Irrational Exuberance - Mason Publishing Journals

... career. They might d ecide to not go to college at all. Others, who are a little older, may find that their careers or ambitions are thwarted. With smaller economic resources, the need to maintain an income level and fulfill everyday obligations will be destructive to individual fulfillment. Those w ...

... career. They might d ecide to not go to college at all. Others, who are a little older, may find that their careers or ambitions are thwarted. With smaller economic resources, the need to maintain an income level and fulfill everyday obligations will be destructive to individual fulfillment. Those w ...

FREE Sample Here

... B) assuring that governments need never resort to printing money. C) getting people with funds to lend together with people who want to borrow funds. D) both A and B of the above. ...

... B) assuring that governments need never resort to printing money. C) getting people with funds to lend together with people who want to borrow funds. D) both A and B of the above. ...

PDF Size : 1533 kb - 10th World Islamic Economic Forum

... Contributes to development and growth of Halal as well as SRI businesses and economy Provides more options for issuers and investors – facilitates diversification and reduces concentration risk ...

... Contributes to development and growth of Halal as well as SRI businesses and economy Provides more options for issuers and investors – facilitates diversification and reduces concentration risk ...

Financialisation, Business Lending And Profitability In The UK

... lending as a source of profits for UK banks? And does the answer to this question depend on individual banks’ capacity and characteristics or is it possible to identify systematic characteristics of banks that affect their profitability? In this study we concentrate on two such characteristics, name ...

... lending as a source of profits for UK banks? And does the answer to this question depend on individual banks’ capacity and characteristics or is it possible to identify systematic characteristics of banks that affect their profitability? In this study we concentrate on two such characteristics, name ...

Central Bank Watch Sweden - Nordea e

... As we see it, the low inflation is a result of the fact that wage growth and wage growth expectations have been muted, while imported deflation has at the same time been significant. The decline in import prices appears to be decelerating. The strong domestic economy will lift inflation somewhat. Ho ...

... As we see it, the low inflation is a result of the fact that wage growth and wage growth expectations have been muted, while imported deflation has at the same time been significant. The decline in import prices appears to be decelerating. The strong domestic economy will lift inflation somewhat. Ho ...

Working Capital

... amount of money available) is a reflection of the lender’s sensitivity to, and appetite for, risk. The biggest money lenders are banks which receive deposits from individuals. Banks can be borrowers when they seek to raise additional money to lend to their clients. The availability of money to comme ...

... amount of money available) is a reflection of the lender’s sensitivity to, and appetite for, risk. The biggest money lenders are banks which receive deposits from individuals. Banks can be borrowers when they seek to raise additional money to lend to their clients. The availability of money to comme ...

Document

... - First set of variables representing real economy includes corporate default risk measured by high-yield spread (HYS), risk aversion (VIX) and returns on S&P 500. - Second set representing banks’ financial risks includes credit spread (LIBOR minus overnight index swap), liquidity spread (overnight ...

... - First set of variables representing real economy includes corporate default risk measured by high-yield spread (HYS), risk aversion (VIX) and returns on S&P 500. - Second set representing banks’ financial risks includes credit spread (LIBOR minus overnight index swap), liquidity spread (overnight ...

Market valuation, the Fed`s success, and high stakes in November

... finally started to pick up. At the same time, financial markets have been on a tear. It is rare for both stocks and bonds to boom at the same time, as they have recently. On balance, the Fed can be judged to have succeeded in a hostile environment that started with the worst financial crisis since t ...

... finally started to pick up. At the same time, financial markets have been on a tear. It is rare for both stocks and bonds to boom at the same time, as they have recently. On balance, the Fed can be judged to have succeeded in a hostile environment that started with the worst financial crisis since t ...

12-20-05 Letter.ppc - Federal Reserve Bank of San Francisco

... to full employment. In effect, the Fed took a calculated risk. It took out some insurance to lower the chances of a potentially devastating deflationary episode.The cost of that insurance was an increased possibility of overheating the economy.These policy actions arguably played some role in our ho ...

... to full employment. In effect, the Fed took a calculated risk. It took out some insurance to lower the chances of a potentially devastating deflationary episode.The cost of that insurance was an increased possibility of overheating the economy.These policy actions arguably played some role in our ho ...

Pension Fund Management Private Client Investment Portfolios

... This is a speculative fund geared to more risk tolerant investors looking for substantive growth in the medium to long term. The fund is actively managedto take advantage of pricing discrepancies and invests in shares that are undervalued but have potential for significant upside. Minimum investment ...

... This is a speculative fund geared to more risk tolerant investors looking for substantive growth in the medium to long term. The fund is actively managedto take advantage of pricing discrepancies and invests in shares that are undervalued but have potential for significant upside. Minimum investment ...

Working Papers - Federal Reserve Bank of Philadelphia

... No study thus far has explored empirical evidence for this effect. Moreover, at least three theoretical aspects of this effect have also been previously overlooked. First, to the extent that banks rely on common filters (shared databases and uniform screening criteria) in assessing applications, the ...

... No study thus far has explored empirical evidence for this effect. Moreover, at least three theoretical aspects of this effect have also been previously overlooked. First, to the extent that banks rely on common filters (shared databases and uniform screening criteria) in assessing applications, the ...

Are Markets Efficient - NYU Stern School of Business

... consistent basis. Even the savviest investors—George Soros, Warren Buffett, Julian Robertson—occasionally stumble. If markets were irrational, the argument goes, then the very best investors would find strategies to make money consistently and without risk. The fact that they do stumble proves that ...

... consistent basis. Even the savviest investors—George Soros, Warren Buffett, Julian Robertson—occasionally stumble. If markets were irrational, the argument goes, then the very best investors would find strategies to make money consistently and without risk. The fact that they do stumble proves that ...

www.ci.com

... Source: Bloomberg. August 2013 The Bloomberg U.S. Financial Conditions Index combines yield spreads and indices from U.S. money markets, equity markets, and bond markets into a normalized index. The Bloomberg Euro-area Financial Conditions Index combines yield spreads and indices from euro-area mone ...

... Source: Bloomberg. August 2013 The Bloomberg U.S. Financial Conditions Index combines yield spreads and indices from U.S. money markets, equity markets, and bond markets into a normalized index. The Bloomberg Euro-area Financial Conditions Index combines yield spreads and indices from euro-area mone ...

Legg Mason Western Asset US Money Market Fund

... calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities held in the Fund. Past performance is not indicative of ...

... calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities held in the Fund. Past performance is not indicative of ...

Breaking Up Is Hard to Do: Three Market Odd Couples That Won`t

... Old habits die hard, and stocks and bonds are confident in their very different perspectives. Stocks are excited about the potential for better economic growth, improving earnings, lower taxes, less regulation, still low rates and very little inflation. This is the perfect love potion and stocks hav ...

... Old habits die hard, and stocks and bonds are confident in their very different perspectives. Stocks are excited about the potential for better economic growth, improving earnings, lower taxes, less regulation, still low rates and very little inflation. This is the perfect love potion and stocks hav ...

Risk and Return

... What is the portfolio rate of return? Portfolio Rate of Return = wIBM rIBM wSBUX rSBUX wW rW ...

... What is the portfolio rate of return? Portfolio Rate of Return = wIBM rIBM wSBUX rSBUX wW rW ...

Guaranteed Accumulation funds

... growth and a guaranteed medium-term return, backed by investments in high quality corporate and government bonds. The funds are available in sterling, US dollars and euros and offer capital growth through investments in the global bond market. The funds protect against loss by ‘smoothing’ the divide ...

... growth and a guaranteed medium-term return, backed by investments in high quality corporate and government bonds. The funds are available in sterling, US dollars and euros and offer capital growth through investments in the global bond market. The funds protect against loss by ‘smoothing’ the divide ...

HOMEWORK 3 SOLUTION Chapter 8 1. Assume that your company

... A's track record is p = r/n = 30/50 = 60%. This is greater than 50%. But with only 50 observations, the standard error of the estimate is fairly large, 0.0707 = (0.5*(1‐ 0.5)/50)0.5 = (p*(1‐p)/n)0.5. So the t‐value against the null hypothesis that p=0.5 [t=(0.60 ‐ 0. ...

... A's track record is p = r/n = 30/50 = 60%. This is greater than 50%. But with only 50 observations, the standard error of the estimate is fairly large, 0.0707 = (0.5*(1‐ 0.5)/50)0.5 = (p*(1‐p)/n)0.5. So the t‐value against the null hypothesis that p=0.5 [t=(0.60 ‐ 0. ...

Financial Services & Public Policy Alert June 2009

... In addition, the SEC would have clear authority to require robust, ongoing reporting by ABS issuers. Under current law, a registered offering of ABS triggers a reporting obligation, but the reporting obligation is normally suspended because of an exception in the law. Implementing the proposal may i ...

... In addition, the SEC would have clear authority to require robust, ongoing reporting by ABS issuers. Under current law, a registered offering of ABS triggers a reporting obligation, but the reporting obligation is normally suspended because of an exception in the law. Implementing the proposal may i ...

The financial system: Strengths and weaknesses

... lending activities, lending by the banking system to the public sector, changeability in the inflation rate, mounting default, foreign interest rate developments and susceptibility to external influences. Indicators from the financial sector A turnaround in the economy often leads to difficulties in ...

... lending activities, lending by the banking system to the public sector, changeability in the inflation rate, mounting default, foreign interest rate developments and susceptibility to external influences. Indicators from the financial sector A turnaround in the economy often leads to difficulties in ...

William C Dudley: The importance of financial conditions in the

... A contrasting example is the sharp appreciation of the dollar that began in 1978 and reached a peak in March 1985. The persistent strength of the dollar had a significant negative consequence for U.S. trade performance. Our trade deficit widened sharply in 1985 and 1986, which contributed to the sha ...

... A contrasting example is the sharp appreciation of the dollar that began in 1978 and reached a peak in March 1985. The persistent strength of the dollar had a significant negative consequence for U.S. trade performance. Our trade deficit widened sharply in 1985 and 1986, which contributed to the sha ...

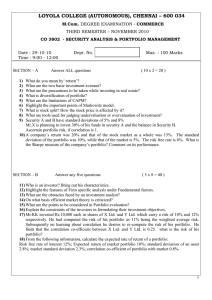

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... the Sharpe measure of the company’s portfolio? Comment on its performance. ...

... the Sharpe measure of the company’s portfolio? Comment on its performance. ...

Central-Bank Communication and Stabilization Policy

... appropriate policy action. There will be different paths by which inflation might be projected to reach the desired level two or three years in the future; these different paths may require quite different actions by the central bank in the short run, and of course it is always only the immediate po ...

... appropriate policy action. There will be different paths by which inflation might be projected to reach the desired level two or three years in the future; these different paths may require quite different actions by the central bank in the short run, and of course it is always only the immediate po ...

NEFA speech licensing and usury (00117674).DOC

... Installment Sale Contracts: In order to originate or purchase installment sale contracts in Florida a lender must a Sales Finance Company license. Fla. Stat. § 520.52(1) provides “[a] person may not engage in the business of a sales finance company or operate a branch of such business without a lic ...

... Installment Sale Contracts: In order to originate or purchase installment sale contracts in Florida a lender must a Sales Finance Company license. Fla. Stat. § 520.52(1) provides “[a] person may not engage in the business of a sales finance company or operate a branch of such business without a lic ...

The corporate finance implications of rapidly rising interest rates.

... been expecting rising interest rates for the last several years. Over the last three years, for example, economists had forecast the 10-year U.S. Treasury rate to be 70 basis points (bps), 160 bps, and 80 bps higher than the actual rate at the end of 2010, 2011, and 2012, respectively. Today, econom ...

... been expecting rising interest rates for the last several years. Over the last three years, for example, economists had forecast the 10-year U.S. Treasury rate to be 70 basis points (bps), 160 bps, and 80 bps higher than the actual rate at the end of 2010, 2011, and 2012, respectively. Today, econom ...