PDF - Faircourt Asset Management

... maintaining exposure in many of the sub-sectors within the S&P/TSX and S&P 500. In order to generate additional returns and reduce risk, the Fund may write covered calls on securities held in the portfolio and cash secured put options on securities desired to be held in the portfolio. The Fund will ...

... maintaining exposure in many of the sub-sectors within the S&P/TSX and S&P 500. In order to generate additional returns and reduce risk, the Fund may write covered calls on securities held in the portfolio and cash secured put options on securities desired to be held in the portfolio. The Fund will ...

Clear perspectives on bond market liquidity

... US bond mutual funds have grown significantly in recent years. From the end of 2004 through 2014, they took in $1.9 trillion in net new cash flow. Their growth illustrates the benefits of a financial system with a balance between capital markets-based and bank-based funding. As banks have recapitali ...

... US bond mutual funds have grown significantly in recent years. From the end of 2004 through 2014, they took in $1.9 trillion in net new cash flow. Their growth illustrates the benefits of a financial system with a balance between capital markets-based and bank-based funding. As banks have recapitali ...

Low global bond yields: low growth, monetary policy, market dynamics

... Monetary (balance sheet) policy of central banks Central banks have influenced global bond yields in a variety of ways. They have set their short-term policy rates at low, even negative, levels; they have guided market participants to expect such rates to be low in the future; and they have publish ...

... Monetary (balance sheet) policy of central banks Central banks have influenced global bond yields in a variety of ways. They have set their short-term policy rates at low, even negative, levels; they have guided market participants to expect such rates to be low in the future; and they have publish ...

Chapter 18 - McGraw Hill Higher Education

... new information is a realistic one.3 However, no studies have examined the impact of elections on market variables such as interest rates. Because financial markets are efficient with respect to processing information, interest rates at any point in time will factor in the probability of the ALP and ...

... new information is a realistic one.3 However, no studies have examined the impact of elections on market variables such as interest rates. Because financial markets are efficient with respect to processing information, interest rates at any point in time will factor in the probability of the ALP and ...

Document

... 2. Two frameworks are closely linked, but differ in practice because liquidity preference assumes only two assets, money and bonds, and ignores effects on interest rates from changes in expected returns on real assets ...

... 2. Two frameworks are closely linked, but differ in practice because liquidity preference assumes only two assets, money and bonds, and ignores effects on interest rates from changes in expected returns on real assets ...

DOC - Europa.eu

... market failure in the EU, the divergence in performance between Member States points to market fragmentation and to the existence of country-specific constraints on more efficient market functioning. To close this gap, the Commission proposes action in several areas. Actions to accelerate market int ...

... market failure in the EU, the divergence in performance between Member States points to market fragmentation and to the existence of country-specific constraints on more efficient market functioning. To close this gap, the Commission proposes action in several areas. Actions to accelerate market int ...

Set 6 - Personal.psu.edu

... i. Note that Treasuries are the most liquid of bonds. They have the most active and largest market. It is easy and fast to sell a T-bond. ii. The same cannot be said for corporate bonds or muni’s. These markets are much thinner and it takes much more time to convert a bond in these markets into cash ...

... i. Note that Treasuries are the most liquid of bonds. They have the most active and largest market. It is easy and fast to sell a T-bond. ii. The same cannot be said for corporate bonds or muni’s. These markets are much thinner and it takes much more time to convert a bond in these markets into cash ...

5vcforum - Attica Ventures

... In the winter of 2003 the TSMEDE Pension Fund became the first to decide an investment in a PE fund following a decision by its Board of Directors to participate in the VC fund managed by Attica Ventures. In March 2004 the ZAITECH fund, a venture capital fund, was set up under the management of Atti ...

... In the winter of 2003 the TSMEDE Pension Fund became the first to decide an investment in a PE fund following a decision by its Board of Directors to participate in the VC fund managed by Attica Ventures. In March 2004 the ZAITECH fund, a venture capital fund, was set up under the management of Atti ...

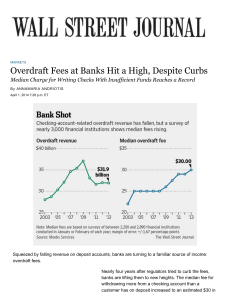

Overdraft fees at banks make a comeback, hitting a record.

... law included an amendment that went into effect in 2011 lowering a debit-card fee large financial institutions charge ...

... law included an amendment that went into effect in 2011 lowering a debit-card fee large financial institutions charge ...

www.lem.sssup.it

... One can think of this equation as the solution of a firm's optimization problem (Greenwald and Stiglitz, 1993): ...

... One can think of this equation as the solution of a firm's optimization problem (Greenwald and Stiglitz, 1993): ...

DOC - Europa.eu

... Let me start by saying that there is no commonly agreed definition of what is a Sovereign Wealth Fund. But they have common features that help to identify them. Sovereign funds are special investment funds created and owned by governments with the aim of investing in foreign assets so as to generate ...

... Let me start by saying that there is no commonly agreed definition of what is a Sovereign Wealth Fund. But they have common features that help to identify them. Sovereign funds are special investment funds created and owned by governments with the aim of investing in foreign assets so as to generate ...

World Bank Document

... of less than 660). Third, there are alt-A loans (such as “liar loans”) where the borrower had a FICO score above 660, but failed to provide documentation. These were favorite instruments of speculators and have conventionally been classified as prime; but they are defaulting at a rate approaching su ...

... of less than 660). Third, there are alt-A loans (such as “liar loans”) where the borrower had a FICO score above 660, but failed to provide documentation. These were favorite instruments of speculators and have conventionally been classified as prime; but they are defaulting at a rate approaching su ...

Switchgear Market worth $144.41 Billion USD by 2021,at a CAGR of

... number of substations would increase, which in turn would raise the demand for switchgears. Asia-Pacific is the dominant market for switchgears In this report, the switchgear market has been analyzed with respect to five regions, namely, North America, Europe, Asia-Pacific, South America, and the Mi ...

... number of substations would increase, which in turn would raise the demand for switchgears. Asia-Pacific is the dominant market for switchgears In this report, the switchgear market has been analyzed with respect to five regions, namely, North America, Europe, Asia-Pacific, South America, and the Mi ...

Weekly Market Commentary November 21, 2016

... payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are sub ...

... payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are sub ...

Links Between the Domestic and Eurobond

... their actions, and renegotiating loan agreements. Technological improvements in areas such as data manipulation and telecommunications have greatly reduced the costs of obtaining and processing information about the conditions that affect the creditworthiness of potential borrowers. Any analyst now ...

... their actions, and renegotiating loan agreements. Technological improvements in areas such as data manipulation and telecommunications have greatly reduced the costs of obtaining and processing information about the conditions that affect the creditworthiness of potential borrowers. Any analyst now ...

The rationales for public sector intervention to support finance for

... project is not only limited, but asymmetric. The entrepreneur (or firm) looking for finance has more accurate information than potential investors about how promising an innovation project is, as well as about the entrepreneur’s effort and choices when developing it. This leads to two classical sour ...

... project is not only limited, but asymmetric. The entrepreneur (or firm) looking for finance has more accurate information than potential investors about how promising an innovation project is, as well as about the entrepreneur’s effort and choices when developing it. This leads to two classical sour ...

Presentation to the 18th Annual Hyman P. Minsky Conference on... World Economies—“Meeting the Challenges of the Financial Crisis”

... probably would have worked beautifully if individual investors had faced shocks that were uncorrelated with those of their counterparties. But declines in bond and house prices hit everyone in the same way, inflicting actual and expected credit losses broadly across the financial system. Moreover, t ...

... probably would have worked beautifully if individual investors had faced shocks that were uncorrelated with those of their counterparties. But declines in bond and house prices hit everyone in the same way, inflicting actual and expected credit losses broadly across the financial system. Moreover, t ...

DOC - Europa.eu

... Securitisation transactions enable banks to refinance loans by pooling individual assets and converting them into securities that are attractive to institutional investors. For institutional investors, such securities, if of sufficient size, offer liquid investment opportunities in asset classes in ...

... Securitisation transactions enable banks to refinance loans by pooling individual assets and converting them into securities that are attractive to institutional investors. For institutional investors, such securities, if of sufficient size, offer liquid investment opportunities in asset classes in ...

Determinants of loan rates

... government tries to making housing more affordable. It reduces the interest rate to 3%. What is the new monthly payment on the mortgage? Does the government policy improve the affordability of housing market over the short term? If the housing supply doesn’t increase, those who can afford the monthl ...

... government tries to making housing more affordable. It reduces the interest rate to 3%. What is the new monthly payment on the mortgage? Does the government policy improve the affordability of housing market over the short term? If the housing supply doesn’t increase, those who can afford the monthl ...

HKEx to Consult Market on Infrastructure for Clearing and Settlement

... a scripless securities market is expected to enable straight-through processing (STP), eliminate risks associated with share certificates, reduce the cost of ownership transfer and enhance processing efficiency of securities transactions. HKEx supports, in principle, moving towards a scripless envir ...

... a scripless securities market is expected to enable straight-through processing (STP), eliminate risks associated with share certificates, reduce the cost of ownership transfer and enhance processing efficiency of securities transactions. HKEx supports, in principle, moving towards a scripless envir ...

I-45 Investments - Town of Cardston

... 2. Meet daily cash flow requirements. The investment portfolio shall remain sufficiently liquid in order to meet all financial obligations that may be reasonably anticipated. 3. Provide competitive investment returns. The investment portfolio shall be designed with the objective of attaining a marke ...

... 2. Meet daily cash flow requirements. The investment portfolio shall remain sufficiently liquid in order to meet all financial obligations that may be reasonably anticipated. 3. Provide competitive investment returns. The investment portfolio shall be designed with the objective of attaining a marke ...

Investment Portfolio

... • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However, it, to certain extent, did n ...

... • The gap between assets and liabilities - 2 If liabilities duration is longer than assets’, and if effective duration matters, the duration gap will cause HUGE under-reserve. • Derivative will help – for example, receive fixed IRS could extend assets duration • However, it, to certain extent, did n ...

The challenges for monetary policy

... reinvestment of principal payments as they mature, and leaving MBS sales as a residual option for the final phase of the normalisation process, with agents being given advance notification of this strategy. — The FOMC has subsequently indicated that it will raise official interest rates a number of ...

... reinvestment of principal payments as they mature, and leaving MBS sales as a residual option for the final phase of the normalisation process, with agents being given advance notification of this strategy. — The FOMC has subsequently indicated that it will raise official interest rates a number of ...

H1 2007 - First Trust Bank

... accompanying slides will not be based on historical fact, but will be “forwardlooking” statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward looking statements. Factors that could ...

... accompanying slides will not be based on historical fact, but will be “forwardlooking” statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward looking statements. Factors that could ...

Irrational Exuberance - Mason Publishing Journals

... career. They might d ecide to not go to college at all. Others, who are a little older, may find that their careers or ambitions are thwarted. With smaller economic resources, the need to maintain an income level and fulfill everyday obligations will be destructive to individual fulfillment. Those w ...

... career. They might d ecide to not go to college at all. Others, who are a little older, may find that their careers or ambitions are thwarted. With smaller economic resources, the need to maintain an income level and fulfill everyday obligations will be destructive to individual fulfillment. Those w ...