The Sinister Side of Cash

... Cutting interest rates delivers quick and effective stimulus by giving consumers and businesses an incentive to borrow more. It also drives up the price of stocks and homes, which makes people feel wealthier and induces them to spend more. Countercyclical monetary policy has a long-established recor ...

... Cutting interest rates delivers quick and effective stimulus by giving consumers and businesses an incentive to borrow more. It also drives up the price of stocks and homes, which makes people feel wealthier and induces them to spend more. Countercyclical monetary policy has a long-established recor ...

Additional Computer Exercise 3

... Part 7. NPER function – How long will it take to repay a loan of $30,000, if you pay $2000 per year and the interest rate is 5% per year? Parts 8-12: Based on the following - Jane is buying a new car. She agrees to a fixed payment - fixed interest loan of $25,000 at 8% per year compounded monthly t ...

... Part 7. NPER function – How long will it take to repay a loan of $30,000, if you pay $2000 per year and the interest rate is 5% per year? Parts 8-12: Based on the following - Jane is buying a new car. She agrees to a fixed payment - fixed interest loan of $25,000 at 8% per year compounded monthly t ...

Setting aside the debate on when the exact date of an interest rate

... U.S. financial system, and its primary function is to enact monetary policy that helps to stabilize and improve the U.S. economy. The Fed’s three main objectives are: to maximize employment, keep prices of goods stable, and moderate long‐term interest rates. As the economy goes through cycles f ...

... U.S. financial system, and its primary function is to enact monetary policy that helps to stabilize and improve the U.S. economy. The Fed’s three main objectives are: to maximize employment, keep prices of goods stable, and moderate long‐term interest rates. As the economy goes through cycles f ...

Investment Policy

... The PCN should disclose in the Management Notes: • The assets and liabilities that have been classified as financial instruments and what they have been classified as (ex. Held for Trading) • The Fair Value of the financial instruments and how the fair value was measured. o Fair value is the amount ...

... The PCN should disclose in the Management Notes: • The assets and liabilities that have been classified as financial instruments and what they have been classified as (ex. Held for Trading) • The Fair Value of the financial instruments and how the fair value was measured. o Fair value is the amount ...

Tight bank lending, lush bond market

... stagnation and low investments. Indeed, it was fear of a credit crunch – not sympathy – that motivated governments to bail out troubled banks to begin with. Judged by such figures, these efforts may not have been entirely successful. Indeed, much work by academics, regulators, supervisors and financ ...

... stagnation and low investments. Indeed, it was fear of a credit crunch – not sympathy – that motivated governments to bail out troubled banks to begin with. Judged by such figures, these efforts may not have been entirely successful. Indeed, much work by academics, regulators, supervisors and financ ...

PDF - EMM Wealth Management

... The Dangerous Yield-Chasing Cycle The interminable search for yield is an all too common story. As yields on riskless securities fall, most investors look to maintain income and return objectives. This inevitably leads to capital flowing toward riskier, high-yielding assets such as belowinvestment-g ...

... The Dangerous Yield-Chasing Cycle The interminable search for yield is an all too common story. As yields on riskless securities fall, most investors look to maintain income and return objectives. This inevitably leads to capital flowing toward riskier, high-yielding assets such as belowinvestment-g ...

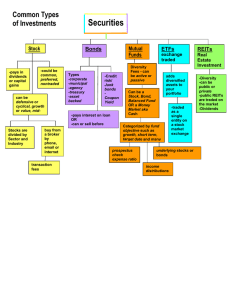

Securities

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

Revision 1 – Financial Management, Financial Objectives and

... capital structure. The market value therefore depended on the business risk of the company and not on its financial risk. The investment decision, which determined the operating income of a company, was therefore shown to be important in determining its market value, while the financing decision, gi ...

... capital structure. The market value therefore depended on the business risk of the company and not on its financial risk. The investment decision, which determined the operating income of a company, was therefore shown to be important in determining its market value, while the financing decision, gi ...

Standard Life Investments event PDF

... term ends in April 2018 or whether it will be rolled over, either as Kuroda extends his term, or to a successor. The outcome is dependent on the magnitude of the burden, with three key areas for consideration. The first is the risk of fiscal dominance. This is particularly plausible given the yield- ...

... term ends in April 2018 or whether it will be rolled over, either as Kuroda extends his term, or to a successor. The outcome is dependent on the magnitude of the burden, with three key areas for consideration. The first is the risk of fiscal dominance. This is particularly plausible given the yield- ...

Working Paper No. 580 An Alternative View of Finance, Saving

... decide to spend less than their incomes only if those incomes are actually generated. Again, in Keynesian terms this is simply another version of the twin statements that “spending generates income” and “investment generates saving.” Here, however, the statement is that the government sector’s defi ...

... decide to spend less than their incomes only if those incomes are actually generated. Again, in Keynesian terms this is simply another version of the twin statements that “spending generates income” and “investment generates saving.” Here, however, the statement is that the government sector’s defi ...

Order Number: 41512 Running Head: A JOB AT EAST COAST

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

Long-term interest rates, GDP and inflation in Poland

... = Duration risk premium for holding a long-term bond yield: the compensation investors get for locking up their money for long stretches rather than constantly rolling it over Cannot be observed, has to be estimated Some approaches based solely on term structure models using bond yields at a range o ...

... = Duration risk premium for holding a long-term bond yield: the compensation investors get for locking up their money for long stretches rather than constantly rolling it over Cannot be observed, has to be estimated Some approaches based solely on term structure models using bond yields at a range o ...

The Instruments of Macroprudential Policy

... Banks play an important role in the provision of credit to the private sector in certain economies, not least in Ireland. Credit growth, therefore, varies with the financial soundness of the banking sector as well as economic conditions. As entities, banks can be fragile to external shocks, as they ...

... Banks play an important role in the provision of credit to the private sector in certain economies, not least in Ireland. Credit growth, therefore, varies with the financial soundness of the banking sector as well as economic conditions. As entities, banks can be fragile to external shocks, as they ...

Handouts No 11

... 4. Investment banks started offering what were essentially checking accounts. To get around banking legislation, certain restrictions would be put on the accounts to distinguish them from regular checking accounts. Example: minimum check amount, maximum checks per month, etc. Money market mutual fun ...

... 4. Investment banks started offering what were essentially checking accounts. To get around banking legislation, certain restrictions would be put on the accounts to distinguish them from regular checking accounts. Example: minimum check amount, maximum checks per month, etc. Money market mutual fun ...

newton`s paul brain: why the us could enter a

... pricing. For Brain this means that while the fund will remain cautious in its positioning in high yield debt it will also be looking to selectively deploy capital on attractively priced assets. “From its current defensive mind-set the investment team views the prospect of defaults and of an associat ...

... pricing. For Brain this means that while the fund will remain cautious in its positioning in high yield debt it will also be looking to selectively deploy capital on attractively priced assets. “From its current defensive mind-set the investment team views the prospect of defaults and of an associat ...

Financial Market Its Types and Roles in Industry

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

... witnessed a flurry of IPOs serially. The market saw many new companies spanning across different industry segments and business began to flourish. The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India) in the mid-1990s helped in regulating a smooth and tra ...

ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

EY ITEM Club Outlook for financial services Summer 2016

... today. We are in a slowdown rather than a full-blown solvency crisis. There have been concerns about the commercial real estate market, but banks are much less exposed to this sector than in the past and have been careful to apply more stringent credit standards and stronger risk management than pre ...

... today. We are in a slowdown rather than a full-blown solvency crisis. There have been concerns about the commercial real estate market, but banks are much less exposed to this sector than in the past and have been careful to apply more stringent credit standards and stronger risk management than pre ...

CLTL - PowerShares Treasury Collateral Portfolio fund in

... securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivatives. However, there may be operational challenges with pledging Treasury Bills as collateral, ...

... securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivatives. However, there may be operational challenges with pledging Treasury Bills as collateral, ...

Banking Union in Europe and Implications for Financial Stability

... The stress tests themselves will rely in part on the accuracy of the information on asset quality, the risks associated with them, and on leverage. They will also rely on the rigour with which the stress scenarios are conducted and carried out. This means not only the assumption of what macroeconomi ...

... The stress tests themselves will rely in part on the accuracy of the information on asset quality, the risks associated with them, and on leverage. They will also rely on the rigour with which the stress scenarios are conducted and carried out. This means not only the assumption of what macroeconomi ...

the determinants of banking system vulnerability

... The effects of the crisis rippled further throughout the highly interconnected and overleveraged global financial system. In the months thereafter, what started as liquidity problems transformed into greater solvency concerns about important global financial institutions (Claessens et al., 2010). Ev ...

... The effects of the crisis rippled further throughout the highly interconnected and overleveraged global financial system. In the months thereafter, what started as liquidity problems transformed into greater solvency concerns about important global financial institutions (Claessens et al., 2010). Ev ...

Mark Eppli Plenary Housing, Household Tenure Choice

... • Net worth of U.S. households now exceeds 2007 in real and nominal terms; • 28% of the U.S. net worth is held by the bottom 90% of the population; • 39% of households have a net worth of less than ...

... • Net worth of U.S. households now exceeds 2007 in real and nominal terms; • 28% of the U.S. net worth is held by the bottom 90% of the population; • 39% of households have a net worth of less than ...

Diversification. - Principal Financial Group

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

Clear perspectives on bond market liquidity

... US bond mutual funds have grown significantly in recent years. From the end of 2004 through 2014, they took in $1.9 trillion in net new cash flow. Their growth illustrates the benefits of a financial system with a balance between capital markets-based and bank-based funding. As banks have recapitali ...

... US bond mutual funds have grown significantly in recent years. From the end of 2004 through 2014, they took in $1.9 trillion in net new cash flow. Their growth illustrates the benefits of a financial system with a balance between capital markets-based and bank-based funding. As banks have recapitali ...