ITEM

... Cash and cash equivalents Government bonds Corporate bonds Equity Investment funds Hybrid securities Other securities - Equity risk Other securities - Interest rate risk Other securities - Currency risk ...

... Cash and cash equivalents Government bonds Corporate bonds Equity Investment funds Hybrid securities Other securities - Equity risk Other securities - Interest rate risk Other securities - Currency risk ...

Presentation - CFA Institute

... • The decision about how much currency risk to hedge—from none to all—is important because currency movements can have a dramatic effect on the investor’s return from international bond holdings. ...

... • The decision about how much currency risk to hedge—from none to all—is important because currency movements can have a dramatic effect on the investor’s return from international bond holdings. ...

The Timeless Case for Floating-Rate Loans as a Strategic Allocation

... discerning investors. For more information about Eaton Vance, visit eatonvance.com This material is presented for informational and illustrative purposes only as the views and opinions of Eaton Vance as of the date hereof. It should not be construed as investment advice, a recommendation to purchase ...

... discerning investors. For more information about Eaton Vance, visit eatonvance.com This material is presented for informational and illustrative purposes only as the views and opinions of Eaton Vance as of the date hereof. It should not be construed as investment advice, a recommendation to purchase ...

Shan Yan - Eli Broad College of Business

... abnormal stock returns are increasing in firms’ use of bank debt, but not public debt. This suggests that market participants believe that banking relationships are leading to better decision making for this particular type of investment/liquidation decision. We find no significantly different effec ...

... abnormal stock returns are increasing in firms’ use of bank debt, but not public debt. This suggests that market participants believe that banking relationships are leading to better decision making for this particular type of investment/liquidation decision. We find no significantly different effec ...

Discussion on “Monetary Policy “Contagion” in the Pacific: A Historical Inquiry

... – Some control variables are not negligible in the long run: Expected U.S. inflation, (domestic) inflation in Tables 4-7; U.S. 10-year yield and (domestic) policy rates in addition to short-term deposit rates in Tables 11-12 Policy rates, short-term deposit rates, and U.S. funds rates could be coi ...

... – Some control variables are not negligible in the long run: Expected U.S. inflation, (domestic) inflation in Tables 4-7; U.S. 10-year yield and (domestic) policy rates in addition to short-term deposit rates in Tables 11-12 Policy rates, short-term deposit rates, and U.S. funds rates could be coi ...

The Risk and Term Structure of Interest Rates

... some bonds over others for reasons other than interest-rate risk (their preferred habitat). To hold other bonds, investors need to be compensated – by a term premium, which acts the same way as liquidity premium. Either of these theories accounts for all 3 facts. ...

... some bonds over others for reasons other than interest-rate risk (their preferred habitat). To hold other bonds, investors need to be compensated – by a term premium, which acts the same way as liquidity premium. Either of these theories accounts for all 3 facts. ...

Banking & Financial Markets

... Characteristics of Debt Markets Instruments • Debt instruments – Buyers of debt instruments are suppliers (of capital) to the firm, not owners of the firm – Debt instruments have a finite life or maturity date – Advantage is that the debt instrument is a contractual promise to pay with legal rights ...

... Characteristics of Debt Markets Instruments • Debt instruments – Buyers of debt instruments are suppliers (of capital) to the firm, not owners of the firm – Debt instruments have a finite life or maturity date – Advantage is that the debt instrument is a contractual promise to pay with legal rights ...

Working Paper

... about the “Great Moderation” and praise for advances in monetary economics that had helped stabilize the economy [Bernanke 2004; Goodfriend, 2007; Blanchard, 2008]: now there is talk among policy insiders of need to rethink monetary policy. The status quo insider rethink focuses on the role of monet ...

... about the “Great Moderation” and praise for advances in monetary economics that had helped stabilize the economy [Bernanke 2004; Goodfriend, 2007; Blanchard, 2008]: now there is talk among policy insiders of need to rethink monetary policy. The status quo insider rethink focuses on the role of monet ...

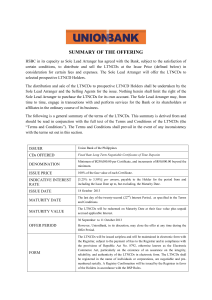

summary of the offering

... [3.25% to 3.50%] per annum, payable to the Holder for the period from and including the Issue Date up to, but excluding, the Maturity Date. ...

... [3.25% to 3.50%] per annum, payable to the Holder for the period from and including the Issue Date up to, but excluding, the Maturity Date. ...

SM_C02_Reilly1ce

... Most experts recommend that about 6 month’s worth of living expenses be held in cash reserves. Although these funds are identified as “cash,” it is recommended that they be invested in instruments that can easily be converted to cash with little chance of loss in value (e.g., money market mutual fun ...

... Most experts recommend that about 6 month’s worth of living expenses be held in cash reserves. Although these funds are identified as “cash,” it is recommended that they be invested in instruments that can easily be converted to cash with little chance of loss in value (e.g., money market mutual fun ...

Financial Intermediation

... 5.15 During 2012-13 the overall growth in balance sheet of banks moderated further. The growth in the consolidated balance sheet of SCBs in 2012-13 was 15.1 per cent, lower than the 15.8 per cent in the previous year (Table 5.8). The major source of this moderation was bank credit. The moderation in ...

... 5.15 During 2012-13 the overall growth in balance sheet of banks moderated further. The growth in the consolidated balance sheet of SCBs in 2012-13 was 15.1 per cent, lower than the 15.8 per cent in the previous year (Table 5.8). The major source of this moderation was bank credit. The moderation in ...

Working Paper No. 412 - Levy Economics Institute of Bard College

... sees the transmission mechanism as operating through the equalization of various rates of return (Keynes 1936; see also Rogers 1989). Indeed, this is the primary alternative theory of the monetary transmission mechanism. If the real rate of interest exceeds the rate of return on investment, business ...

... sees the transmission mechanism as operating through the equalization of various rates of return (Keynes 1936; see also Rogers 1989). Indeed, this is the primary alternative theory of the monetary transmission mechanism. If the real rate of interest exceeds the rate of return on investment, business ...

Business 7e - Pride, Hughes, Kapor

... • The central bank of the United States responsible for regulating the banking industry – Controlled by a 7-member board of governors who are appointed by the president and confirmed by the Senate to serve 14-year terms – Composed of 12 district banks and 25 branch banks – District banks are owned b ...

... • The central bank of the United States responsible for regulating the banking industry – Controlled by a 7-member board of governors who are appointed by the president and confirmed by the Senate to serve 14-year terms – Composed of 12 district banks and 25 branch banks – District banks are owned b ...

Liquidity Crises - Business Review, Second Quarter 2008

... uncertainty averse. That is, when evaluating outcomes about which they are uncertain, they use the most pessimistic probability assessments. In particular, each participant overweights the probability that he will be among those hit by the second shock. (See Uncertainty Aversion.) This creates a des ...

... uncertainty averse. That is, when evaluating outcomes about which they are uncertain, they use the most pessimistic probability assessments. In particular, each participant overweights the probability that he will be among those hit by the second shock. (See Uncertainty Aversion.) This creates a des ...

Market Capitalisation– The overall market capitalisation remained

... Market Capitalisation– The overall market capitalisation remained stagnant this week as there was no price movement experienced in the market. STRI – the accumulation index witnessed an increase of 0.11% to conclude the week at 2904.39. Since STRI factors in dividend returns into its calculation, th ...

... Market Capitalisation– The overall market capitalisation remained stagnant this week as there was no price movement experienced in the market. STRI – the accumulation index witnessed an increase of 0.11% to conclude the week at 2904.39. Since STRI factors in dividend returns into its calculation, th ...

1111823359_323913

... – The difference between short- and longterm interest rates • Indicator of the state of the economy • Forecasting how fast the economy will grow © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license dist ...

... – The difference between short- and longterm interest rates • Indicator of the state of the economy • Forecasting how fast the economy will grow © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license dist ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... credit expansion and those due to residual components permits us to test whether their effects on interest rates differ. In Chapter 5 the sources are examined in further detail: Bank credit is divided into loans and investments, to see whether they have differential effects on particular interest ra ...

... credit expansion and those due to residual components permits us to test whether their effects on interest rates differ. In Chapter 5 the sources are examined in further detail: Bank credit is divided into loans and investments, to see whether they have differential effects on particular interest ra ...

ch19

... • The central bank of the United States responsible for regulating the banking industry – Controlled by a 7-member board of governors who are appointed by the president and confirmed by the Senate to serve 14-year terms – Composed of 12 district banks and 25 branch banks – District banks are owned b ...

... • The central bank of the United States responsible for regulating the banking industry – Controlled by a 7-member board of governors who are appointed by the president and confirmed by the Senate to serve 14-year terms – Composed of 12 district banks and 25 branch banks – District banks are owned b ...

presentation

... Adverse selection: arranger already knows the borrower through previous deals, so needs to show to participant that (s)he will not abuse it → arranger needs to retain more of loans to repeat borrowers ...

... Adverse selection: arranger already knows the borrower through previous deals, so needs to show to participant that (s)he will not abuse it → arranger needs to retain more of loans to repeat borrowers ...

PDF Download

... banks to record book losses on assets. The portfolio of bad loans increases sharply. Entire financial sectors run into trouble, which threatens to lead to a credit crunch (Ishikawa and Tsutsui 2005):3 Since the banks suffer high book losses on their balance sheets, their equity shrinks. This forces ...

... banks to record book losses on assets. The portfolio of bad loans increases sharply. Entire financial sectors run into trouble, which threatens to lead to a credit crunch (Ishikawa and Tsutsui 2005):3 Since the banks suffer high book losses on their balance sheets, their equity shrinks. This forces ...

The Effect of Restructuring on the Financing Pattern of Development Banks in Nigerian:

... stock markets, directly influence the financial structure choices of firms. The utmost role of financial intermediaries, such as DFIs is that of monitoring borrowers. Similarly, Diamond (1984) argues, intermediaries have economies of scale in obtaining information. It is within this context that Ak ...

... stock markets, directly influence the financial structure choices of firms. The utmost role of financial intermediaries, such as DFIs is that of monitoring borrowers. Similarly, Diamond (1984) argues, intermediaries have economies of scale in obtaining information. It is within this context that Ak ...

Two models of central banking

... • This does not mean that the Federal Reserve followed better policies than the ECB. • There is now consensus among economists that the Fed’s monetary policies during 2001–04 were too expansionary for too long – fueling a boom in the US housing market. – contributing to a general consumption boom in ...

... • This does not mean that the Federal Reserve followed better policies than the ECB. • There is now consensus among economists that the Fed’s monetary policies during 2001–04 were too expansionary for too long – fueling a boom in the US housing market. – contributing to a general consumption boom in ...

Growth in Agricultural Loan Market Share for

... deposits as the principal source of funds to finance their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may a ...

... deposits as the principal source of funds to finance their assets. In some periods growth in local deposit volume, particularly for rural banks, has not kept pace with the growth in aggregate demand for loans, However, there are sources of funds from outside the local deposit market that banks may a ...

Bank of Canada`s mandate renewed

... could be weaker for a small, open economy like Canada. In general, it would also seem that the higher the amounts involved, the less effective this tool becomes. This does not take the costs into account. Applying measures that keep interest rates extremely low for a very long time can lead to probl ...

... could be weaker for a small, open economy like Canada. In general, it would also seem that the higher the amounts involved, the less effective this tool becomes. This does not take the costs into account. Applying measures that keep interest rates extremely low for a very long time can lead to probl ...

Chapter 22 File

... Sources of funds: predominantly deposits, some borrowed funds Investment of funds: predominantly loans and fixedincome securities Active in securitized loan and asset markets Not active in equity except in trust function ...

... Sources of funds: predominantly deposits, some borrowed funds Investment of funds: predominantly loans and fixedincome securities Active in securitized loan and asset markets Not active in equity except in trust function ...