05RISKS FROM LOW INTEREST RATES – OPPORTUNITIES FROM

... A sharp rise in interest rates after an extended period of low rates poses the greatest risk of a renewed financial crisis. This could put the solvency of large parts of the banking system at risk and bring about a rise in the cancellation rates of life insurance policies. A strong decline in asset ...

... A sharp rise in interest rates after an extended period of low rates poses the greatest risk of a renewed financial crisis. This could put the solvency of large parts of the banking system at risk and bring about a rise in the cancellation rates of life insurance policies. A strong decline in asset ...

NBER WORKING PAPER SERIES TAXATION OF ASSET INCOME WORLD SECURITIES MARKET

... securities should be downward sloping — foreign investors need more attractive terms to induce them to concentrate their portfolios further in any one security. Similarly, the supply curve of foreign securites should be upward sloping. The above observations suggest ...

... securities should be downward sloping — foreign investors need more attractive terms to induce them to concentrate their portfolios further in any one security. Similarly, the supply curve of foreign securites should be upward sloping. The above observations suggest ...

Central banks and financial crises

... ‘Precautionary Principle’; (2) overestimation of the effect of house prices on economic activity; (3) mistaken focus on ‘core’ inflation; (4) failure to appreciate the magnitude of the macroeconomic and financial correction/adjustment required to achieve a sustainable external equilibrium and adequa ...

... ‘Precautionary Principle’; (2) overestimation of the effect of house prices on economic activity; (3) mistaken focus on ‘core’ inflation; (4) failure to appreciate the magnitude of the macroeconomic and financial correction/adjustment required to achieve a sustainable external equilibrium and adequa ...

Decision CPC 57_2011

... into the following areas: (a) Loans (b) Deposits and (c) Financial Market Services. Loans comprises of banking services such as personal loans, mortgages, loans for businesses etc. ...

... into the following areas: (a) Loans (b) Deposits and (c) Financial Market Services. Loans comprises of banking services such as personal loans, mortgages, loans for businesses etc. ...

here - EBS

... There are a number of factors we consider when we set or change our variable interest rates and these currently include:Cost of funds; we obtain funds from multiple sources, for example; customer deposits, wholesale markets (e.g. from other banks) and bonds (i.e. loaned funds from investors), which ...

... There are a number of factors we consider when we set or change our variable interest rates and these currently include:Cost of funds; we obtain funds from multiple sources, for example; customer deposits, wholesale markets (e.g. from other banks) and bonds (i.e. loaned funds from investors), which ...

A stable option for uncertain times

... When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments will be invested by choosing from more than 100 sub-accounts. How t ...

... When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments will be invested by choosing from more than 100 sub-accounts. How t ...

High earnings growth on low interest rates

... Loan-to-value did not continue to increase (56% in Q3) The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop fr ...

... Loan-to-value did not continue to increase (56% in Q3) The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop fr ...

Interbank intermediation

... suggestion by Moore (2011) describing interbank markets as a way of stacking bank leverage. In his model, banks seek interbank exposures for inflows and outflows resulting from commercial banking business, i.e. deposit taking and lending. The bank book in his model is derivative to the autonomous cl ...

... suggestion by Moore (2011) describing interbank markets as a way of stacking bank leverage. In his model, banks seek interbank exposures for inflows and outflows resulting from commercial banking business, i.e. deposit taking and lending. The bank book in his model is derivative to the autonomous cl ...

PDF Download

... 2010; Whelan 2014a).4 These foreign liabilities were obtained through international bond issues, the gathering of foreign corporate deposits and cross-border interbank positions. Albeit to a lesser extent, the domestic banks also expanded foreign asset positions through an increase in the scale of f ...

... 2010; Whelan 2014a).4 These foreign liabilities were obtained through international bond issues, the gathering of foreign corporate deposits and cross-border interbank positions. Albeit to a lesser extent, the domestic banks also expanded foreign asset positions through an increase in the scale of f ...

Key Concepts and Skills

... • Prices reflect all information, including public and private • If the market is strong form efficient, then investors could not earn abnormal returns regardless of the information they possessed • Empirical evidence indicates that markets are NOT strong form efficient, and that insiders can earn a ...

... • Prices reflect all information, including public and private • If the market is strong form efficient, then investors could not earn abnormal returns regardless of the information they possessed • Empirical evidence indicates that markets are NOT strong form efficient, and that insiders can earn a ...

Financial System Overview and the Flow of Funds

... of institutions and markets Major institutions and their regulators Interest rate determination Risk. risk management, and risk premiums Important financial markets in depth Closer scrutiny of the money market and important factors influencing conditions Detailed review of important cred ...

... of institutions and markets Major institutions and their regulators Interest rate determination Risk. risk management, and risk premiums Important financial markets in depth Closer scrutiny of the money market and important factors influencing conditions Detailed review of important cred ...

Portland International Jetport

... RBC Capital Markets, LLC (“RBC CM”) and may not be disclosed, reproduced, distributed or used for any other purpose by the recipient without RBCCM’s express written consent. By acceptance of these materials, and notwithstanding any other express or implied agreement, arrangement, or understanding to ...

... RBC Capital Markets, LLC (“RBC CM”) and may not be disclosed, reproduced, distributed or used for any other purpose by the recipient without RBCCM’s express written consent. By acceptance of these materials, and notwithstanding any other express or implied agreement, arrangement, or understanding to ...

Will the U.S. Economy Face Deflation?

... The 1930s demonstrate that deflation is most dangerous when debt burdens are heavy, as they were in the 1920s and are today. "When a deflation occurs ... without any great volume of debt, the resulting evils are much less," Yale University economist Irving Fisher wrote in 1933. "It is the combinatio ...

... The 1930s demonstrate that deflation is most dangerous when debt burdens are heavy, as they were in the 1920s and are today. "When a deflation occurs ... without any great volume of debt, the resulting evils are much less," Yale University economist Irving Fisher wrote in 1933. "It is the combinatio ...

Wells Fargo Funds to merge certain funds

... prospectus/proxy statement—when available—in its entirety because it will contain important information about the acquiring funds, merging funds, transaction, fees, expenses, risk considerations, persons soliciting proxies in connection with the transaction, and the interests of these persons in the ...

... prospectus/proxy statement—when available—in its entirety because it will contain important information about the acquiring funds, merging funds, transaction, fees, expenses, risk considerations, persons soliciting proxies in connection with the transaction, and the interests of these persons in the ...

Delay SocialSecurity :Funding the Incom e Gap with a Rev ers e M

... RM draws are tax-free - they are loan proceeds. The client’s high income tax rate magnifies the taxfree RM’s benefit. o IRA withdrawals are fully taxable. At a 33% marginal rate, to spend $1.00 it takes $1.50 from an IRA. To spend $1.00 it takes $1.00 from a RM. o The client has about a 33% combined ...

... RM draws are tax-free - they are loan proceeds. The client’s high income tax rate magnifies the taxfree RM’s benefit. o IRA withdrawals are fully taxable. At a 33% marginal rate, to spend $1.00 it takes $1.50 from an IRA. To spend $1.00 it takes $1.00 from a RM. o The client has about a 33% combined ...

Market concentration and competition in Vietnamese banking sector.

... One of the most striking feature of Vietnamese banking sector is the domination of stateowned banks and partial state-owned banks (From now onwards, they are all called state-owned banks – SOCBs as government is having controlling right in all of these bank with over 51% of total chartered capital). ...

... One of the most striking feature of Vietnamese banking sector is the domination of stateowned banks and partial state-owned banks (From now onwards, they are all called state-owned banks – SOCBs as government is having controlling right in all of these bank with over 51% of total chartered capital). ...

Capital gains: At what rate will your long

... Who’s Eligible: Any collector in the 28% tax bracket or higher; some small-business stock shareholders. Net long-term gains from collectibles (stamps, coins, baseball cards and the like) are subject to a 28% maximum federal rate rather than the usual 20%. To the extent a long-term collectibles gain ...

... Who’s Eligible: Any collector in the 28% tax bracket or higher; some small-business stock shareholders. Net long-term gains from collectibles (stamps, coins, baseball cards and the like) are subject to a 28% maximum federal rate rather than the usual 20%. To the extent a long-term collectibles gain ...

FIN 534 FIN534 Quiz 9 - Welcome to homeworks.16mb.com!

... be obtained more quickly than a long-term loan, but the cost of short-term debt is normally higher than that of long-term debt. If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect ...

... be obtained more quickly than a long-term loan, but the cost of short-term debt is normally higher than that of long-term debt. If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect ...

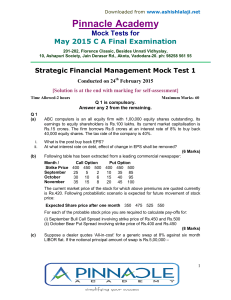

Pinnacle Academ y

... shall pay to A Inc. 1 % over the ¥ Loan interest rate, which the later will have to pay as a result of currency swap whereas A Inc. will reimburse interest to B Inc. only to the extent of 9%. Assuming stability of exchange rate, determine the net gain or loss to each of the party due to currency swa ...

... shall pay to A Inc. 1 % over the ¥ Loan interest rate, which the later will have to pay as a result of currency swap whereas A Inc. will reimburse interest to B Inc. only to the extent of 9%. Assuming stability of exchange rate, determine the net gain or loss to each of the party due to currency swa ...

Market Outlook

... Euro is likely to continue consolidating in a 1.08-1.13 range. Helping to hold the EUR up are (1) an oversold currency that has also overshot levels consistent with real expected short term interest rate differentials, and (2) supportive net portfolio inflows. With Euro data looking ok, the ECB coul ...

... Euro is likely to continue consolidating in a 1.08-1.13 range. Helping to hold the EUR up are (1) an oversold currency that has also overshot levels consistent with real expected short term interest rate differentials, and (2) supportive net portfolio inflows. With Euro data looking ok, the ECB coul ...

UGANDA MARKET UPDATE

... while Grade B buildings had lower occupancy levels averaging at 60% over the past 6 months. These occupancy rates are slightly higher than those recorded during the same period last year. Demand for Grade A space has continued to be driven by Government agencies, financial services sector, especiall ...

... while Grade B buildings had lower occupancy levels averaging at 60% over the past 6 months. These occupancy rates are slightly higher than those recorded during the same period last year. Demand for Grade A space has continued to be driven by Government agencies, financial services sector, especiall ...

Advanced Economy Monetary Policy and Emerging Market Economies Jerome H. Powell Opening RemaRks

... growth performance in EMEs. And in 2011, capital inflows diminished along with the growth differential. Another key driver of EME capital flows is global attitude toward risk. Swings in sentiment between “risk-on” and “risk-off” have led investors to reposition across asset classes, resulting in cor ...

... growth performance in EMEs. And in 2011, capital inflows diminished along with the growth differential. Another key driver of EME capital flows is global attitude toward risk. Swings in sentiment between “risk-on” and “risk-off” have led investors to reposition across asset classes, resulting in cor ...

New Zealand Financial Product Market Licence (Australian

... acquire products offered on a New Zealand-based market; (d) New Zealand investors who acquire products offered on the Existing Market may be subject to the effects of changes in currency exchange rates. ...

... acquire products offered on a New Zealand-based market; (d) New Zealand investors who acquire products offered on the Existing Market may be subject to the effects of changes in currency exchange rates. ...

Changes in Germany`s Bank-Based Financial System: A Varieties of

... illustrates this description. As late as the mid-1990s, non-market forms of finance such as bank loans and deposits continued to dominate the financial system, at 74% of financial system assets even more so than the 64% recorded by Japan, the other most prominent bank-based financial system (see tab ...

... illustrates this description. As late as the mid-1990s, non-market forms of finance such as bank loans and deposits continued to dominate the financial system, at 74% of financial system assets even more so than the 64% recorded by Japan, the other most prominent bank-based financial system (see tab ...

The Political Economy of Shadow Banking: Debt

... funding of capital market lending,” [19] which generally takes place outside the regular banking system [3, 28]. This definition highlights the activities of financial intermediaries that use short-term money market funding (sourced from global dollar markets) to fund long-term investment projects—n ...

... funding of capital market lending,” [19] which generally takes place outside the regular banking system [3, 28]. This definition highlights the activities of financial intermediaries that use short-term money market funding (sourced from global dollar markets) to fund long-term investment projects—n ...