h ...

... on lending while simultaneously cutting down the rates that they offer on deposits. This will enable banks to improve upon their lending margins, which have been under pressure in the current regulatory environment. Banks are also adopting a risk-based pricing approach that allows them to charge a h ...

Market Volatility: a Friend of Active Management?

... where small- to mid-sized companies have been oversold because of general risk aversion, and prices are no longer reflecting the underlying value of these companies. Conclusion While in many cases benchmarks have been outperforming the relevant peer groups of active managers over the past 12 months, ...

... where small- to mid-sized companies have been oversold because of general risk aversion, and prices are no longer reflecting the underlying value of these companies. Conclusion While in many cases benchmarks have been outperforming the relevant peer groups of active managers over the past 12 months, ...

Contribution of the European Structural and Investment Funds to the

... new opportunities have opened up for consumers, workers, and businesses. ...

... new opportunities have opened up for consumers, workers, and businesses. ...

Answer 2 - Problem set 7

... shirking benefit at a cost, hence the problem of asymmetric information is reduced but not gone. In addition, banks must have incentives to monitor. Hence, banks may have incentives to knowingly lend to shirking firms if risk can be carried over to uninformed investors. Clearly, banks knowingly inve ...

... shirking benefit at a cost, hence the problem of asymmetric information is reduced but not gone. In addition, banks must have incentives to monitor. Hence, banks may have incentives to knowingly lend to shirking firms if risk can be carried over to uninformed investors. Clearly, banks knowingly inve ...

Group LTD Pricing Issues

... Pros and Cons of a simple formula: • Easy to understand and explain • More likely to be used by underwriters • Convenient to periodically review • Approximates equity to the satisfaction of ...

... Pros and Cons of a simple formula: • Easy to understand and explain • More likely to be used by underwriters • Convenient to periodically review • Approximates equity to the satisfaction of ...

Credit Risk: Individual Loan Risk Chapter 11

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

2017 NC-CCIM COMMERCIAL MARKET FORECAST

... Focus Design Builders RCA of Greensboro Highwoods Properties RCA of Winston-Salem Horack, Talley, Pahrr & Lowndes, P.A. Regus INTEC Richardson Properties IREM Chapter 56 Sam’s Real Estate Lincoln Harris ...

... Focus Design Builders RCA of Greensboro Highwoods Properties RCA of Winston-Salem Horack, Talley, Pahrr & Lowndes, P.A. Regus INTEC Richardson Properties IREM Chapter 56 Sam’s Real Estate Lincoln Harris ...

ANALYSIS TO INSTRUMENTS OF MONETARY POLICY USED BY

... of Romania have created the conditions of using the new instruments, which have contributed towards the elasticity specific to monetary policy. The regulations have also foreseen the using of permanent conferring of credit and deposit facilities. Notwithstanding, considering the conditions existing ...

... of Romania have created the conditions of using the new instruments, which have contributed towards the elasticity specific to monetary policy. The regulations have also foreseen the using of permanent conferring of credit and deposit facilities. Notwithstanding, considering the conditions existing ...

The Banking System in Turkey

... growth continued in the banking sector. 1. General Outlook Capital inflows to developing countries were strong: US Federal Reserve increased policy rate by 25 basis points in the December 2015 Meeting. Weak growth in Europe and downward trend of oil prices on the global markets continued. Capital ...

... growth continued in the banking sector. 1. General Outlook Capital inflows to developing countries were strong: US Federal Reserve increased policy rate by 25 basis points in the December 2015 Meeting. Weak growth in Europe and downward trend of oil prices on the global markets continued. Capital ...

A secular period is a long term cycle in the market which generally

... it's the amount of earnings you buy for every dollar worth of stock. Therefore, the higher the earnings yield the better value of the financial markets. Of course, as you would now suspect, the earnings yield of the market reached a peak around 1974 whereas currently the earnings yield of the market ...

... it's the amount of earnings you buy for every dollar worth of stock. Therefore, the higher the earnings yield the better value of the financial markets. Of course, as you would now suspect, the earnings yield of the market reached a peak around 1974 whereas currently the earnings yield of the market ...

1. Basic Elements of the International Monetary System

... • n-th country currency (N-currency) is convertible into a widely accepted good at a fixed price, the currencies of all other countries are related to it in a fixed relationship • no automatism! • countries must accept and implement economic policy measures for balance-of-payments adjustments Countr ...

... • n-th country currency (N-currency) is convertible into a widely accepted good at a fixed price, the currencies of all other countries are related to it in a fixed relationship • no automatism! • countries must accept and implement economic policy measures for balance-of-payments adjustments Countr ...